Automotive dominates 2019 Best Global Brands study, Toyota and Mercedes in Top 10

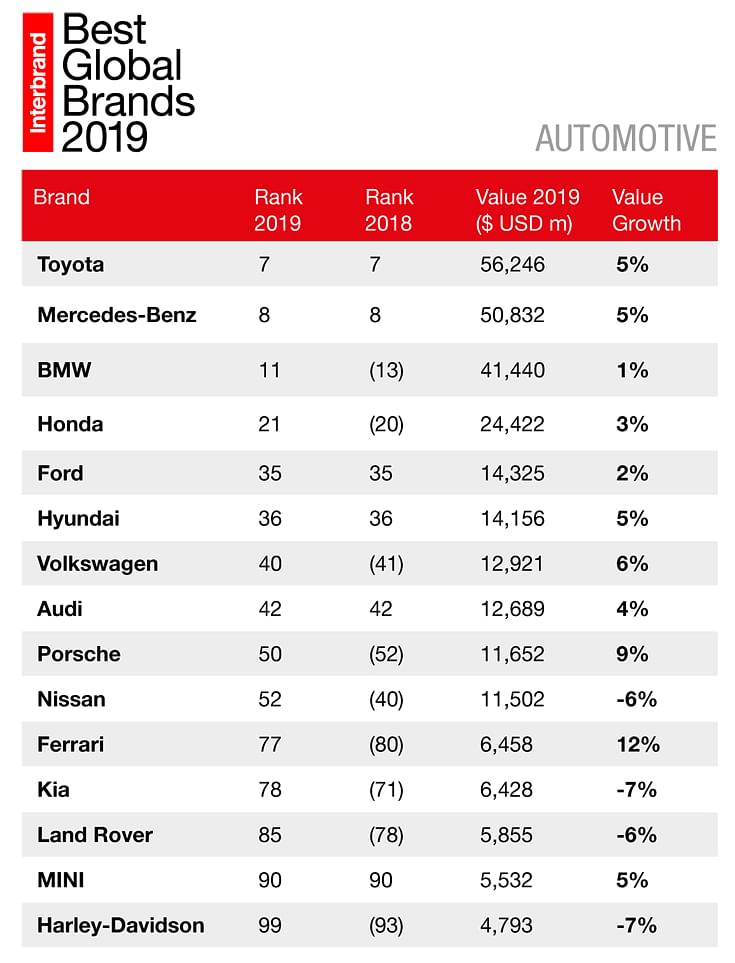

With 15 OEMs in the 2019 Best Global Brands ranking, automotive has the largest sector representation and boasts $279 billion of combined brand value. However, in today’s disruptive times, cumulative brand value growth is the slowest among all sectors at a mere 3%.

Automobile companies have once again, as they did in 2018 and 2017, stamped their dominance when it comes to global brand power. The latest 2019 Interbrand Study sees 15 vehicle manufacturers – 14 carmakers and 1 motorcycle manufacturer – confirm their presence in the best of the best global brands. All these 15 automakers are present in the Indian market. The financial services sector, with 12 brands, is second only to automotive.

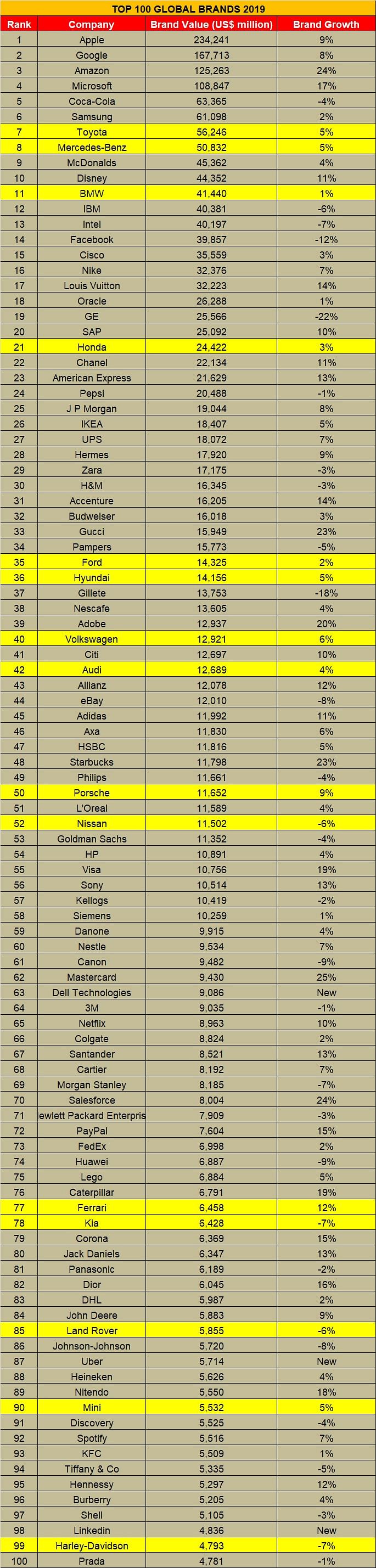

The annual study comes from Interbrand, which today released its Best Global Brands 2019 report, the 20th edition of the world’s first brand valuation survey. While Apple, Google, and Amazon continue their success as the world’s three most valuable brands worldwide, the report also uncovers that the luxury and retail industry is still the fastest growing sector.

“Twenty years on from our first report, customers today are more informed, more connected and more demanding than ever before through a combination of wealth of choice, erosion of loyalty and shifting frames of reference wanting immediacy, abundance and intimacy – all at the same time,” said Charles Trevail, Global CEO of Interbrand. “The age of brand positioning is over. In a world where customer expectations will continue to move faster than businesses, static brand positions and incremental change will just about keep brands in the game – but it will take, brave, we would say ‘iconic’, moves, to make brands leap ahead of customer expectations and ultimately deliver extraordinary business results.”

Future business landscape for auto looks like a minefield

Best Global Brands 2019 features a large number of automotive brands, many of them well-known, globally respected and long established. However, this is one of the sectors with the biggest, scariest challenges looming in the near future. Its overall growth rate is nowhere near that of the booming technology sector, which is in many ways a potential rival, and there’s a perfect storm of technological, geopolitical, regulatory, and societal factors combining to make their business landscape look more like a minefield.

The smarter automotive brands though are already readying their strategy to deal with the fast-changing demands of their customers and the threats posed by shifts in consumption and purchasing patterns. The category is ripe for an iconic move by one or more of the major brands, whether automotive or technology, which will define how their future pans out.

The world’s leading technology and electronics brands make up 50% of the top 10 Best Global Brands in 2019; their impact upon customers, business' and wider society has been profound. Uber’s immediacy, Amazon’s abundance, and Netflix’s intimacy ripple across every aspect of life and line of business, raising the threshold of what makes a good experience for businesses that play in and out of this arena. They have redefined loyalty and enabled the mass and rapid adoption of new technologies such as IoT, Voice, and AI. Yet despite what currently looks like almost limitless opportunities and total brand domination, sustainable growth for the tech giants is not without its challenges. As they grow larger and ever more powerful, their latent promise becomes clouded by regulatory concerns. As they set their sights on connecting ever more intimate aspects of our lives, customers also wrestle with the degree to which they prize utility over privacy.

The automotive risers and fallers

The highest riser in the automotive sector this year is Ferrari with a 12% increase in brand value over the year, from $5,760m to $6,458m. However, the luxury sports car maker only ranks at No. 77, up from 2018’s 80, and it’s the 21st biggest riser overall, underlining the fact that while their cars may be superfast, the sector overall has shown relatively sluggish performance.

Down at the other end of the table, Kia has dropped 7% and 7 places. The Korean brand, a sister to the solidly stable Hyundai, may well be suffering slightly as it tries to reposition itself from a maker of economy cars to a more upmarket image with smartly designed, if still moderately priced, offerings . Shifting from a low-end offering to becoming a Volkswagen rival is an ambitious aim, but they may well get there given time.

The venerable, iconic all-American brand Harley-Davidson is another faller, also dropping 7%, but sliding six places, which leaves it hovering close to the bottom of the rankings in 99th place. The motorcycle maker has been suffering for some time with a customer base which is ageing out of its market and a conservative, unexciting product range. However, in a bold business move the firm has just announced its first electric motorbikes, which puts them well ahead of many rivals. Only time will tell if this brave leap into the future will succeed, but it’s a creditable attempt to reboot the brand’s appeal and customer profile.

Role of brand in automotive purchasing 2019: 42%

According to Interbrand, the percentage for the automotive sector contrasts with that of less glamorous sectors such as energy or financial services, which score 20% this year. However, automotive is placed sixth in Interbrand’s rankings this year behind luxury, at a predictably high 67%, beverages, alcohol, sporting goods and media.

Does that mean that the automotive sector is sliding towards becoming a distress purchase rather than a coveted lifestyle choice? Not really, not yet. But it’s a statistic that auto manufacturers should keep a close eye on while they navigate the transition from personal purchasing to leasing, sharing or hailing as a consumer model. Do people really care which badge is on the taxi or robocar your app just summoned? It’s a question that is on the minds of many in the industry at the moment.

Pressure on automotive brands is coming from many directions. Shifting customer desire is one – do young people actually want to own a car? And do they care which badge it wears? Then there are new entrants to the market such as Tesla, with its ecofriendly electric powertrains and desirable Apple-like high-tech branding. Then there are the impacts of technology changes including location-based mobile computing which could soon enable self-driving vehicles, new power sources, a fast-changing legislative landscape and much, much more.

The more traditional brands have been struggling to adapt to the pace of these changes; a manufacturing-led industry in which the product development cycle is measured in years will always struggle to match the super-speed of today’s customer experiences, like smartphone software updates and on-demand retail.

Automotive companies are inevitably in the business of manufacturing fixed physical hardware, while consumers are feeling the benefits of software’s flexibility. But it’s still a large sector with a proliferation of high-profile brands. There are 15 representatives in the 2019 Best Global Brands ranking, the largest sector representation across the entire report, and one which boasts $279 billion of combined brand value. Automotive brands are represented across almost every decile in the report, with Toyota claiming the top automotive spot and the #7 overall ranking. However, while it has the most brands in the 2019 report, cumulative brand value growth is the slowest among all sectors at a mere 3%.

Technology is one of the key transforming forces in the automotive industry and this raises an intriguing question: Should automotive brands try to become technology companies? And do they even have a choice?

Change in the automotive sector is coming thick and fast, but it’s by no means uniform, either socially or globally. Younger customers’ expectations and desires are different from their parents’; new and fast-developing markets in Asia and elsewhere have very different ideas of brand value and execution.

In China, for example, the government’s enforced push towards electric vehicles in urban areas, the country’s vast size and heavily congested megacities, and the customers’ desires and needs, which are very different from those of the US or European markets, have produced a very specific and unusual brand landscape which poses unique challenges. Vehicles often have to be designed to carry three generations, for instance, to fit in with the Chinese social system. Interior space, equipment and comfort are very important, largely due to the amount of time buyers are likely to spend in stationary traffic. But the long period of communist rule during which the average person could not gain access to a car, let alone a high-quality one, means that China has almost entirely missed out on other markets’ respect for a brand’s heritage of speed and performance. China, though, is coming to join the global automotive industry, and its ambitions will not be satisfied with a minor role. Interbrand confidently predicts that Chinese brands will be featuring in its list before too long, and other Asian countries like South Korea, India and Vietnam are also on the way, if at different speeds, to building sizeable presences in the automotive sector.

How global brands perform over 20 years

Twenty years of brand valuation data has many stories to tell. Only 31 brands (Disney, Nike, and Gucci) from the year 2000 ranking remain on the table today; 137 brands (Marlboro, Nokia, and MTV, to name a few) have come and gone in the intervening years. Coca-Cola and Microsoft are the only brands to have retained top ten spots.

In 2001 (the first year in which the table included 100 brands), the cumulative brand value residing in the world’s top 100 brands was $988B. Today, that value stands at $2.1T— representing a 4.4% average CAGR and more than 2.1x increase in total value. These figures behind Best Global Brands tell a clear story: in such a fluid market landscape, investing in brand is key to long-term success.

As Charles Trevail Global Chief Executive Officer, Interbrand, says: “Today, there is no question as to whether brands have intrinsic value or not. Millennials and Gen Z continue to push companies to redefine what effective brand-building means —and increasingly, what it means to be a truly valuable brand in their eyes. With ever-savvier consumer bases, brands are expected to act in line with their customers’ values. Consumers expect not just engaging experiences, but bold actions that transform traditional categories and help make the world a better place. While it’s an exciting time to be a brand leader, a far more dynamic landscape means brand-building is more difficult than ever. What we are seeing in this evolving market landscape, where customers’ expectations are moving faster than a company’s ability to respond, is that incremental moves can only keep you in the game for the short term. The fastest growing brands are making what we call Iconic Moves — the big bets that transform the way customers interact with brands. When executed successfully, Iconic Moves reframe customer expectations and result in temporary market monopolies and noteworthy brand and business successes.”

Also read: 2018 Best Global Global Brands Study

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

17 Oct 2019

17 Oct 2019

57549 Views

57549 Views

Ajit Dalvi

Ajit Dalvi