Two-wheeler sales rev up smartly in August

Cumulative sales of six OEMs indicative that the fizz is back in the two-wheeler industry and with farm incomes on the rise, expect demand to keep growing.

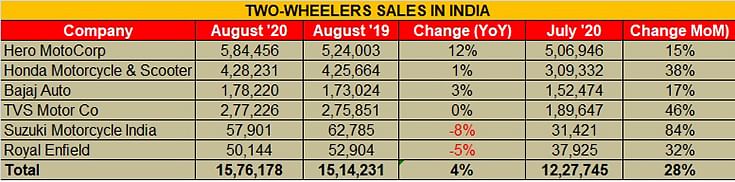

The two-wheeler industry, like the passenger vehicle industry, is leading the revival at India Auto Inc. With many states easing out of the lockdown and demand for personal mobility growing, two-wheeler manufacturers have reported a smart rise in sales last month. Here’s looking at some of the OEM sales performance.

Hero MotoCorp: 584,456 units (12%)

Market leader Hero MotorCorp was on growth road in volumes for the fourth consecutive month selling a cumulative 584,456 motorcycles and scooters in August 2020. This constitutes 12 percent year-on-year growth (August 2019: 524,003 units). In July 2020, the company had sold 514,509 units; which mean the August sales are indicative of steady month-on-month growth.

The company says it is witnessing a strong retail off-take and experiencing a demand in the rural and semi-urban markets. It expects this to continue with increasing consumer confidence and continued government policy support. Hero MotoCorp’s plants are running at a nearly 100% capacity and almost all its customer touch-points are open.

Honda Motorcycle & Scooter India: 443,969 units (38%)

Honda Motorcycle & Scooter India's total sales stood at 443,969 units, including 428,231 domestic sales and 15,738 exports in August 2020. This is a 38 percent increase over July 2020 which stood at 309,332 units. Continuing to ramp up production step-wise, Honda’s domestic sales breached the 400,000-units mark for the first time in FY2021 and registered 1% Y-o-Y growth. The company’s domestic sales continue to add over 100,000 incremental units for the third consecutive month (202,000 unit sales in June 2020, 309,000 units in July 2020 and 428,000 units in August 2020).

Yadvinder Singh Guleria, Director – Sales & Marketing, Honda Motorcycle & Scooter India said, “In August, over 90% of our network is back to business and we are seeing some green shoots with higher customer enquiries. Honda’s domestic sales crossed the 400,000 units’ mark for the first time this fiscal on the back of improved supplies and higher utilisation of production capacity. With festivals approaching, our line-up of 14 models including our latest motorcycle Hornet 2.0 will excite new customers.”

Bajaj Auto: 178,220 units (3%)

Bajaj Auto’s overall two-wheeler sales dropped one percent with 321,058 units sold in August 2020 compared to 325,300 units for the same period last year. The company sold 178,220 units last month, which is a 17 percent increase from July 2020 where it sold around 152,474 units. Exports dropped by 6 percent in August 2020 where the company exported 142,838 units as compared to 152,276 units exported in August 2019.

TVS Motor Co: 277,226 units (0.5%)

Chennai-based TVS Motor Company reported total domestic market sales of 277,226 units in August 2020, which is flat growth (August 2019: 275,851). The marginal uptick is due to demand for its motorcycles, which saw sale of 119,878 units in August 2020 (August 2019: 109,393). Scooter sales comprised 87,044 units as against 109,272 units in August 2019. TVS’ two-wheeler exports stood at 58,888 units in August 2020. (August 2019: 56,323 units). TVS has resumed its operations from the second week of May 2020 in a graded manner across all its factories in Hosur, Mysuru, and Nalagarh.

Royal Enfield: 50,144 units (-5%)

Royal Enfield reported sale of 50,144 motorcycles in August 2020 (August 2019: 52,904), down 5 cent but a marked improvement of 24% over July 2020’s 40,334 units.

Suzuki Motorcycle India: 57,901 units (-8%)

Suzuki Motorcycle India sold 57,901 units in August 2020 which is an 8% drop (August 2019: 62,785 units). Last month, managing director Koichiro Hirao said the company will be trying to achieve the pre-Covid levels in production and volume.

Going ahead, the increasing preference for personal vehicles over public transport will drive two-wheeler demand across the country. Also, with rural India reaping the gains from a bountiful monsoon, demand for entry level commuter motorcycles should grow substantially.

Furthermore, OEMs would be looking to increase inventory levels and keep their dealers well stocked with popular models in view of the upcoming festive season.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

03 Sep 2020

03 Sep 2020

13663 Views

13663 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal