Vehicle retail sales grow 27 percent in June: FADA

June retail sales show demand stability and signs of recovery across vehicle categories in Indian automobile sector.

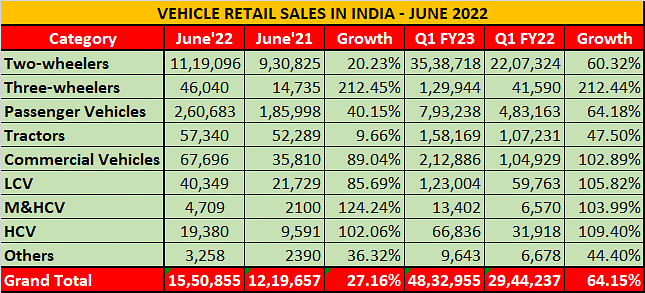

The retail sales numbers for all categories of vehicles for June, as announced by the Federation of automobile dealers associations (FADA), shows that industry clocked 1,550,855 units last month (June 2021: 1,219,657), and registered a year-on-year (YoY) growth of 27.16 percent.

The industry’s quarterly performance was also in sync and recorded a notable 64 percent uptick. Retail sales across vehicle categories were pegged at 4,832,955 units between April and June 2022, as against 2,944,237 units in Q1 of FY22. However, there’s an 8 percent decline when compared to the pre-Covid levels of 5,260,403 units clocked in Q1 FY20.

Passenger vehicles (PVs) registered a 40 percent uptick last month with cumulative sales of 260,683 units (June 2021: 185,998). Q1 FY23 sales also registered a 64 percent uptick, going from 483,163 units in Q1 FY22 to 793,238 units. According to FADA president Vinkesh Gulati, “The PV segment continued to see robust growth, with the increase in wholesales clearly indicating a relaxation in semiconductor availability.”

While Gulati is confident that the demand parameters seem to be stable with the flurry of new car launches getting away with robust bookings, “waiting periods particularly in the compact SUV and SUV segments continued to remain high in the month”, he added.

Although far from over, the chip crisis has been under control to a certain extent, with industry experts indicating at a mid-2023 timeline when the problem will be completely resolved. Carmakers continue to keep a careful watch on the situation, are and are acting swiftly in taking corrective actions to manage inventories.

The two-wheeler segment, on the other hand, recorded cumulative retail sales of 1,119,096 units last month, registering a YoY growth of 20.23 percent (June 2021: 930,825). Q1 FY23 retail sales were pegged at 3,538,718 units (Q1 FY22: 2,207,324 / +60.32%).

Despite the uptick, two-wheelers continued to be in the slow lane, with FADA flagging issues such as high acquisition cost, high fuel prices, as well as inflationary pressures as the prime reasons for the comparatively slower growth rate compared to what the industry has already witnessed in FY20, when it breached the four-million-unit mark in the first quarter itself. With the monsoon hitting major parts of India, June also happens to be an inherently slower month for two-wheeler sales across the country.

While three-wheelers remained in the fast lane with the accelerated shift towards electric mobility, and more than tripled monthly sales to 46,040 units in June (June 2021: 14,735 / +212.45%), commercial vehicles (CVs) registered a significant 89 percent growth, with June retail sales pegged at 67,696 units (June 2021: 35,810).

In terms of the quarterly numbers as well, the Q1 FY23 three-wheeler sales trebled to 129,944 units (Q1 FY21: 41,590). CVs, on the other hand, saw sales getting doubled to 212,886 units in Q1 FY23, as against 104,929 units sold in Q1 FY21. FADA is upbeat about the recovery in the CV segment wherein bus, along with LCVs are regaining traction, as well as the category registered a 4 percent uptick for the first time in last three years in June, when compared to June 2019’s retail sales of 65,136 units.

With sales of all vehicle categories being in the green, the Indian automobile industry is likely poised to witness a cheerful festive season, given there aren’t any major external disruptions. However, FADA has raised red flags in terms of the increased inflationary pressure due to the Russia-Ukraine crisis, as well as the high fuel prices driving up transportation costs. While easing off of the semiconductor supplies is a sign of relief, concerns regarding the instability in rural economy still loom large. “If rural India stabilises, the industry will enter the festive season on a happy note,” commented Gulati.

Also read

Maruti Suzuki’s fleet sales down; records best-ever subscription numbers in June

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

06 Jul 2022

06 Jul 2022

10730 Views

10730 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau