Autocar Professional's Man of the Year 2016: Vinod Dasari, MD, Ashok Leyland

The managing director of Ashok Leyland surely has had the challenge of his career in leading the transformation of this 68-year-old company for the new age, earning Autocar Professional's 'Man of the Year' title.

In today's business world, age and experience are no assurance of sustainability or growth. A young start-up can become the toast of the community or a well-established organisation's future could be at risk. Ashok Leyland is one such well-established company which reached almost the nadir and is on the comeback trail now.

The managing director of Ashok Leyland surely has had the challenge of his career in leading the transformation of this 68-year-old company for the new age, earning Autocar Professional's 'Man of the Year' title.

The year 2016 has seen quite a few developments that made news which impacted the automotive industry too. Donald Trump's election to the office of the president of the US could be one, but we are not talking about it now. Otherwise the challenge of meeting BS VI emission norms by 2020, thrown to the industry by the government at the beginning of the year, tops the list. Then there were some regional and global developments such as the odd-even rule, the diesel ban in NCR, fuel efficiency controversies, alliances and new brands in the global automotive world, to list a few. But none of them helped us in our tough task of choosing Autocar Professional's 'Man of the Year'.

Then we realised that in the midst of all this, India's second largest commercial vehicle manufacturer, Ashok Leyland's turnaround journey, though not as dramatic, has been a significant one from the perspective of revival from the brink of financial collapse.

This dire situation was in mid-2013 when Ashok Leyland's managing director, along with the company's CFO, made an urgent trip to London to apprise the promoters about the gravity of the situation. After getting approval to take some "drastic" action – major cost-cutting steps in other words – a detailed plan was shared with the company's board in July 2013.

"The substance of that was what we called as ‘We're not going to cut our costs towards glory’, that's not what we will do. We will create a company which will be restructured, and be prepared for growth," says Vinod Dasari, managing director, Ashok Leyland. And the growth continues to reflect in the current financial year's results. During the last quarter (Q2 FY’17), Ashok Leyland's net profit rose 71 percent to touch Rs 294 crore. Revenue fell seven percent to Rs 4,911.6 crore but the company sees this as an impact of the 14 percent fall in the M&HCV industry's volumes. Current market and economic conditions threaten to dampen the turnaround story though.

That aside, Dasari as well as his team have reason to be proud. Ashok Leyland's market share has climbed from 23 percent to over 30 percent in the past three to four years. Over the past eight quarters, the profitability of the commercial vehicle manufacturer has managed to attain double-digit EBITDA margins with the working capital coming down from 75 days to around 12 days now. The company’s debt level has come down from a record high of Rs 7,000 crore to around Rs 1,500 crore. The debt-equity ratio, which stood at 2.4:1, reached a level of 0.24:1 at the end of FY'16. The year saw Ashok Leyland reach the highest market share in its history, as well as achieve record profitability and lowest working capital.

Well-planned strategy

These impressive results also constitute the returns of an adroit mix of cost-cutting measures, divestments and enhanced efficiencies. The tough period also taught Dasari a lesson that "if you're going to cut costs, cut deeper than necessary (because) you can always add back costs." That meant 70 percent of the cost was reduced where 60 percent would, perhaps, have been okay. The business restructuring measures included exiting from joint ventures, diluting stakes, selling off land and exiting some businesses. In addition, employee levels were also brought down.

Critics would argue that with significant multiple cost cutting and burden-lowering exercises, the job of strengthening a company becomes easier. But for Dasari, who took over his current role in 2011, it was about realigning the focus of the company which, had over the years, got itself in multiple activities that today are seen as non-core. It is interesting to note that the amount of investment made in Ashok Leyland during its first 60 years till 2008 to be self-reliant (including buying out Italian truck maker Iveco's stake in Ashok Leyland in 2007) and diversify, was outdone by the investments made in 4-5 years thereafter. . . at around Rs 100 crore a month! Almost all of these investments were funded by debt and output didn't come as projected. That, along with the market crash due to economic recession, saw Ashok Leyland's debt pile up to a level of Rs 7,000 crore.

It was a "perfect storm" that Dasari and his team were in. "My fixed-cost was high, my debt was high, my pricing was bad, my capacity utilisation was terrible. It was a perfect storm scenario, a perfect problem I guess, nothing else could go wrong. At that time, I remembered when things are so bad, you actually take a step back and say, 'Okay, so what do I have in my hand?'" recalls Dasari candidly. From that perspective, the current steps to stabilise the business seem to be just what the doctor ordered.

Stepping up the game

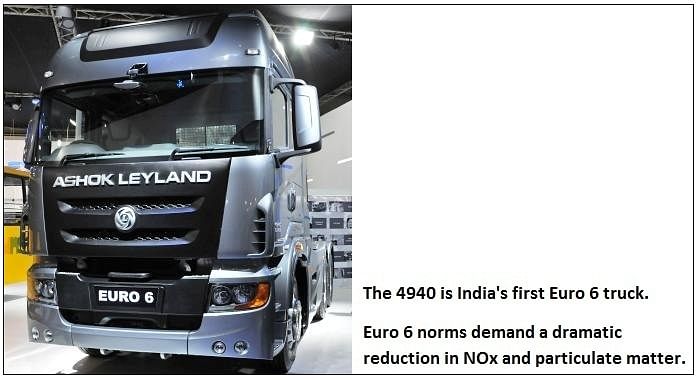

Anyone who saw the 4940 (India's first Euro VI-compliant truck) and the Hybus (India’s first non-plug-in hybrid bus) at Ashok Leyland's pavilion at the Auto Expo 2016 would perhaps find it difficult to imagine that the same OEM was on the brink of a financial collapse only a couple of years earlier.

The Hybus, for example, is a project that is "done in India, for India and by Indians" at the company's 1,500-strong R&D centre. According to Dasari, who is also the president of the Automotive Skill Development Council (ASDC), Indian innovation should not be discounted as jugaad. "That’s disrespecting the innovation that inherently exists in Indian mentality," he says. The Hybus project also benefitted from this mentality. This non-plug-in hybrid bus helps reduce emissions and also offers significant efficiencies in operating costs. Especially designed for urban transport with start-stop cycles, the ultra-capacitors provide the diesel motor with necessary power for movement.

For the Euro VI-compliant 4940 truck, Ashok Leyland leveraged its access to Albonair in Germany, which manufactures products for exhaust after-treatment. The company tapped into its pool of engineering innovation to develop the solution for Indian conditions. Albonair is also owned by the Hinduja Group, the promoter group of Ashok Leyland. But it was not just a plug-and-play strategy because adopting Euro VI technology to meet BS VI norms without recalibrating and modifying the solutions to meet suit Indian driving cycles could lead to fatal incidents. "On one hand, while we're cutting (costs), we also invested in growth. Some of the highest level of investments in new products came during that time. Our fastest growth in network came in during that time (2013-2015)," recalls Dasari.

To keep pace in a rapidly developing automotive world, Dasari, who is also the president of the Society of Indian Automobile Manufacturers (SIAM), says that research activities should be ramped up significantly. That will also help address the problem of skilled manpower availability. "By the way, 10 to 12 percent of the R&D in this country happens in the auto industry. And now with rapid changes, the clock speed of our industry has gone up much faster. Nowhere in the world has anybody gone from Euro 4 to Euro 6 in three years. People have taken 10-12 years; we will do it in three. At the same time, we’re going to be working on electric vehicles, hybrid vehicles, ultra-capacitor vehicles and CNG vehicles. There's also a push for ethanol vehicles. We’re going to be doing all of this simultaneously," says Dasari. Ashok Leyland, which invests 2-3 percent of its sales revenue on R&D annually, has seen its R&D team grow from 100-200 people to 1,500 now.

The gain of market share in its core M&HCV market has earned the confidence of many that Ashok Leyland is on the growth path again. Analysts also point out that the growth in market share in North and East India, where the company has been traditionally weak, is also an indication that the comeback strategy is yielding results on the ground.

But there's also a point of view that in the marketplace which has seen record levels of price discounts, Ashok Leyland has bought market share. Dasari has a "simple" counter to that – "I also have the highest profitability. If I was buying market share, I wouldn't have that," he says.

Heavy focus on LCVs

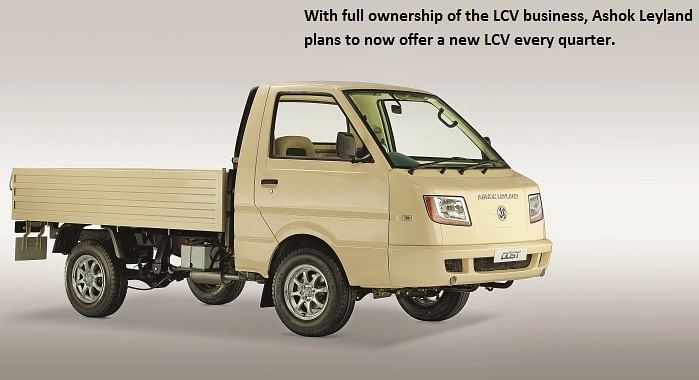

While things are stable and growing (notwithstanding the current market slowdown) on the M&HCV front, Ashok Leyland is yet to attain success in the light commercial vehicle space (LCV) which it envisioned when embarking on the LCV journey in 2011, in partnership with Nissan. The Dost light truck, the JV's first product, did get the numbers but hasn't been able to do much alone in a market dominated by Tata Motors with its popular Ace range of light trucks and passenger carriers. "The LCV part is still pending for Ashok Leyland," says an equity analyst.

Read more: Ashok Leyland to launch an LCV every quarter

A key reason for the slow movement of Ashok Leyland in the LCV market has been the virtual suspension of projects at the three Ashok Leyland-Nissan joint ventures as the partners got into a legal dispute. The companies have settled the dispute for good recently by diluting their equity partnership. Nissan will continue to provide technology support for the LCVs under a new agreement.

Dasari and team, after putting the house in order in the bread-and-butter M&HCV segment, are now gearing up for some aggressive moves in the LCV space, to make up for the lost time. "The LCV market is also doing well. It is counter-cyclical to the large commercial vehicle business. So you will see almost a new product coming out from our LCV division every quarter," reveals Dasari. A passenger-carrier version of the Dost and a midsize Mitr bus are in the pipeline.

An efficient organisation

Ashok Leyland's Pantnagar manufacturing plant has bagged the prestigious Deming award for TQM.

Ashok Leyland couldn't have reached this far without the people who served the company, but some realignment was also required in the human resources for the organisation to sustain itself and grow in the new VUCA (Volatility, Uncertainty, Complexity, Ambiguity) world. The turnaround drive led by Dasari also involved changes of some key personnel and also the responsibilities of a few roles. For example, regional managers are now evaluated not in terms of the sales volume in their respective regions, but he/she has the responsibility of the profitability of the business in the region, which also includes profitability of the dealers.

Dasari says that his management style is to "find the right people, tell them what needs to get done and don’t tell them how to do it. Let their ingenuity surprise you." He brought on board a few people, and let go of some in scripting the turnaround story. When asked what is it that he looks for in people, Dasari says: "I appreciate the attitude in people more than their aptitude." Bureaucracy or misuse of power is something that he "can't stand." Around 12 executives who report directly to Dasari are either new or in a new role."

Ashok Leyland was seen as a conservative and bureaucratic organisation. That is changing. There was, perhaps, disconnect between departments. Now it is fairly streamlined," says an equity analyst on the condition of anonymity.

Dasari feels that the industry has gone on to be not only cyclical but also volatile and uncertain. But he wouldn't call the business complex. "I think it's a very simple business. I am not selling a vehicle because of the way it looks. My customer buys a vehicle because he wants to make money off it,” says Dasari. To ensure more customers buy Ashok Leyland trucks, a new approach called PRISM (practical implementation in sales and marketing), which meant a more structured route to reach out to prospective customers, gain leads, and convert them into transactions by the dealers. "He is an extension of my family, but if he has to retail a hundred, he must have at least 200 prospects. And if he has 200 prospects, he must have about 400 leads. If he has to have 400 leads, he must have about 600-800 spaced calls that he must make. So we said, let us not practice retail, let us practice sales-call adherence. It's a beat plan adherence as we call it. So for all 2,500 dealer sales executives across the country, we designed a small little device. The daily beat plan is given and every single day we track all 2,500 people as to how many beat plans they are making, because we have to submit a daily call report," explains Dasari. He claims taking the digital methodology to sell vehicles made Ashok Leyland the world's first commercial vehicle OEM to do so.

Along with this step, the company also dipped into the Internet of Things (IoT) to enhance its competitiveness. Last year, the OEM introduced SAP HANA IoT application to increase vehicle productivity, reduce fuel costs and improve driver performance based on the huge amount of data generated by the vehicles and their users. Another benefit at the production level was the reduction in the time taken for the material resource planning module. "It used to take us five or six days to run. So when we did SAP, they said: ‘We are really good now. We can do it in two days.’ I challenged them to do it in two hours. They said there is no way, that it has never been done anywhere else in the world. Believe me, we now do it in half an hour," says a pleased Dasari.

With competition rising and global OEMs increasingly getting interested in the mainstream truck and bus market, incumbent players like Tata Motors and Ashok Leyland had to up the game to protect their turf. Quality improvement was therefore was crucial than ever before. Dasari was surprised when a consultancy firm commissioned to help improve quality found that there were 7.8 defects per vehicle at the end of the production line, in 2012. The global benchmark stood at 0.2 or 0.3. "Today I'm happy that we are consistently below 0.2," says Dasari. It is to be noted that Ashok Leyland became the first commercial vehicle company outside of Japan to win the coveted Deming Award for its Pantnagar plant. "Actually we are the world's first truck and bus company to win the award," stresses a proud Dasari.

Big global dreams

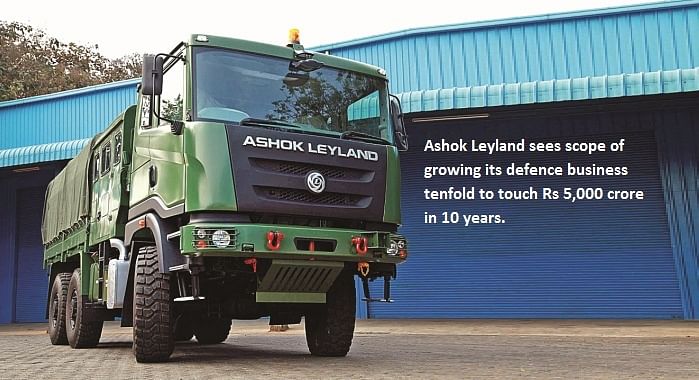

Stepping up quality levels to match the global benchmark will aid Ashok Leyland in powering its global dreams. The country's second largest commercial vehicle has already realised its dream of being among the top five bus makers (No. 4 now) and be among the top 10 truck makers (around 19th now), globally. Dasari believes that outside of China, Ashok Leyland is already No. 1 in buses.

Dasari takes pride in the level of innovation, across company divisions, underway at Ashok Leyland. Commenting on the evolution, he says: “Innovation in product, innovation in processes, innovation in supply chain. It’s innovation in logistics, innovation in dealers, everywhere. We pride ourselves on the second hemisphere of innovation and we believe that our mission is to leverage the second hemisphere of innovation to achieve our vision. ”

The reshaping journey of Ashok Leyland over the past two years or so hasn't been easy but is successful. For Dasari and his team, it is a fulfilling one for sure. But the job is not fully done yet. As Dasari says, "The best is yet to come." After preparing a good recipe for the company's turnaround, this industry captain who loves to cook to unwind perhaps now can think of preparing some new dishes. . . to eat of course!

INTERVIEW: Vinod Dasari on turning Ashok Leyland into an aggressive company

RELATED ARTICLES

Inside Three-Pointed Star's Global EV Rethink and Why the CLA Matters More Than It Seems

After years of building EVs under a separate identity, Mercedes-Benz is folding electric models back into its core brand...

Why India’s CBG Revolution is Stuck in Neutral

Seven years after a bold promise to build 5,000 plants, India’s compressed biogas sector is struggling to move past the ...

The Car that Exists Before it Exists

The car you buy today was likely built twice — once in software, once in steel. The companies that have figured out how ...

By Sumantra B Barooah

By Sumantra B Barooah

06 Jan 2017

06 Jan 2017

25482 Views

25482 Views

Ketan Thakkar

Ketan Thakkar

Arunima Pal

Arunima Pal

Anurag Chaturvedi

Anurag Chaturvedi