Honda gains ground in a slowing market

While motorcycle sales have remained subdued, scooters are firing on all cylinders and the upper end of the bike market is gathering more muscle. An analysis by Brian de Souza.

While motorcycle sales have remained subdued, scooters are firing on all cylinders and the upper end of the bike market is gathering more muscle. An analysis by Brian de Souza.

The two-wheeler industry in India, which is bristling with a flurry of new models, emerging segments and also new entrants, has been driving new gains, in the face of the ongoing slowdown. In fact, it is the sole vehicle segment to have bucked the downturn.

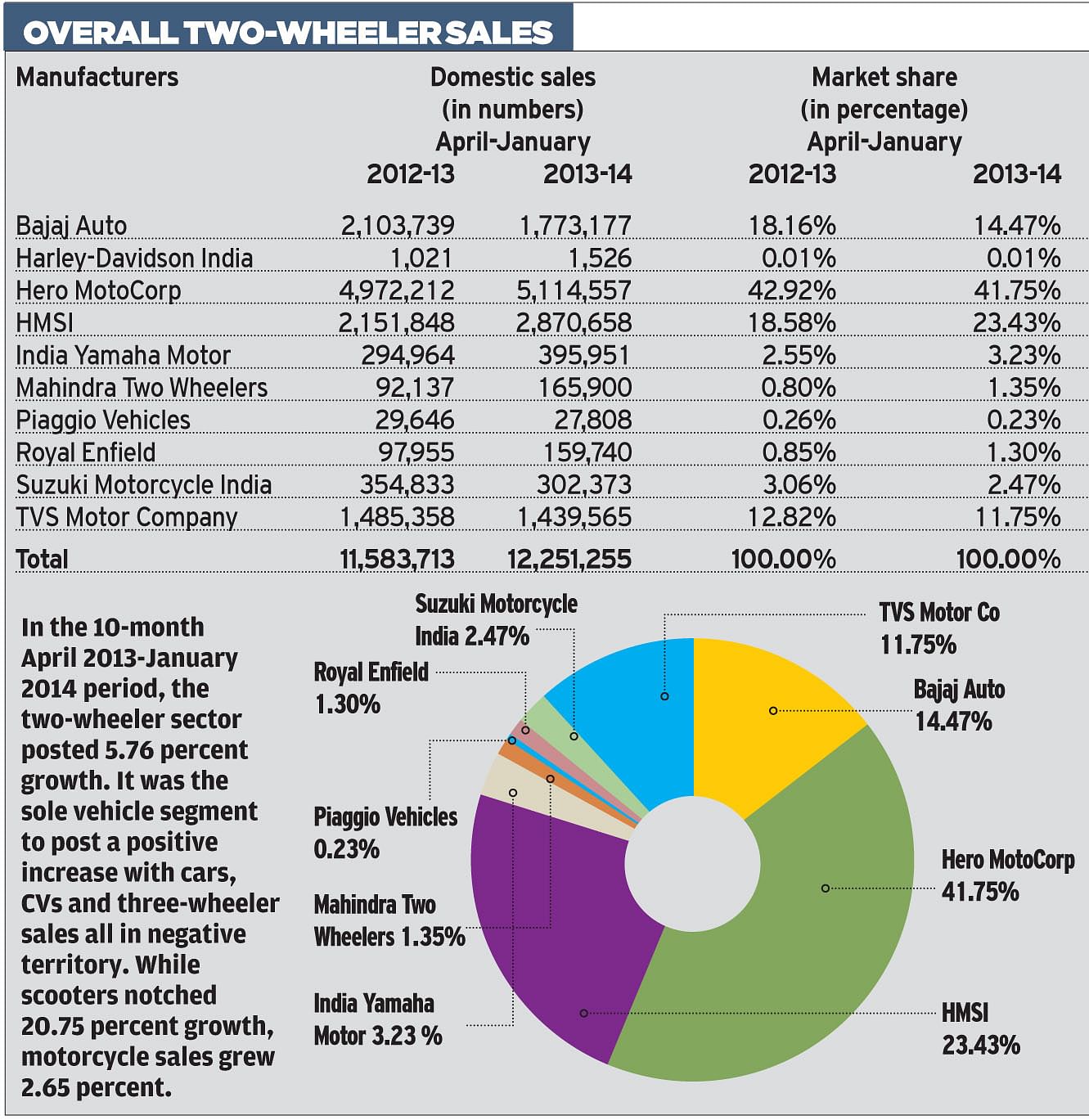

With 5.76 percent growth (12,251,255 units sold in April-January 2013-14 compared to 11,583,713 units in April-January 2012-13), two-wheeler sales helped the overall industry numbers post a 2.46 percent, albeit flat, growth. Sales in all the other segments fell (passenger vehicles by 6.13 percent, commercial vehicles by 18.63 percent and three-wheelers by 11.07 percent).

Nevertheless, at the beginning of 2013, who would imagined that the slowdown would hit the two-wheeler segment so significantly as it has the passenger car market? That was one abiding feature of the past year or so even as several trends have become visible that bear close scrutiny as we ride into 2014.

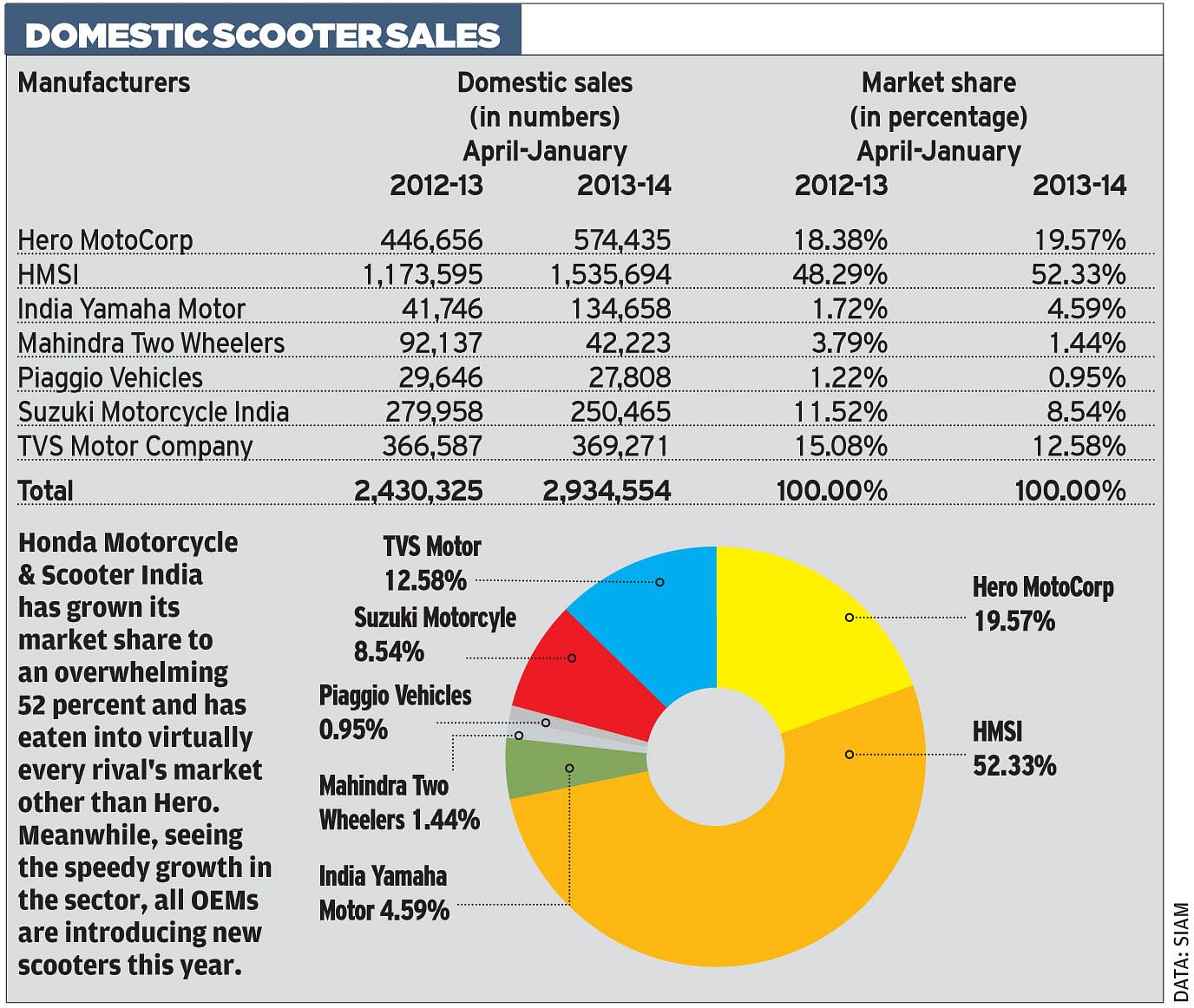

Firstly, the scooter segment which witnessed a surge last year saw that momentum gather even more thrust in the first 10 months of the current fiscal. For the 10-month April 2013-January 2014 period, SIAM has reported that scooter numbers went up to 2,934,554 units as against 2,430,325 units in the year-earlier period, accounting for a 20.75 percent increase.

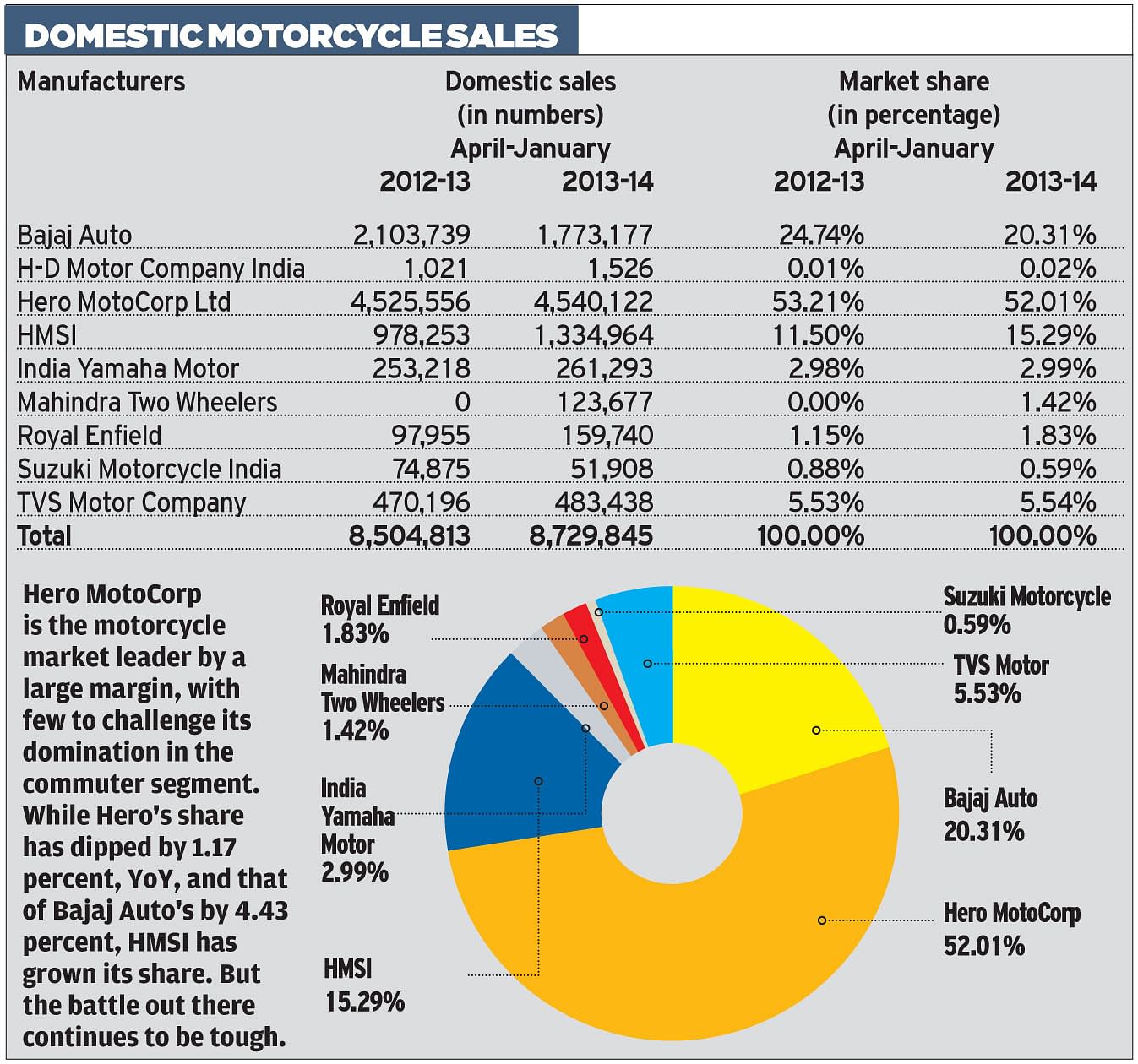

In comparison, motorcycles registered a 2.65 percent growth to 8,729,845 units, albeit the bike parc is three times larger.

Secondly, if the two-wheeler OEs made key investments in R&D last year, this was the year when they put out a varied range of products. At last month’s Auto Expo, a good number of manufacturers showcased their latest products, high-quality concepts, many of which should see it through to production, and new technologies. For instance, Hero MotoCorp made the show its own, carpet-bombing the Expo with as many as 12 new product reveals. Its 620cc Hastursportsbike concept was undoubtedly the star of the show. There was also the RNT concept bike which has a 150cc, liquid-cooled, diesel engine. Hero will offer a turbocharged version too and is working on powering the RNT with an additional electric motor. It also showcased its future-ready hybrid Leap scooter that uses range extender tech.

While Bajaj Auto took the covers off its range-topping Pulsar SS400 and CS400 concept bikes, TVS Motor Co revealed its Draken-X21 streetfighter motorcycle as well as the Graphite scooter concept developed with inputs from the TVS racing team and featuring an AMT (Automated Manual Transmission) gearbox with button shift technology.

Thirdly, the upper end of the motorcycle market has seen impressive numbers, thanks to Royal Enfield and Harley-Davidson India which raked in good numbers. The products that shone included the Classic 350 and the Bullet 350 Twin Spark, among others, while Bajaj Auto did well with its KTM bikes and Harley-Davidson made an impact with bikes like the Dyna and more recently, with the Rs 410,000-priced Street 750.

While the segment has been affected by the ongoing slowdown, the fall in GDP and high inflation (this has made the Reserve Bank of India up the key interest rate thrice), it is the scooter segment that has brought cheer to manufacturers. Among these, the players that can take the credit are Honda Motorcycle & Scooter India (HMSI) with its trio of the Honda Eco Technology-enabled Activa, Dio and Aviator, TVS Motor Company with the Jupiter and Wego, and India Yamaha Motor with its first scooter, the Ray and more recently the Ray Z targeted at male riders.

MARKET MOVERS AND SHAKERS

The biggest gainer in the overall two-wheeler segment has been Honda Motorcycle & Scooter India (HMSI), a company which has expressed its unabashed ambition to be No 1 in the Indian market. With sales of 2,870,658 units (1,535,694 scooters and 1,334,964 motorcycles) in the April-January 2013-2014 period, this manufacturer has made solid gains in the fiscal year till now. The company notched a 33.40 percent sales growth and increased its market share by 4.85 percent (from 18.58 percent to 23.43 percent). Much of this gain has come from its scooter range which has upped HMSI’s scooter market share by 4.04 percent (from 48.29 percent to 52.33 percent). In motorcycles, HMSI sold 1,334,964 units and enhanced its market share by 3.79 percent (from 11.50 percent to 15.29 percent).

Hero MotoCorp, the No 1 player in India, remains in pole position by sheer dint of its sales numbers. With overall sales of 5,114,557 units (4,540,122 bikes and 574,435 scooters) in April-January 2013-14, Hero has an overwhelming 41.75 percent of India’s two-wheeler market. However, in the face of a continuing slowdown and a hard-charging HMSI, its share has slipped marginally by 1.17 percent year on year, the pressure being faced on the motorcycle front and in commuter bikes.

Nevertheless, the company is driving ahead on the tech front. In October 2013, Hero has commenced construction of its Rs 450 crore Hero Centre of Global Innovation and Research & Design at Kukas, on the outskirts of Jaipur in Rajasthan. Once operational, HMCL’s current R&D centres, located at the Gurgaon and Dharuhera factories, will shift here to create a technology hub. In July 2013, the company inked a partnership with Erik Buell Racing of the US, taking a 49.2 percent stake (its first-ever equity stake in an overseas company) and then in December, formed a new joint venture in partnership with MagnetiMarelli of Italy to develop advanced powertrain solutions (EFI) for all Hero motorcycles and scooters.

Bajaj Auto, which sold a total of 1,773,177 motorcycles in the fiscal year till January 2014, saw its year-on-year growth decline by 15.71 percent and market share go down by 4.43 percent.

The other big player TVS Motor Co has also experienced a tough year. Overall sales at 1,439,565 units were 3.08 percent down YoY. These comprised sales of 483,438 bikes, 369,271 scooters and 586,856 mopeds. TVS saw its overall market share dip by 1.07 percent. However, it has reason to be pleased with the Wego and Jupiter scooters that together bought in close to 200,000 units for the 10-month period under review. The Wego and Jupiter together sold 196,864 units in the 10 months ended January 31, 2014, up 30 percent YoY.

Royal Enfield, which is riding a continuing wave of demand for its products, posted a 63.07 percent increase in its motorcycle sales of 159,740 units. This is thanks to increased production from its new plant at Oragadam, positive word of mouth from the legion of RE bikers and also the recent rollout of the eye-catching Continental GT.

India Yamaha Motor has had a good fiscal till now. With sales of 395,951 units (261,293 motorcycles and 134,658 scooters), this manufacturer posted YoY growth of 34.24 percent. In the process it has increased its overall market share from 2.55 percent to 3.23 percent. Targeting women and men as buyers with differing requirements, Yamaha launched the Ray and the Ray Z scooters respectively; the Ray Z has interestingly turned out to be a hit with women as well.

Mahindra Two Wheelers, a relatively new player, now seems to be gearing up for bigger play finally, thanks to its Centuro commuter bike clicking with buyers. The company sold a total of 165,900 units, up 80 percent, albeit on a low base. While scooters sold 42,223 units, the Mahindra bikes saw 123,677 buyers.

Piaggio Vehicles, which launched the Vespa LX 125 scooter nearly two years ago as a high-end lifestyle product, has seen sales fall from 29,646 units to 27,808 units, despite a price reduction of Rs 6,000 effected about six months ago.

TWO-WHEELERS WHICH CLICKED

Product-wise, the longstanding Splendor from Hero MotoCorp, Honda’s Dream Yuga and Neo, the latter being a slightly de-contented version, and Yamaha’s Ray and Ray Z were products that really stood out this ongoing fiscal.

A big surprise and the first product that clicked for Mahindra Two Wheelers has been the 106.7cc Centuro, which has sold over 100,000 units since its launch a year ago.

Enthused with the success, Autocar Professional has learnt that Mahindra is now working on an all-new 160cc motorcycle to be positioned in the premium commuter motorcycle segment which currently has models such as TVS Apache RTR 160, Yamaha FZ variants (153cc), Suzuki Gixxer (150cc), Honda Unicorn variants (150cc), Hero CBZ Xtreme (150cc) and Bajaj Pulsar 150 DTS-i and others. Clearly, the company now has plans of being a part of every high-selling segment.

TECH THAT. . . AND MORE

In the two-wheeler arena, tech is doing the talking. HMSI is benefitting from its Honda Eco Technology (HET) introduced across its scooter and bike range. For Bajaj Auto, the launch of the 100M, one of the six new products under the Discover brand, is a plus. And we're already seeing Hero MotoCorp's new, tech-charged face, what with its blitz of concepts.

Meanwhile, given the product saturation in the commuter segments, the likes of Hero MotoCorpand TVS are looking at midsize bikes which offer more margins and profitability. Royal Enfield has already taken the lead there with its Continental GT and its existing range of thumpers.

Also, while the big luxury bikes are seeing higher sales, they are looking to reduce engine capacity for upcoming products as they come to grips with the peculiar India market characteristics. Localisation is the buzzword and after H-D India, which launched its Street 750 at a killer price of Rs 410,000, Triumph Motorcycles, which has a 10-bike model line-up for India, is believed to be looking at an affordable bike too. So, expect plenty more activity on two wheels this year. Stay tuned.

RELATED ARTICLES

Mahindra & Mahindra Poised to Clock New Sales High of 650,000 SUVs in FY2026

Having sold 539,986 SUVs with 19% YoY growth in the past 10 months and averaged monthly sales of 56,930 units in the Nov...

Tata Punch Punches Past 700,000 Units Ahead of New Punch EV Launch

Tata Motors’ second compact SUV, equipped with petrol, CNG and electric powertrains, has driven past 700,000 sales four-...

Tata Nexon on Track for Record 200,000 Sales in FY2026, Over a Million Sold Since Launch

Tata Motors’ best-selling SUV, which has sold over a million units in India since September 2017, hit a new monthly high...

04 Mar 2014

04 Mar 2014

39204 Views

39204 Views

Ajit Dalvi

Ajit Dalvi