Eighty gigafactories may be insufficient if EV sales are to surpass ICE by 2030s

Global EV battery production needs significant boost and automation to meet demand, says new report.

The global electric vehicle industry could face a problem of battery capacity in the future, despite plans for 80 new EV battery gigafactories. A recent ABB report, in conjunction with the automotive intelligence unit of Ultima Media, highlights the role of automation in meeting demand as EVs are predicted to overtake ICE-powered vehicles by 2036.

According to the ‘Electric Vehicle Battery Supply Chain Analysis,’ while 2036 is the changeover year when all-electric passenger vehicles are predicted to overtake sales of ICE-equipped equivalents, concerns over EV battery supply to meet the escalation in demand poses serious risk to the growth of electricity as a clean propulsion fuel.

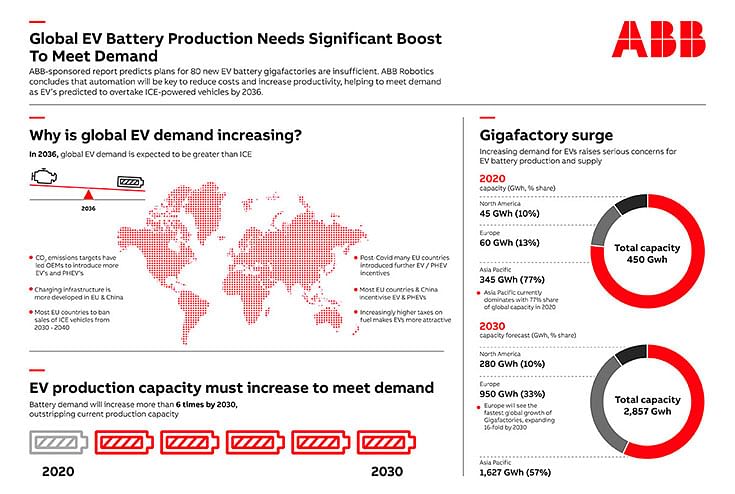

Battery production capacity will likely need to outpace EV demand to meet the rising need for lithium-ion power in other sectors, along with mitigating supply and production constraints. The report estimates that global capacity for lithium-ion batteries will increase from 450 gigawatt hours (GWh) in 2020 to more than 2,850 GWh by 2030.

The report outlines that although Asia leads EV battery production, Europe will make up vital ground over the next few years while US manufacturers are also planning increases in capacity.

“Automation is key to increasing assembly safety, quality and traceability and delivering battery technologies cost effectively, which is critical to the expansion of electric vehicles.” said Tanja Vainio, Managing Director of ABB Robotics Auto Tier 1 Business Line. “With production speed and flexibility essential to the successful scale-up of the EV battery industry, our cellular production architecture enables manufacturers to quickly validate a cell design and then roll out production cells globally with uniform quality, safety and productivity standards. Roll-outs can be scaled to demand with the flexibility to adjust capacity in real time.”

Location of battery assembly plants critical

The report’s researchers point to the importance of battery pack assembly being located close to or within car assembly facilities.

“Co-locating battery pack assembly not only boosts sustainability by reducing transportation, it increases flexibility. A cellular approach to production is easily integrated alongside existing lines. If the demand curve moves, cells can be added or removed quickly to maintain accurate production scale. Our robots are designed to be quickly repurposed as needed, boosting flexibility and adding to our sustainable approach by maximising the life of each robot we build,” added Vainio.

“We believe that building a robust battery supply chain will create a distinct competitive advantage for OEMs, setting a trend towards maximum production flexibility, whether battery pack production is insourced or outsourced, to further reduce costs and boost productivity,” Vainio added.

Cutting battery costs imperative

The high price of EVs will increasingly create a barrier to further market penetration, reducing vehicle cost has therefore become a whole-industry focus. Given that the battery represents up to a third of vehicle costs, ABB is focused on solutions that improve battery manufacturing productivity.

“Increasingly we see that higher productivity and lower costs are driven by assembling battery cells straight into packs,” concludes Vainio. “ABB is working in partnership with a number of manufacturers, using its systems and knowledge to increase productivity, quality and safety levels, as well as reduce finished pack costs through automated assembly – vital if EVs are to meet their required cost and adoption targets.”

Suppliers need to diversify. . . quickly

The race to electrification will inevitably bring pain and disruption to many parts of the supply chain. For OEMs, developing and producing ICE powertrains have been part of how brands differentiate themselves; phasing out petrol and diesel threatens many manufacturing and engineering jobs, too. As EV powertrains have fewer components, many existing suppliers may be threatened and even eliminated. But electrification and especially the battery supply chain represent one of the most significant growth opportunities across the automotive industry. The new manufacturing networks, supply patterns and business relationships will play a large role in defining the next generation of the automotive value chain.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

27 Apr 2021

27 Apr 2021

8370 Views

8370 Views

Ajit Dalvi

Ajit Dalvi