Weak September and H1 point to tough FY2020. Where's the scrappage policy?

With overall sales down 22% in September and 17% in the first six months of the fiscal, India Auto Inc stares at continuing difficult times and desperately needs a scrappage policy to revive demand.

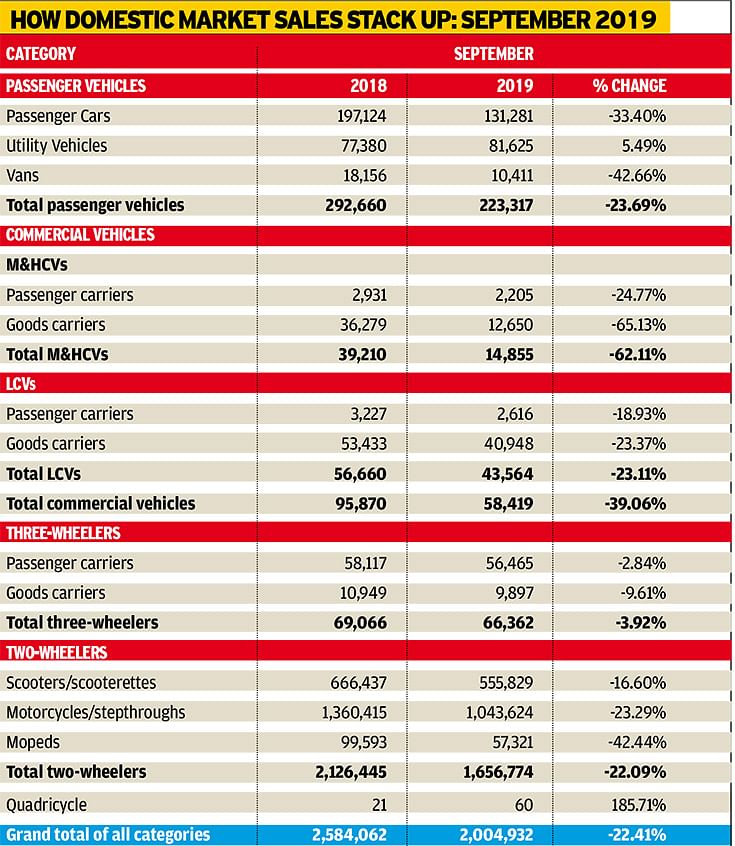

Despite all stakeholders fervently hoping that vehicle sales would see better days in September, the month turned to be yet another month of poor demand for the Indian automobile industry. Overall sales across vehicle segments were down sharply by 22.41 percent with total factory despatches of 2,004,932 units (September 2018: 2,584,062).

Passenger vehicle numbers dropped 23.69 percent to 223,317 units (292,660) with commercial vehicle despatches declining 39.06 percent to 58,419 units (95,870). While three-wheelers were marginally down by 3.92 percent to 66,362 units (69,066), twowheelers slumped by 22.09 percent to 1,656,774 units (2,126,445) last month. September also marked the completion of the first half of the ongoing financial year FY2020.

In the absence of a growth catalyst from the government and the continuing slowdown in the economy, automobile sales are currently experiencing what is possibly the worst downturn in recent years, down 11 months in a row.

At a press conference in New Delhi on October 11, Rajan Wadhera, president of the Society of Indian Automobile Manufacturers (SIAM), said, "We are at a very critical juncture with the first half of FY2020 getting over and have mixed feelings about the growth outlook for the complete fiscal at the moment."

New SUV launches offer some respite

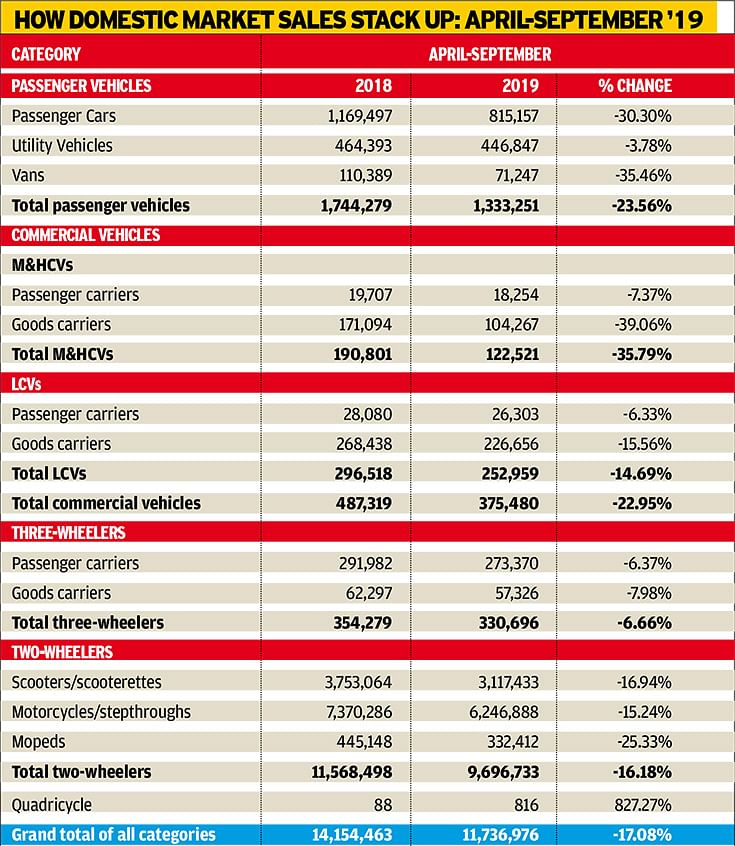

Overall industry sales between April and September 2019 stood at 11,736,976 units, recording a 17.08 percent slump (April-September 2018: 14,154,463). PVs were down by 23.56 percent to register cumulative sales of 1,333,251 units (1,744,279). Within the PV segment, passenger cars were on a 30.30 percent downhill trend, reaching 815,157 units during the six-month period (1,169,497). However, demand for UVs is on the upswing and the segment closed with net sales of 446,847 units (464,393). SIAM says that a slew of new model launches in the form of the Kia Seltos, MG Hector and the Hyundai Venue have helped revive demand in the UV segment.

In comparison, PVs have borne the brunt of a slowing economy, weak consumer sentiment and increasing ownership costs along with the ramifications of the recent floods in states such as Uttar Pradesh, Bihar and Maharashtra.

The half-year statistics do not make for good reading either. Worryingly, sales in the medium and heavy commercial vehicle sector, and good carriers within it, are seeing a particularly sharp decline.

No good news for M&HCV goods carriers

In the commercial vehicle segment, there has been a similar double-digit decline of 22.95 percent with overall CV sales touching 375,480 units in the period (487,319). While M&HCV numbers declined 35.79 percent to 122,521 units (190,801), LCVs saw a 14.69 percent de-growth to 252,959 units (296,518). It was the passenger-carrying CVs that fared better than goods carriers within both the M&HCV and LCV segments. While M&HCV passenger carrier sales declined 7.37 percent to 18,254 units (19,707), the same in LCVs dropped by 6.33 percent to 26,303 units (28,080).

Goods carriers, on the other hand, witnessed a considerably bigger drop of 39.06 percent in M&HCVs and 15.56 percent in LCVs, respectively. While sales of goods carriers stood at 104,267 units in the M&HCV category (171,094), 226,656 LCVs (268,438) were sold. According to SIAM, a fall in the GDP growth rate to a six-year low along with revised axle-load norms allowing up to 25 percent more payload, have together resulted in the slowdown in M&HCV goods carriers. The apex industry body also says flat growth in crop production and a drop in consumer durables sales resulted in slow sales for SCVs and pick-ups.

Passenger carrier (bus) sales, on the other hand, were marred by slowdown in procurement of buses by STUs. However, SIAM is of the belief that with government's revised GDP estimates for H2 of FY2020, which have improved from hovering between 5-5.5 percent in H1 to now 6-6.5 percent, there are high chances of a revival. While three-wheelers dropped 6.66 percent to 330,696 units (354,279), the two-wheeler segment saw a de-growth of 16.18 percent between April and September to culminate total sales at 9,696,733 units (11,568,498). Scooters and motorcycles performed similarly with a drop of 16.94 percent and 15.24 percent, respectively. Where scooter sales closed at 3,117,433 units for the half year (3,753,064), motorcycles registered sales of 6,246,888 units (7,370,286).

According to Wadhera, "While we have faced all sorts of challenges till now, we have started seeing some green shoots (of recovery) whether coming from the effect of the various measures announced recently by the government or due to the enhanced mood during the festive season." "Retail sales over the last 10-12 days of the auspicious Navratri period have been quite good for some OEMs. Also, the special messaging from the government in August regarding co-existence of internal combustion engined vehicles and electric vehicles and clearing the air on longevity of BS IV vehicles coupled with huge discounts (higher than last year) has led to a visible improvement in the consumer sentiment," he added. Will all of these moves translate into better numbers October onwards?

Near-term challenges

Inventory liquidation still remains a big challenge for the industry and even though RBI had recently announced a cut in the repo rate, concerns of lack of finance availability especially at the NBFC level will continue to pose challenges in the short term. Considering that the automotive industry has to maintain a lean inventory for a smoother BS VI transition in less than six months from now, it is expected that OEM production will remain subdued over the coming few months. However, with H2 FY2020 setting off over a low year-ago base of H2 FY2019, the growth is expected to be much more pronounced. Growth enablers While the auto sector did receive some indirect incentives from the Finance Minister, the industry is now looking forward to a scrappage policy that incentivises replacement of old trucks. "These trucks do not adhere to any emission norms, nor have respectable fuel efficiency either. Such policies in the US and Europe have given an impetus to new vehicle sales," said Wadhera.

The industry is also hopeful that a bountiful monsoon brings back demand in the CV segment due to higher crop produce and also because of the increasing number of road and infrastructure projects getting commissioned. "We will need to wait for October to get over to forecast anything meaningful in terms of the growth outlook for this fiscal, but we feel that the consumer sentiment is improving and the industry is hopeful of recovery. "The festive season itself could be the flywheel which will generate the momentum for growth," said the rather optimistic-sounding president of SIAM.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

12 Oct 2019

12 Oct 2019

8431 Views

8431 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi