Mobility business delivers highest sales growth for Bosch in 2022

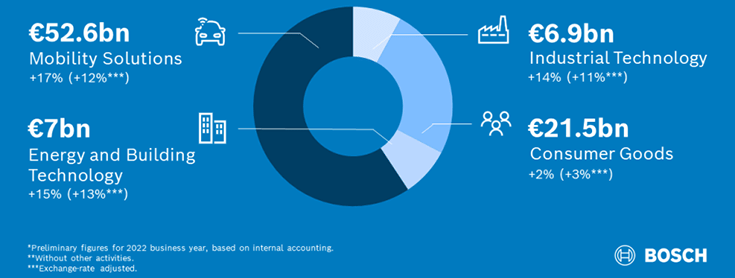

Bosch recorded total sales revenue of 88 billion euros in 2022, up 12%, of which the Mobility Solutions business accounted for 52.6 billion euros and 60% of revenues, growing by 17% year on year.

Technology and services supplier Bosch Group has reported total sales of 88.4 billion euros, up 12% over 2021.

“The difficult 2022 business year once again demonstrated that Bosch is crisis-proof while possessing tremendous innovative strength,” said Dr Stefan Hartung, chairman of the board of management of Robert Bosch GmbH, at the presentation of the company’s preliminary business figures yesterday. “In an environment that remains challenging, we are securing our growth opportunities worldwide with targeted investments and expanding our international presence. We want to offer people around the world technology that is ‘Invented for life’ and thus make a meaningful contribution to society – from climate-friendly heating to energy saving and sustainable mobility.”

"Despite semiconductor shortages and a weak economy, all business sectors were able to increase their sales,” said Dr. Markus Forschner, member of the board of management and chief financial officer of Robert Bosch GmbH.

At 52.6 billion euros, the biggest business sector – Mobility Solutions – once again generated the highest sales in 2022 at 17% and accounted for 60% of Bosch’s total revenues for CY2022. “The good news is that our sales thus grew faster than automotive production,” Forschner said. Nonetheless, he added that profitability was impacted as margins were burdened by cost increases along the entire supply chain as well as upfront investments for the transformation of the company’s mobility business, he said.

At 52.6 billion euros, the biggest business sector – Mobility Solutions – once again generated the highest sales in 2022 at 17% and accounted for 60% of Bosch’s total revenues for CY2022. “The good news is that our sales thus grew faster than automotive production,” Forschner said. Nonetheless, he added that profitability was impacted as margins were burdened by cost increases along the entire supply chain as well as upfront investments for the transformation of the company’s mobility business, he said.

While the Industrial Technology business sector achieved sales growth of 14% to 6.9 billion euros, the Consumer Goods vertical managed to increase sales slightly by 2% to 21.5 billion euros despite significant consumer reluctance to buy home appliances and power tools. The Energy and Building Technology business sector’s sales increased to 7 billion euros, up 13 percent.

Recently, Bosch announced that an investment of 950 million euros over 10 years in an engineering and manufacturing centre in Suzhou, China. The facility will create mobility solutions and products in the areas of electrification and automation which are specifically designed to serve local market demand.

Bosch is also helping to boost Europe’s status as a high-tech location: “A prime example is the expansion of our wafer fabs in Dresden and Reutlingen,” Hartung said. “In the years up to 2026, we plan to invest another 3 billion euros in our semiconductor business – also as a contribution to countering chip shortages in the mobility sector.”

Bosch also plans to focus more on expanding its business globally, in places including Egypt, India, Mexico, the United States, and Vietnam.

Collaboration essential for climate action

Bosch states that the changes in the market and technology environment being ushered in by connectivity, automation, and electrification in particular, along with the growing importance of sustainability, will serve as growth drivers in the years ahead. Additional demand in emerging regions such as the ASEAN countries will open up further market growth.

Against this backdrop, Hartung believes that the company is well positioned with regard to the economic and energy policy situation. However, the energy shortages driving inflation might negatively impact consumption, and thus monetary stability, over the long term. “A fragmentation of economic systems threatens innovative strength and prosperity for everyone,” cautioned Hartung. “Most importantly, climate action needs international cooperation.”

Hartung sees the further development of renewables as a way of resolving the conflicting goals of environmental and economic sustainability. “The transformation of energy systems needs to remain affordable, must not lead to power supply failures in businesses or households, and should leave fossil fuels behind wherever possible.”

Bosch is playing its part in this, he said, and upping the pace in fuel-cell and hydrogen technology. “Where electromobility is concerned,” Hartung said, “we are registering a consistently high order intake.” As a result, Bosch expects to register sales of 6 billion euros in this segment by as early as 2026. In China, business with e-axles and motors is already forecast to turn a profit this year.

Bosch is aiming for a leading position in vehicle operating systems. India is gaining in importance in the competition for software experts. Bosch currently has 17,000 such associates in India.

Bosch is aiming for a leading position in vehicle operating systems. India is gaining in importance in the competition for software experts. Bosch currently has 17,000 such associates in India.

India shines with software expertise

According to Filiz Albrecht, member of the board of management and director of industrial relations at Robert Bosch GmbH, the company’s sustainability strategy is an increasingly important consideration for applicants. In times when skilled workers are in short supply, finding the best talent around the world is also becoming more difficult for Bosch, she said.

She pointed out that India is gaining in importance in the competition for software experts. Bosch has 17,000 such associates there, and worldwide their number has risen from 38,000 to 44,000. The need for software developers remains high; the company expects to add around 10,000 by the middle of the decade. “Bosch will soon employ more than 50,000 people in software development,” Albrecht said. The Bosch Group is also developing the digital skills of its assembly-line associates: this year, for example, will see the launch of “LernWerk,” an initiative in the Mobility Solutions business sector. Its initial aim is to improve the skills that will be needed to work in the “factory of the future” at all locations in Germany.

Worldwide, some 420,300 people worked in the Bosch Group as of December 31, 2022 -- around 18,400 more people than in 2021 and an increase of around 4 percent. “Nearly half this total growth was among associates in R&D,” Forschner said. The number of associates in this area was 84,800 of which 44,000 are software developers.

APAC benefits from strong growth in India

APAC benefits from strong growth in India

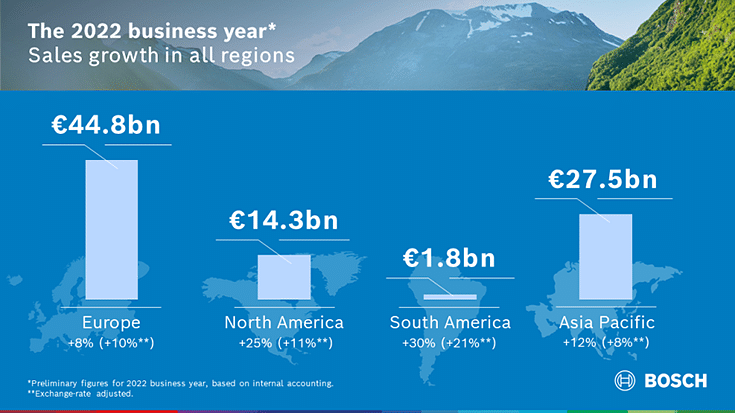

Bosch saw sales growth across all regions, especially in the second half of 2022. In Europe, sales totalled 44.8 billion euros, up 8% YoY. “Growth in Europe was hit harder than the other regions by the war in Ukraine and its consequences,” said Forschner. In North America, sales grew by 25% to 14.3 billion euros. In South America, sales totalled 1.8 billion euros, rising faster than in any other region – by 30% or 21% after adjusting for exchange-rate effects. As Forschner pointed out, “The strong economy was a key factor in this growth.”

In Asia Pacific, sales growth was 12%, or 8% after adjusting for exchange-rate effects, with sales amounting to 27.5 billion euros. According to Forschner, the region benefited from strong growth in India. By contrast, China’s changes to its Covid-19 policy dampened business developments there at the end of the year.

Outlook for 2023: global economic upswing losing impetus

Bosch anticipates an economic slowdown and expects global economic output to grow by less than 2 percent in the current year.

“The global business climate is already reflecting economic burdens,” Forschner said. “Rising interest rates are weighing on investment, especially construction activity and private consumption.” In Europe, this is being compounded by the marked rise in energy costs, even after the recent declines. In China, on the other hand, following the abandonment of its zero-covid policy, a recovery process is likely to begin once the massive infection waves have subsided.

According to Forschner, Bosch is feeling an economic slowdown in important sectors and expects to see ongoing cost pressure in value chains. At the same time, a significant amount of capital must be outlaid in order to finance growth in future technologies. “An innovative company like Bosch must make heavy upfront investments,” he said. Over the course of 2023, he went on, Bosch thus aims to increase its sales and further improve its profitability. “We are on course to achieve our long-term target margin of at least 7 percent,” Forschner said. “On these rough economic seas, we’ll maintain a balance – between securing our profitability and financial strength on one hand, and investments and possible acquisitions on the other.”

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

07 Feb 2023

07 Feb 2023

7113 Views

7113 Views

Ajit Dalvi

Ajit Dalvi