Women's Day Special: Clearing the mis-s-understanding

Car buying is no longer only a man's prerogative. A growing number of women in India today choose their own set of wheels and also influence car-buying decisions. A survey by consumer insights-based consulting company PremonAsia offers a number of insights into what women look for in a car.

Car buying in India is considered to be a male-dominated arena. However, this isn’t to say that women are a small segment as they currently make up 15 percent of the total car buyers, a figure that’s only expected to rise. Driven by education, work, higher spending power and changing lifestyles, an increasing number of Indian women are taking to the wheel. So, what do they look for when purchasing cars? Are colour, cost and ease of driving really the main buying criteria? Or are their buying patterns completely different? PremonAsia, a consumer insights company conducted a country-wide survey to find out exactly that and much more.

OWNERSHIP EXPERIENCE SURVEY

Overview: A survey of 3,945 individuals – comprising 3,350 women car owners and intenders (has a shared home car but intends to buy new one), and 595 men who bought a car for a woman – was conducted across 28 cities in India. They had their say in five keys areas of vehicle ownership – brand image, product performance, sales and delivery process, aftersales service, and cost of ownership, with appropriate weightings given to each of them. Here are some insights into the psyche of the woman car buyer.

HONDA: Honda has come out on top, displaying good performance across most parameters. Product and cost of ownership seem to be trump cards for the brand and it aces the competition in these areas. Models which contributed towards positive sentiment for the brand included the City sedan and the Jazz hatchback, with strengths like seating comfort, infotainment and ease of usage.

Honda’s ability to command a high resale value for longer periods also proved to be a major pull for women buyers. However, many felt that there is some scope for improvement in areas like the customer-handling skills of the salesperson, vehicle delivery timing and a smoother aftersales experience.

Brand: 7.5/10

Product: 8.5/10

Sales & Delivery: 9/10

Aftersales Service: 8.5/10

Cost of Ownership: 8/10

Overall: 8.5/10

VOLKSWAGEN: The promise of German engineering seems to have bided well with women who voted VW a close second in the survey. Visually appealing products and innovative technology helped it post an industry-best score for brand image. Additionally, women also seem impressed with the sales experience VW offers, barring a timely vehicle delivery.

Both the Polo and Vento came highly rated, but respondents did point out drawbacks like poor engine refinement and AC performance. Also, the higher costs involved in servicing and repairs are a major concern.

Brand: 8/10

Product: 7.5/10

Sales & Delivery: 9/10

Aftersales Service: 8.5/10

Cost of Ownership: 8.5/10

Overall: 8/10

NISSAN: Nissan scored a rating identical to that of Volkswagen. It lost out on brand image and there is a perception that it lacks exciting cars, along with innovative technology. However, where it does really well is in its ownership experience, posting high scores for overall sales experience and vehicle delivery timing, along with the highest score for aftersales service. Also, the costs of owning a Nissan are not very high and women buyers seem to like their reliable, fuel-efficient nature.

The Micra hatchback finds a strong likeability among women, especially for its adequate headroom, driving smoothness and interior design.

Brand: 7/10

Product: 7.5/10

Sales & Delivery: 8.5/10

Aftersales Service: 9/10

Cost of Ownership: 8.5/10

Overall: 8/10

FORD: The Blue Oval comes fourth in the survey, with consistent likeability among owners, across parameters. However, its brand image rating falls as most buyers indicate a lack of exciting cars.

The EcoSport SUV came across as the best-rated Ford model and buyers liked it for its manoeuvrability, seat comfort and infotainment system. Resale value is, however, perceived to be a major drawback for these vehicles. Buyers felt that Ford did a decent job with the sales experience and vehicle delivery but said that the dealership facilities could improve.

Brand: 6.5/10

Product: 7.5/10

Sales & Delivery: 8.5/10

Aftersales Service: 8/10

Cost of Ownership: 8/10

Overall: 7.5/10

MARUTI SUZUKI: India’s biggest carmaker achieves middle-of-the-pack ranking. Its traditional strengths like low cost of ownership and high resale value record strong performance. However, brand and product pull the company down. There is a wide variance in model-level performance for the brand.

The Wagon R, Swift and the Dzire find greater likeability among women owners compared to the Alto, Baleno and Brezza. They also seem to show preference for other brands within a segment.

Brand: 7/10

Product: 7/10

Sales & Delivery: 8.5/10

Aftersales Service: 8.5/10

Cost of Ownership: 8.5/10

Overall: 7.5/10

RENAULT: The French brand is co-ranked fifth, alongside Maruti, in this survey. While dealer measures is where Renault does well in managing women car buyers, brand and product lowers their overall standing. There is a perception that the brand’s cars aren’t very exciting and that spares are expensive.

At the model level, the Kwid does marginally better than the Duster. While ratings on product and brand for these models are similar, the Kwid scores better on cost of ownership and dealer measures. Respondents were impressed with the overall sales experience, especially with the knowledge of the sales personnel and with the vehicle delivery.

Brand: 7/10

Product: 6.5/10

Sales & Delivery: 8.5/10

Aftersales Service: 8.5/10

Cost of Ownership:8/10

Overall: 7.5/10

HYUNDAI: It neither excels nor does poorly on any of the parameters. Sales and delivery is an area which records strong ratings. Buyers also responded positively to the styling and interior quality of its cars. However, there is a wide variance in model-level performance. Where the i20, Eon and Creta perform quite well across measures, the i10 Grand pulls Hyundai’s overall standing lower. Cost of servicing and spare parts is on the higher side and is an area of concern.

However, there is a wide variance in model-level performance. Where the i20, Eon and Creta perform quite well across measures, the i10 Grand pulls Hyundai’s overall standing lower. Cost of servicing and spare parts is on the higher side and is an area of concern.

Brand: 7/10

Product: 7/10

Sales & Delivery: 8.5/10

AfterSales Service: 7.5/10

Cost of Ownership: 7.5/10

Overall: 7.5/10

TOYOTA: Toyota’s performance is a mixed bag. The Japanese carmaker records industry-best ratings on sales and vehicle delivery. Most women buyers felt that they received a good

deal with their vehicles which were delivered on time and free of any defect. Toyota’s products though seem to fail in exciting women owners and many feel that the brand lacks visually appealing and innovative cars.

While the Etios recorded the best ratings among entry midsize cars, other models of Toyota didn’t do as well. The brand’s aftersales experience is largely fine. However, there is a perception of high cost of repairs and spares.

Brand: 6.5/10

Product: 7.5/10

Sales & Delivery: 9/10

Aftersales Service: 8/10

Cost of Ownership: 7/10

Overall: 7.5/10

MAHINDRA & MAHINDRA: Mahindra’s ranking is lowered due to brand, product and cost of ownership aspects. In the survey, many women buyers feel that the brand lacks visual appeal and innovative products.

Though none of its models excel, the KUV100 and TUV300 perform marginally better. Resale value for Mahindra products too is seen as a negative. Buyers, however, acknowledge the large boot space, seat comfort and ground clearance offered by the Indian SUV maker. Dealer experience too is rated slightly higher, and so is the aftersales experience.

Brand: 5.5/10

Product: 6.5/10

Sales & Delivery: 7.5/10

Aftersales Service: 7.5/10

Cost of Ownership: 7/10

Overall: 6.5/10

TATA MOTORS: Tata Motors records mediocre performance across all measures, with product being the main weakness. Barring the Tiago, which does relatively better, most of Tata’s models fail to provide an impressive experience to their women owners. Ease of getting in and out of the vehicle, smoothness of driving, and legroom are listed as areas of weakness.

Visual appeal hasn’t been a strength, but this has been changing since the Tiago’s launch and subsequent new products like the Hexa, Tigor and the Nexon compact SUV. Tata Motors’ low cost of maintenance also shone through in the survey.

Brand: 6/10

Product: 5.5/10

Sales & Delivery: 7.5/10

Aftersales Service: 7/10

Cost of Ownership: 7/10

Overall: 6.5/10

MYTH VS REALITY

“As long as it is red” or “smaller the better” are but two general assumptions made about what women want from their cars. Seemingly, men buying on behalf of a woman relative or friend, and also the industry as whole, are largely driven by these stereotypical assumptions. So, here are some realities that contradict these common myths and tell us what women actually want from the cars they are buying.

IT’S NOT JUST ABOUT COLOUR: It is commonly believed that exterior colours are among the key drivers of choice for women. This study defies that belief, with only 16 percent of women stating colour or the availability of a particular colour as the reason for selecting a specific car.

On the other hand, aspects like the vehicle’s brand, its visual appeal, the kind of innovative technology and features that it offers are ranked much higher on a woman’s car-buying wish list. The study shows that women are willing to spend money on safety and infotainment features in their cars.

IT’S NOT JUST ABOUT COMMUTING: Men buying for women family members or friends tend to gravitate more towards the lower variant, as they only tend to look at it as a means of transport. However, women are more discerning, with almost all of them tilting more in favour of the top or the mid variant for the added features.

STYLE MATTERS: While brand and style are placed at the top, practical aspects like fuel efficiency, budget, ease of parking, etc., are placed lower in the list of what a woman wants from her car. On the other hand, men buying for women cite the practical aspects as major reasons for choosing a car.

PRODUCT & BRAND ARE CRITICAL: Of the men buying a car for a women family member or friend, 80 percent stated budget and 63 percent stated cost of ownership as key choice drivers. In contrast, women buying for themselves, while staying mindful of budget and cost, attach more importance to the vehicle brand and the product itself.

SAFE & SOUND: Safety, security, and convenience are key expectations that women buyers have from their cars, and are willing to pay more for such features and services. Hence, a good security alarm system, 24-hour roadside assistance, rear camera and automatic door-closing system are features that top the list. Also, a hassle-free experience while getting their cars serviced is very important for women buyers. Facilities like pick and drop, and mobile apps that give live progress of a car’s service are sought after. Staying connected with their job, home or even social network is important, even while on the move. So, features like in-car infotainment and navigation are right up there on a woman’s buying list.

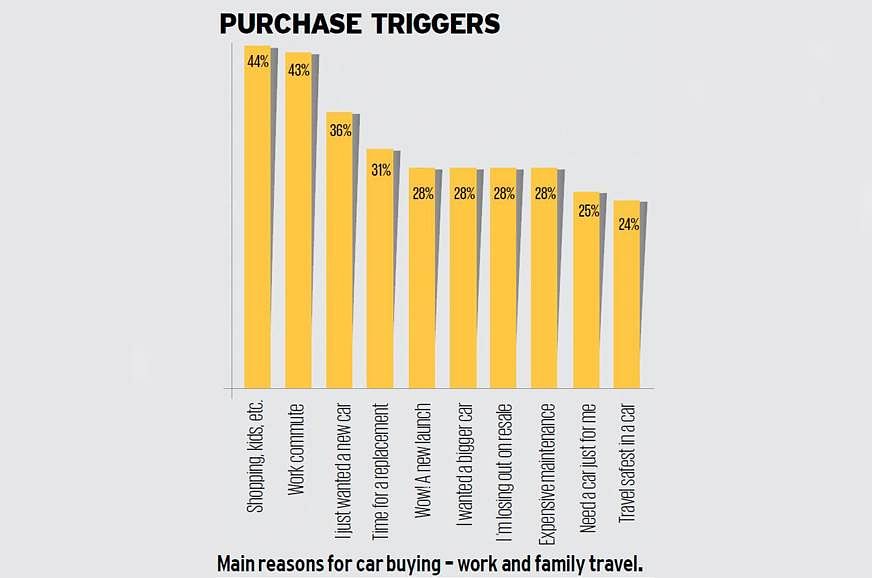

DRIVING HABITS: Unlike bygone times, a woman driving is hardly a rare sight today, with most acquiring their driving licenses in their early twenties. Interestingly, women in smaller cities tend to begin sooner than those in metros. Most women drive all days of the week, with purposes ranging from work commuting, shopping to ferrying kids. Also, most women cover a weekly range of 25-50km, while a significant number manage to clock around 50-100km in a week.

Many women, today, believe that the ability to drive is a necessary skill as it makes them independent of public transport or the need for someone else in order to go places.

- 22-25 years is the age range in which most women have learnt to drive and acquire a license.

- 25-100 kilometres is the range that 45 percent of women drive in a week. 32 percent manage to clock above 150km.

- 78 percent women say that they use their cars in 4-8pm time frame. 74 percent use it before 12pm.

- 45 percent of women buyers drive to work every day and 25 percent like driving to outstation destinations.

LUX SUPREME: When it comes to brand awareness, it’s BMW that comes on top, followed by Audi, Mercedes-Benz and then Volvo. Brand association, however, sees Audi at the top, followed by BMW, Mercedes-Benz and Volvo. Design, innovation and premium-ness were perceived to be highest for Audi. BMW was considered to be the stand-out from the crowd and offered good bang for the buck as well. Mercedes-Benz and Volvo were viewed as vehicles engineered for safety.

POWER OF WORDS: ‘Word of mouth’ plays a big part in the buying decision of women.

Seeking inputs from a trusted family member, friend or even another owner of the product are considered the most important sources of information for a woman car buyer.

Digital and social media are used during the shopping process but are not the principal source of information gathering. Some also rely on auto journals to get information and opinions about cars.

Q&A: RAJIV LOCHAN, FOUNDER AND CEO, PREMONASIA

Is this the first time that the choices of women car buyers are being surveyed in India?

Yes, a study of this nature has not been done before, particularly at this scale and depth. The study covers the woman buyer’s journey from pre-purchase to future purchase, and in the process we are trying to discover their needs and expectations.

Fundamentally, women car buyers are an important consumer group, much like men. Their needs have to be understood and addressed, whether it is about requiring a greater emotive connect with the brand at the point of purchase, or the desire to have certain features and services in the future, catering to their need for safety, security and convenience.

What are the key differentiators with male buyers?

The focus of this study was not about male buyers purchasing for self. However, one of the study modules surveyed men buying for women family members to compare them against women buying for themselves. These men are driven by the belief that practical aspects like budget, cost of ownership, and fuel efficiency are (or should be) the key choice drivers for women. Contradicting this myth, the study reveals that women buyers are more discerning as they attach significantly higher importance to brand image and product elements.

How significant is the voice of the woman car buyer in today’s car market? Do manufacturers need to pay heed?

At an estimate of 15 percent of the market, one could see them as significant or not, depending on what strategy one wants to pursue. The fact is that this target group is going to grow further as women expand their roles in different professions and gain financial independence. We also need to be mindful of the fact that women are strong influencers within car-owning households, so their sphere of influence is beyond their own car. Hence, I have absolutely no doubt that the voice of women in a car’s purchase will continue to gain significance and manufacturers will have to include them in their future strategies.

Just to put things in perspective, this study is not suggesting that manufacturers need to create women-only cars or devise women-only business strategies. The objective of the study is to simply understand the needs and expectations of women, which might well be served through the existing product platforms with a sharper marketing focus.

Were there any significant eye-openers during the survey?

The study throws up quite a few interesting revelations. For example, automotive marketers have long held the belief that women only give importance to pretty colours when it comes to car purchase. Defying this age-old myth, the study reveals that exterior car colour, as a driver of choice, is way down the pecking order among women buyers. Instead, women attach far greater importance to aspects related to brand, style and product.

What this clearly proves is that manufacturers need to move away from using stereotypical assumptions. The objective of the study is to simply understand the needs and expectations of women, which might well be served through the existing product platforms with a sharper marketing and communication focus. When designing any value-added services or offers, it is important to understand what women really want instead of assuming what they want.

Do women car buyers prefer any particular vehicle type? For example, small cars and SUVs.

We find the presence of women buyers across all segments of the market. A significant number of women own a hatchback, which isn’t surprising given the structure of India’s car market. However, we see trends indicating that SUV preference is on a sharp growth trajectory for women as well.

Among car owners, 13 percent own either an SUV or a crossover. This figure jumps to 21 percent when you look at future intentions, while hatchbacks drop from 61 percent to 49 percent. Another interesting observation is the composition of body type between single versus multiple-car households; SUV and crossover jumps from 10 percent in single-car households to 20 percent in multi-car households.

Some carmakers seem to shine over others when it comes to women car buyers. Is there any particular reason for this?

It is all about meeting expectations better on the key factors impacting women’s ownership experience, which is reflected in the performance of the top-3 makes. Honda leads overall and on product and cost of ownership factors. Volkswagen ranks highest on brand image, while Nissan does well on aftersales service. We also see a fairly narrow gap between brands, which shows that any brand that chooses to differentiate among this target group has an opportunity in the future.

(This feature was published in Autocar Professional's December 15, 2017 issue)

RELATED ARTICLES

Why India’s CBG Revolution is Stuck in Neutral

Seven years after a bold promise to build 5,000 plants, India’s compressed biogas sector is struggling to move past the ...

The Car that Exists Before it Exists

The car you buy today was likely built twice — once in software, once in steel. The companies that have figured out how ...

Can Isobutanol Solve Diesel’s Dirty Emissions Secret?

As the global automotive industry faces a green ultimatum for heavy-duty transport, isobutanol emerges as a high-potenti...

08 Mar 2018

08 Mar 2018

11441 Views

11441 Views

Arunima Pal

Arunima Pal

Anurag Chaturvedi

Anurag Chaturvedi