M&HCV bus sector in India in recovery mode

During FY2015-16, the overall CV industry did well to post 11.51% year-on-year growth with sales of 685,704 units (FY2015: 614,948 units).

The medium and heavy commercial vehicle passenger carrier sector is headed for better times.

During FY2015-16, the overall CV industry did well to post 11.51% year-on-year growth with sales of 685,704 units (FY2015: 614,948 units). Expectedly, the M&HCV sector was the big provider to these gains, with sales of 302,373 units and handsome 30% YoY growth (FY2015: 232,755 units). Within this segment, the passenger carrier segment, which comprises about 20 percent of the total M&HCV segment, registered strong double-digit growth after two years of negative growth.

During 2015-16, the M&HCV passenger carrier segment, classified as maximum mass exceeding 7.5T but not exceeding 12T and maximum mass exceeding 12T but not 16.2T has grown 19.5%, selling 43,885 buses as compared to negative growth of 4.83% (36,837 buses) and 17.48% (38,709 buses) during FY15 and FY14 respectively.

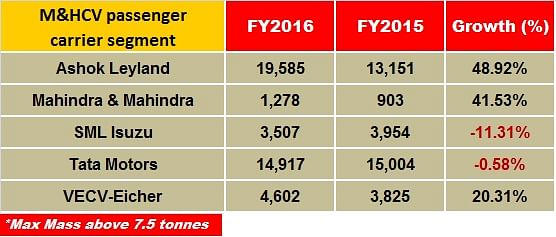

Ashok Leyland, as in the goods carrier segment, also made big gains in this segmentWith sales of 19,586 buses, it posted healthy 48.92% growth (FY2015:13,151 units), which is attributed to its strong performance in the city bus and intercity segment. In the 16.2-tonne segment the company sold 15,511 units, up 55.1% (FY2015: 9,997 units).

Tata Motors with sales of 14,917 units, saw flat growth. (FY15: 15,004 units) while VE Commercial Vehicles recorded 20.31 percent growth in the segment, selling 4,607 units. (FY2015:3,825 units.). SML Isuzu, which has been strong in the 7.5T-12T segment, saw its sales decline by 11.30% to 3,507 units (FY2015:3,954 units). Mahindra & Mahindra registered a growth of 41.5% albeit on a smaller base; the company sold 1,278 units (FY2015: 903 units.)

In its outlook for FY17, the Society of Indian Automotive Manufactures predicts that in the passenger carrier segment, MCVs will likely see moderate growth over a high base with the opening up of roads for private participation to remain a key parameter. Demand from the intercity segment, which saw a sharp growth in FY2016 due to delayed replacement demand, is expected to moderate over a high base. Demand from corporates is also to grow at a faster pace compared to FY2016. State Transport Undertaking sales are also slated to pick up, catering to delayed replacement of over-aged vehicles. Also, JnNURM II orders for about 2,000-2,500 buses are expected to be fulfilled in FY2017.

Also read:

- Ashok Leyland grabs M&HCV market share from Tata Motors in 2015-16

- Indian commercial vehicle exports surge to a three-year high

- India LCV market sees green shoots of recovery after two-year decline

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

By Kiran Bajad

By Kiran Bajad

15 Apr 2016

15 Apr 2016

15607 Views

15607 Views

Shahkar Abidi

Shahkar Abidi