Ban steel and iron ore exports as high prices impacting forging industry: AIFI

AIFI says Steel is the basic raw material for the forging industry and typically constitutes 60 to 65 percent of the ex-factory value of forgings.

The Association of Indian Forging Industry (AIFI) has urged the government to ban exports of steel and iron-ore as high steel prices are impacting the forging industry adversely in the country.

The widespread disruption caused by the Covid-19 pandemic has affected the automobile industry and in turn the automotive components and forging industries. While the industry was reviving post the pandemic, the increase in steel prices is now hammering the forging industry in India.

To manage the impact, forging steel manufacturers have hiked prices by 10 percent over the last six months, and have now sought a further 15 percent increase. While the initial increase itself was all but impossible to sustain, the further increase will prove to be disastrous, says AIFI.

The association adds that steel is the basic raw material for the forging industry and typically constitutes 60 to 65 percent of the ex-factory value of forgings. With these two recent prices increases, this is expected to rise to around 75 percent. This hike in percentage of the input cost can have a detrimental effect on the forging industry.

At the moment, the prices of steel are record highs, in the face of increased demand amid low allocation of production for the domestic market coupled with minimal imports due to import restrictions imposed by the government of India. As such, domestic steel manufacturers have increased prices twice in the current quarter for forging quality steel and three times in the current month for other types of steel, bringing the benchmark hot-rolled coil prices in the wholesale market (ex-Mumbai) to Rs 52,000 per tonne from only 36,500 per tonne in July, which is a rise of 43 percent. This could mean prices of forging quality steel will be further revised upwards in the immediate future in line with the increases in the prices in Hot Rolled Coil prices.

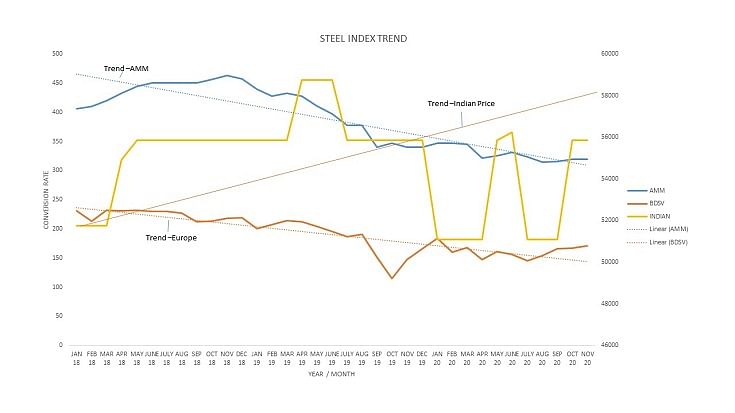

The price increases of steel in the domestic market are due to the increase in exports to neighbouring countries and the resultant reduction in supply within the domestic market has resulted in Indian prices, moving contrarian to the prices of steel in the European and American markets, thereby reducing the price competitiveness of the Indian manufactures in these markets, besides forcing the manufacturers to absorb the increases on existing orders, resulting in them incurring losses on them.

Steel Index Trend - Price movement comparison between Europe, America and India.

More than 80% of iron ore exported to China

In addition to the increased export of steel, India's iron ore exports to have increased by 63 percent. This increase in exports is mainly motivated by the record steel production of the world's largest steel manufacturer— China. In FY2020, India's iron exports increased by 133% to 37.69 million tonnes over the period April-July 2020 compared to the corresponding period in FY2019. And more than 80% of these exports have been to China. If Indian steel prices are higher than international steel prices, it will lead to exports becoming uncompetitive. Export rates have risen sharply in post-Covid times and have almost doubled.

Vikas Bajaj, president, AIFI said “Steel prices have increased by 25 to 30 percent in the last three months, putting the forging industry at serious risk, particularly when we are still recovering from Covid-inflicted business losses and the resultant pressure on cash flow, and cash reserves. The industry is still going through a very difficult time and is not in a position to absorb losses. I believe that rising demand for steel, low steel production for the domestic market due to increased steel exports are the prime reasons for price hikes. The Forging Association requests the government to consider a ban on steel and iron ore exports so that demand of steel within the country can be met in a cost / price-effective manner”.

According to AIFI, at present steel accounts for 7 percent of the country's GDP. As steel prices have increased by 10 percent and are projected to increase by another 15%, that could ultimately have an inflation rise of about 1.5 percent. If inflation increases, it will result in higher interest rates, leading to a slowdown of the economy.

India's exports of finished and semi-finished steel to China increased sharply in this financial year despite the growing border tensions. Also, India's overall iron and steel exports to China in the first five months of this fiscal year were more than three times the amount for the entire fiscal year 2019-20.

AIFI says the Indian forging industry is one of the key players in the auto component manufacturing sector and a major contributor to the government’s Make in India initiative. The Industry apart from catering to the automotive sector, solar, aerospace, railways and wind sector also plays a key role in contributing to the forex by way of huge exports. The current overall capacity utilisation of the industry stands around 50 to 55 percent against a normal of 65 percent and the industry provides direct employment to 250,000 plus people and indirect employment to approximately 250,000 people against 600,000 earlier. The industry has turnover of around Rs 34,000 crore.

Yash Jinendra Munot, VP, AIFI said “Export of steel is the major reason for the rate hike. Large mills are preferring to export steel to neighbouring countries. Also, orders have been booked for Europe, the Middle East, which is one reason for the shortage of steel in India. Thus, steel companies are in a position to increase prices at their will due to the gap in supply and demand. The government should consider banning the export of steel and iron ore for the next six to eight months or till such time that the local demand is met and should look at regulating steel prices for domestic consumption.”

“Another factor that can be attributed to steel manufacturers to increase prices is minimal imports from other countries. Japan and Korea, the main two exporting countries to India apart from China, are exporting more to Europe due to the restrictions placed upon imports into India by the government of India,” added Munot.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

24 Dec 2020

24 Dec 2020

8739 Views

8739 Views