MapmyIndia aims at leadership in navigation services

The location service provider has made key investments in startups to enhance its software business solutions and tap the two- and four-wheeler and logistics markets.

MapmyIndia (MMI), a location service provider for automotive and other sectors has made key investments in two startups as it attempts to tap a burgeoning market for auto navigation in the country. The New Delhi-headquartered company, which offers advanced digital maps, geospatial software and location-based IoT technologies recently made investments in mobility startups - PupilMesh and Gtropy - within which it plans to integrate its mapping and other software to expand its product portfolio. While in PupilMesh, MapmyIndia bought nearly 10 percent stake for Rs 50 lakh investment, in Gtropy, it bought a 76 percent stake for Rs 12-13 crore.

According to a Frost & Sullivan report, by 2025, India’s auto navigation segment is expected to reach about $4.2 billion for digital map services and $44 billion for navigation solutions and telematics, driven by the fact that about 3 million new vehicles are sold every year. In addition, about 280 million existing vehicles are already on road and about $52 billion will be spent on enterprise digital transformation.

Rohan Verma, CEO & Executive Director at MapmyIndia told Autocar Professional that the acquisition of a stake in PupilMesh is because it is an augmented reality metaverse tech company. Its flagship product, christened as Navisor (navigation visor) is a helmet kit which gives a rider turn-by-turn VR guidance and safety alerts in the helmet like a heads-up display. It can help in avoiding a significant number of accident-related injuries and fatalities as the rider need not have to look at a mobile phone mounted on the handlebars, as it usually happens. "People keep phones near the handle which is dangerous," said Verma. As part of natural extension, PupilMesh is in the process of developing a similar system for four-wheelers wherein the navigation visor can be placed on the windshield itself.

MapmyIndia, on its part intends to integrate its software based USP with the solution systems developed by PupilMesh. The market size is estimated at 15 million units of two-wheelers and close to 2.70 million units of four-wheelers sold annually. Verma says the challenge will certainly be to bring down its production costs making it affordable for the average customer, he added. The product is expected to be launched in the next two months.

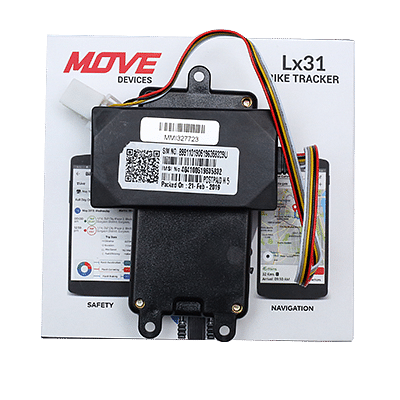

Gtropy, on the other hand, provides GPS-based fleet management solutions and data analytics. As of now, the company says it has over 1 lakh vehicles to its credit with quarterly growth of 40 percent and a network of 350 plus partners offering an array of solutions in the logistics domain including logistics operations management, passenger transportation, fleet management, amongst others.

Verma explains that the acquisition of Gtropy has to be seen in context of recent developments in the transportation and logistics sector where demand is expected to expand exponentially as the government aggressively works to reduce logistics costs by 5 percent from around 14 percent of Gross Domestic Product (GDP) at present. This is being done through the Centre’s Gati Shakti plan, a national master plan for multi-modal connectivity in which 16 ministries will work together on an integrated planning and coordination implementation of infrastructure connectivity projects. "A project like this gives us a lot of scope to expand through IoT and logistic applications," he adds.

What is further likely to boost the company's penetration, Verma believes, is the regulatory mandate from the Centre released last year which restricts foreign mapping entities including the likes of Google, TomTom, Trimble and others from conducting vehicle-based ground surveys or street view surveys. It has also restricted them from acquiring, reselling or reusing granular geospatial data (finer than 1 meter in horizontal or 3 meter in vertical).

The development, therefore, confers an advantage on Indian entities such as MapmyIndia, which is believed to be a dominant local player in the field. "With this, it is apparent that it (quality of offerings by foreign entities) may continue to go down and they will not likely be able to make newer features, or do road construction monitoring, 360 road-based tourism and others even in road and non-roads areas," noted Verma.

According to Verma, the company's core offering of maps covers the entire length and breadth of the country with over 300 million places and addresses, 400 million plus geo-referenced images, videos and value-added location analytics data sets developed over 25 years.

MapmyIndia has started using drones to capture and offer high definition 3-dimensional photo-realistic data for parts of different Indian cities and using vehicle-mounted cameras and sensors to create and offer sub-meter highly accurate, high-definition maps and 360 degrees real view. The company's offerings are geography agnostic and therefore can be accessed in 200 countries across the globe.

As part of its business model, MapmyIndia, which currently generates more than 50 percent of its annual revenues from the automotive and mobility sector, charges customers royalties, subscriptions, and annuities in return for providing licences and usage rights to its IPR-based digital map data, platforms, APIs and software.

About 90 percent of its income in FY21 came from royalties, annuities and subscription fees. The company counts some of the leading OEMs as customers including MG Motor India, Mahindra & Mahindra, Honda, Ford, TVS, Blu, Suzuki, Hero, BMW, Maruti, Hyundai, Mercedes Benz, Yulu, AVIS, amongst its clients. At the government level, MakemyIndia has collaborated with the union ministry of road transport for integrating information of accident-prone areas in addition to safety alerts based on ADAS data.

The company’s business model with the automotive OEMs, the MapmyIndia leadership during an investor call in January 27 revealed is based on vehicle models and the volumes that are planned to come pre-installed with its applications. Usually, the industry practice is for the usage of 3-5 years which may even be longer in case of certain customers. Also, the pricing per vehicle is also dependent on the kind of technologies for which the agreement has been made.

In addition, there are recurring revenue streams depending on the feature set or services that the OEM takes from MMI. "It is not just embedded navigation, but a lot of connected vehicle services that we are providing. So, there are top-ups per vehicle per year that have started to come in the last one to two years. As the vehicles are starting to come connected only in the 1-2 years from OEM, the per vehicle per year top-ups will also start to increase,” the company’s management said during the investor call.

The feature was published in Autocar Professional's May 1, 2022 issue.

RELATED ARTICLES

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

How the India-EU Trade Deal Could Quietly Reshape the Auto Industry

While immediate price relief for the buyer is unlikely, the India-EU FTA will help reshape long-term industry strategy, ...

02 May 2022

02 May 2022

19365 Views

19365 Views

Darshan Nakhwa

Darshan Nakhwa

Shahkar Abidi

Shahkar Abidi

Prerna Lidhoo

Prerna Lidhoo