Lumax lines up investments to ride a sustainable future

India's upcoming BS VI emission regulation offers new business opportunities to suppliers.

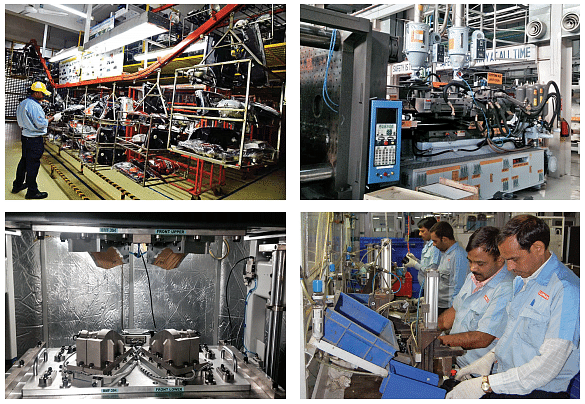

The automotive lighting major is set to add two more plants to its manufacturing network. It is also lining up investments to tap some of the megatrends in the automotive industry.

Over the next five years, auto component major Lumax Industries plans to invest around Rs 500 crore. Thirty percent, or Rs 150 crore, out of the overall investment budget will be spent this year for brownfield and greenfield expansions, joint ventures and on research and development. The greenfield projects will come up in Gujarat, taking the total count of its plants to 28 by next year.

The initial investments will be to cater to Suzuki's Gujarat plant as part of Lumax's ‘Follow Customer’ policy. Later, the company's operations in the Western state could grow significantly as its sees good opportunity to supply to other OEMs who are setting up, and plans to set up, plants in Gujarat. It is already investing in acquiring land for future expansion.

Beyond the short and mid-term investment plans, there is a larger goal. "The idea is to have a sustainable performance, and there are certain goals," Deepak Jain, managing director, Lumax Industries, tells Autocar Professional. Some of the goals, Deepak says, are technology self-reliance, quality manufacturing excellence, move towards enhanced levels of electronics as well as move towards connected cars, and adopting smart manufacturing. These are some of the pillars for the Group's vision for 2025.

A third-generation entrepreneur, 42-year-old Deepak does not believe in chasing revenue. He sees revenue as an outcome of a financially stable and sustainable business model. That also helps in gaining customers' confidence as vehicle OEMs would prefer to partner with suppliers who have a sustainable business model over those with scale but without a robust business model. Lumax expects to be a debt-free group next year.

TAPPING MEGATRENDS

As the automotive industry evolves, there are new megatrends that are emerging. To keep growing in an increasingly technology oriented play, Lumax has to strengthen its technical capabilities.

That, perhaps, explains why the company is investing three percent of the Group's annual revenue on R&D activities. This, according to Deepak, is double the Indian industry's average investment in R&D. During 2016-17, the Lumax Group clocked total revenue of around Rs 2,600 crore, over half of which came from its lighting business.

"I think we have been able to convince all our partners to invest together jointly in technology in our current joint ventures. So all our partners are willing to invest and then whatever technology we actually are able to develop for India becomes proprietary of the joint venture," says Deepak.

This approach has led to Lumax's joint venture with Japan's Mannoh for gear shifters to file for 6-7 patents. At some places, the Indian partner is supporting the Japanese company's global needs. "But we respect their geographies, technologies. Our intent is to get the right appropriate technology at the right time at affordable price to create value for the customer," says Deepak. With the focus on localisation, Lumax Mannoh Allied Technologies claims to be the first company in India to localise the gear shifter for automatic transmission (AT) vehicles. It says very soon it will also be the first in India to supply shift by wire technology.

JOINT VENTURES AS A GROWTH DRIVER

The Lumax Group has eight firms catering to the automobile industry, out of which four are joint ventures. Among the new megatrends in the industry, a couple are attracting Lumax's strong interest. "What we are very excited about is electronification. That is one thing which we will play in is because about 80 percent of the Group's revenue is coming from electrical systems," says Deepak.

Connected cars is another megatrend that attracts his interest. Lumax plans to tap these megatrends through more partnerships. "Our whole intent and strategy is to get the best of partners in the world and then align them with the Indian market needs for the customers, (and) localise," says Deepak.

The strategy at Lumax is to tap new opportunities through partnerships, and also be up to speed with the technological shift in its traditional businesses. Even as the global megatrends find their way into India, the transition to Bharat Stage VI gives Lumax that opportunity to expand its market and thereby revenue and possibly margins as well. For example, OEMs are looking at reducing energy consumption in the traditional vehicle architecture to be able to fit components/systems that will help their vehicles meet the stringent BSVI emission norms. To an automotive lighting supplier offering energy efficient technologies like LED, that presents an opportunity. Lumax is looking to leverage that advantage and be part of the technology transition in the industry.

The JV with Spanish supplier Francisco Albero S.A.U (FAE) to assemble and supply oxygen sensors in India, inked on QAugust 24, 2017, is also aimed at tapping new opportunities arising due to the new emission norm set to kick in from April 2020. Lumax has a 51 percent stake in the JV, called Lumax FAE. It will commence production from early 2019. The new association aims to fulfil the upcoming needs of the domestic automotive market in India. It will initially focus on the immediate requirement of oxygen sensors coming in from the two-wheeler market, also taking the total number of global tie-ups of the Lumax Group to eight. The JV is eyeing a 10 percent market share, with an overall revenue size of Rs 1,000-1,500 crore.

Even as the Indian automotive industry prepares for BS VI, there is also work going on to be ready for an era of electric mobility. The transition to electric mobility could affect Lumax partially. For example, its air intake systems business could be one. Deepak and his team are conducting overall risk assessment and closely monitoring the market to be able to take the right decisions. "My personal opinion is that the migration towards electric vehicles will be a phased migration, it is not going to be from 0-100," says Deepak. In that phased migration, there will be opportunities as well as threats but Lumax foresees more of opportunities.

(This article was first published in the November 1, 2017 print edition of Autocar Professional)

RELATED ARTICLES

Mahesh Babu’s Drive to Make Olectra’s EV Math Add Up

Mumbai’s electric bus operations reveal gaps between tender assumptions and real-world conditions, impacting energy use,...

BKT, the ‘Off-Road King,’ Chases the Consumer Market

The company has unveiled a broad range of tyres for the Indian two-wheeler and CV markets.

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

18 Nov 2017

18 Nov 2017

9282 Views

9282 Views

Shahkar Abidi

Shahkar Abidi

Darshan Nakhwa

Darshan Nakhwa