Auto dealers’ fortunes to rebound to pre-Covid levels in FY2022: CRISIL

With 20-22% revenue growth and 50-100 basis points improvement in operating margin expected for FY2022; revenue and operating profits of dealers likely to scale back to pre-Covid levels, says CRISIL Ratings.

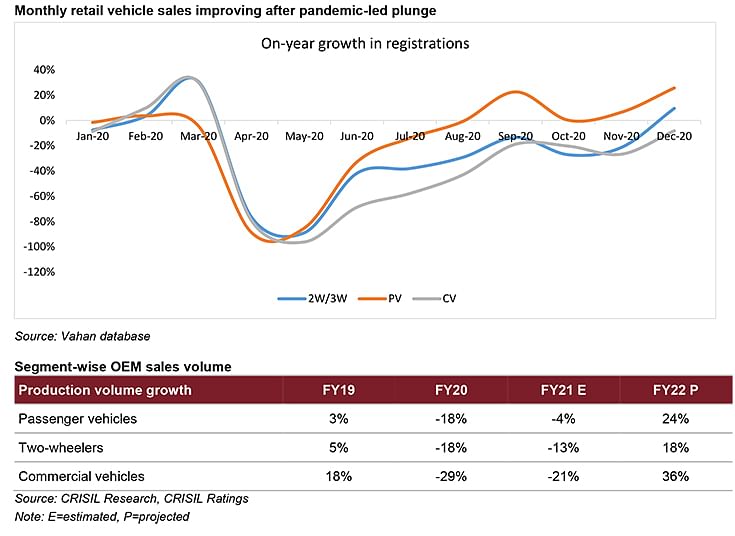

Revenues, which were significantly impacted in FY2020 and FY2021, will see a strong recovery due to improved demand for automobiles across segments. This, along with improved ancillary revenues, which is more profitable than vehicle sales, will support overall operating profitability for automobile dealers, and boost cash accruals. These are the findings of a recent CRISIL Ratings study.

Over the past 12 months, the cost of ownership of passenger vehicles (PVs) and two-wheelers (2Ws) has risen 8-10 percent following a 15-17% surge in fuel prices, price hikes by OEMs to cover BS-VI costs, and costlier raw material. While that affected sales, the nationwide lockdown also slammed the brakes on ancillary revenue, the study claims.

According to Gautam Shahi, director, CRISIL Ratings, “We are seeing a turnaround. PV and two-wheeler dealers are expected to see revenue growth of 20-22% and 15-17%, respectively, in FY2022. Healthy rural demand and increasing preference for personal mobility will drive growth for PVs and two-wheelers. Revenue growth for commercial vehicle (CV) dealers is expected at 35-40% in FY2022, supported by improving economic activities, increase in Budget allocation for infrastructure, and low base effect".

As per the CRISIL Ratings study, recovery in new vehicle sales, and ancillary revenues (through service, spare parts and insurance at 10-12% of revenue and 25% of operating profit) would also help restore operating profitability to pre-pandemic levels of 3-4 percent for automobile dealers. With improving operating performance, credit ratio (ratio of number of rating upgrades to downgrades) is expected to improve next fiscal. This is after two years of weak operating performance which impacted the credit metrics of CRISIL Ratings’ rated automobile dealers. This was evident in the credit ratio declining to 0.3 time for the sector for April 2020-January 2021, the lowest in the past five fiscals. Increased support from OEMs and moratorium availed by automotive dealers helped manage liquidity pressures.

According to Sushant Sarode, Associate Director, CRISIL Ratings. inventory levels are expected to stabilise at 3-4 weeks from almost 1.5 months seen earlier this year, obviating balance sheet pressures and stabilising credit profiles. Interest coverage and gearing are expected to improve to 2.5-3.0 times and 1.2-1.3 times, respectively in fiscal 2022, from 1.9 times and 1.4 times, respectively, in fiscal 2021.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

13 Mar 2021

13 Mar 2021

8191 Views

8191 Views

Autocar Professional Bureau

Autocar Professional Bureau