STMicroelectronics Q2 FY2019 profit at $339 million, down 32.7% YoY

STMicroelectronics president Jean-Marc Chery confirms the company’s plans for investment of $1.1 to $1.2 billion in 2019.

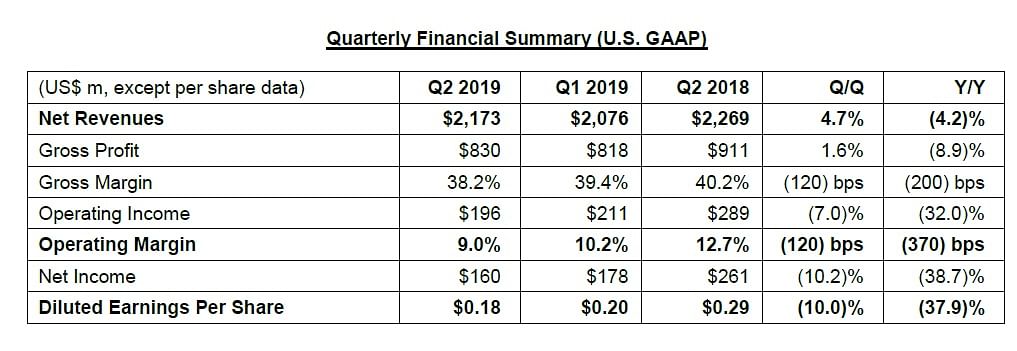

STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, reported U.S. GAAP financial results for the second quarter ended June 29, 2019. ST reported second-quarter net revenues of $2.17 billion (Rs 14,937 crore), gross margin of 38.2 percent, operating margin of 9.0 percent, and net income of $160 million (Rs 1,101 crore).

Jean-Marc Chery, STMicroelectronics president and CEO, commented, “As planned, in the second quarter we returned to sequential revenue growth. In fact, revenues increased 4.7 percent, above the mid-point of our guidance of 2.4 percent, driven by specialised imaging sensors, RF products for front end modules, silicon carbide MOSFETs and digital automotive, partially offset by general-purpose analog, microcontrollers and legacy automotive products. We delivered an operating margin of 9.0 percent. During the first half of 2019 we delivered sales and profitability results in line with our quarterly guidance and we continued to advance our strategic investments. Looking at the third quarter, we expect strong sequential revenue growth of about 15.3 percent at the midpoint."

He further confirmed, "The growth will be driven by engaged customer programs and new products in a softer than expected legacy automotive and industrial market. Gross margin is expected to be about 37.5 percent at the mid-point, including about 140 basis points of unsaturation charges. For the full year 2019, we now expect net revenues to be in the range of about $9.35 to $9.65 billion (Rs 64,357 crore to Rs 66,417 crore). We confirm our investment plan of $1.1 to $1.2 billion (Rs 7,571 crore to Rs 8,259 crore).”

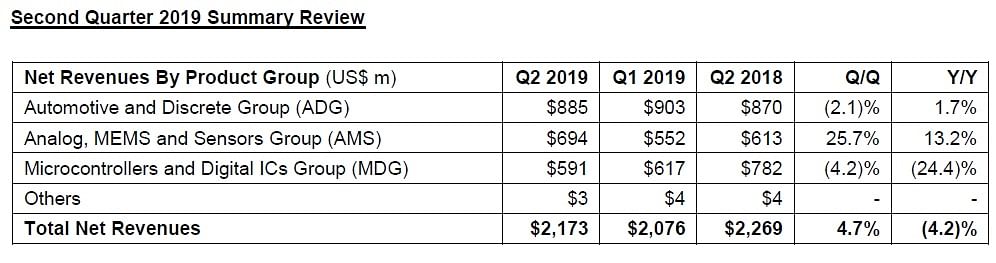

Net revenues totaled $2.17 billion. On a sequential basis revenues increased 4.7 percent. On a year-over-year basis, second quarter net revenues decreased 4.2 percent as STMicroelectronics recorded lower sales in Analog, Microcontrollers and Digital ICs, partially offset by growth in Automotive and Power Discrete, MEMS and Sensors. On a year-over-year basis, sales to OEMs increased 10.3 percent, while distribution decreased 27 percent due to the ongoing inventory correction.

Gross profit totaled $830 million (Rs 5,714 crore), representing a year-over-year decrease of 8.9 percent. Gross margin of 38.2 percent decreased 200 basis points year-over-year, mainly impacted by usual sales price pressure, unfavorable product mix and unsaturation charges. Second quarter gross margin was 30 basis points lower than the mid-point of the Company’s guidance, mainly due to unfavorable product mix. Second quarter gross margin includes 80 basis points of unsaturation charges.

Operating income decreased 32 percent to $196 million (Rs 1,349 crore), compared to $289 million (Rs 1,989 crore) in the year-ago quarter. The Company’s operating margin decreased 370 basis points on a year-over-year basis to 9 percent of net revenues, compared to 12.7 percent in the 2018 second quarter.

Also read: STMicroelectronics new GNSS module targets business from tracking and navigation market

STMicroelectronics' introduces new microcontroller for next-gen vehicles

STMicroelectronics and Hyundai Autron open joint development lab for eco-friendly vehicle solutions

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

29 Jul 2019

29 Jul 2019

6059 Views

6059 Views

Ajit Dalvi

Ajit Dalvi