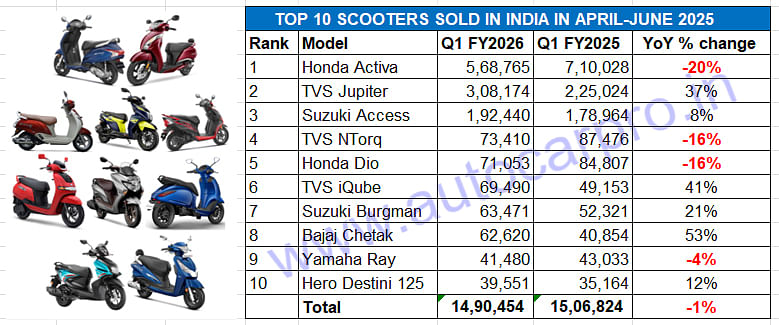

TVS iQube, Bajaj Chetak in Top 10 best-selling scooters for Q1 FY2026

While Honda’s Activa rules as the No. 1 scooter with 568,765 units, its sales are down 20% YoY. The TVS Jupiter registers 37% growth with 308,174 units and the Suzuki Access with 192,440 units is up 8 percent. The TVS iQube and Bajaj Chetak, India’s best-selling electric scooters separated by 6,870 units in the April-June 2025 quarter, and the Ather Rizta narrowly misses entering the Top 10 list.

Of the three sub-segments in the Indian two-wheeler industry, scooters with 1.66 million units sold in April-June 2025 saw the lowest rate of decline (-0.2%) compared to motorcycles (2.90 million units, -9.2%) and mopeds (109,361 units, -11%). What keeps the scooter market ticking is the sustained and strong demand for key models. The Top 10 best-selling scooters, from the 30-odd models sold in India, in the first quarter of FY2026 (as detailed below) are a good indication.

The Honda Activa, sold in 110cc and 125cc avatars, still rules the Indian scooter market but at 568,765 units in April-June 2025, demand was down by 20% YoY. While this gives the Activa a market share of 34%, it is down on the commanding 45% share a year ago. The Honda Dio, also in 110 and 125cc guise, also saw a decline in sales – 71,053 units, down 16% YoY albeit it maintains its fifth rank. The sales decline for both models meant that HMSI scooter sales, with 639,818 ICE and 2,288 EVs (2,256 QC1s and 32 Activa e-scooters) were down 19% YoY, its market share falling sharply to 39% from 48% a year ago.

The Honda Activa, sold in 110cc and 125cc avatars, still rules the Indian scooter market but at 568,765 units in April-June 2025, demand was down by 20% YoY. While this gives the Activa a market share of 34%, it is down on the commanding 45% share a year ago. The Honda Dio, also in 110 and 125cc guise, also saw a decline in sales – 71,053 units, down 16% YoY albeit it maintains its fifth rank. The sales decline for both models meant that HMSI scooter sales, with 639,818 ICE and 2,288 EVs (2,256 QC1s and 32 Activa e-scooters) were down 19% YoY, its market share falling sharply to 39% from 48% a year ago.

The longstanding No. 2 is the TVS Jupiter, TVS Motor Co’s flagship scooter sold in 100cc and 125cc avatars which registered best-ever fiscal year sales of 1.10 million units and stellar 31% YoY growth in FY2025, is continuing the same strong growth trajectory. In Q1 FY2026, the Jupiter sold 308,174 units, up 37%, maintaining its No. 2 rank and accounted for 00% of the company’s scooter sales. Its sibling, the TVS NTorq, though seems under pressure from the competition – the 73,410 units are down 16% YoY and give it the fourth rank.

Ranked sixth in the Top 10 scooter list is the TVS iQube, with 69,490 units and 41% YoY growth, is the first of the two electric scooters in the Top 10 list and gives TVS Motor Co a 15% EV penetration level its total scooter wholesales of 476,196 (up 23%) which includes 476,196 ICE scooters comprising the Jupiter, NTorq and the Zest. The iQube’s strong sales, helped along by the recent slashing of prices, have enabled the company to increase its scooter market share to 29% from 23% in Q1 FY2025.

The Suzuki Access, Suzuki Motorcycle India’s best-selling product, comes in at seventh position. Among the first scooters to benefit from the continuing consumer upgrade to 125cc, it has clocked factory dispatches of 192,440 units and 8% YoY growth.

The Bajaj Chetak, with 62,620 units, is the second EV in this list, and has registered a 53% YoY increase. The Chetak’s sales battle with the TVS iQube continues in right earnest and after three months in the current fiscal, they are separated by 6,870 units. What would have helped drive demand is the recent launch of the Chetak 3001, the new entry-level variant priced at Rs 99,990 (ex-showroom Bengaluru). While the base 3001 variant costs Rs 99,990 (ex-showroom Bengaluru), the top-end Chetak 3501 has a price sticker of Rs 135,000. The 3001, the most affordable Chetak, slots between the TVS iQube 2.2 kWh and iQube 3.5 kWh at the lower end, and the premium Ather Rizta S at the higher end.

The Yamaha Ray ZR has sold 41,480 units (down 4%) to be ranked ninth and the Hero Destini 125 with 39,551 units, up 12%, wraps up the Top 10 best-selling scooters list for Q1 FY2026.

Interestingly, robust demand for Ather Energy’s flagship family electric scooter, the Ather Rizta meant that it took 11th rank in the 30-odd scooters sold in India with a total of 34,149 units sold between April and June 2025.

Launched in April 2024, the Rizta has sold a total of 123,788 units till end-June 2025. In early May 2025, the Rizta surpassed 100,000 sales – news which Autocar Professional broke.

As in the motorcycle segment, the consumer shift from fuel-sipping 100cc scooters to the 125cc category is apparent. Other than the two EVs in this Top 10 list, all the other eight are either 125cc or have 125cc siblings.

New electric scooters coming from TVS and Yamaha

While two of the ICE scooters – Honda Activa and Suzuki Access – already have their electric avatars in the form of the Activa e and Suzuki e-Access, TVS Motor Co is understood to be working on an entry-level electric scooter likely to be called the TVS Orbiter.

India Yamaha Motor too is plotting its entry into the electric scooter market. The Japanese major has partnered Bengaluru-based startup River Mobility to develop and roll out its first global EV on two wheels. Billed to be a zero-emission performance scooter, the Yamaha EV is being co-developed by Yamaha global teams in Japan, USA and Europe along with River Mobility.

ALSO READ: Honda scooter market share drops to 39%, TVS’ rises to 29% in Q1 FY2026

Legacy e-2W OEMs keep startups at bay, capture 58% share in first-half CY2025

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

26 Jul 2025

26 Jul 2025

13277 Views

13277 Views

Shahkar Abidi

Shahkar Abidi