Bosch targets sales of over 80 billion euros by 2029, bets big on software and SDVs

Driven by demand for software-defined vehicles, the automotive software business is likely to reach a volume of over 200 billion euros by 2030; Bosch, which is equally at home in the software and hardware domains, is keen to maximise gains

More than ever, innovations in the automotive sphere are coming about through bits and bytes. Technology and component major Bosch is responding to this trend toward software-based automotive engineering by realigning its automotive-supply business.

Within Robert Bosch GmbH, Bosch Mobility will in the future be managed as a business sector with responsibility for its own business and its own leadership team. At the Bosch annual press conference on May 4, Dr. Stefan Hartung, chairman, Robert Bosch GmbH, said the aim is to be able to serve existing and new customer needs even better and faster with customised technologies and solutions from a single source. With some 230,000 associates at more than 300 locations in 66 countries worldwide, Bosch Mobility will be the biggest of Bosch’s four business sectors.

“Software won’t only change how we use and experience cars in the future. It will also change the way cars are engineered. For some time now, Bosch has also seen itself as a mobility software company. Now, in response to customer requirements, our structure is changing to reflect this and to open up further growth,” added Dr. Markus Heyn, member of the Bosch board of management and the future chairman of the five-strong Bosch Mobility sector board.

Effective January 1, 2024, some of the business sector’s individual divisions will be redrawn and all divisions will be given horizontal, cross-divisional responsibilities as well. With its mobility solutions alone, Bosch’s aim for this new structure is that it will generate sales revenue of more than 80 billion euros worldwide by 2029.

Bosch expects the global market for software-defined vehicles to hit a volume of significantly more than 200 billion euros by 2030. This is three times more than in 2020.

Bosch expects the global market for software-defined vehicles to hit a volume of significantly more than 200 billion euros by 2030. This is three times more than in 2020.

First wave of SDVs expected from mid-decade

One pillar of this growth will be the market for automotive software. Driven by the trend toward software-defined vehicles (SDVs), this market is likely to reach a volume of significantly more than 200 billion euros by 2030. This is three times more than in 2020.

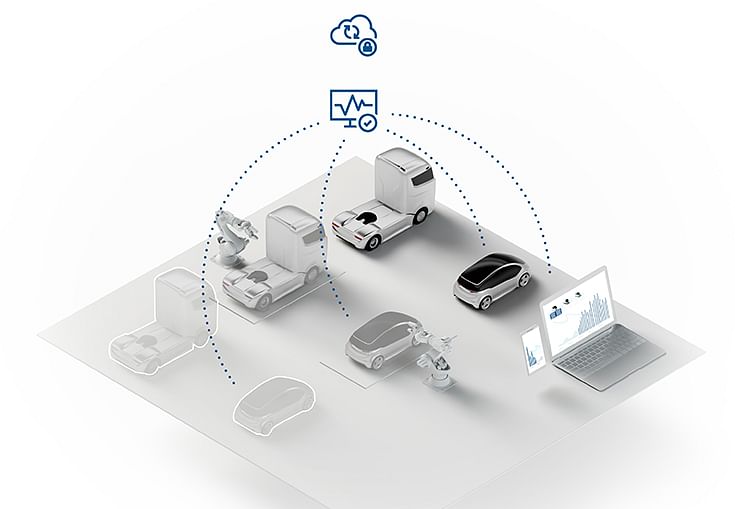

Currently, Bosch’s growth in this market is in double digits. At present, the global automotive industry is putting a stronger focus on software development and its share in development cost will be roughly 30% by 2030. In comparison, at Bosch, it is already higher than that. More than 50% of all R&D associates working for Bosch Mobility are software engineers. Software-defined vehicles offer two outstanding advantages. The first is the speed of development. Instead of taking years, implementing new functions in existing systems will in the future be just a matter of days. The second is the decoupling of software and hardware development, which means that cars will feel like new for longer thanks to software updates.

Explaining this, Heyn said: “Drivers across the globe want to seamlessly integrate their vehicles into their digital world. After all, we have gotten used to constant updates and new features on our smartphones. Now, we are applying this to cars as well.” From 2025, Bosch expects that software-defined vehicles will be introduced on a broad scale.

Software-defined vehicles go hand in hand with a new, centralised electrical and electronic (E/E) architecture. More than 100 control units are installed in the latest premium-class vehicles. Even today’s compact-class vehicles feature between 30 and 50 control units.

Software-defined vehicles go hand in hand with a new, centralised electrical and electronic (E/E) architecture. More than 100 control units are installed in the latest premium-class vehicles. Even today’s compact-class vehicles feature between 30 and 50 control units.

“Our focus will be on making the complexity of electronic systems controllable and as reliable as possible,” Heyn said. In the future, it will be possible to significantly reduce the number of control units by using powerful computers for the various vehicle domains, such as cockpit and connectivity functions, driver assistance systems and automated driving, and the powertrain.

This is why, according to Bosch, it is developing a uniform IT architecture for the entire vehicle – from the cloud, to the central vehicle computer, to the individual control units.

One major advantage is that Bosch is equally at home in the software and hardware domains. Whether brakes, steering systems, or eco-friendly powertrains – where Bosch pursues a technology-neutral approach with fuel cells, batteries, and hydrogen engines – the supplier of technology and services develops and manufactures the key components of modern vehicles under one roof. This includes more than 250 million control units each year, which are also configured with the company’s proprietary software. Furthermore, Bosch specialises in another field that is becoming increasingly important – the integration of software from diverse sources and resulting from collaboration between the automotive and IT industries.

Business realignment to see seven divisions

The Bosch Mobility sector board has defined the business sector’s new configuration in consultation with associates and executives from the individual divisions. Organizationally, the business sector will in the future comprise seven divisions. Some of them have been redrawn, and in some cases additional horizontal responsibilities have been created across all divisions. More specifically, the Electrified Motion division will be concerned with everything relating to electric motors, from the Bosch e-axle to seat adjusters. Vehicle Motion will deal with vehicle dynamics, from ABS and ESP to steering. Power Solutions will handle combustion-engine technology, mobile and stationary fuel cells, electrolyzers, and hydrogen engines. Cross-Domain Computing Solutions will develop solutions for areas ranging from automatic parking to automated driving. Mobility Electronics will drive forward the development of control units.

It will also promote in-house semiconductor activities at Bosch. Mobility Aftermarket will deal with the spare-parts market and the Bosch Car Service workshop franchise. E-Bike Systems will supply systems solutions – comprising drive units, rechargeable batteries, ABS, and connected displays – for e-bikes. The Bosch subsidiary ETAS will be given horizontal responsibility for hardware-agnostic software for operating systems and engineering tools.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

06 May 2023

06 May 2023

7547 Views

7547 Views

Ajit Dalvi

Ajit Dalvi