Size Matters, But Smaller Wins: India's SUV Market

SUVs are credited with eclipsing the small car in India, but within SUVs, it's the smaller ones that are winning.

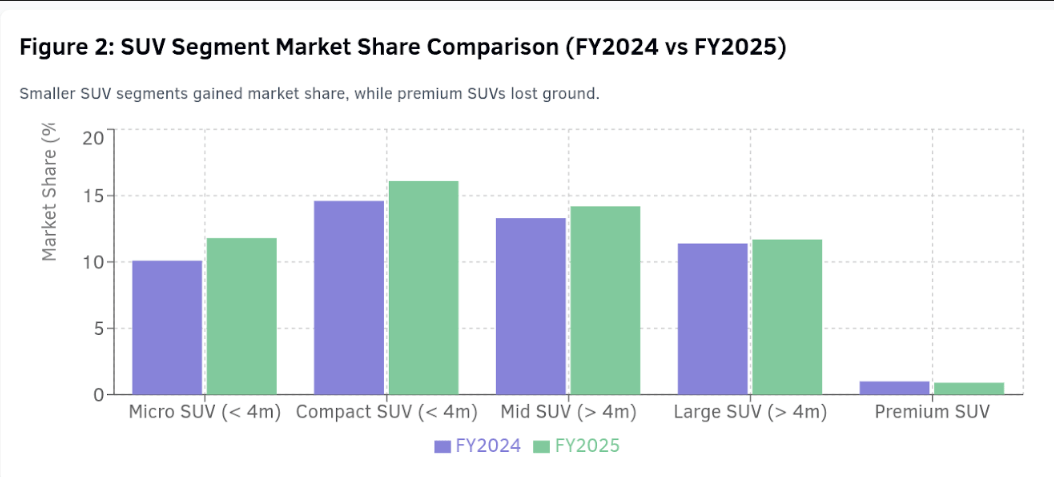

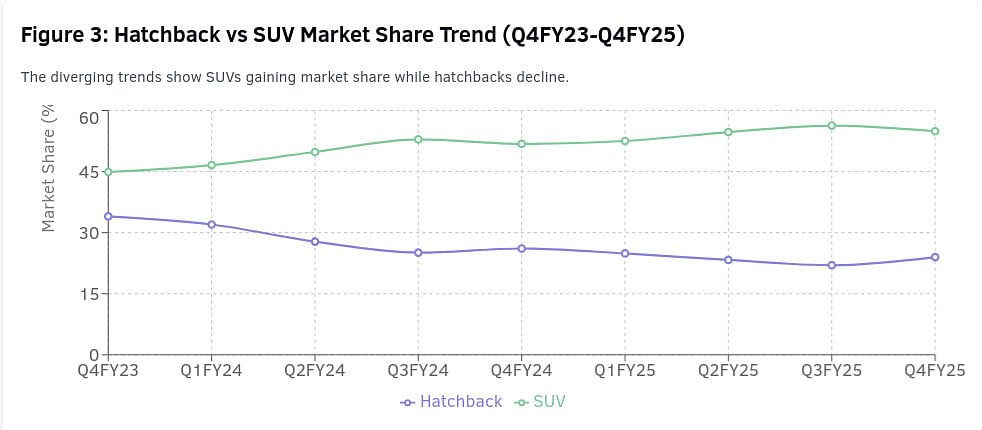

In India's automotive discourse, a common lament echoes through industry analysis: SUVs have killed the beloved small car. While this narrative captures part of the truth—hatchback segment share has indeed plummeted from 34.0% in Q4FY2023 to just 24.0% in Q4FY2025—it misses a more nuanced reality emerging in the market. Within the SUV segment itself, a fascinating inverse relationship between vehicle size and growth rate has emerged, with smaller SUVs dramatically outperforming their larger counterparts.

Shipment data reveals a striking pattern: in FY2025, growth rates across SUV categories almost perfectly correlate inversely with vehicle size. As SUVs get smaller, their market performance gets stronger—challenging conventional wisdom about India's automotive future.

The Inverse Correlation: Size vs. Growth in India's SUV Market

The data tells a compelling story of how SUV growth rates in FY2025 demonstrate an almost perfect inverse relationship with vehicle size:

- Micro SUVs (< 4m): 20.4% year-over-year growth

- Compact SUVs (< 4m): 13.5% year-over-year growth

- Mid SUVs (> 4m): 9.8% year-over-year growth

- Large SUVs (> 4m): 6.1% year-over-year growth

- Premium SUVs: 10.0% year-over-year decline

This pattern suggests that while SUVs as a category are flourishing, consumer preferences are skewing decisively toward more accessible, compact offerings—a trend that runs counter to the perception of relentless upsizing in the Indian market.

Micro SUVs (< 4m): The Explosive Growth Segment

Market Performance

The Micro SUV segment registered the highest growth in FY2025 at a remarkable 20.4% year-over-year, with sales surging from 424,197 units in FY2024 to 510,793 units in FY2025. This segment now commands 11.8% of the total passenger vehicle market, up from 10.1% in the previous fiscal year.

Popular Models

Key models driving this growth include the Tata Punch, Maruti Suzuki Fronx, Hyundai Exter, Nissan Magnite, and Renault Kiger. These vehicles typically offer SUV styling, higher ground clearance, and feature-rich cabins in a sub-4 meter footprint.

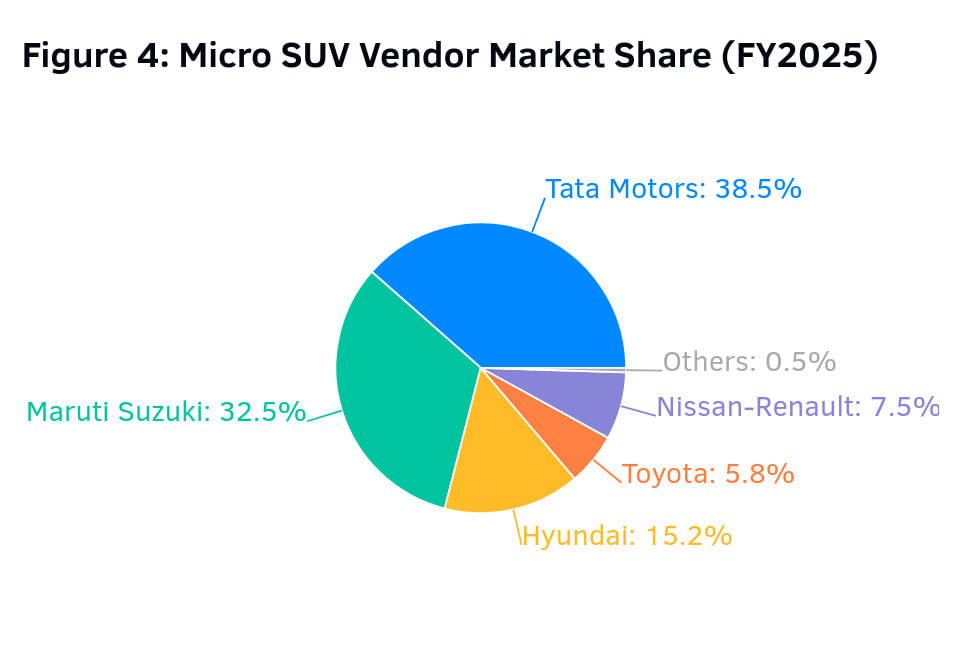

Vendor Performance

- Tata Motors: Maintains segment leadership with the Punch, commanding 38.5% market share in FY2025, though slightly down from 39.8% in FY2024.

- Maruti Suzuki: Strengthened its position with the Fronx, increasing market share to 32.5% in FY2025 from 31.8% in FY2024.

- Hyundai: Captured 15.2% market share with the Exter, though down from 16.8% in FY2024.

- Toyota: New entrant to the segment in FY2025, quickly securing 5.8% market share.

- Nissan-Renault: Combined share declined from 10.2% to 7.5%, suggesting challenges in maintaining momentum against newer competitors.

Compact SUVs (< 4m): Solid Growth Continues

Market Performance

Compact SUVs posted strong 13.5% year-over-year growth in FY2025, with volumes increasing from 614,009 units to 697,013 units. This segment represents 16.1% of the total passenger vehicle market, up from 14.6% in FY2024.

Popular Models

This segment includes vehicles like the Maruti Brezza, Tata Nexon, Hyundai Venue, Kia Sonet, and Mahindra XUV300—all designed to maximize features and space while staying under the crucial 4-meter length threshold for tax benefits.

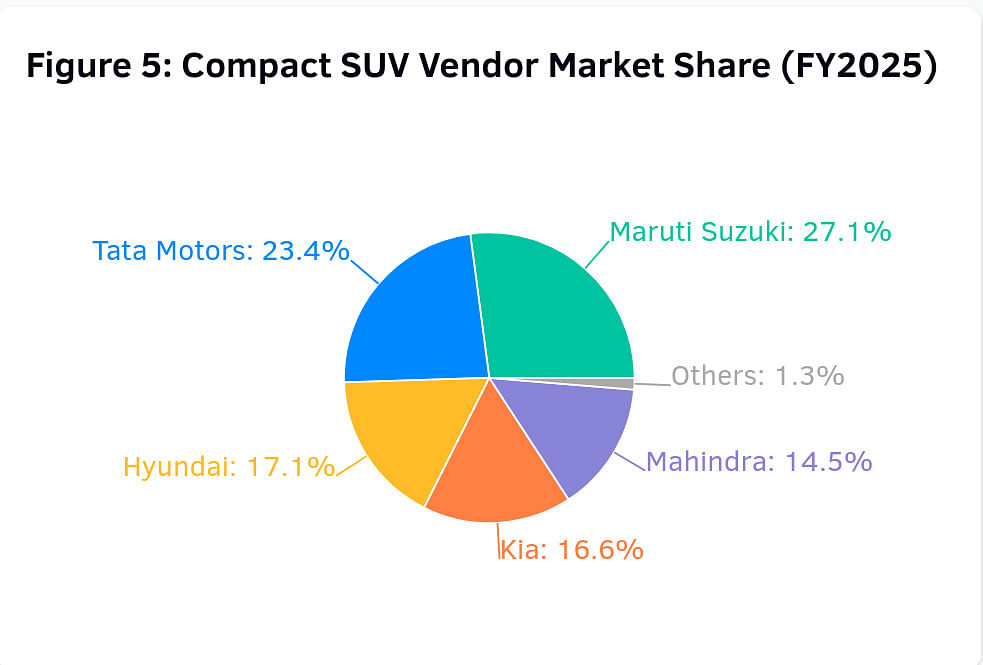

Vendor Performance

- Maruti Suzuki: Maintained segment leadership with the Brezza at 27.1% market share in FY2025, slightly down from 27.7% in FY2024.

- Tata Motors: The Nexon helped secure 23.4% market share, though down from 28.0% in FY2024.

- Hyundai: Experienced significant decline with the Venue, dropping to 17.1% market share from 21.0% in FY2024.

- Kia: Increased its presence with the Sonet, growing to 16.6% market share from 13.3% in FY2024.

- Mahindra & Mahindra: Substantial growth with the XUV300, reaching 14.5% market share, up from 8.8% in FY2024.

Mid SUVs (> 4m): Moderating Growth

Market Performance

Mid SUVs recorded 9.8% year-over-year growth in FY2025, with sales increasing from 561,031 units to 615,749 units. The segment now represents 14.2% of the total passenger vehicle market, up from 13.3% in FY2024.

Popular Models

This segment includes popular models like the Hyundai Creta, Kia Seltos, Maruti Grand Vitara, Toyota HyRyder, and newer entrants like the Tata Curvv. These vehicles offer additional space and features compared to compact SUVs, but at higher price points.

Vendor Performance

- Hyundai: Maintained segment leadership with the Creta, increasing market share to 31.6% in FY2025 from 29.1% in FY2024.

- Maruti Suzuki: Slightly decreased to 20.1% market share with the Grand Vitara, down from 21.6% in FY2024.

- Kia: Experienced significant decline with the Seltos, dropping to 11.8% market share from 17.9% in FY2024.

- Toyota: Increased its HyRyder's market share to 9.8%, up from 8.7% in FY2024.

- Tata Motors: New entrant with the Curvv, quickly securing 5.5% market share in FY2025.

Large SUVs (> 4m): Growth Slowing

Market Performance

Large SUVs showed a more modest 6.1% year-over-year growth in FY2025, with volumes increasing from 480,210 units to 509,416 units. This segment accounts for 11.7% of the total passenger vehicle market, marginally up from 11.4% in FY2024.

Popular Models

Key models in this segment include the Mahindra Scorpio, Mahindra XUV700, Tata Harrier, Tata Safari, and Hyundai Alcazar. These vehicles typically offer three-row seating, more powerful engines, and premium features.

Vendor Performance

- Mahindra & Mahindra: Strengthened its dominant position with the Scorpio and XUV700, increasing market share to 85.9% in FY2025 from 82.7% in FY2024.

- Tata Motors: Experienced a decline with the Harrier and Safari, dropping to 7.7% market share from 9.1% in FY2024.

- Hyundai: Lost ground with the Alcazar, decreasing to 3.4% market share from 4.3% in FY2024.

- Maruti Suzuki: The Jimny struggled, with market share declining to 1.7% from 3.5% in FY2024.

Premium SUVs: The Only Declining Segment

Market Performance

Premium SUVs were the only SUV category to register negative growth, declining by 10.0% year-over-year in FY2025, with volumes falling from 41,774 units to 37,610 units. This segment represents just 0.9% of the total passenger vehicle market, down from 1.0% in FY2024.

Popular Models

This segment includes luxury offerings like the Toyota Fortuner, Toyota Land Cruiser, Hyundai Tucson, and various imported models from luxury brands. These vehicles command premium prices and typically offer the highest levels of features and performance.

Vendor Performance

- Toyota: Further consolidated its dominant position with the Fortuner and Land Cruiser models, increasing market share to 92.5% in FY2025 from 88.1% in FY2024.

- Hyundai: Suffered significant decline with the Tucson, dropping to just 4.4% market share from 10.3% in FY2024.

- Other Premium Brands: Combined share of other premium SUV manufacturers remained minimal at around 3%.

Market Dynamics: Understanding the Inverse Relationship

Several factors help explain why smaller SUVs are outperforming their larger counterparts:

Economic Pragmatism

In a price-sensitive market like India, the affordability of smaller SUVs makes them accessible to a much broader customer base. With economic uncertainties and rising vehicle costs, consumers are increasingly prioritizing value-oriented purchases that don't compromise on desired features.

Regulatory Environment

India's tax structure significantly favors sub-4-meter vehicles, creating powerful incentives for both manufacturers and consumers to gravitate toward smaller SUVs. Additionally, stricter emission norms make smaller, more efficient vehicles increasingly attractive.

Urban Practicality

India's congested urban environments and limited parking infrastructure make compact vehicles inherently more practical. Smaller SUVs offer the desired high seating position and road presence without the navigational challenges of larger vehicles.

Fuel Efficiency Concerns

With fuel prices remaining volatile, smaller SUVs' better efficiency resonates with cost-conscious Indian consumers. The significant efficiency gap between compact and larger SUVs weighs heavily in purchase decisions.

Shifting Product Strategies

Manufacturers are responding to these trends with notable strategic shifts:

Downsize Focus

Even traditional proponents of larger vehicles like Mahindra are developing smaller offerings, recognizing the market's direction. The company's upcoming compact SUV lineup demonstrates this pivot.

Feature Democratization

Features once exclusive to premium segments—like sunroofs, connected car technology, and ADAS systems—are increasingly appearing in compact SUVs, further eroding the value proposition of larger vehicles.

Expansion of Compact Lineups

Most manufacturers are expanding their small SUV portfolios faster than their mid or large SUV offerings. Maruti Suzuki, traditionally focused on hatchbacks, now offers multiple sub-4-meter SUVs.

Redefining India's SUV Revolution

The narrative that SUVs are killing small cars in India requires important nuance—what we're witnessing is not simply a shift from small vehicles to large ones, but rather a transformation in how Indians define desirable small vehicles. The modern micro and compact SUV effectively represents the evolution of the small car for Indian conditions: practical dimensions with enhanced ground clearance, commanding seating position, and contemporary styling.

As growth rates continue to favor smaller SUVs, manufacturers must recalibrate their strategies. The future of India's automotive market appears to be converging on a sweet spot that combines the aspirational qualities of SUVs with the practical dimensions and affordability that have always defined successful vehicles in the market.

This trend suggests that while SUVs may indeed be supplanting traditional hatchbacks, the small car ethos—practical, efficient, affordable—remains fundamentally intact, merely transformed into a more contemporary and desirable form factor. The real revolution isn't that Indians no longer want small cars—it's that they want small cars that don't look or feel like traditional small cars.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

By Shruti Shiraguppi

By Shruti Shiraguppi

20 May 2025

20 May 2025

9295 Views

9295 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal