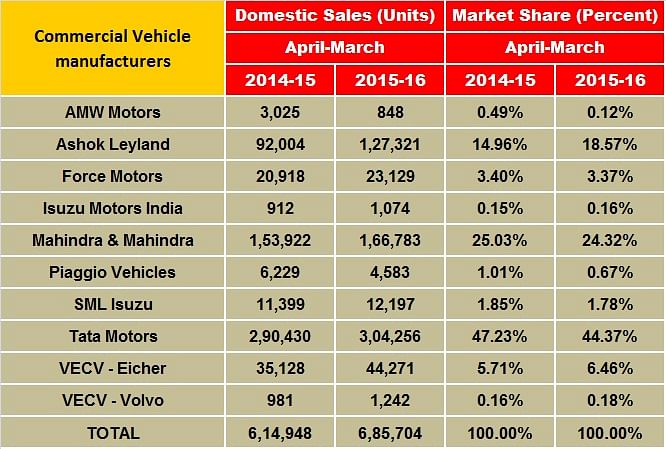

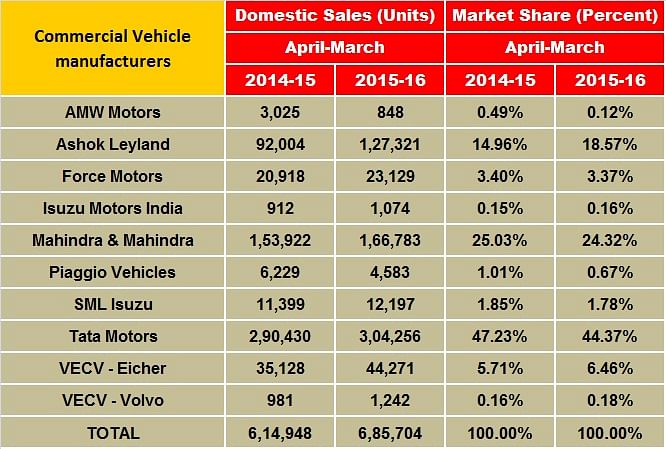

With FY2015-16 sales numbers out, it’s time to take stock of how key players have performed. India’s commercial vehicle industry, comprising medium and heavy commercial vehicles (M&HCVs) and light commercial vehicles (LCVs) has done well to post 11.51% overall year-on-year growth with sales of 685,704 units (FY’15: 614,948 units).

Expectedly, the M&HCV sector was the big provider to these gains with sales of 302,373 units and notching handsome 30% YoY growth (FY’15: 232,755 units). The LCV sector, which is just about seeing the green shoots of recovery and slowly gaining momentum, recorded flat growth (0.30%) with total sales of 383,331 units (FY’15: 382,193 units).

The big news of the CV sector in India is that an aggressive Ashok Leyland, with overall sales of 127,321 units, registered growth of 38.39% YoY in 2015-16 (FY’16: 92,004 units). This has helped it increase its market share by a good 3.61%, growing from 14.96% in 2014-15 to 18.57%. This, in a year which saw a decline in almost all CV OEMs’ market shares other than Ashok Leyland and VE Commercial Vehicles.

Ashok Leyland has particularly benefited in the higher-tonnage segment (25T, 31T, 35T and 37T), thanks to rising demand from infrastructure spend across the country, partial lifting of the ban on mining and fleet operators’ focus on renewing their fleets.

Sales for Tata Motors, the largest commercial vehicle maker in the country, grew 4.76% at 304,256 units but the company saw its market share dip by 2.86% to 44.37% from 47.23% in 2014-15. Ashok Leyland, with a substantial increase in its M&HCV sales, clearly has eaten into Tata’s share as well as other CV players. Tata Motors, nevertheless, straddles the overall CV market with a varied range of products and is now looking to drive new gains with its new Signa HCV range.

Meanwhile, Mahindra & Mahindra, the second largest in the overall CV segment by volumes, saw its sales grow 8.36% at 166,783 units but its market share reduced by 0.71% to 24.32%.

VE Commercial Vehicles, which has traditionally been strong in the medium duty segment, registered healthy 26.03% growth with total sales of 44,271 units. Chandigarh-based SML Isuzu posted 7 percent sales growth with 12,197 units but its market share growth stayed flat.

Ashok Leyland rides the M&HCV sales wave

In the M&HCV passenger and goods carrier segments, Ashok Leyland has made remarkable gains, snatching market share from Tata Motors. The company succeeded in growing its M&HCV (passenger carrier) market share sizeably from 35.70% in 2014-15 to 44.63% in 2015.16. In the goods carrier segment too, its market share grew from from 27.20% in 2014-15 to 30.65% in 2015-16.

During FY’16, the Chennai-based manufacturer sold 19,586 passenger carriers against 13,151 units in 2014-15, gaining market share of 8.93%. With burgeoning sales of its higher-tonnage vehicles, Market leader Tata Motors, which sold 14,917 units, saw its M&HCV passenger carrier market share fall 6.74% to 33.99% from 40.73% in 2014-15.

Similarly, in the M&HCV goods carrier segment, Ashok Leyland with total sales of 79,223 units as against 53,291 units in 2014-15 gained market share of 3.45% in 2015-16. Tata Motors, which sold 142,044 M&HCV passenger carriers in 2015-16 as compared to 112,007 units in 2014-15, lost 2.22% market share.

Exciting times lie ahead in FY'17

Expect the battle between the two lead players to continue in 2016-17. According to apex industry body SIAM, M&HCV goods carrier sales are expected to grow in double-digits thanks to an improvement in the overall economy led by an increase in industrial output and higher agricultural production. There is also the potential of consumers advancing sales in Q4 FY17 due to the all-India implementation of BS IV norms from April 1, 2017.

As regards the buses segment, SIAM expects demand for LCV buses from shcools and other educational institutions to outpace that of 2015 along with continued improving demand from the tourism sector. Sales of M&HCV buses too is set to grow with projected demand from the inter-city market, the corporate sector as well as from State Transport Undertakings. Further, orders for about 2,000-2,500 buses from JnNURM II are expected to be fulfilled in 2016-17.

Also read:

- Indian CV exports surge to a three-year high in FY2016

- India LCV market sees green shoots of recovery after two-year decline

- M&HCV bus sector in India in recovery mode