Hyundai Reclaims Third Position in India's Domestic Market After Three-Month Slide

Korean automaker edges past Tata Motors in domestic shipments while Mahindra solidifies No.2 position.

Hyundai Motor India reclaimed the third position in India's domestic passenger vehicle market in May 2025, ending a three-month streak where it had been relegated to fourth place behind Mahindra and Tata Motors. The Korean automaker's domestic sales of 43,861 units in May narrowly edged past Tata Motors' domestic passenger vehicle sales of 41,557 units.

Breaking the Fourth-Place Streak

Hyundai's return to the third position comes after being displaced from February through April 2025, when both Mahindra and Tata Motors had consistently outsold the Korean manufacturer in domestic shipments. The May performance represents a crucial recovery for Hyundai, which has traditionally held the second or third position in India's passenger vehicle hierarchy.

With 43,861 domestic units, Hyundai managed to stay ahead of Tata Motors by approximately 2,300 units—a relatively narrow margin that underscores the intensely competitive nature of the Indian market beyond market leader Maruti Suzuki.

Mahindra Emerges as Domestic No.2

Perhaps more significantly, the May numbers confirm Mahindra & Mahindra's emergence as the clear second-largest passenger vehicle manufacturer in India's domestic market. M&M's passenger vehicle division (primarily SUVs) recorded robust sales of 52,431 units, representing 21% year-on-year growth and establishing a comfortable lead over both Hyundai and Tata.

This positioning marks a remarkable transformation for Mahindra, which has successfully leveraged India's SUV boom to leapfrog traditional players. The company's focused strategy on utility vehicles has paid dividends, with domestic volumes significantly exceeding both Korean and Indian competitors. READ MORE: Tracing Mahindra's Ascent to India's No.2 Car Brand

Hyundai No.2 Overall

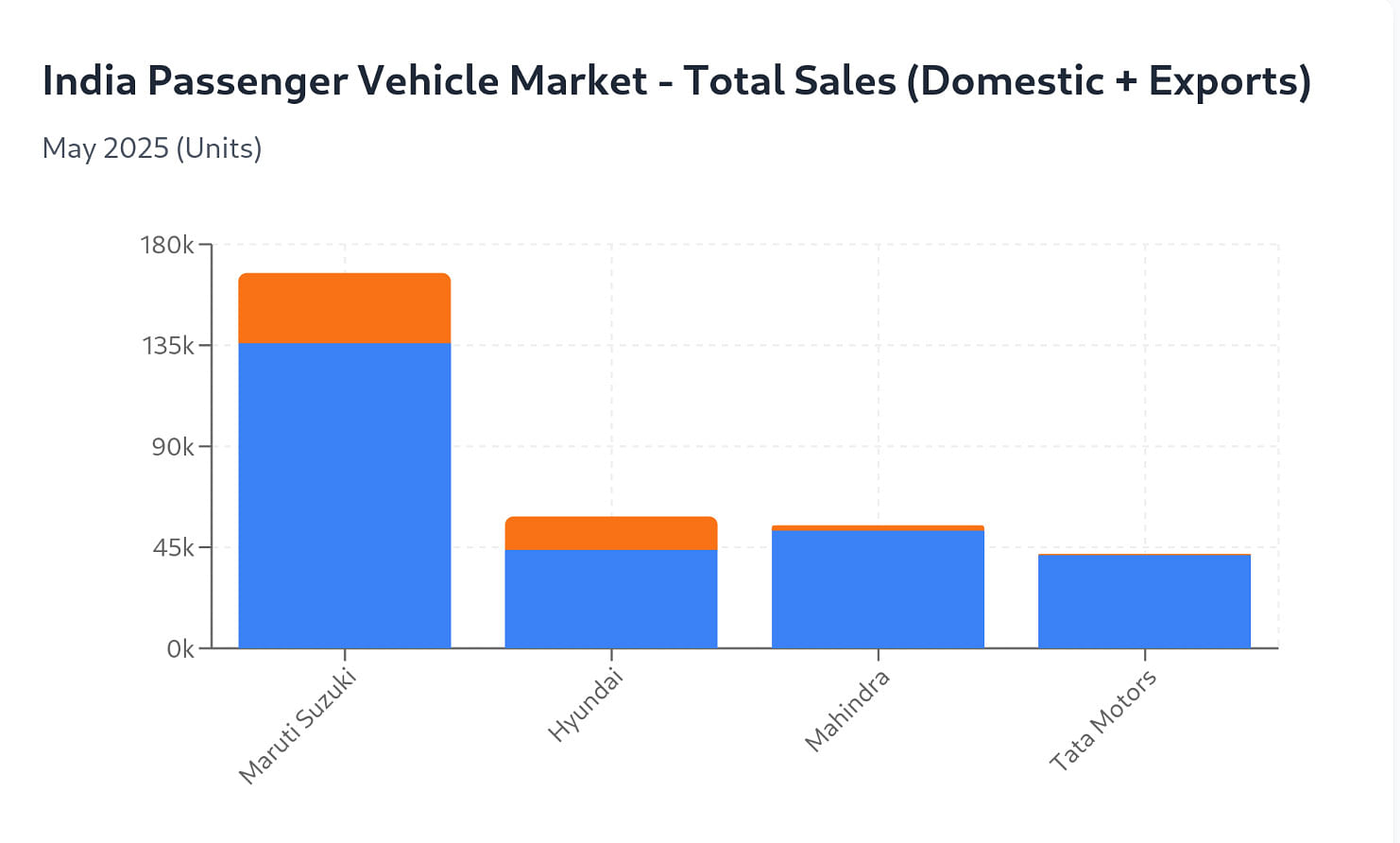

While Hyundai slipped to third in domestic sales, the company maintains its overall No.2 position in India when including export volumes. Hyundai's total sales (domestic + exports) reached 58,701 units in May, compared to Mahindra's total passenger vehicle sales of 54,819 units (including exports of 2,388 units).

Total sales, including exports (shown in orange)

Total sales, including exports (shown in orange)

Hyundai's export performance of 14,840 units in May demonstrates the company's significant role as a manufacturing hub for global markets, leveraging its Chennai facility to serve international demand. This export strength provides crucial volume support and helps maintain Hyundai's overall market position despite domestic market pressures.

Impact of Plant Maintenance

Hyundai attributed some of its May performance challenges to a scheduled biannual plant maintenance shutdown at its Chennai manufacturing facility. According to Tarun Garg, Whole-time Director and Chief Operating Officer at HMIL, this routine maintenance affected the availability of "few critical models" during the month.

However, the company expressed optimism about future performance, with Garg noting: "We continue to witness consistent growth in our exports volume and this is a testament to the 'Make in India, Made for the World' philosophy that we passionately uphold."

The May rankings reflect evolving competitive dynamics in the Indian passenger vehicle market:

Mahindra's SUV Strategy: The company's exclusive focus on utility vehicles has proven highly effective, with 21% growth demonstrating strong market acceptance of models like the Scorpio-N, XUV700, and Thar.

Hyundai's Recovery: The return to third position suggests Hyundai's diverse portfolio across segments—from the Grand i10 to the Creta and Venue—retains competitive appeal despite market challenges.

Tata's Pressure: Tata Motors' fourth position, with an 11% year-on-year decline, indicates the company faces challenges despite its electric vehicle leadership and strong SUV portfolio including the Nexon and Harrier.

Market Share Implications

The shifting positions have important market share implications. While Maruti Suzuki continues to dominate with approximately 40% market share, the battle for second place has intensified significantly. Mahindra's domestic market share has likely crossed 15%, while Hyundai and Tata are competing in the 12-13% range.

This fragmentation suggests a maturing market where specialized strategies—like Mahindra's SUV focus or Hyundai's export-domestic balance—are becoming increasingly important for competitive positioning.

Hyundai's May recovery to third position provides the company with crucial momentum as it seeks to stabilize its domestic market share while maintaining export growth. The narrow margin over Tata Motors suggests this ranking battle will remain fluid in coming months.

For Mahindra, the solid No.2 domestic position validates its SUV-centric strategy and positions the company well for continued growth as Indian consumers increasingly prefer utility vehicles.

The competitive intensity among the three players vying for positions 2-4 highlights the dynamic nature of India's automotive market, where monthly performance can significantly impact overall positioning and investor sentiment.

Hyundai's ability to reclaim third position despite plant maintenance challenges demonstrates the resilience of its market strategy, though sustaining this position will require continued execution across both domestic demand generation and export market development.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

By Shruti Shiraguppi

By Shruti Shiraguppi

02 Jun 2025

02 Jun 2025

9310 Views

9310 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal