GST IMPACT: Entry-Level Car Sales Double in Four Months

The Mini segment’s response to the September 2025 GST reduction is the single most measurable policy impact in recent Indian automotive history.

In September 2025, the Indian government reduced the Goods and Services Tax on vehicles under four metres in length. The policy was designed to make cars and SUVs more affordable for a wider set of buyers. Four months later, the data from SIAM’s monthly wholesale reports offers a clear answer to the question of whether tax cuts translate into actual demand: in the cheapest segment of the market, they do — and with considerable force.

The Mini segment, which covers passenger cars under 3,600mm in length and consists primarily of Maruti Suzuki’s Alto and S-Presso, averaged 7,167 units per month in domestic wholesales during the six months before the GST cut (April through September 2025). In the four months that followed (October through January), that average rose to 12,945 units — an increase of 80.6 per cent. This is not a one-month spike. It is a sustained shift to a new demand level, with January’s 14,771 units sitting comfortably at more than twice the April figure of 6,927.

A Textbook Demand Recovery Curve

What makes the Mini segment data particularly instructive is the shape of the recovery. The GST cut took effect on September 22. October, the first full month under the new rate, saw wholesale volumes rise 24.6 per cent from September to 9,621 units. November jumped another 33 per cent to 12,794. December added a further 14 per cent to reach 14,594. January recorded 14,771, effectively flat against December.

This progression — sharp initial gain, continued acceleration, followed by a plateau — is a recognisable pattern in demand economics. The initial surge reflects latent demand that had been suppressed by the higher price. The continued acceleration in November and December suggests word-of-mouth and dealer-level activity pulling in additional buyers. The plateau in January indicates that the segment has reached a new equilibrium.

Maruti Suzuki

Maruti Suzuki dominates the Mini segment with a share exceeding 96 per cent. The company’s Alto and S-Presso are the only models with meaningful volume in this space. Maruti’s Mini wholesales moved from an average of 6,734 units per month pre-GST to 12,477 post-GST — an 85 per cent increase. The remaining volume comes from Renault’s Kwid, which contributes intermittently and in small numbers (typically 200–500 units when reported).

This near-total dominance means the Mini segment’s story is, for practical purposes, Maruti’s story. The GST cut gave Maruti a tool it has long needed to re-energise its entry-level business, which had been in structural decline as buyers moved to larger and more expensive vehicles. What the data suggests is that a meaningful pool of price-sensitive first-time buyers was sitting outside the market, waiting for the economics to shift.

Production Confirms the Shift

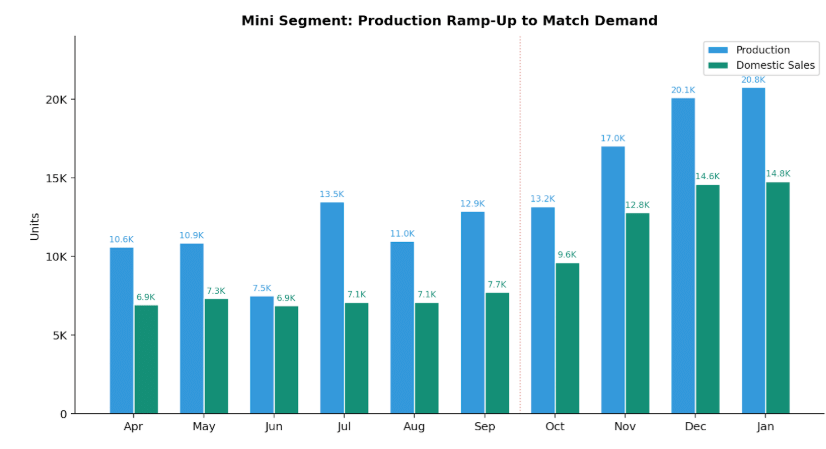

If there were any doubt about whether Maruti treats this as a temporary bump or a permanent demand shift, the production data resolves it. Mini segment production was in the 7,500–13,500 range from April to September. Starting in October, it climbed to 13,173, then 17,024 in November, 20,103 in December, and 20,754 in January.

The production-to-sales ratio in the post-GST months has ranged from 1.33 to 1.41, meaning Maruti is producing 33–41 per cent more than it sells domestically. This is the sign of a company building channel inventory at a new, higher demand level — filling dealer pipelines for what it expects to be sustained sales. A manufacturer anticipating a short-lived bump would not ramp production from 11,000 to 20,000 units per month.

The production-to-sales ratio in the post-GST months has ranged from 1.33 to 1.41, meaning Maruti is producing 33–41 per cent more than it sells domestically. This is the sign of a company building channel inventory at a new, higher demand level — filling dealer pipelines for what it expects to be sustained sales. A manufacturer anticipating a short-lived bump would not ramp production from 11,000 to 20,000 units per month.

Why Mini Responded Most Strongly

The Mini segment’s 80.6 per cent response dwarfs the Compact segment’s 22.8 per cent or UVC’s 29.6 per cent, even though all three fall under four metres and benefited from the same rate cut. The reason is straightforward: the GST reduction delivers the largest percentage price change on the cheapest vehicles, particularly given that OEMs have added to the tax cut by offering discounts on top in the languishing mini segment. Hence, an Alto retailing at around ₹3.5–4.5 lakh sits in a band where a price reduction of ₹50,000-65,000 can meaningfully alter a family’s purchase decision. For a Brezza or WagonR buyer already spending ₹7–10 lakh, a reduction of ₹70,000-90,000 represents a smaller fraction of the total outlay.

This finding carries implications for future policy design. If the objective is to broaden automobile ownership among lower-income households, tax relief at the bottom of the market delivers the most concentrated results. The Mini data demonstrates that demand at entry-level price points is more elastic than many industry observers had assumed.

RELATED ARTICLES

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

By Angitha Suresh

By Angitha Suresh

18 Feb 2026

18 Feb 2026

118 Views

118 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi