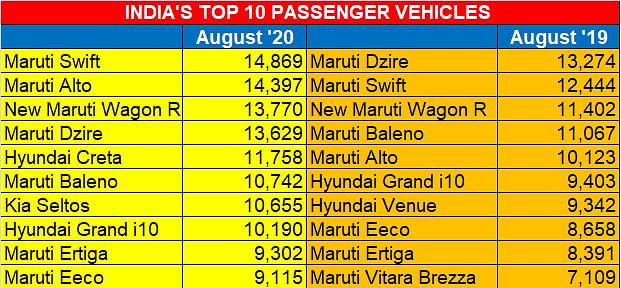

Top 10 Passenger Vehicles in August 2020 | Maruti Swift pips Alto to top spot by 472 units, Hyundai Creta and Kia Seltos rev up PV numbers, demand for CNG cars grows

Maruti Suzuki maintains its stranglehold on the PV segment with all of seven models; sees demand growing smartly for its CNG models.

The Passenger Vehicle (PV) segment has made a rousing return to the black in August what with 215,916 vehicles getting despatched to dealers and marking 14.16% year-on-year growth. What’s heartening is that all three sub-segments – Cars (124,715 units / 14.13%), UVs (81,842 units / 15.54%) and vans (9,359 units / 3.82%) have notched YoY growth.

Look at the sales table below, compare the August 2020 and August 2019 sales numbers and you’ll see that all models, other than the Maruti Baleno, have bettered their year-ago sales. This performance coming ahead of the festive season augurs well for the industry, which has been battling Covid-induced lack of demand in an embattled economy since the beginning of this year.

The comparison between the April-August 2020 numbers will see a sharp downturn because April was a Covid-impacted zero production-and-sales month, May was a truncated one, and sales began in a tepid fashion only in June. Here’s looking at the top performers in August, which turned out to be quite an august month for the PV segment.

No. 1 Maruti Swift: 14,869 units

This cute little hatchback, which is arguably India’s most-loved car, is a permanent fixture on the best-sellers list. In August 2020, with sales of 14,869 units, it beat its sibling, the entry level Maruti Alto by just 472 units. Compared to August 2019’s 13,274 units, last month’s numbers are a 12% improvement.

In the April-August 2020 period, the Swift has sold a total of 29,652 units, which is 60% down on the year-ago’s 74,266 units – put that down to the absence of a diesel engine now in the Swift.

No. 2 Maruti Alto: 14,397 units

The most affordable Maruti, the Alto sold 14,397 units – 709 CNG and 13,688 petrol – last month, compared to August 2019’s 10,123 units, growth which is indicative of the fact that demand is returning to the entry level hatchback from town and country. This number

In the April-August 2020 period, total Alto sales were 36,855 units compared to 79,593 units.

No. 3 Maruti Wagon R: 13,770 units

The New Wagon R is making the moves for Maruti Suzuki India. With sales of 13,770 units, this popular hatchback is third on the Top 10 PVs list. Last month’s sales better the year-ago sales (August 2019: 11,402) by a good 21%.

The New Wagon R is making the moves for Maruti Suzuki India. With sales of 13,770 units, this popular hatchback is third on the Top 10 PVs list. Last month’s sales better the year-ago sales (August 2019: 11,402) by a good 21%.

Interestingly, what is helping this growth for the New Wagon R is the growing consumer demand for the CNG-powered model. Over a year, demand has risen remarkably from 447 units to 4,123 units in August 2020. Furthermore, as a percentage of sales in August 2020, the CNG model accounts for 30% of total Wagon R sales (13,770 units) as compared to 4% in August 2019 (447 units). This would be welcome news for Maruti, which has targeted selling a million more CNG cars in a shorter span of time than the first CNG-powered million took.

No. 4 Maruti Dzire: 13,629 units

The No. 1 a year ago, the streetcar named Maruti Dzire is now at fourth place with 13,629 units, comprising 464 CNG and 13,165 petrol variants. For this popular sedan, petrol power seems to put the absence of a diesel engine at bay. August 2019 had seen total sales of 13,274 units – 845 CNG, 6,637 diesel and 5,792 petrol. With 13,165 buyers driving home a petrol-engined Dzire in August 2020, which constitutes splendid 127% YoY growth, the carmaker must be pleased with this performance.

No. 5 Hyundai Creta: 11,758 units

Hyundai Motor India’s new Creta it seems can do no wrong. Demand continues to surge for this midsized SUV and August saw it go home to 11,758 buyers, taking it to the top of the UV charts. As much as 56% of these (6,540 units) were diesel variants as compared to 5,218 petrol variants, indicative that the Korean carmaker’s strategy to remain bullish on diesel is paying off.

In the April-August 2020 period, a total of 33,726 Cretas have been sold (20,844 diesel and 12,882 petrol), comprising for 62% of total Hyundai UV sales in the first five months of FY2021: 54,402.

The new Creta, which competes with the Kia Seltos, MG Hector, Renault Duster and Nissan Kicks, is very much on the upswing. With the festive season around the corner, Hyundai will be doing all to ensure that the Creta stays where it is right now – at the top. It helps that the Creta has helped Hyundai to lead the UV market share table too at 24.59%, just ahead of Maruti Suzuki India which has 24.23 percent.

No. 6 Maruti Baleno: 10,742 units

The Maruti Baleno is the sole PV in the Top 10 to see its August 2020 numbers below the year-ago sales. At 10,742 units, last month’s numbers are 3% down on August 2019’s 11,067 units. This marginal difference can be put down to the absence of a diesel model, considering that 592 diesel Balenos were sold a year ago and none last month. In terms of petrol power, the Baleno has bettered August 2019’s 10,475 units by 267 units – 10,742 units.

No. 7 Kia Seltos: 10,655 units

Kia Motors India’s best-seller, which is the No. 2 UV in August 2020, is at No. 6 position in the Top 10 PV chart. The midsized SUV sold a total of 10,655 units comprising 5,987 petrol variants and 4,668 diesel, which shows that 56.18% of buyers plumped for the petrol model. In the April-August 2020 period, the fuel-wise demand situation is similar. Of the total 27,650 units sold in these five months, 55% of buyers (15,302 units) opted for petrol compared to diesel variants (12,348 units). The Seltos, Kia’s first product in India, accounts for an overwhelming 97.73% of total April-August 2020 sales with the Carnival MPV accounting for the balance 641 units.

On June 1, Kia rolled out a 10-feature re-jig to the crossover’s variant line-up with pricing of the refreshed Seltos starting at Rs 989,000 ex-showroom, India. While it is premature in the auto industry for a carmaker to be bringing any updates to a model as fresh as nine months old, Kia’s step can be assumed to have come in response to the launch of the Creta from Hyundai – its sister company giving it the home-grown competition, which starts at Rs 999,000 ex-showroom.

The Seltos has been instrumental in giving Kia a strong foothold in the Indian market and the company currently has a 12.79% UV market share – not bad for a year-old company and fourth in the pecking order among 16 UV players.

No. 8 Hyundai Grand i10: 10,190 units

The second Hyundai model in this best-sellers’ list, the Grnad i10 hatchback sold a total of 10,190 units comprising 644 CNG (August 2019: 64), 160 diesel (August 2019: 314)and 9,386 petrol (August 2019: 9,025). Like Maruti Suzuki, Hyundai is seeing increasing demand for CNG models and last month’s performance is a sharp 906% YoY increase albeit on a low base.

A replacement for the old i10 in 2013, the Grand i10 continues to soldier on to this date as a more affordable alternative to the newer Grand i10 Nios. Buyers can avail of benefits of up to Rs 60,000 on the hatchback which is available in two trim levels and solely with a 1.2-litre petrol engine. Those looking for an automatic gearbox option or a diesel variant though will have to look at the more expensive Nios.

No. 9 Maruti Ertiga: 9,302 units

Maruti Suzuki India's MPV, which was a surprising and a speedy mover in FY2020 with total sales of 90,543 units (39% YoY growth) is maintaining good sales momentum.

In August 2020, it sold a total of 9,302 Ertigas, accounting for 11.36% of total UV sales and 44% of total Maruti Suzuki India’s UV sales in August 2020 (21,030 units). These 9,302 units comprise 3,050 CNG variants and 6,252 petrol. The Ertiga’s April-August 2020 sales tally is 23,465 units, which is 25% of the carmaker’s total UV sales (92,684) in the first five months of FY2021. Clearly, moving out of diesel has impacted demand – in the year-ago April-August 2019 period, total Ertiga sales were 42,127 units including 22,035 diesel. But the positive news for Maruti is that demand is gradually growing for its CNG variant: a 10-fold increase from the 618 units in August 2019 to 6,507 units in August 2020.

No. 10 Maruti Eeco: 9,115 units

That the momentum is back in the PV sector is evident from the demand for the Eeco van, which has sold 9,115 units or 294 units for every day of August 2020. The numbers comprise 1,821 CNG (August 2019: 1,299) and 7,294 petrol (August 2019: 7,359) Like the Alto, Wagon R and the Dzire, CNG power is also giving a fillip to Eeco sales. The Eeco is the fourth Maruti model with CNG.

In March 2020, Maruti Suzuki launched the BS VI-compliant Eeco CNG. As before, the CNG model is targeted at both private and commercial buyers, with the latter getting the option to configure the model as a 5-seater (Tour V) or a cargo van.

The Eeco CNG for private buyers is priced at Rs 495,000 and is available solely as a 5-seater, with the Tour V (for commercial buyers) priced around Rs 1,000 less, at Rs 494,000. Air-conditioning is a standard fit, as are the driver airbag, ABS, front seatbelt reminders, reverse parking sensors and a speed alert system. Commercial buyers can also opt for the Eeco CNG in cargo van configuration, with this model priced at Rs 464,000 for the non-air-conditioned model and a pricier Rs 506,000 for the air-conditioned unit.

Growth outlook for the PV segment

Given August’s smart 14% growth, things can only get better for the overall PV segment. Demand for passenger cars, including entry level models has joined the surge in demand for UVs which are firing on all cylinders. With the Kia Sonet and Toyota Urban Cruiser having entered the hot-and-happening compact SUV segment last month, expect their numbers to further contribute to better times for the PV segment. With most PV makers increasing production levels and ensuring their dealers are well stocked and ready for the festive season, demand should remain consistent. OEMs will be keeping their fingers firmly crossed though.

READ MORE

Top 5 Utility Vehicles in August

Top 10 Scooters in August

Top 10 Motorcycles in August

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

29 Sep 2020

29 Sep 2020

45147 Views

45147 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi