Attero aims at leadership in battery recycling

Attero says it is India's only company focused on producing sustainable materials such as nickel, tin, cobalt and others.

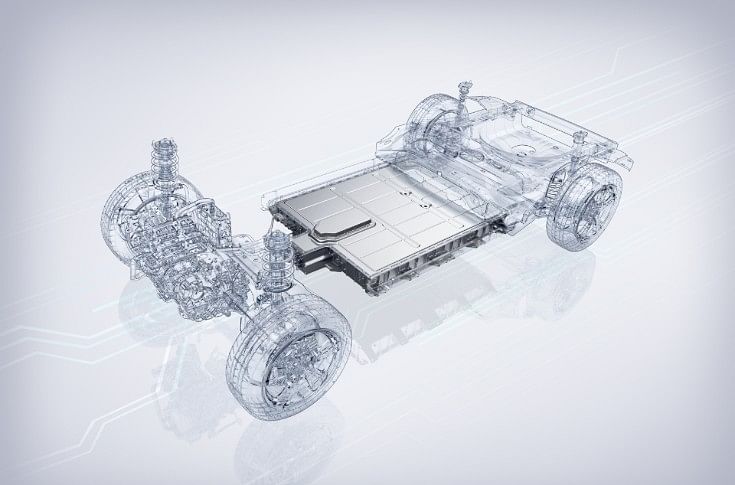

In the quest for green mobility electrification, lithium-ion batteries are expected to play a key role. However, there are several challenges for India which depends largely on import of the key raw materials, lacks lithium-ion battery manufacturers and most importantly, safe recycling of the batteries.

This is where, Attero Recycling, which claims to be India's largest electronic waste recycling company, hopes it can become a leading partner for India's ambitious EV segment.

Lithium-ion batteries are made of materials such as cobalt, graphite and lithium which are considered critical minerals. These raw materials are economically and strategically important, as most of it has to be imported with no easy substitutes.

Founded in 2008, by Rohan Gupta and Nitin Gupta, the company says it is India’s only cleantech organisation focused on producing sustainable materials such as cobalt, tin, nickel, copper, silver and gold. "We have 9-plus global patents in US, China, Singapore, Australia and other parts of the world including India. Our electronic waste recycling technologies recycles electronic waste in the most eco-friendly manner, extracts pure gold, silver, copper and aluminium that we supply back in the circular economy manner,” says Gupta, co-founder and CEO, to Autocar Professional Gupta says.

A few years ago, the company started looking at lithium-ion battery recycling as a new sort of base stream. Today, it collect all kinds of lithium-ion batteries, whether it is from consumer electronics like Samsung, LG, Acer, Oppo, Vivo, Foxconn, or coming back from stationary storage, such as Reliance Jio or other telecom tower companies, or from EVs like Tata Motors, MG Motor India and Maruti Suzuki among others.

“ We recycle them and extract battery grade cobalt, graphite, which is 99.99 percent pure. We are able to extract battery grade manganese oxide, copper aluminium that we put back in the circular economy," says Gupta.

According to Gupta, the key reason that lithium-ion battery has got much acceptance is because of the three key reasons – high energy density, fast-charging time and slowest discharging time. Interestingly, it is estimated that hundreds of billion of dollars have been invested and it continues to see investment by global stakeholders to further improve efficiency.

At present, Attero has a capacity of processing 1,000 tonnes per annum for lithium-ion battery recycling at its Roorkee plant, which is in the process of being enhanced to 11,000 tonnes per annum by October 2022. Gupta estimates that the lithium-ion battery recycling industry size in India at present is close to around 100,000 tonnes. Alongside, it is also in the process of expanding its e-waste capacity through the franchise route to 300,000 metric tonnes a year.

Battery disposability

Another of the challenges of the recycling business is improper disposing of li-ion batteries which not only is a waste of resources but also poses severe environmental challenges. Gupta estimates that the "environmental cost and social costs that India has to bear because of informal recycling, for electronic waste, and battery is more than $5 billion (Rs 38,445 crore) individually. That is $5 billion is a environmental cost and $7 billion (Rs 53,823 crore) in social costs because in the informal refining sector, where typically women and children are involved. They have an average lifespan of just 37 years as they're exposed to toxic lead fumes or cyanide.

This is something which Attero sees as a concern as well as an opportunity. It has, therefore, outlined an investment of Rs 300 crore to expand its recycling capacity. The company is looking to significantly expand its capacity in five years. " We will be growing at least 200 percent YoY on the lithium-ion battery recycling capacity,” Gupta says." At present, Attero has 30 plus patents – 9 for the electronic waste and over 20 for the lithium-ion battery recycling.

India is dependent on importing battery cells from either South Korea, China or Japan. But now, with the government pushing a proposal for the industry to set up 50 gigawatt of cell manufacturing capacity through the PLI scheme, Gupta says that no real cell manufacturers are planning to put up Giga factories in India anytime soon. The only ones that have shown interest and have made announcement is ATL which has bought land near Gurgaon and is putting above Rs 5,000 crore odd investment to put up one Giga watt factory capacity in India. That capacity should come online, probably in the next 6-months. The other entrant is C4V which has announced a Rs 4,000 crore facility in Karnataka, but it will begin production in two years.”

Battery recycling

India has an ambitious target to drive electric vehicle adoption but the global supply chain of critical raw materials for lithium-ion batteries is unevenly spread. Metals like cobalt, lithium, graphite are mined and India’s large miners do not have any stake in these reserves, which are critical materials for batteries. These materials also need to be refined.

"Although China does not have 97 percent of the world's mining market, it controls refining. All the mining stuff comes back to China for refining then it gets produced as lithium carbonate or lithium hydroxide which is then sold off to anode and cathode makers. If you look at a typical battery cell, it has an anode, which is graphite and a cathode which is made of lithium nickel, cobalt and manganese, and in between there are separators of copper and aluminium and electrolyte in between. That is the key design of a lithium-ion cell," shares Gupta.

He cites the example of Germany's BASF which is a classic case of an anode and a cathode material manufacturer. These anode and cathode materials are supplied to cell manufacturers some of which prefer to manufacture their own anode and cathode. This in turn is bought by companies to produce a cell, using various battery chemistries. Then comes the role of battery pack makers who in turn put the battery management system (BMS) to regulate the load and manage the heat generated. At the end of the battery life, this comes back to companies like Attero, which extracts lithium and graphite which when completely refined goes back to anode and cathode manufacturers directly.

"Our cost of extraction of extracting cobalt, lithium, graphite, manganese, copper and nickel among others are lower than the mining cost. We are the cheapest battery materials manufacturer anywhere in the world. Having said that, these metals prices are determined by internationally set metal market. When we sell our metals, for instance, the recycled cobalt directly goes into cathode manufacturing. Why would Attero reduce its price? There is no commercial benefit whatsoever to reduce its price and sell," adds Gupta.

But is it possible that the Attero could possibly supply the raw material to companies in India, who wish to take advantage of the same at a cheaper cost? "The short answer is that it's definitely possible. In any case, when we sell our material in India, the anode and cathode manufacturers when they come up in India will have a lower cost structure working with Attero as our material output has lower logistics costs. There are no import duties, in any case, and the materials will have cost advantage compared to imports. Having said that, we are selling our material at metal prices internationally dictated," explains Gupta.

INTERVIEW: Nitin Gupta, co-founder and CEO, Attero Recycling

What is the status for Attero’s onboarding of franchise partners?

It is an ongoing process and we have on boarded a few partners, and every month we continue to onboard partners with the objective that will end up in the 15-odd franchise partners by end-2022. But as of now, the franchisee partners are only for electronic waste. Once they are established, we e will add lithium-ion recycling on top of it.

In addition to MG Motor India, who are your other automotive clients?

The Hyundai Kona battery recalls are handled by Attero. We also have Tata Motors, Maruti and Toyota, among others. We serve almost 80-90 percent of the India's auto OEMs.

Do you have plans to set-up recycling facilities outside India?

Our technology for recycling lithium-ion batteries globally is the best. We are able to extract more than 98 percent of battery materials. What that means is if there is 100 grams of cobalt in the incoming battery, one is able to extract 90 grams. Globally, all our competitors are sitting below 70 percent efficiency. There's a huge arbitrage. But our vision is to make India the leader in battery recycling at this point in time. Obviously, we have global plans and announce them very soon.

What about your IPO plans?

We are a profitable company and have decent cash flows. From our own planning perspective, an IPO is on the cards two years from now.

In 2021, there were reports about talks between Tesla and Attero. Any update?The Tesla team visited our Roorkee facility for lithium battery recycling almost just before the pandemic hit. The preliminary discussions centred around whether we can do something for them outside of India. But as of now there is no update.

The feature was first published in Autocar Professional's March 15, 2022 issue.

RELATED ARTICLES

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

14 Mar 2022

14 Mar 2022

7145 Views

7145 Views

Darshan Nakhwa

Darshan Nakhwa

Shahkar Abidi

Shahkar Abidi