Top 10 Scooters – February 2020 | Honda sells 7,688 Activas a day, Suzuki Access stays strong, Yamaha Fascino and TVS NTorq post better numbers

In a slow-moving market, there are still some scooters that are pulling buyers with their adroit mix of power, performance and competitive pricing.

Do you know that at end-February 2020, Honda Motorcycle & Scooter India (HMSI) was 23,698 Activas short of crossing the 25 lakh Activa sales mark in FY2020? Considering that the company is averaging 7,500 unit sales a day of the popular scooter, this milestone would have been crossed in the first three days of March 2020 itself. Yes, in the 11-month April 2019-February 2020 period, HMSI sold 24,76,302 Activas, which translates into 225,118 units every month or 7,503 units every single day for the past 11 months. But this figure is still 13.41% down on year-ago sales (April 2018-February 2019: 28,60,093). Blame it on adverse market and consumer sentiment and the prolonged economic downturn.

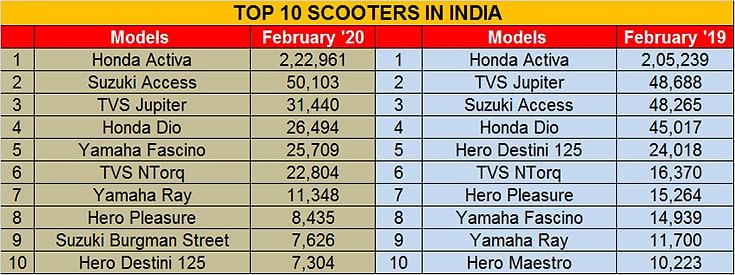

At 222,961 units, the Activa remains unsurpassable at the top of the Top 10 best-sellers list and will remain so in the foreseeable future. The yawning gap to No. 2 is simply too much to be filled in a hurry.

Suzuki Access now the regular No. 2

Suzuki Motorcycle India, which has a scooter doing all the good work for it, is riding high on the success of the Access 125. Amidst all the red ink that lies splattered across the domestic market sales numbers of the Indian two-wheeler industry due to a multiplicity of growth-impacting issues, there is one company which is firmly bucking the slowdown: Suzuki Motorcycle India. And it has the Access 125 to thank because this best-selling 125cc model has single-handedly given Suzuki a new charge in the market.

In February 2020, the Access 125 sold 50,103 units, a 3.8% year-on-year growth (February 2019: 48,265). But the real growth is seen the cumulative 11-month numbers: 544,422 units, which marks 11.27% YoY growth (April 2018-February 2019: 489,248). This performance has helped Suzuki increase its scooter market share to 11.61% from 8.83% a year ago. All the six other OEMs have shown negative sales. In terms of market share, Suzuki has gone ahead of Hero MotoCorp (7.08%) and is now third in the pecking order, after leader HMSI (56.64%) and TVS Motor Co (18.61%)

TVS Jupiter is No. 3 but down 35% YoY

Sales of the TVS Jupiter, the flagship scooter for the Chennai-based manufacturer, are slowing down. In February, the Jupiter sold 31,440 units, down 35% on year-ago sales of 48,668 units, and much lower than January's 38,689 units,. This trend is also reflected in the product’s sales in the April 2019-February 2020 period – 574,544 units – which is 22% down on year-ago sales of 734,993 Jupiters.

On November 27, 2019, a day after it rolled out its first BS VI-compliant two-wheeler, the Apache RTR, TVS expanded its BS VI product range to its Jupiter, which is now equipped with ET-Fi (Ecothrust Fuel injection) technology. The BS-VI TVS Jupiter Classic ET-Fi is priced at Rs 67,911 (ex-showroom Delhi).

Launched in 2013, the Jupiter remains the best-selling TVS scooter and crossed the million-unit sales mark 30 months after launch. It has a customer base of over 3 million customers. The TVS Jupiter is available in four variants – Base, ZX (Disc and Drum), Classic and Grande.

Honda Dio sales down 41% YoY

Like the TVS Jupiter, HMSI too has its work cut out with the Dio. This scooter, which takes the fourth spot in the Top 10 rankings, sold 26,494 units in February 2020, which is a sizeable 41% decline over year-ago sales of 45,017 units. However, seen over an 11-month period, the sales decline is not sharp. At 410,271 units sold in April-February 2020, the numbers are down 6.65% YoY.

Improved performance from Yamaha Fascino and TVS NTorq

At No. 5 and No. 6 are the Yamaha Fascino and TVS NTorq respectively, both of whom have bettered their year-ago sales numbers last month.

The Yamaha Fascino, with 25,709 units sold in February 2020, has shown robust 72% YoY growth. While cumulative 11-month sales at 152,058 units are still 18.46% down YoY (April 2018-February 2020: 186,488), the introduction of the 125cc model in December has given the model a new charge. The Fascino is powered by a new 125cc, fuel-injected, air-cooled engine that produces 8.2hp at 6500rpm and 9.7Nm at 5000rpm. These figures are pretty much in the same ballpark as the Activa 125 BS VI, but are considerably lower than the 125cc scooters from TVS, Suzuki and Aprilia. What helps the Yamaha is its low 99kg kerb weight, resulting in a higher power-to-weight ratio of 82.82hp per tonne.

Prices for the Fascino 125 begin at Rs 66,430 for the standard, drum brake version, and go up to Rs 68,930 for the top-spec, disc-brake-equipped Deluxe version. The prices are extremely competitive and the top model is Rs 5,560 less than the top-spec Activa 125. That said, the Activa 125 does offer a much longer feature list, as well as a larger service network.

The TVS NTorq, once the talk of the town, is still doing decent numbers albeit TVS would have hoped for more. At 22,804 units last month, sales are 39.30% up YoY (February 2019: 16,370). For the first 11 months of FY2020, the NTorq has 255,865 units to its credit, 31.61% better than year-ago sales of 194,482 units.

The scooter market, like the motorcycle market, is feeling the heat of the prolonged slowdown and more recently the countrywide lockdown. In the fiscal year to date, scooter sales are down 16% (53,02,858 vs 63,13,878), in line with the 16% sales decline of the overall two-wheeler market: 165,59,770 vs 197,39,254.

Given the ongoing 21-day all-India lockdown, sales numbers will be very muted in March and also in April. From the looks of it, the first sparks of revival can only be seen around festive season time.

READ MORE: Top 5 Utility Vehicles in February 2020

Top 10 Passenger Vehicles in February 2020

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

27 Mar 2020

27 Mar 2020

22913 Views

22913 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau