Samson Khaou: ‘We are working on electric mobility with many OEMs, including Tesla’

Managing director of Dassault Systemes India new EV start-ups, India as a high-growth market, roadmap for future growth among other areas.

Dassault Systemes India, which launched its cloud-based services for the local market a few months ago, has a special focus on micro, small and medium enterprises (MSMEs) and start-ups, thereby encouraging entrepreneurship amongst engineers across sectors. Managing Director Samson Khaou, who often travels between Dassault's Delhi and Bangalore offices, spoke to Autocar Professional on the software giant's emerging focus areas that include new EV start-ups, India as a high-growth market, roadmap for future growth among other areas.

What is the contribution of MSMEs and start-ups to Dassault India’s overall business? Is your focus on them sharper now?

At present, more than 50 percent of our turnover in India comes from the MSMEs, in general. But in MSMEs too, we have what you call innovators, OEMs or start-ups. We no longer differentiate between them, whether they are in the traditional supply chain or the innovative start-ups.

Is this a unique approach for growing business in India?

No, this is our global model.

Why did it take so long for you to launch cloud-based services in India?

We wanted to make sure that we have the cloud, the data centre that is hosting our cloud in India. We had to know where the data would be – will it be in India, do we have the right security, and the right performance to access this software and technology?

It took us about a year to ensure we bring this technology and this model to India and be ready in terms of infrastructure and support. We always wanted to ensure that we give the MSMEs their ready-to-use solution.

Who is Dassault Systemes’ partner for using cloud services in India?

We are now working with Amazon and we have provisioned all our applications with Amazon in Mumbai.

India is seeing a host of new start-ups investing in electric mobility solutions. Are these new businesses on your radar as a market opportunity?

Today, we are well connected to those start-ups, especially in the electro-mobility space. Whether it is an electric scooter or a company which is looking for new mobility as part of the national initiative, we have tried to see how we can fulfill their requirement in terms of solutions and technology.

We have solutions for electric mobility but we want to make sure what we bring to them is well-tailored to their needs, because you can have electro-mobility and all those start-ups looking at the product in terms of shape and the styling.

You can also look at what they want to bring as a user experience, what they want to use as a kind of metering tool because you also want to understand the way consumption will be optimised. You also want to look which kind of services they want to provide and this is about all the metered data that you capture.

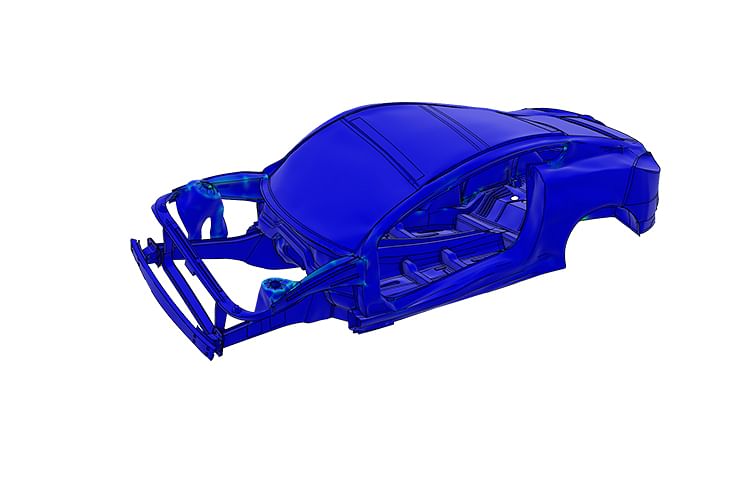

Dassault's DriveEmotion industry solution experience, based on the 3DExperience platform, makes design an iterative process in which designers and engineers collaborate in real time.

That's because their (new upcoming start-ups around EVs) purpose is to not only provide the product, but also services around the product. This is the reason why we want to understand what kind of (Dassault) solutions or part of these solutions would be relevant for them. We are very mindful that we want them to use the solution that is best fit for their profitability.

Tesla is one of our global references and is the first company we are collaboratively working towards achieving our electro-mobility solutions. We started to work with them about three years ago and have strengthened our cooperation since then.

How many companies in India are your customers?

We are working on electric mobility with a large number of OEMs, not only start-ups but also business units or small entities in the large OEMs who have this kind of exploration and research projects.

Can you name some start-ups with which Dassault Systemes India is working?

We have one based in Bangalore which is developing an electric scooter. The reason why we do not want to quote our customer is because I think they have a lot of constraints in terms of being named. However, partners like General Aeronautics are fine to let us communicate their name.

We also have various other customers who are into electric mobility where again we face the limitation of naming them. It is true that those electric mobility companies are very cautious about their name because this market is very competitive, in terms of innovation and each kind of experiences they can bring to the market.

What is the difference in the approach to EV development in India versus other global markets where e-mobility has come of age?

The electric mobility market depends on the prevalent technology around battery. The differentiator in the field is technology and the research on the battery. When we have to deal with EVs, we have to look at the driving distance, the kind of charging facility and power supply we can give.

When the first iPhones were launched, customers were complaining about the battery, the heating in the battery, the time taken to charge them and other issues. Those things needed a lot of research around the battery. We are also working on the solution perspective of the battery technology, to help those in research, to release it later.

Are you working with any of the lithium ion battery makers, like LG or Panasonic?

We are working with many of those high-tech companies dealing in batteries globally. By high tech, we mean those specialising in electronics.

Dassault Systemes has business across 12 verticals including automotive. How many of them use cloud-based services?

The software technology used by SMEs is of design, which can be about heavy components of a car or an aircraft. The three main domains where SMEs use our technology are design, simulation and manufacturing. What we bring in additionally is what we are doing here is that how to create experiences.

Experiences are to how to create usage around your product, which has to be explained in an immersive environment. We have created a headset with virtual reality (VR) that helps to interact and penetrate the product from the consumer experience perspective.

With this technology we enable customer and market insight that helps to understand social media. Whenever you want to understand consumer feedback, you have the Big Data Analytics or social analytics to help companies understand the trends and also the feedback on their existing products, or how they are going to take the market feedback to launch these new products.

Do you see any increase in Dassault’s engagement with Tier 1 and 2 suppliers in the automotive value chain?

Yes, I think in India, especially in automotive, Tier 1 suppliers are becoming global. They are also looking to grow up in the value chain by what they used to call in the past as Tier 0.5.

We see a number of Tier 1 suppliers, with whom we are working, going to this level. It is very interesting for us as to how we can help them work as a global OEM. This means that the way these Tier 1 suppliers want to manufacture products is very close to the way global OEMs make their products. They are going for a cost and quality perspective to capitalise on all the know-how they have created on different projects.

You see a lot of adaptability, flexibility and response to market (as standard processes) being developed among Indian Tier 1 suppliers in India and also outside of India. What is reveals is that they are expanding by reducing the cost but also by creating value. This is the reason why we feel that it is important for us to work with them because we have a lot of experience for those companies in Asia.

Stress test for body in white to identify noise and vibration characteristics of the vehicle.

Also, we learn a lot about the global Tier 1 and Tier 0.5 companies, and we see the same trend and the same requirements coming from Tier 1 OEs here. For example, we are working with the UNO Minda Group and see the same trend wherein it is moving up the automotive value chain.

How big is the automotive sector for Dassault’s business in India?

For Dassault Systemes, which was founded in 1981, automotive is part of its DNA. Our first customer for automotive was in 1983. We are born from the aerospace industry and the first industry we expanded to is automotive with whom we have been working since the past 35 years globally.

The first customer is a German company and the second one is Honda. In India, our software was first used in design and we believe we have started here back in the late 1980s. We have created our footprint for automotive and our solutions are widely used by local players in India.

Automotive accounts for more than 50 percent for us, because if you look at this industry it is not only about the large OEMs but also about the global companies having their operations in India. If you take all those global and local automotive players and their suppliers, scattered across India, they all represent more than 50 percent of our business and turnover here in India.

What is Dassault’s three-year roadmap for India?

I am not allowed to tell because of the competition! What is clear is that the SMEs are one of the highest growth areas. This sector is going to grow faster. So the focus is on the SMEs.

The second sector we are looking at is how we are going to support the government projects in terms of infrastructure, construction, smart cities and others. I think we are also looking forward at growing in healthcare.

And the last thing for us, besides the automotive industry, construction, infrastructure, smart cities, healthcare and pharma, is the area for diversification. One area where we want to contribute is not as a business but as a company that wants to support the country is education.

What percentage of global revenue comes from India currently?

We cannot share that information because all our final consolidation is done at the HQ level. Last year, we have grown in double digits, more than 10 percent growth over 2016. This year too, we have to keep the same trend because this market is growing, and the potential of this market is seen as one of the highest potential in all of Asia for the company.

In Asia, we have five main geographies – Japan, Korea, China, India and South-East Asia including Australia – and today with regard to the macroeconomics, India becomes one of the highest growth countries for us. Between China and India, India has the potential of growing faster. And now if you look at the macroeconomics in terms of GDP growth, India has the highest potential for our business.

(This interview was first published in the 1 September 2018 issue of Autocar Professional)

RELATED ARTICLES

"Connectivity and ADAS will drive the next wave of disruption": Sundar Ganpathi

Tata Elxsi's CTO Sundar Ganapathi on how connectivity, ADAS, and data will define the next wave of automotive disruption...

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

28 Sep 2018

28 Sep 2018

12402 Views

12402 Views

Darshan Nakhwa

Darshan Nakhwa

Hormazd Sorabjee

Hormazd Sorabjee

Prerna Lidhoo

Prerna Lidhoo