SUVs overtake humble hatchbacks as the biggest selling body style in India

With an estimated sale of over 1.5 million units, SUVs are likely to account for 42% of India’s overall passenger vehicle market in CY2022, while the share of hatchbacks share is estimated at 35 percent.

The Sports Utility Vehicle (SUV) segment has become the largest selling vehicle body type in the Indian market, overtaking the humble hatchback which was the primary choice for the millions of Indians over the years. Increased affordability due to rising disposable income and high-decibel new vehicle launches over the years have expanded the bouquet of choices for the prospective Indian buyers.

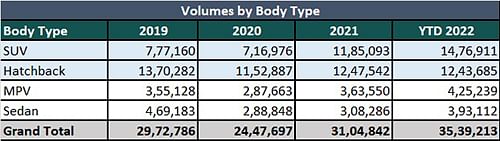

As per the latest data sourced from JATO Dynamics India (detailed below), in 2022 the sale of hatchbacks stood at 1.24 million compared to 1.47 million SUVs. Over the past four years, hatchback volumes have come down from 1.37 million in 2019 to 1.24 million units. In the same time frame, SUV sales have almost doubled from 777,000 units to 1.47 million units, accounting for the majority in 2022.

Ravi Bhatia, president of JATO Dynamics India, says SUVs are considered as a boom that became a long-term trend and continue to drive industry growth. In the process they saved many OEMs from the financial crisis years and are now the only source of profit for many car makers.

“The SUV body style allows an OEM to earn more profit than on the hatchback platform, which is evident from the SUV launch activity. They are popular because of their high driving position, that gives a sense of safety when driving, especially the older people. Plus, with higher ground clearance, they are more comfortable to get in and out, especially for old people,” added Bhatia.

In addition to these, SUVs sport aggressive design and are positioned as more capable vehicles whih are designed to handle all road conditions with ease. They are definitely more appealing to a larger part of the population, believes the head of JATO Dynamics India.

Bhatia is of the opinion that their popularity is so big that brands, which have historically been manufacturers of sports cars and luxury sedans – Porsche, Lamborghini, Volvo and Rolls-Royce – are now selling more SUVs than cars. Over a period of time, SUVs have transformed from being boxy and expensive (old Land Rovers and Toyotas) to become more modern and affordable.

One of the key contributors to India’s booming SUV market has been the Tata Punch compact SUV at the entry level, while the midsize SUV segment has benefitted from the entry of Maruti Suzuki along with its global alliance partner Toyota, which has brought in the incremental volumes.

Shashank Srivastava, senior executive director, Sales and Marketing at Maruti Suzuki, says the increased preference towards SUVs have been due to the design, strong road presence, high ground clearance and seating position and the flexibility in usage of interior space. "There is an overlap in consideration, as the entry SUV prices have started overlapping with premium hatchbacks and entry sedans in the market," added Srivastava.

SUVs eat into hatchback and entry sedan market

At 35%, the share of hatchbacks in India’s overall PV market is likely to be the lowest ever in several decades. The launches of entry SUVs took away a sizeable chunk of hatchbacks and entry sedans from the marketplace.

As per JATO Dynamics India’s data (above), SUVs are likely to account for 42% of total PV sales at the end of CY2022, up from the 26% share the segment had in 2019. In comparison, the share of hatchbacks over the past three years, has dropped sizeably from 46% in 2019 to 35% at the end of 2022. The SUV market share trend in India is inching closer to that of evolved markets like Europe, where SUVs account for 45% of sales.

In the past three years, the choices in SUVs have gone up from a dozen models to over a couple of dozens and they are available from a price point of Rs 600,000 through to upwards of Rs 1 crore.

SUV buyers in India are spoilt for choice as they have a multitude of powertrain options – right from petrol, diesel, hybrid and electric – to choose from.

Tata Motors, the country’s third largest carmaker, has capitalised from the multi-powertrain strategy – of offering petrol, diesel and electric option on the Nexon SUV, which has made the vehicle the highest selling SUV in the market with a monthly volume of 15,000 units. The Nexon, in tandem with its entry-level sibling Punch, has helped Tata Motors grab the leadership position in the SUV segment.

Given the shift in preference for SUVs, new entrants like Kia and MG have exclusively focused on the growing utility vehicle space.

This feature was first published in Autocar Professional's January 1, 2023 issue.

ALSO READ:

India’s Top 5 UVs in April-November 2022 amass total sales of over 3 million units

RELATED ARTICLES

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

How the India-EU Trade Deal Could Quietly Reshape the Auto Industry

While immediate price relief for the buyer is unlikely, the India-EU FTA will help reshape long-term industry strategy, ...

Policy, Protectionism and Pressure: Inside India’s Construction Equipment Downturn

India’s construction equipment sector faces a tough battle as it takes on cheaper imports from China and a slowdown in g...

23 Dec 2022

23 Dec 2022

19404 Views

19404 Views

Shahkar Abidi

Shahkar Abidi

Prerna Lidhoo

Prerna Lidhoo