Lead vs Lithium - The hunt for greener power

Do lead-acid batteries, which fare poorly in their energy-weight density compared to the lithium-ion tech, still stand a chance in an era which looks set to be dominated by electric mobility?

As the world hunts for cleaner sources of power and in turn power storage, the automotive world is actively engaged in research for cleaner energy sources including solar power. Lead acid and lithium-ion are common battery chemistries deployed. India, which has its annual consumption of primary lead fall in the ballpark of 1.1 million tonnes, sees a major portion of it getting recycled and coming back into the ecosystem.

The much-touted lithium, billed as the new gold in the automotive world, while superior in terms of offering a better weight-energy density when put into batteries, struggles when it comes to recyclability and generous availability around the world. It’s a well-known fact that lithium reserves are located only in some limited pockets on the planet such as in Latin America, China, Australia and the United States. This poses a huge concern about future battery electrification for motorised vehicles including cars, two-wheelers and commercial vehicles as regards the lithium supply chain and, importantly, battery prices.

According to Harsha Shetty, chief marketing officer, Hindustan Zinc, “Today, EV sales in India are less than one percent of overall vehicle sales and when it moves to 50 percent, there will be a constraint on lithium supply. When the demand increases so much that the supply cannot keep pace, the whole foundation of offering a cost-effective mobility solution will be challenged.”

“So, if the battery cell itself gets imported, it's not something right for our economy. We cannot let the entire mobility of India depend upon imports (including crude). That would mean giving substantial control and power to those few countries such as Argentina, Chile, Brazil, Bolivia and China which can export lithium,” he points out.

“Secondly, the world is increasingly moving towards a circular economy in order to reduce waste and forex outflow. In that case, we need to look at the recyclability of lithium-ion. While the research is currently on, what we understand is that lithium-ion batteries are recyclable by up to 25 percent in the present day. Research says that we will reach 50 percent, but it's still a long way to go,” explains Shetty.

In a lithium-ion battery, as much as 90 percent of lithium-ion anodes are comprised of graphite, silicon or titanium-based materials used to get better life and performance, which form the basis for the significantly higher costs. This makes the energy density in such a battery at 250Wh/L to be more than double than that of a similar capacity lead-acid battery, which can only offer up to 100Wh/L.

Also, while lithium, as an element, is very corrosive, aggressive and toxic, in the case of a cell, it doesn’t really matter as it is sealed inside a package. Lead, however, poses risks by being carcinogenic in nature if disposed in unscientific ways.

Lead . . . in the lead

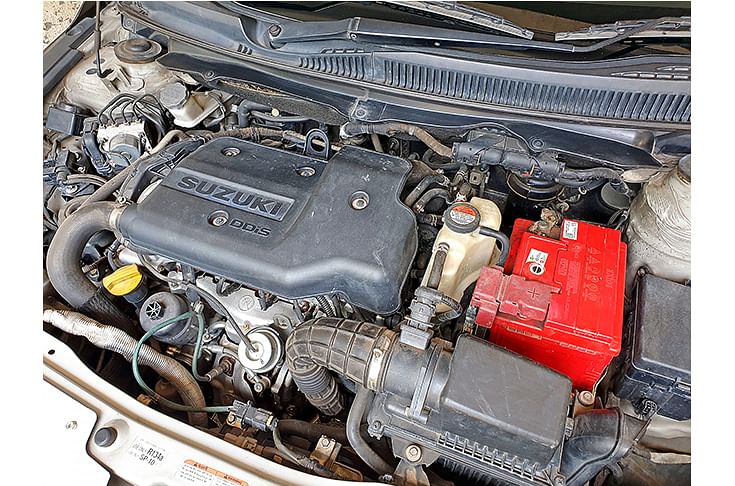

While it’s a very effective storage medium for off-grid purposes, in the automotive domain, lead-acid batteries are primarily used in SLI applications – start, light and ignition – of a vehicle where they need to deliver very high pulses of power for short durations. It is understood that they will continue to see their usage in these functions even in EVs as well, which are predominantly powered by lithium-ion batteries.

“So, while there will be a 20 percent drop in overall demand for lead-acid batteries by 2025, it will, however, get hugely compensated by the growth in automobile volumes in India,” says Hindustan Zinc's Shetty. India’s current vehicle-to-people ratio is set to move from 120 per thousand to 180 per thousand over the next five years, which includes the passenger vehicle and two-wheeler segments. “This will ensure that lead-acid batteries continue to observe a 50 percent year-on-year growth,” he adds.

But can lead-acid really act as a powering medium? So far, it’s the e-rickshaw and electric three-wheeler segments wherein India has seen a constant rise in the use of lead-acid batteries to the tune of 25-30 percent year-on-year. Shetty explained that this is because there’s a need for a recycled battery which is cost effective for an e-rickshaw application. Furthermore, lead-acid batteries are abundantly available, cheaper and lead as a metal is 100 times more recyclable than lithium. Also, what’s crucial to ensure the price competitiveness is that there are a several established lead-acid battery manufacturers, which essentially make lead-acid a cost-effective solution for application in an e-rickshaw.

Not all are believers in the case for lead though. According to Atul Arya, head, Energy Systems, Panasonic India, “E-mobility requires a lot of energy density, which is just not possible with lead-acid batteries. However, there will be some areas where there will be an overlap and lead-acid batteries will continue to be there for a considerable amount of time in the future.”

“Pollution is one area which everybody is looking at solving very quickly. So, 2020 will be the mainstreaming of electric mobility. Just like a boom happened in the telecom space, the adoption curve of EVs will keep growing as well,” he remarks.

“It’s a big opportunity for India to start making EVs and its components and take on the world. Lithium-ion batteries are not just going to remain limited to cars, but there are mobile phones and laptops as well. Moreover, there are unexplored reserves in the country which might have lithium, and also, over a period of time, a circular economy would develop and India would not be dependent on imports to that extent,” adds Arya.

While both executives have a similar take on the role lead acid is going to play in the future, in a contrary view, Shetty says that in a decade, we could see the cost of lithium increasing dramatically. “Consumer behaviour is going to play a huge role in the growth and so far, there has been a noticeable growth in lead-acid batteries,” he hastens to point out.

Alternatives to lithium-ion

Even as lithium-ion is a superior alternative for powering a vehicle because of its better energy density than lead-acid, is it really a viable solution for India in terms of its chemistry?

“I don't think lithium-ion in the current state of things is well suited for India unless there is some further breakthrough in the technology, because what works well in the temperate countries may not be the right solution for a tropical country like ours. And, when we put solutions to cool a battery, there is an overall increase in weight and the sole advantage on which lithium-ion is based upon gets comprised,” says Shetty.

“Having said that, there are other competing technologies against lithium-ion such as zinc-air and aluminium-air batteries. Millions of dollars are flowing into research to make these as preferred fundamentals for making battery cells. The International Zinc Association (IZA) is keeping an eye on the progress in research on zinc-air batteries,” he details.

Can India become Li-ion hearted?

According to Deepak Pahwa, chairman and managing director, Bry Air, “The characteristics and the choices of anode and cathode change as per the requirement and the application; but lithium-ion is by far the most predominantly adopted technology. The current lithium-ion cell manufacturing capacity is pegged at 70-80GW globally, which is set to rise to 700-1,000GW by 2030, opening a huge opportunity for India.”

“Lithium-ion cell manufacturing is very technology and capital-intensive and raw material and environment are the two most critical aspects. While it hasn’t been attempted in India so far, it requires specially-dehumidified and hermetically vapour-tight dry rooms that operate at temperatures as low as 1deg Celsius,” adds Pahwa.

“People have become so complacent with lead-acid technology. But, we can now see a huge surge in technology improvement taking place on the lead-acid side; lead acid will not go anywhere. On the other hand, there is so much research and development happening, and people are trying to develop other alternative electrolytes to lithium-ion. There could be zinc-air and aluminium-air batteries," he says.

Advances in lead-acid

So, when it comes to both lead-acid and lithium-ion competing as a powering medium, it becomes a new space for lead, which has, all this while, acted as a cost-effective energy support.

“While all the economics are in favour of lead-acid batteries, the efficiency is in the favour of lithium-ion. For India, economics are very important. Now, we need to see how the economics shift going ahead, and if there are any technological breakthroughs, it may give a space to lead-acid batteries,” says Hindustan Zinc's Shetty.

“Research is happening on lead-acid batteries towards performance enhancement in terms of their energy-weight density. There have been funding and fiscal expenditure in the US on the research on lead-acid batteries. The international lead association (ILA) is overlooking the research and that makes us hopeful about lead-acid batteries coming back as a vehicle powering source,” he explains.

While Indian Oil Corporation, the state-run oil marketing company in India has collaborated with Israel’s Phinergy to intensify R&D in metal-air batteries such as aluminium-air and has recently announced field-testing with two OEMs in the country, Hindustan Zinc is planning to partner reputable institutes to fund this research, with IIT Chennai being one of them. An alternative like aluminium-air or zinc-air could solve India’s raw material problems as both of these elements are present in abundance.

“We are more than self-sufficient when it comes to our zinc consumption. Currently India consumes around 700kT of zinc, and next year we (Hindustan Zinc) will manufacture to make 800kT. We have plans to make 1.3 million tonnes over the next two years and that is why we are starting this research because zinc as a fuel application is going to be very exciting over the next decade,” concludes Shetty.

Lead-acid batteries have primarily been facilitating SLI (start, light and ignition) functions in conventionally-powered vehicles and will continue to operate lighting and ignition in EVs too. Research is underway to enhance the performance potential of these batteries.

So, with massive research underway in lead-acid and alternatives being developed to lithium-ion, the last word has not yet been said in terms of the go-to technology for the future. It would be interesting to see where the greener quest for automotive power lands – will it be lead-acid, lithium-ion or something completely different? The answer is still blowin' in the wind.

RELATED ARTICLES

BKT, the ‘Off-Road King,’ Chases the Consumer Market

The company has unveiled a broad range of tyres for the Indian two-wheeler and CV markets.

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

16 May 2020

16 May 2020

13199 Views

13199 Views

Shahkar Abidi

Shahkar Abidi

Darshan Nakhwa

Darshan Nakhwa