Two-wheeler OEMs clock growth in December but will 2021 see sustained sales rally?

Six OEMs record growth in the last month of 2020 but the industry concern is whether the momentum continues into 2021 on a sustained basis.

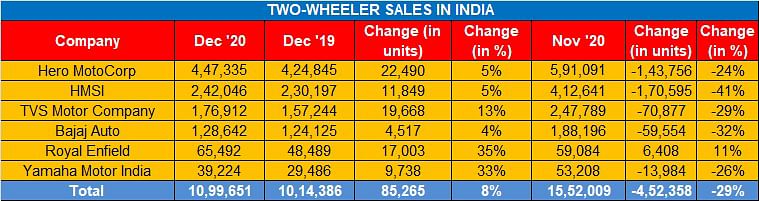

In sync with the passenger vehicle industry, two-wheeler manufacturers have ended 2020 on a slightly happy note albeit it is to be seen if the sales momentum can be sustained in 2021. While the numbers, from six OEMs, indicate year-on-year growth, the month-on-month numbers are down by 29%, which is a 7% more than the previous month. Let’s have a look at the six pack of OEMs who have released their December 2020 sales / despatch numbers.

Hero MotoCorp: 447,335 units / 5%

The world’s largest two-wheeler manufacturer Hero MotoCorp sold around 447,335 units registering a 5% growth on a YoY basis (December 2019: 424,845). This total comprised 415,099 motorcycles and 32,236 scooters were sold during the period. On a month-on-month basis this is a 24 % drop, as 591,091 units were sold in November 2020.

The company further consolidated its market leadership by clocking its best ever third quarter, with 18.45 lakh units sold during the October-December period. This is a 19.7% growth over the corresponding quarter in the previous fiscal (FY2020).

Honda Motorcycle & Scooter India: 242,046 units / 5%

Signalling its demand recovery continuing after the festival season, Honda’s two-wheeler YoY sales uptick continued for the fifth consecutive month in December as well. Honda’s domestic sales grew 5% to 242,046 units in 2020’s last month compared to 230,197 units a year ago. But, on a MoM sales basis, HMSI sees a 41% decline, having sold 412,641 units during November 2020. With exports of 20,981 units, Honda’s total sales in December 2020 closed at 263,027 units with a 3% growth over 255,283 units last month.

Yadvinder Singh Guleria, Director – Sales & Marketing, Honda Motorcycle & Scooter India said, “After the positive retail and wholesale traction in December 2020, we enter 2021 with new hope. The third quarter marked the first quarter of positive sales after a long time. The next two quarters too, are expected to show some growth due to the low base effect but real positive growth and market expansion may take some time.”

TVS Motor Co: 176,912 units / 13 %

Chennai-based TVS Motor Company’s two-wheeler domestic two-wheeler sales grew by 13%, registering 176,912 units in December 2020 as against 157,244 units in December 2019. The company had sold 247,789 units in November 2020, which is a 29% drop on the MoM sales. The motorcycle and scooter sales stood at 119,051 units and 77,705 units, respectively.

Though the two-wheeler OEM’s exports were affected last month by the cyclone Nivar, the company registered a YoY growth of 39% with 81,327 units in December 2020.

Bajaj Auto: 128,642 units / 4 %

Pune-based Bajaj Auto recently became the first two-wheeler company to globally to cross a market capitalization of Rs 1 lakh crore. This market cap is considerably higher than all other domestic two-wheeler companies.

Commenting on this, Rajiv Bajaj, Managing Director, Bajaj Auto said, “The company’s sharp focus on the motorcycle category and its unwavering commitment to strategies of differentiation as well as the practice of TPM combined with global ambitions have today made Bajaj the most valuable two-wheeler company across the globe. This inspires us even more to serve and delight customers all over the world”.

Bajaj Auto posted a 32% decline in MoM sales (November 2020: 188,196 units). In India, the company registered 4% growth with 128,642 units sold, up from 124,125 units sold in December 2019. Exports saw 31 percent growth with 209,942 units.

Royal Enfield: 65,492 units / 35%

Chennai-based Royal Enfield registered domestic sales of 65,492 units for the month, posting a 35% growth compared to same period last year (48,489 units). Exports saw 82% growth with 3,503 units sold. The total sale stood at 68,995 units in December 2020 with a growth of 37%. Around 59,084 units sold during the month November 2020 which is a 11% growth on a MoM basis. It is understood that the recently launched cruiser, Meteor 350 has boosted sales for the midsize motorcycle segment player.

Yamaha Motor India: 39,224 units / 33%

Yamaha Motor India clocked total sales of 39,224 units in December 2020. This is a 33% growth when compared to the same period last year, (29,486 units - Dec 2019). The company sold around 53,208 units in November 2020 registering a sales decline of 26% on a MoM basis. The company has been reporting growth in its sales volumes consecutively over the past six months, following the lifting of the Covid-led lockdown. With a strong focus in 2020, Yamaha had registered positive growth on a YoY basis. The company expects overall demand to grow in 2021 owing to a varied demand of personal mobility.

2021 has begun and the rural India market is showing all signs of growing further in the coming months, which could spell good news for commuter motorcycle sales. However, demand from urban India, which accounts for the majority of scooter sales, is still tepid. The buzzword for industry is: cautiously optimistic.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

05 Jan 2021

05 Jan 2021

11519 Views

11519 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi