'India is in quite a good position to meet the new crash requirements for pedestrians as well as occupants.'

Spain’s Applus+ IDIADA Group is eyeing new business in safety, powertrain, ADAS and green mobility in India. Mandeep Singh Tack, director, Business Unit India, in an exclusive interview.

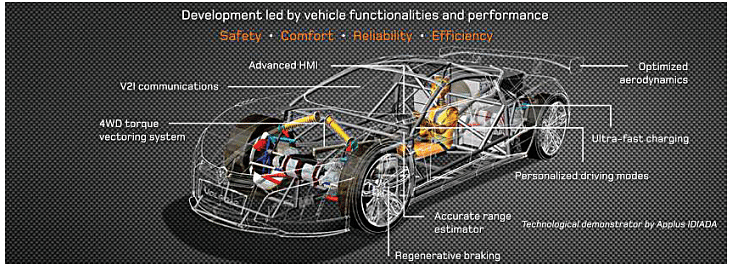

Spain’s Applus+ IDIADA Group, which specialises in providing design, engineering, testing and homologation services to the global automotive industry, is eyeing business opportunities in the areas of safety, powertrain, ADAS and green mobility. Mandeep Singh Tack, director, Business Unit India, Applus+ IDIADA Group, tells Amit Panday that it is also keen to explore the surging tractor and two-wheeler markets in India.

What are the core areas of focus within the automotive industry for Applus IDIADA in India?

IDIADA is involved with clients pretty much across the range of transport solutions. Currently, we are focusing upon passenger cars, commercial vehicles (both trucks and buses – medium and heavy duty), and we are also foraying into the tractor market as well.

Can you throw some light on Applus IDIADA’s engineering setup in India?

We have a full-fledged engineering setup here. We have about 150 engineers focusing mainly on the interior and exterior designs, passive safety simulation, NVH (noise-vibrationharshness) simulation, vehicle dynamics, brake durability and brake analysis, durability and testing, and other areas. We have a new workshop in Pune now to handle these types of projects for vehicle validation programs.

How does Applus IDIADA see the evolving automotive market in India along with the new opportunities around safety and emissions that are mushrooming for an R&D service provider?

For Bharat NCAP, I think that the larger players (in the auto industry) are quite well equipped with the requirements for meeting the norms. A lot of effort has already gone into putting the right solutions and architectures in place. So, I think, it may be the smaller players, the ones with smaller volumes or ones operating in the niche segments, who may need the additional support. We are working with some of them on these types of opportunities with help from our experts from Spain as well.

IDIADA is very focused on passive safety. We are one of the members of the board of the Euro NCAP. Passive safety is one of our key forte areas. I think India is in quite a good position to meet the new requirements for crash for pedestrians as well as occupants.

Besides vehicle makers, do you also work with Tier 1 component suppliers in India?

Our engagement with Tier 1 component suppliers is very little at the moment. Our main focus is on the OEMs. We work with the Tier 1s in relation to, may be, bumper systems development or cockpit development. So Tier 1 manufacturers who outsource their engineering work to us or when the OEMs nominate us to take up such projects while supplier(s) take care of the manufacturing portion only.

Body-in-white supplier Gestamp, another company from Spain, says that with Bharat NCAP kicking in, most OEMs have to shift from cold stamping to hot stamping technology to improve upon safety of the exteriors of the vehicles along with cutting down the weight. Is Applus IDIADA working with these companies that are directly associated with the safety features of vehicles?

We design the vehicle and we are involved from the concept phase. We help in defining the sections, we guide them in terms of selecting the right materials and technologies. So, in terms of working closely with a company providing body-in-white (BIW), I would say no. This is pretty much across the group because we are working directly for the OEMs.

We work from the very early phases of the project where our inputs are required; the client comes to us for required design solutions. And then, at one point, the OEM decides that we should go for the Tier 1 supplier and which Tier 1 supplier to go for.

We are involved in the project development from stages a lot earlier than where the component suppliers step in. However, in some cases, a Tier 1 is nominated as the preferred partner directly by the OEM, like the company you just mentioned. So they may be doing all the passive safety work and may also be doing the crash simulations as part of their ongoing support to that client.

We don’t really focus heavily on Tier 1 component suppliers. Many of them (component suppliers) do lot of research and technology development not just on the BIW but also on the systems development front and they collaborate with the OEMs too across stages.

On the other hand, what we do is we take the best solutions from the market remaining independent at the same time. So yes, we can integrate with different suppliers at different stages. But we try to give solutions that best-fits the needs of the client / OEM.

Since you mentioned safety as one of your core areas of focus, has Applus worked with two-wheeler companies in India? The domestic twowheeler market here is the biggest in the world.

We have made very small progress in the two-wheeler segment and it’s one area where we definitely want to move into. We actually had some discussions with one of the suspension systems suppliers that may be wanting to collaborate with us. But I think you are right. The two-wheeler market has not got its due as it gets understood as a category with low-value products, some companies are not willing to pay for engineering support as they keep a lot of developments in-house. However, I think the two-wheeler market really has a lot of potential for engineering companies and we would like to explore it further.

Several European two wheeler companies now upping the ante in India. Other than KTM and Triumph Motorcycles, BMW Motorrad is the latest entrant to have started manufacturing sub- 500cc motorcycles locally. Does Applus plans to bank upon its relationship with European clients for business in India?

It’s true that we work with a lot of OEMs globally. Obviously, when an OEM is willing to explore a market in India, then whatever area(s) of expertise we supply them with in Spain or Germany or Czech Republic, we try to make sure that our capabilities are built up and we are very much aligned with the integration and ensure that the knowledge is transferred.

One of the key aspects for delivery is to show that we have the necessary skills and resources built up here to complement and support projects from both areas. This is so because a lot of OEMs don’t want to purely rely on European expertise because the costs make the projects uncompetitive. So you want to build up the capabilities here. This is what we are doing here.

What are your priority areas in India, going forward? Applus does not offer powertrain development capabilities?

Our headquarters has about 200 powertrain engineers and we don’t develop engines from scratch. Instead, we focus on integrating new engineering inputs. For example, the new BS VI norms will require tuning and re-calibration of engines. This is one of our key areas of expertise and we will be reinforcing a team on this in Pune for new opportunities. We think there is a lot of scope both in terms of capacities and engineering support.

What does Applus IDIADA offer on the front of vehicle dynamics?

Our clients have been appreciating our services on the front of vehicle dynamics, both from our experts in our headquarters and from what we have been developing here over the past two years.

We now have the right instrumentation in place to undertake objective testing. We have built up the capabilities of our engineers here to undertake subjective testing as well for both ride comfort and handling, which are the main attributes.

So things are now really taking off and we are getting good feedback from our clients.

The Applus team in India is speaking about ADAS associated functionalities for the first time and you even displayed ADAS technology at SIAT earlier this year. Are you beginning to build your team and competencies around that also in India now?

Our clients wanted us to look at the different aspects of ADAS. The ADAS solutions have to be tailored for the Indian market. Let’s take an example of emergency braking. There are many crashes and fatalities in India, especially in commercial vehicles and in night-time driving. So having a system, which could operate between medium to high speeds on highways and expressways, something tailored to the locality, could help save lives and reduce the costs of insurance as well.

We don’t have a team dealing in ADAS for the India market. We still rely on our experts based overseas who come over here to understand the project and deliver accordingly. But ADAS is clearly on the radar for India.

Autonomous driving for India, on the other hand, is decades away. We may have more cruise controlrelated systems and ADASrelated systems. But these again need to be tailored to suit the Indian conditions. A lot of these systems rely on good road markings, which need tremendous improvements in India. Fundamental definitions of lanes and others have to improve here in order to support autonomous driving in India.

(This interview was first published in the November 1, 2017 print edition of Autocar Professional)

RELATED ARTICLES

"Connectivity and ADAS will drive the next wave of disruption": Sundar Ganpathi

Tata Elxsi's CTO Sundar Ganapathi on how connectivity, ADAS, and data will define the next wave of automotive disruption...

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

19 Nov 2017

19 Nov 2017

11329 Views

11329 Views

Darshan Nakhwa

Darshan Nakhwa

Hormazd Sorabjee

Hormazd Sorabjee

Prerna Lidhoo

Prerna Lidhoo