Samvardhana Motherson targets more Japanese OEM business with Atsumitec buyout

Atsumitec, which has core capabilities in metal and machining business primarily manufacturing gear-shifters, chassis and transmission components for four-wheelers and two-wheelers, is a key supplier to Japanese OEMs including Honda Motor, Toyota, Mitsubishi, Suzuki and Daihatsu.

The Motherson Group, one of India's and the world's leading specialised automotive component manufacturers, through Samvardhana Motherson International Ltd (SAMIL) has announced plans to acquire Atsumitec Co of Japan for $57 million (Rs 475 crore).

Founded in 1949, Atsumitec has core capabilities in metal and machining business primarily manufacturing gear-shifters, chassis and transmission components for four-wheelers and two-wheelers. Atsumitec has direct and indirect subsidiaries in Thailand, Hong-Kong, USA, Vietnam, China, Japan and Indonesia.

The Japanese supplier, which has nine facilities across developed and emerging markets with around 3,400 employees, is a key supplier to Japanese OEMs including Honda Motor, Toyota, Mitsubishi, Suzuki and Daihatsu.

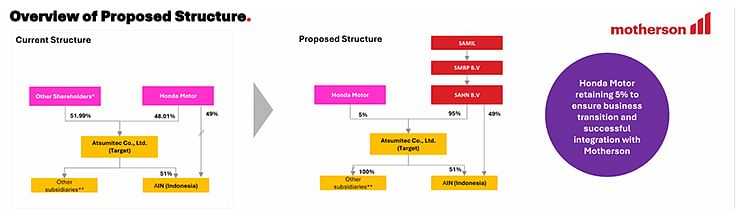

Following the completion of the acquisition by SAMIL, Honda Motor’s stake will stand reduced to five percent (visual: Motherson Group presentation).

At present, Honda Motor has a 48.01% equity stake in Atsumitec, with the remaining 51.99% held by the founding family, management, current and former employees, and business partners. As of December 6, 2024, SAMIL’s SPC has already procured 31.75% stake from other shareholders out of the 51.99 percent. While SAMIL will hold at least 48% shareholding and reconstitute the board of Atsumitec by Q4 FY2025, the acquisition is expected to be completed by Q1 FY2026.

Following the completion of the acquisition by SAMIL, Honda Motor’s stake will stand reduced to five percent. In FY2024, Atsumitec recorded a turnover of around 62 billion Japanese yen (US$ 412 million / Rs 3,432 crore).

Atsumitec will enable SAMIL to diversify its product portfolio with entry into new product lines like chassis and transmission parts for two- and four-wheelers as also entry into new markets like Vietnam (for two-wheelers).

Motherson’s 3CX strategy behind acquisition

The proposed acquisition is in line with the Motherson Group’s three-pronged 3CX strategy which will enable entry into new product lines, further diversification of clientele base with Japanese automakers, and entry and expansion into new markets.

Atsumitec will enable SAMIL to diversify its product portfolio with entry into new product lines like chassis and transmission parts for two- and four-wheelers as also entry into new markets like Vietnam (for two-wheelers).

The Motherson Group foresees potential cross-selling opportunities of its existing product portfolio to Japanese OEMs. Its strategic goal behind acquiring Atsumitec is mainly to expand its share of business with Japanese OEMs, which account for over 25% of global passenger vehicle production. It also aims to achieve further growth and expansion in the metal business through access to the Japanese major’s global metal and machining capabilities, which will complement SAMIL’s existing footprint for the same in India and Mexico. Atsumitec’s in-house global machining capabilities include high value add processes such as heat treatment, carburizing, grinding and broaching.

Lead image: Atsumitec Co of Japan

ALSO READ: Samvardhana Motherson to acquire 11% stake in electric tech company REE Automotive

Samvardhana Motherson’s Q2 profit soars 273% on strong segment performance

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

08 Dec 2024

08 Dec 2024

17396 Views

17396 Views

Ajit Dalvi

Ajit Dalvi