Bosch India's FY2020 earnings drop 19% due to industry slowdown, wins big on BS VI

Technology major further expects impact of coronavirus to slow down recovery by at least two years.

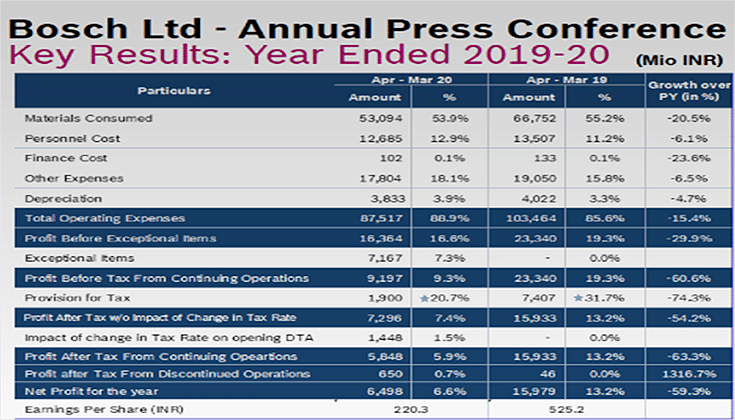

Bosch Limited, the listed entity of Bosch Group companies in India, today announced its annual results for FY2020 following its Board meeting. The company saw its earnings drop 18.6 percent to Rs 9,842 crore, which is attributed to the slump in the automotive sector, which contributes 80 percent to its revenues.

Profit before tax (PBT) before exceptional items also dropped 29.9 percent to Rs 1,636 crore in the last fiscal. However, the company announced a dividend of Rs 105 to its shareholders at 50 percent face value.

"The financial figures reported are in line with the downward trend in the automotive industry which has been going through a challenging phase for some time and is now having to deal with the impact of the coronavirus. More than ever, it is now important to stay connected with associates and customers and assess ground-level activities. We have to prepare ourselves for a prolonged slowdown in the market in FY2020-21”, said Soumitra Bhattacharya, managing director, Bosch.

Bosch's Mobility business sector declined by 24.4 percent in 2019-20, due to slowdown in the auto segment. While domestic sales declined 25.9 percent, exports registered a drop of 6.1 percent. Within the Mobility segment, the Powertrain Solutions business registered a decline of 30.2 percent, owing to the underperforming automotive market in India. However, business verticals other than mobility registered a decline of 14.4 percent.

Globally, 2019 was a year full of challenges for the technology giant with overall turnover pegged at euro 77.7 billion (Rs 642,346 crore) and EBIT of euro 2.9 billion (Rs 23,974 crore). However, investments continued to be in the range of 8-10 percent at euro 6.1 billion (Rs 50,428 crore).

The BS VI accomplishment

During the last financial year, Bosch has announced making provisions of Rs 717 crore towards various restructuring, reskilling and redeployment initiatives aimed at capitalising on the opportunities in electromobility and other mobility-related projects.

The company had undertaken 79 OEM projects and claims having the largest market share in the BS VI transition with a lifetime acquisition of Rs 24,000 crore.

The regulations which came into country-wide effect on April 1, 2020, were touted to be "the most important changeover" in the automotive industry by Bhattacharya in the online press conference earlier today.

"We strive to deliver technology of the future and our BS VI products are all 'made-in-India'," he added.

Globally, Bosch has been supplying Euro-6 technology for powertrain implementation for up to 800,000 vehicles every year, with business worth 400 million euros (Rs 3,306 crore), according to the aforementioned company spokesperson.

Adding his viewpoints, Jan-Oliver Roehrl, joint managing director and CTO, Bosch, said, "We are grateful to our customers for believing in us. It was a challenging time for all of us upgrading a lot of powertrains to BS VI norms. It was carried over by almost 1,400 people at Bosch and we intensely joined hands with our international development network for speedy accomplishment."

New technology capitalisation

As the mobility ecosystem increasingly moves towards futuristic and sustainable means including electromobility, Bosch is ready to cash in on the opportunity with its innovations.

The company is already supplying the diagnostic solutions on the all-electric Bajaj Chetak scooter as well as connectivity tools to Daimler for its e-Call service, it is now bullish on the boom in the smart mobility space.

"Our connected vehicle and cloud-based services will be valuable for the mobility industry," Roehrl added.

"At the moment, there is a very nascent market for EVs in India. Our estimation is that hybrid vehicles will find their way far quicker than EVs. We are already supplying some of the hybridisation components to OEMs thriving to meet BS VI norms in India," he said.

The company says it also has readily available 48V mild-hybrid solutions which it can offer for P0 to P4 application requirements of OEMs to meet their CAFE targets and conform to RDE norms in the future. It estimates ICE to co-exist with electrification until 2030 with an 80:20 ratio.

Covid-triggered paralysis

While all of its 16 plants across the country went shuttered as the government announced nationwide lock-down as a precautionary step to the Covid-19 outbreak on March 25, the company is gradually resuming operations.

"Most of our operations have resumed. However, safety is a must and further resumption will happen in due course of time" Bhattacharya said, also indicating that the company doesn't employ any contractual workers at its manufacturing plants.

"Majority of our plant associates live in the vicinity of the factories, but we do see a challenge with our Tier 2 and Tier 3 suppliers."

"We know that the recovery will be slow but supply chain bottlenecks will be slowly eased going forward," he added.

The company is only recommending 20 percent of its white-collar staff to report at office, while the major chunk of its employees who also deliver primarily for its software and technology businesses, have been advised to work remotely.

However, in order to save costs, it plans to continue its restructuring activities which will include "redefining jobs" by doing them with utmost care.

Tough 4-6 years ahead

Even though FY2020 saw the auto industry face a major setback with overall vehicle production dropping 17 percent, of which the passenger vehicle segment declined 15 percent, FY2021 is going to see an even bigger challenge due to the economy being hit hard by the coronavirus.

According to Bhattacharya, "Unless there are special interventions from the government, this slowdown could go on for a long time."

"April 2020 was a wipeout for the entire industry due to the lock-down. The months of May and June will also be slow with production activities going to a maximum of only 25 percent. There is a supply as well as demand crisis and both need to be addressed. While there is pent up demand, liquidity issues loom large," he added.

Capex impacted by Covid

On the capex side, the coronavirus impact will see Bosch cut down its usual investments by almost half.

"We have had annual capex ranging between Rs 350-500 crore over the last five years and now we are estimating a 40-50 percent reduction on this, be it for mobility-related or other future projects," Bhattacharya disclosed.

However, the company's plans to come up with a 75-acre sprawling new 'Smart Campus' in Adugodi, Bangalore is on-track and will see completion by 2022.

"While we are facing market realities, we will bounce back in the mid-term and are very confident of the long-term. We anticipate proper recovery happening for us by FY2022-23 / 24," Bhattacharya concluded.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

22 May 2020

22 May 2020

23294 Views

23294 Views

Autocar Professional Bureau

Autocar Professional Bureau