How India’s top 2 OEMs service 2m cars every month

An operation that sees an average of 66,666 vehicles enter workshops to exit in the pink of health every single day calls for a heightened level of expertise, skill and management. Here's knowing what makes Maruti and Hyundai tick.

An operation that sees an average of 66,666 vehicles enter authorised workshops to exit in the pink of health every single day calls for a heightened level of expertise, skill and management. Mayank Dhingra finds out what makes Maruti Suzuki's and Hyundai Motor India's service tick.

Dale Carnegie’s award-winning book, ‘How to Win Friends and Influence People’, which has sold over 30 million copies worldwide, offers plentiful advice in handling people, winning friends, bringing people to your way of thinking, being a great leader, and navigating home life successfully. Surveys by global automakers have revealed that relationships with cars mimic relationships with people, often feeling ‘very attached’ or ‘somewhat attached’ to their metal steeds. This also infers that customer satisfaction is intrinsically linked to the quality of service a vehicle gets from an automaker after it goes home to a buyer.

In a cost-conscious market like India, passenger vehicle buyers seek value for every rupee they spend and when they get what they seek, their word of mouth speaks more volumes than crores of rupees OEMs spend in advertisements. Achieving excellence across their service operation is what the top two carmakers in the country – Maruti Suzuki India and Hyundai Motor India – have been consistently pegging at over the years, and on which have built their reputations. These two OEMs accounted for 64 percent of the total new passenger vehicle (PV) sales in FY2017 – 1,953,346 units (1,443,641 Marutis and 509,705 Hyundais) from 3,046,727 PVs sold, the first time that sales crossed the 3-million units landmark.

With fast-changing customer preferences, low interest rates, higher disposal incomes and the advance of technology inside the cabin, car ownership has dropped from an average of over seven years in 2010 to around four years now. To ensure their buyers are happy, the aftersales divisions of OEMs are tasked with the onerous job of topping customer satisfaction, which in turn ensures buyers stick to the brand in a highly dynamic market swamped with global players and 205 PV models.

The magnitude of the Maruti Suzuki India and Hyundai Motor India aftersales service operation boggles the mind. Together, these two players handle more than 2 million cars each month, through over 4,500 service workshops across the country.

Do the math and you arrive at a humongous figure of 66,666 cars being serviced every single day! Clearly, these two majors – one with Japanese brand equity and the other Korean – are doing something very right to service 24 million cars a year. Here’s looking at just what.

NETWORK STRENGTH

While Maruti Suzuki handles over 1,500,000 PVs a month, through 3,250-odd dealer workshops and authorised service centres, Hyundai caters to over 510,000 customers through its 1,276 workshops, including 487 3S facilities and 284 workshops only catering to rural India. Delhi-NCR is a big market – it sends close to 195,000 cars to Maruti and 64,000 to Hyundai each month.

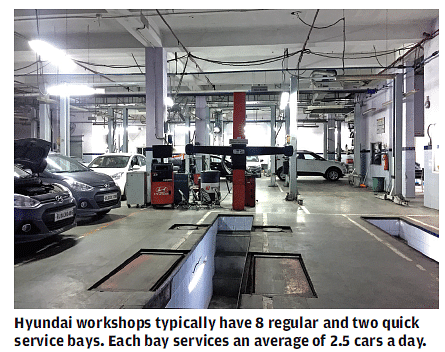

A regular Hyundai workshop comprises an average of 10 servicing bays, including 2 quick bays in an urban setup; a minimum of 2 bays are a prerequisite for an outlet in the rural hinterland or a relatively smaller town, taking the average monthly load per workshop between 700- 800 cars (2.5 cars per bay every day). Maruti Suzuki, with its relatively larger pool of dealer outlets and authorised service centres again sees 8-10 bays on an average per facility, including one or two express bays, to cumulatively handle around 1,000 cars every month, going up to 1,200 including purely running repair jobs in a region boasting a larger car parc.

These workshops, at both OEMs, deploy contemporary garage equipment from the likes of ATS Elgi, Manatec Electronics, Madhus Garage Equipment, LG Heavy Electronics, Karcher, Manmachine Works and Precision, to ensure speedy vehicle turnaround.

THE ‘A’ TEAMS

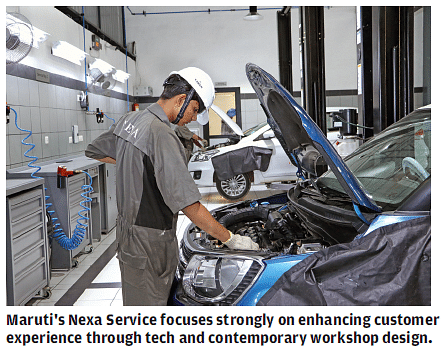

Maruti Suzuki’s service division, categorised as a function of its marketing and sales operations, is led by Partho Banerjee, the incumbent executive vice-president, who closely monitors all the aftersales initiatives and reports to RS Kalsi, senior executive director (Marketing and Sales). Banerjee’s recent pet project has been ‘Nexa Service’, Maruti’s new initiative to drive up the value chain. The company aims to open 70-80 such outlets by end-FY2018, first focusing on Tier 1 cities.

At Hyundai Motor India, S Punnaivanam, assistant vice-president, Unit Head Service, takes care of the business with the sole objective, as he says, being to “not just deliver happiness but bring delight to customers.” Hyundai’s overall marketing and sales operations are headed by director Rakesh Srivastava, who charts out a roadmap for network expansion, capability expansion, process enhancement and, finally, brand enhancement.

Hyundai aims to expand its dealer network to reach 1,300 outlets by March 2018. There will be a sharper focus on rural markets, currently standing at 284 outlets. This is understandable considering the Korean carmaker has seen a surge of demand for its premium products, including the Creta SUV and Elite i20 hatchback, from rural India due to improving agricultural incomes and changing customer trends.

In a bid to enhance customer experience, the company has initiated the process of upgrading its outlets to Hyundai’s Global Dealer Space Identity (GDSI) programme, which became effective in 2015, two years before Maruti’s Nexa Service. GDSI aims to transform the ambience of both workshops and showrooms, offering a feel-good factor to customers. There is also the intervention of technology, with job-card opening turning digital through a tablet handheld by the service advisor. While all outlets will eventually shift to GDSI, Hyundai is making the transition in a phase-wise manner. It has already transformed close to 200 3S facilities and 249-odd 2S outlets, most of which thrum with a servicing volume of over 400 cars every month and are over five years old.

THE EXOSKELETON

A close look into the functioning of one of Maruti’s most crucial operations reveals all the hard work. The carmaker has topped the annual JD Power Customer Service Index (CSI) survey for 18 years straight, a testament to its strong customer centricity.

The company chalked India into six zones – the regular four, central and the south-east. With every zone comprising Regional Offices (ROs) and certain large regions also demanding the need for an additional Area Office (AO) for better work management, the total ROs in Maruti’s service channel stand at eighteen. While ROs and AOs remain common for functioning of the regular workshops as well as for Nexa Service, manpower is separate for both.

The hierarchy handling the humongous amount of work starts with the territory service manager (TSM) working at the ground level. It clambers higher up with an Area Service Manager (ASM), Regional Service Manager (RSM), and a Zonal Head, who reports directly to Partho Banerjee.

At Maruti Suzuki, every region sees the deployment of 10-15 TSMs. However, the number of TSMs taking care of the Nexa channel, is rather low at the moment, with every region doing with just 2-3 dedicated managers because of the initial low quantum of Nexa cars present on the road.

The framework in Hyundai is fairly similar: five operational zones with 17 ROs across the country. Managing every region is a bouquet of 7-8 Area Managers (AMs), who are working on the field and support the entire service network and its customers. With a total of 125 AMs, each individual manages a total of 10 workshops (7 urban + 3 rural) in general.

All 17 RMs are categorised under two separate zonal groups, Zone-I and Zone-II, each reporting to a field group head, who, in turn, reports to Punnaivanam on a regular basis. Hyundai has seen a 46 percent increase in its manpower working on the field (the AMs) within a short span of two years between 2015 until date.

WORK MANAGEMENT

The work management in service runs on the principle of monitoring and measuring the Key Performance Indicators (KPIs) of every workshop, so as to keep them on their toes and get them to perform with maximum efficiency.

Maruti TSMs are responsible for visiting the workshops under their control and monitoring all the parameters in the KPI set. A TSM could be seen doing his workshop audits 2-3 days every week and reporting the data to the RSM, who handles that particular region, manages all the TSMs in it and takes charge for meeting overall targets and the smooth functioning from a broader perspective.

At Hyundai, an AM does the rounds of 2-3 workshops every week, sourcing data on various parameters, including process compliance, dealer manpower, facility enhancement, and also resolving customer complaints alongside.

CUSTOMER IS KING

What makes car owners in India vote for Maruti and Hyundai is their strong customer-centric approach. The first KPI parameter on a Maruti TSM’s radar is the customer complaints received on the number of cars serviced. The ratio is an extremely critical tool for Maruti to keep a qualitative check on the workmanship and a workshop’s performance, and the upper limit has been kept at 30 complaints per 10,000 customers.

In comparison, Hyundai gets its AMs to report feedback on the compliance of the complete six-step process, right from the customer booking a service appointment, until the post-service follow-up call made by the workshop’s CRM. The monitoring is quantified to keep a tab on the proper functioning of the workshops to carry out work in the most streamlined manner.

Not surprisingly, the two OEMs usually battle it out to clinch the top spot in the JD Power CSI each year. This study is a 1,000-point report card, based on a sample survey conducted between May 1 and August 31 of a calendar year, and covers customers who visit a brand service outlet for maintenance or repair jobs in the first 12-24 months of their vehicle ownership. Both companies carry out an internal CSI, which is in complete isolation from the one officially tabulated by JD Power.

The monitoring of this parameter gets the CRM teams of both the companies, outsourced to external agencies from their HOs in New Delhi, engage on a call-back service to a random batch of customers and take the feedback on an extensive questionnaire of 43 pointers, getting to know their experience in a measurable form. Both OEMs see around 20-30 calls per workshop being made every month, to all types of customers, including those with their vehicles in warranty, those who could be potential JD Power respondents and general repair visitors. The questions range from high-ranking ones like the quality of job performed, through to the very basic ones focusing on workshop ambience and the behaviour of the staff.

In the JD Power 2016 CSI, Maruti Suzuki was once again the topper, scoring 901 points and performing well across all across all parameters including service initiation and quality. Hyundai ranked third with a score of 888. With all the efforts going towards enhancing customers’ delight, Hyundai Motor India's Punnaivanam is confident about improving on last year’s score and performing better in this year’s CSI results.

DEALER ENHANCEMENT

To increase viability and revenue for its dealers, Maruti Suzuki monitors all workshops on a third factor of volume growth. An average 10-15 percent annual target is set for all dealers; anything below that indicates some problem areas, which could be poor manpower training, low CSI or even lower profitability due to certain external factors, making the workshop principal becoming disinterested in the business.

Hyundai, since 2003, has been focussing on its Dealer Enhancement Programme (DEP), wherein it encourages efficient utilisation of manpower and process orientation to ensure higher profitability for its ‘partners’ or dealers. The DEP has also seen the implementation of modern equipment like exhaust gas extractors into the workfloor, use of water-borne paint processes at 11 of its outlets (pegged to reach 30 by end-FY2018) and ensuring environmental sustainability by adopting water-less car wash processes. All of this has now also been introduced by Maruti with its Nexa Service.

MANPOWER TRAINING

On-the-job training and imparting skills by conducting special sessions is a strong criterion to ensure high levels of work quality and top-notch customer satisfaction. The basic structure of manpower at the workshop level sees the pool of technicians (15- 20) working on the ground, with service advisors (7-8) being the interface between the customer and technician, both being monitored by a works manager, and finally headed by a workshop general manager.

Maruti has its central service training centre (CSTC), functioning from the Gurgaon plant, along with 18 regional training centres (RTCs) spread across the country. There are three levels of training courses for both technical and soft-skills knowledge, which comprise a Basic, Advanced and a Diagnostic course.

Hyundai, which employs a total of 8,317 technicians and 3,510 service advisors across its network, too has divided the associate training into technical and soft-skills categories, running over a four-step programme, with additional courses on master technician and diagnostic training imparted to technicians on successful completion of the last two stages of the programme.

While service advisors get more hands-on diagnostic and soft-skills training, leadership training for the service head includes a two-level management training course and a highly intensive soft-skill course is imparted to the CRM team of every workshop.

The company has six RTCs, which is set to include two more in Guwahati and Ahmedabad by the end of CY2017. Out of these, four centres currently offer body shop training as well and Hyundai also has 10 training academies in place. It recently opened a state-of-the art training centre, combined with a QC facility in Faridabad, christened India National Quality Centre (INQC). Hyundai is leveraging the potential of this facility to also engage with its customers in a very unique manner by offering first-time car owners from its pool to get skilled in basic car maintenance.

While both carmakers aim to maintain the level of employee training close to 85-90 percent, it is situations like the joining of a new associate, which calls for the general manager of the workshop to suggest, or get direct recommendation from the area offices itself to send 1-2 people from across the workshop hierarchy levels, based on the requirement, to get trained in various disciplines.

Associate trainings range from general subjects including daily diagnosis and fuel-specific engine diagnosis, to specialised ones like common countermeasure of recurring problems, apart from the soft-skills training, which is imparted only at the service advisor level and above.

THE CUSTOMER JOURNEY

The customer journey in a Maruti or Hyundai workshop begins with the service advisor opening a job-card (digitally in case of Hyundai GDSI and Nexa Service outlets, and manually in regular workshops), detailing the work needed to be done on the basis of the scheduled maintenance calendar of the car, also noting down customer-specific inputs, and communicating an estimated cost and delivery time. The customer can either drop off the car and return for delivery, or stay in the customer lounge while the car is being serviced for the next three-four hours in case of regular service, or between 90-120 minutes in case of express service, to carry out the preventive maintenance service until the first 20,000km of a car.

With Nexa Service outlets, Maruti has tried to touch upon this aspect and plans to redefine the customer journey inside a workshop. The new facilities are based on strong integration of technology with design, and have set to utilise the capabilities of a smartphone and offer services like pre-appointments, live webcast of the car being worked upon, and drop-off shuttles. The customer lounge itself is extremely plush and offers facilities like wi-fi, F&B and Know-It-Yourself (KIY) videos on iPads. Maruti Suzuki aims to set a total of 300 such outlets by FY2020, and also leverage the enhanced levels of customer satisfaction. All this in line with its overall sales target of two million cars annually by 2020 and a service network encompassing 5,000 outlets by the year 2021.

All in all, the aftersales service operation at Maruti and Hyundai is a laudable one, considering their vast parc of car owners in India and the task of keeping both the owner and the vehicle smiling at all times.

(This article was first published in the September 1, 2017 print edition of Autocar Professional)

RELATED ARTICLES

BKT, the ‘Off-Road King,’ Chases the Consumer Market

The company has unveiled a broad range of tyres for the Indian two-wheeler and CV markets.

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

12 Oct 2017

12 Oct 2017

46258 Views

46258 Views

Shahkar Abidi

Shahkar Abidi

Darshan Nakhwa

Darshan Nakhwa