Mahindra, Ford: Second time unlucky

The Mahindra-Ford partnership was announced with so much promise and hope, but a little over a year later, it fell apart. Hormazd Sorabjee spoke to sources in both companies to find out what went wrong.

The Mahindra-Ford partnership was announced with so much promise and hope, but a little over a year later, it fell apart. Hormazd Sorabjee spoke to sources in both companies to find out what went wrong.

Remarriage after a divorce isn’t common, but it happens. Richard Burton and Liz Taylor, Elon Musk and Talulah Riley are high-profile examples. Marrying the same partner twice isn’t limited to celebrity couples though; it takes place in the automotive world as well. Well, almost.

Mahindra and Ford – after splitting up in 1998 – rekindled their romance 21 years later, and on October 1, 2019, made a grand announcement that the two erstwhile partners were working towards entering a second joint venture. But, before the two companies could reach the altar, they had an abrupt fallout, which was made official on December 31, 2020 – the deadline set to officially tie the knot, or call it off.

The official statement from both companies for the break-up said “the outcome was driven by fundamental changes in global economic and business conditions – caused, in part, by the global pandemic – over the past 15 months. Those changes influenced separate decisions by Ford and Mahindra to reassess their respective capital allocation priorities.”

But what brought Mahindra and Ford back together for a second time? It certainly wasn’t love. Marriages in the automotive industry are born out of necessity, the need for survival and this certainly was the case with Ford. Realisation had dawned on the American automaker that it needed a partner to survive in India and Mahindra seemed the best bet. By giving Mahindra a majority 51 percent stake in the new joint venture, Ford had effectively given the wheel of the company to its partner. For Mahindra, this joint venture offered synergies and scale with a global partner and the tantalising prospect of a new range of jointly developed SUVs that neither company could have developed on its own.

However, given their history, both companies were initially wary of each other. In fact, in 2017, when Ford decided it didn’t want to go solo in India anymore, it had considered Changan Auto, its joint-venture partner in China, as a potential partner in India as well. Changan had been eyeing the Indian market for several years and piggybacking on Ford, which had two up-and-running plants, would have been the easiest way. However, Ford felt it was better to throw its lot in with an Indian partner and one that is a known devil. But, as it turned out, a devil it was. Or, was the devil in the details?

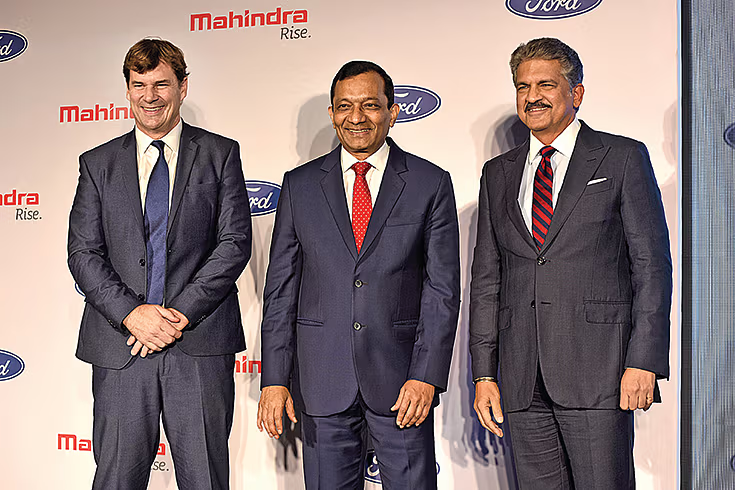

L-R: Jim Farley, Dr Pawan Goenka and Anand Mahindra at the announcement of the partnership in October 2019.

Forged at the top

Mahindra and Ford first started talking in 2017, but both were wary of each other and initially weren’t interested in a joint venture. However, both agreed to start working together on specific projects to judge how the relationship would develop and both signed an MoU called ‘Project Black’ in late 2017. Under the project, Ford would use the Mahindra XUV700’s platform to develop its own SUV (CX757), and the Mahindra 1.2 TGDI mStallion motor would replace Ford’s ‘Fox’ 1.0 Ecoboost engine in the Ecosport.

As the two partners began working together, the bonhomie grew and a strong level of comfort developed between the top management. Jim Farley, then the president of New Businesses, Technology and Strategy of Ford, saw huge value in Mahindra and was seen as a man who wanted the partnership to succeed. Farley is no stranger to India, even at a personal level. He supports an orphanage in Kerala which he regularly visits and thischaritable side of Farley was not lost on Anand Mahindra who called him “a wonderful guy”. Farley also hit it off with then managing director Dr Pawan Goenka, and the two leaders had a good chemistry, and as a result the relationship between both their companies became quite strong too. Hence, it was a given that the joint venture would go through.

However, a change of guard, which saw Dr Goenka retiring and Anish Shah taking the helm at the Mahindra Group, came with a change of heart as well. What looked like a done deal back then was being scrutinised very closely by Mahindra. Shah’s appointment took place during the thick of the COVID-19 pandemic and in the panic, companies downsized overnight and shed their money-sapping ventures. Mahindra called it quits on SsangYong after a decade and the Indian SUV maker was also having second thoughts of the Ford joint-venture. “Three years back, our auto business was in a very different situation than it is today and we could have afforded to go through with Ford,” said a Mahindra source. The joint venture envisaged an investment of Rs 3,000 crore, which a company like Mahindra, just exiting from SsangYong, must have thought about twice in COVID times.

Cracks emerge

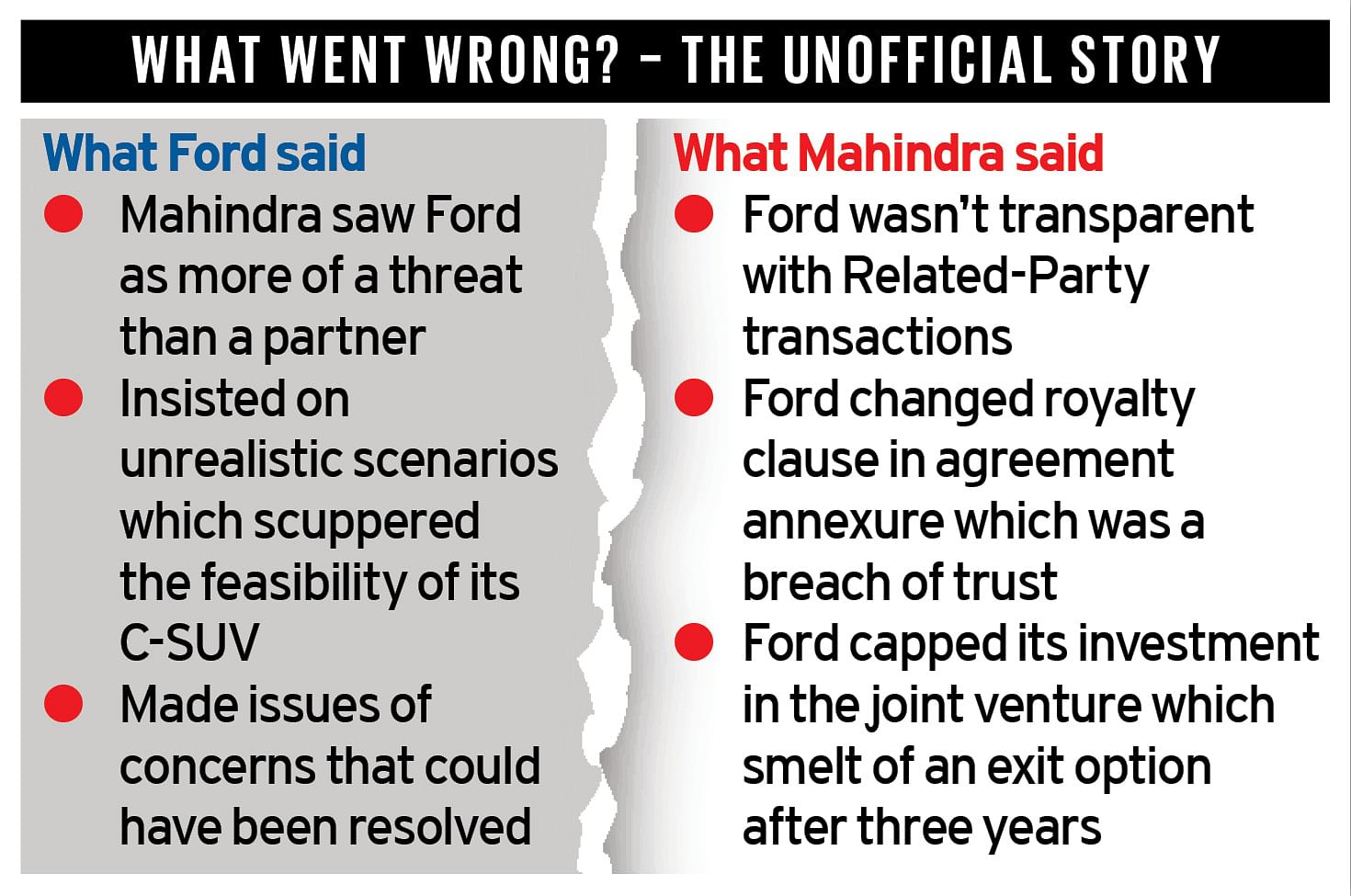

The joint venture may have gone through, if, according to a Mahindra insider, Ford played ball. A few months into the discussions, senior Mahindra sources say they found a lack of transparency creeping into the negotiations, and even a hidden agenda.

“Until April 2020, we hardly had any issues. They were tough negotiators, but that wasn’t a problem. After that, in my view they were following the letter and not the spirit of the agreement,” said a source. Apparently, Ford was being very cagey about Related-Party transactions. “Ford India would import a lot of components from the Forduniverse. But they didn’t give us the pricing formula, which we needed to know for us to negotiate. The formula we worked out is that if the JV is doing anything with Ford, then Mahindra will negotiate, and if the JV is dealing with Mahindra, then Ford will negotiate. This way there would be an alignment of interest and not a conflict of interest. But for this to work, we needed to know the transaction prices with the Ford universe,” the source added.

However, the real shocker, if Mahindra sources are to be believed, is that Ford changed one of the annexures on royalty payments. “When we were finalising the agreements at 4am India time, our team was dog-tired and we assumed there wouldn’t be any changes, but there were! The understanding is that the royalty would be halved for the JV but the figure they put was higher than what was agreed upon.”

Ford denies any wrongdoing or unethical dealings and is of the view that there were no major issues “that couldn’t be resolved”. Mahindra feels the relationship with Ford was spoiled by a handful of Ford executives who wanted to earn brownie points by getting a better deal at the last minute. “In the Ford system, even Jim Farley can’t intervene in the negotiations done by his juniors,” lamented a Mahindra source.

By now deep cracks in the partnership were beginning to emerge and there were more squabbles between the two partners over issues, like indemnities and guarantees from Ford for potential financial liabilities that might crop up and a VAT loan transfer involving the Tamil Nadu government. Insiders feel Mahindra was being a bit too unreasonable by insisting on stronger terms and standards when due diligence for the business was already done.

Ford is of the view that Mahindra saw the American carmaker as a threat and not a partner after it was shown the Ford C-SUV, “which looked far better than the XUV700” and made things difficult for them. Mahindra is supposed to have insisted that Ford make a business case based on production of just 1,000 C-SUVs a year, which, besides being near impossible, would also mean Ford’s version of the C-SUV would be priced far higher and away from the Mahindra version. “It was absurd to think that our C-SUV would sell only 1,000 units a year, even with the Rs 50,000 to Rs 60,000 premium we planned to mark up over the XUV700, our minimum volumes would multi-fold,” said a Ford source.

Ford sources also accuse Mahindra of scuttling the partnership by making “the business case impossibly difficult with unrealistic scenarios”, further adding that “the absurd assumptions based on which impossibly low volumes were projected, ruined the feasibility of those programmes. They spoiled the business case for C-SUV, and for the Aspire EV too. In the end, the only business case they could not spoil was for BX772, because that was in our control. But out of seven products, that was the only one going through.”

What has made Ford bitter is the feeling that Mahindra had already made up its mind to exit the joint venture and were hence making things difficult. Sources in Mahindra, however, claim they “tried to save the joint-venture till the very last day.” Did they?

Cap on cap

The deal-breaker for Mahindra could have been a critical point it caught in the agreement which was missed in the beginning. Mahindra said it homed in on Ford’s condition to cap its investment over a three-year period and not invest beyond the allocated Rs 3,000 crore for the joint venture.

This set off alarm bells at Mahindra, who didn’t want any limits on investment because if one product doesn’t do well, it would suck a huge amount of money to prop up. “In such a scenario, Ford can’t say my funding is capped because my US board is not approving more money. Then what happens? We will end up funding as a majority partner, they will dilute and slowly get out and we will be left holding the can,” said a Mahindra executive. “Credit must be given to Anish Shah for really picking up this critical issue which smelt of Ford’s exit strategy. He really saved us.”

With no one willing to go on record, the unofficial blame game we’ve been privy to won’t reveal all the facts. What there is no doubt about is that Mahindra has come out of this fizzled partnership far better than Ford. It has, on the one hand, eliminated a competitor and can redeploy the capital earmarked for the joint venture back into its own product development. Exiting the partnership may not have been the nicest thing to do (if Ford is to be believed), but for Mahindra and all its shareholders, it’s possibly the smartest thing to have done.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

21 Oct 2021

21 Oct 2021

367344 Views

367344 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal