Three-wheeler passenger carrier sales jump 75% to 378,711 units, Bajaj Auto share rises to 76% in April-November

Like PVs and two-wheelers, three-wheelers are also witnessing strong demand and sales are up 61% in April-November. Passenger-transporting three-wheeler sales have risen 75% to 378,711 units, surpassing FY2023’s 361,094 units and are headed for the half-a-million mark this fiscal.

India Auto Inc is firing on all cylinders in the ongoing fiscal year and while most of the headlines for the number-crunching news stories are dominated by passenger vehicles or two-wheelers, the three-wheeler sub-segment has been carving out its very own solid growth trajectory.

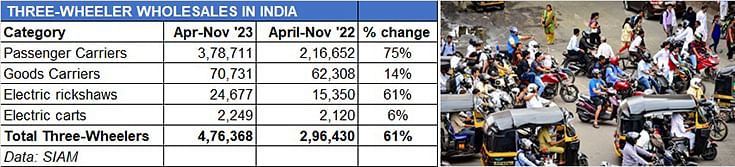

Cumulative April-November 2023 wholesales of the three-wheeler vehicle category, which is split into passenger carriers, goods carriers, e-rickshaws and e-carts, are 476,368 units, which constitutes handsome 60.70% year-on-year growth (April-November 2022: 296,430 units). This eight-month total is already 97.46% of entire FY2023’s sales of 488,768 units and just 12,400 units shy of that number, which will have been crossed in the first fortnight of December 2023 for sure.

Cumulative sales of 488,768 three-wheelers are already 97% of FY2023's 488,768 units. Passenger carrriers account for 79% of total segment sales.

The bulk of the sales in the three-wheeler segment belong to the passenger carrier category. The 378,711 passenger carriers sold in April-November 2023 comprise 79.49% of total segment sales and up 75% YoY (April-November 2022: 216,652 units). What’s more, this means the sales in the first 8 months of FY2024 have already crossed FY2023’s 361,094 units and are headed for the half-a-million mark this fiscal.

BAJAJ AUTO TIGHTENS ITS STRANGLEHOLD ON 3W PASSENGER MARKET

This analysis covers only the passenger-carrying three-wheeler segment, which has seven SIAM members. Bajaj Auto has further tightened its stranglehold in this vehicle category with demand growing massively by 87% YoY to 286,900 units, compared to the 153,046 units in April-November 2022. This performance sees Bajaj Auto increase its market share to 76% from 71% a year ago. The extent of its dominance can be seen in the fact that of the 162,059 additional units sold YoY, Bajaj accounts for 133,854 units or 82 percent! This means not only has it expanded its own share but it has also eaten into rivals’ share.

Piaggio Vehicles, with 47,366 units, has also delivered a good performance to register 42% YoY growth but despite that sees its market share fall marginally to 12.50% from 15.45% a year ago.

Mahindra & Mahindra is in third position with 25,844 units (up 105%), having more than doubled its year-ago sales of 12,634 units. This strong showing sees M&M’s market share rise to 6.82% from 5.83% a year ago.

TVS Motor Co, with 12,937 units, posted a 26% YoY sales increase but couldn’t stave off a market share decline to 1.29% from 2.70% a year ago.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

18 Dec 2023

18 Dec 2023

17405 Views

17405 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal