Tata Motors and Ashok Leyland slug it out for M&HCV supremacy

Medium and heavy commercial vehicles, which are the mainstay of the CV market, are also the ones with the fatter margins. And that’s where the top two players are battling it out in the Indian market.

The mood is good in the domestic commercial vehicle industry, in fact much better than it was six months ago. That’s because 65,310 CVs were sold in August 2017 (+23.22%) and 276,147 units in the April-August 2017 period (+1.58%). While 26,376 M&HCVs were sold in August (+28.43%), 38,934 LCVs were also bought (+19.93%). Going forward, things can only get better.

Even as the critical medium and heavy commercial vehicle (M&HCV) market sees a sustained month-on-month sales uptick in the domestic market, helping drive the overall CV sector back into the black, a good number of industry eyes are firmly on the moves the segment leaders – Tata Motors and Ashok Leyland – are making.

In FY2016-17, total M&HCV sales comprised 302,529 units with Tata Motors and Ashok Leyland together selling 251,214 units and accounting for a combined market share of over 83%, leaving scant little for the competition. The M&HCV segment of 16 tonnes and above is the largest in terms of value and volume and it is here that the OEMs earn fat margins. Little wonder then that both the OEMs are slugging it out to gain new customers and market share.

The stranglehold of Tata Motors and Ashok Leyland in the M&HCV market is so strong that despite their best efforts, Mahindra Trucks & Buses, VE Commercial Vehicles and foreign players like Daimler, Volvo and MAN have since long been unable to make a serious dent in their market share, even though they have introduced a fair number of good products with a focus on lower total cost of ownership.

What also helps Tata Motors and Ashok Leyland is their longstanding play in the Indian market and their countrywide dealer and aftersales network as typical heavy vehicle buyers are always comforted by the fact that help is at hand even in the farthest corner of the land.

Leader comes under fire

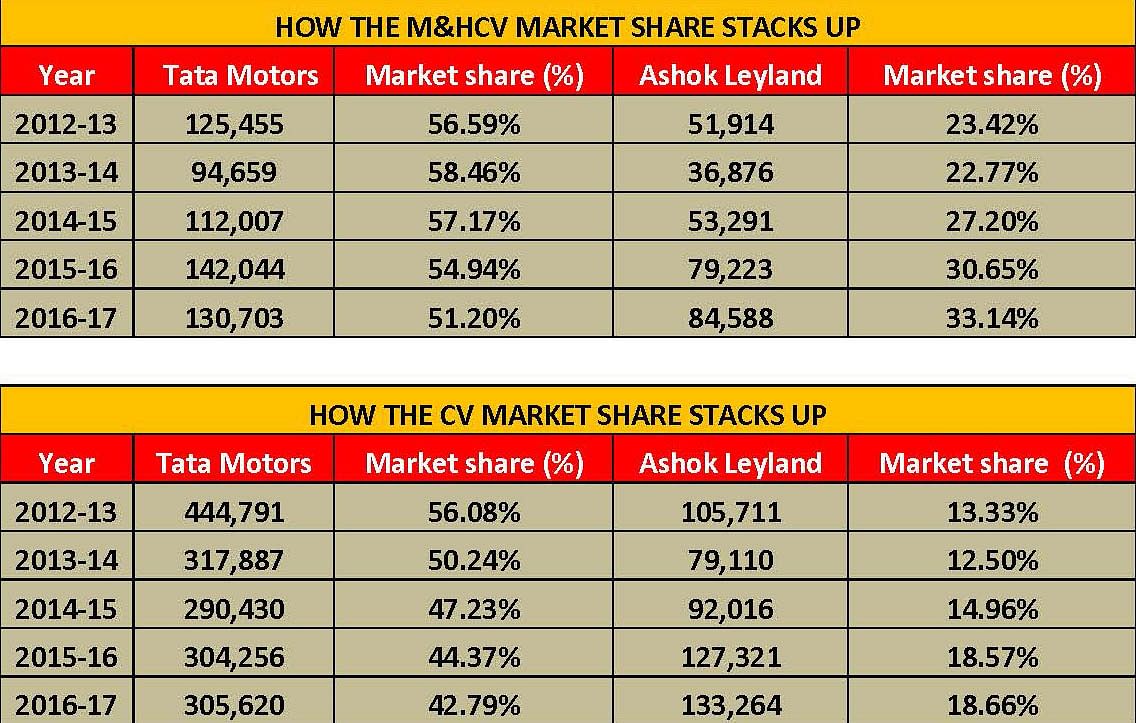

Tata Motors, which has been the market leader for years on end, has seen its market share gradually slip away to Ashok Leyland which has been gaining M&HCV share over the past 3-4 years. In FY2011-12, Tata was the clear market leader with a 58.45% market share in overall CVs, while Ashok Leyland was a distant third with 11%. Five years later, the scenario is rather different – FY2016-17 saw Tata Motors remain No. 1 but with a share of 42.79% while Ashok Leyland’s share has risen 18.66%.

The big fight is in the M&HCV goods carriers segment, where Tata has lost ground to the ambitious Ashok Leyland which has been aggressively launching new products and expanding its service network beyond its traditional strong southern region to the north and eastern part of the country. In FY2011-12, Tata had a 62.24% share of the M&HCV goods carrier market with Ashok Leyland having 20.22%. This gap has narrowed down in FY2016-17 – Tata Motors had 51.2% and Ashok Leyland 33.14%.

The key to Ashok Leyland’s impressive performance in driving gains lies in its new product rollout strategy and better aftersales service. The U truck range earlier and now the Captain range have helped the Chennai-based manufacturer gain market share in the important 25T, 31T, 35T and 37T segments. These are critical categories where the bulk of the haulage and tipper trucks, which are directly linked to the economic activities in the country, are sold. Ashok Leyland has also performed well in the 35T and 37T categories, gaining market share steadily.

Ashok Leyland rides demand for higher-tonnage trucks

In the past couple of years, stricter enforcement of overloading, positive operational economics and a higher level of transport of the rated load has seen fleet operators shift towards higher-tonnage vehicles. As a result, the 31T segment has emerged as the most popular one as most OEMs have introduced new products in the category. However, there is now an upward shift to the 37T rigid segment which is seeing increasing interest from customers. Since 2015, the 37T trucks constitute the fastest-growing category in the M&HCV segment. In FY2012-13, the +35.2 tonne but not exceeding 40.2 tonne category saw total sales of just 931 units. This number rose to 4,876 units in FY2014-15 and further to 11,644 units in FY2015-16.

Ashok Leyland rules this segment with an over 70 percent share. This is thanks to its U3718 five-axle truck which has proved to be popular for transporting cement bags, market loads and tanker applications.

In FY2016-17, the category of M&HCVs of 35.2-40.2 tones saw total sales of 12,085 units with Ashok Leyland having the king’s share of 10,666 units and 88 percent market share. Between April-July 2017, total sales in the segment stands at 3,853 units; Ashok Leyland has sold 3,478 units for a market share of 90 percent.

Tata Motors makes gains in tractor-trailers

Not having made a mark in the 37T segment and as a result seeing erosion of market share, Tata turned its focus on the category and is working to introduce a product in the fast growing rigid segment.

Meanwhile, the company continues to lead in the 40T tractor-trailer segment with its well-established product – the LPS4018 and LPS4023 models – and is also introducing its new Signa range of trucks (pictured below).

In FY2016-17, the 40.2-44-tonne segment sold a total of 21,307 units – Tata Motors, with 17,530 units, had a share of 82% with Ashok Leyland keeping 17.5 percent with 3,777 units.

The reason why both the homegrown OEMs dominate the heavy duty truck segments is largely due to their in-depth understanding of the local markets, value-for-money products and tailor-made products. The Indian M&HCV customer is extremely price conscious and the decision of buying a truck is not just by one-time acquisition cost but the overall lifetime cost of the trucks and the resale value as well. This makes the aftersales service and network critical for the truck buyer. The past few years have seen both Tata and Ashok Leyland expand their network sizeably across the country to offer speedier service to ensure customers’ trucks keep plying and in turn earning them money.

Importantly, both manufacturers have an expansive product portfolio for varied applications. These include rigid, tipper and tractor trucks, starting from a 25T rigid truck up to 49T tractor-trailer in varied engine options. This helps the customer to buy a truck for his specific application with the necessary engine option.

How the OEMs’ new strategies are playing out

Tata Motors, which revealed an aggressive turnaround strategy on August 22, is looking to regain five percent market share across both its commercial vehicle and passenger vehicle businesses.

The strategy is aimed at regaining 5 percent market share through growth across segments. Current CV market share is 41%. This will involve bringing products faster to market and filling product gaps by launching new products in the 37T and 49T range. In FY2018, six new M&HCVs and four intermediate CVs are to be launched. Tata is planning an over Rs 1,500 crore investment across segments this year and annually going forward and will see a focus on accelerating sales efforts in specific micro markets to gain market share. Importantly, it is driving a customer-centric, judicious mix of SCR and EGR technology-driven product mix even as it builds a lean and capable supply chain to bring down number of component suppliers from 200 to 100.

Chairman Natarajan Chandrasekaran, addressing his first AGM of the conglomerate since he took over, faced a slew of questions from shareholders on Tata Motors’ subdued performance over the past couple of years. “Looking ahead, we expect the business environment to remain dynamic and unpredictable. Our clear focus is the turnaround of the domestic business,” he said. Tata Motors’ CV volumes have remained more or less constant at around 320,000 vehicles, over the past three years, while the operating costs have gone up over time, Chandrasekran added. “This has impacted the performance of the company this year,” he said.

Commenting on plans to reverse the situation, Chandrasekaran said, “In CVs, we are focused on ensuring that all product launches happen within our laid-down timelines without any delay, changing the trajectory of our market share curve and start gaining market share, and serious cost improvement plan.”

At the same time, Ashok Leyland is aggressively expanding its product portfolio in the LCV segments to become a full range CV player. The company has launched the Guru ICV and Partner LCV and plans to launch a new LCV product every quarter, going forward, Vinod Dasari, managing director, Ashok Leyland told Autocar Professional last year. Ashok Leyland currently has only one product, the Dost, in the small commercial vehicle space. Launched in September 2011, it currently clocks sales of around 2,500 units a month. Independently, it may be a good figure but not significant in the overall LCV market that sells over 20,000 units a month.

In the April-August 2017 in the overall CV market which saw total sales of 1,16,073 units, Tata Motors has garnered a market share of 42.03 percent. Ashok Leyland with 47,682 units has a market share of 17.27 percent.

In the M&HCV passenger carrier segment, there is a strong battle underway and backed by its strong bus portfolio, Ashok Leyland edges out Tata Motors. While Ashok Leyland has total bus sales of 5,432 units and a market share of 37.16 percent, Tata Motors with sales of 5,212 units has a market share of 35.66 percent.

However, in the key M&HCV goods carrier segment, Tata Motors maintains its leadership with with sales of 42,491 units and a market share of 51.21 percent. Ashok Leyland though continues to perform well with 28,083 unit sales and cornering a market share of 33.84 percent.

As the economy improves and the HCV sector sees a sustained uptick in sales, the battle between these two heavyweights in the CV world is going to turn even more exciting. Stay tuned.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

15 Sep 2017

15 Sep 2017

37040 Views

37040 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal