European passenger cars start 2019 slow, decline 4.6% in January

ACEA has revealed that the demand for new cars have come down in almost the entire European Union, including the EU’s five major markets.

According to ACEA (European automobile manufacturers association), the sales figure for January 2019 for the European passenger car market saw a 4.6 percent decline compared to one year ago. This despite the fact that nearly 1.2 million units registered in total was the second highest January volume or record since 2009. The fall in EU’s five major markets is broadly attributed to the introduction of the latest WLTP norms, decline in demands for diesel and the rising popularity of EVs and other new forms of mobility services like subscription and leasing.

As per the reports, almost every country in the continent have seen decline in sales, except for Lithuania (49%), Portugal (8.3%), Romania (18.8%), Hungary (9.2%), Greece (3.7%), Denmark (7%). One of the biggest YoY loss were seen from Spain (-8%) and Italy (-7.5%). Car sales in countries like Iceland (-47.9%) and Switzerland (-3.4%) also saw a sharp YoY decline. Norway, which recently saw a boom in electric cars, saw a YoY decline in its PV sales at 2.2 percent.

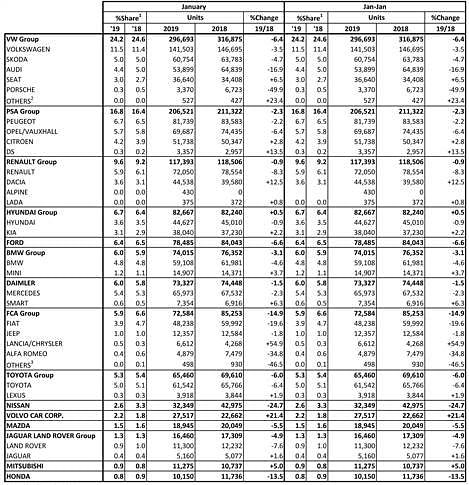

Manufacturer-wise, Volkswagen’s (VW) Porsche saw one of the biggest YoY slide of 49 percent in their sales figures. However, its luxury and performance arms Bentley, Lamborghini and Bugatti have jointly posted a positive YoY sales growth of 23.4 percent. At the same time, FCA’s Lancia/Chrysler saw one of the biggest gains in January 2019 sales with 54.9 percent. Almost every manufacturer have posted negative YoY growth, except for Hyundai (0.3%) and Mitsubishi (2.7%) who just managed to post positive figures.

Some of the other significant gainers in January 2019 include PSA Group’s DS (13.5%), Renault Group’s Dacia (12.5%) and Lada (0.8%), Hyundai Group’s Kia Motors (2.2%), BMW Group’s Mini (3.7%), Daimler’s smart cars Smart (6.3%), Toyota Group’s luxury arm Lexus (1.9%), Volvo Cars (21.4%) and Jaguar Land Rover Group’s Jaguar (1.6%).

Data credits: ACEA

From the start of 2019, it is observed that the trend of the year is more towards frugal and efficient compact SUVs and cars, like BMW Mini, Volvo XC40, Lancia Ypsilon, Dacia Duster, Nissan Leaf as well as premium high end offerings of each Group companies.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

18 Feb 2019

18 Feb 2019

6174 Views

6174 Views

Ajit Dalvi

Ajit Dalvi