Surging SUV sales in India eat into passenger car market

Over a seven-year period, the share of passenger cars in the passenger vehicle market has fallen by 10 percent while that of UVs has risen by 12.5 percent and given the continuing demand, it’s a trend that’s set to continue.

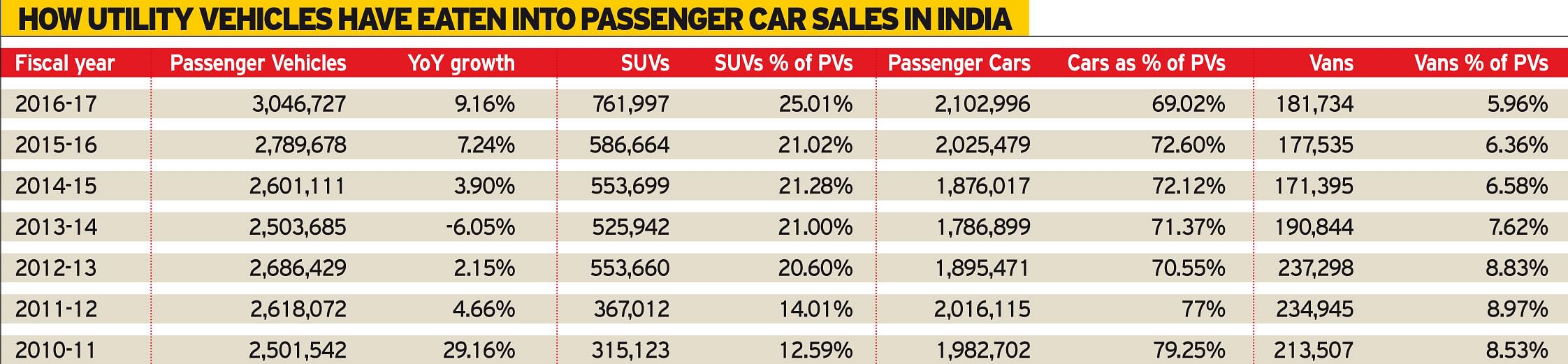

Everything’s official about it now. The Indian passenger vehicle (PV) industry has finally surpassed the three-million-unit sales mark, for the first time ever. In FY2016-17, as per the vehicle sales data released by apex industry body, the Society of Indian Automobile Manufacturers, the PV industry notched sales of 3,046,727 units, recording year-on-year (YoY) growth of 9.23 percent and its best performance since the past six years.

While the fiscal was motoring along at a good pace till the first six months, the second half saw a sales speedbreaker in the form of the demonetisation exercise, which hit the auto sector hard, impacting the PV space for a brief period of time but regaining normalcy by January 2017.

SUV-ival of the fittest

For the fiscal year, the passenger car segment sold a total of 2,102,996 units (+3.85%) but what helped the overall PV industry achieve the 3-million milestone has been the sharp growth in SUV sales at 761,997 units (+29.91%), what with demand for compact SUVs going through the roof. Surging demand for utility vehicles, both in town and country, is also having an impact on the passenger car market.

Autocar Professional’s analysis reveals that over the past seven fiscal years, even as the overall PV market size has grown, the overall share of the passenger car market has fallen by 10 percent while that of UVs has risen by 12.5 percent, clearly indicating that SUVs have eaten into the car market and it’s a trend that’s set to continue.

From a high of 79 percent market share (1,982,702 units) in 2010-11, the passenger car market has declined to 69 percent share (2,102,996) in 2016-17 even as the overall PV market has grown by 21 percent over a seven-year period.

For the SUV segment, of course, it’s been boom time particularly in 2016-17, where it recorded handsome 29.91 percent YoY growth coming on a back of plenty of new product launches, continuing demand for compact SUVs and a marked shift of customer preference for such models over conventional hatchbacks.

A close look at the past seven fiscals indicates that from a 12.59 percent share of the PV market in 2010-11, SUVs now account for 25 percent. This confirms what the industry had known all along – that out of every four new vehicles sold in India, one is an SUV. And the trend looks set to get stronger what with most PV manufacturers hard at work on developing new SUVs for the Indian market.

SUVs headed for the 1m sales landmark

In fact, UV sales in India are predicted to cross the 1 million units mark annually by 2020. In an interview to Autocar Professional earlier this year, Mark Fulthorpe, global director – Light Vehicle Production Forecast, IHS Markit Automotive, said, “We have seen a trend in India on SUVs wherein SUVs are becoming smaller and wider. Increasingly, they are being built on uni-body vehicle structures, which are also used (as platforms) in making hatchbacks and small sedans. So there is a lot of flexibility in vehicle production. This is a strong trend in India, and if this trend remains in its place then we barely see any factor that can disrupt in the next couple of vehicle cycles. So, if you can build and sell cars in India, then you can build and sell elsewhere in the world.

“We expect that the SUV market in India will more than double by the end of this decade. We forecast that the SUV segment will easily cross the one-million unit mark annually. For instance, the success of Maruti Suzuki’s Vitara Brezza has taken the company’s utility vehicle portfolio to new heights.”

Game-changing vehicles

The Vitara Brezza has been the game-changing vehicle of the year and is right now at the top of the UV charts. Clearly, there’s no stopping this sales machine which has seen surging sales right from its launch last year. Right since July 2016, Maruti’s first-ever compact SUV has been the No. 1 in the Top 5 best-selling UVs in the country and crossed the 100,000 unit domestic sales mark in less than a year after launch.

At No. 2 is Hyundai Motor India’s Creta which, as an overall package, is hard to beat and crossed the 150,000 sales milestone in 21 months since launch. It is above average in most areas and in some, it’s the class best. The styling, refinement, practicality and overall ease of use appeal to the average SUV buyer who isn’t interested in off-road ability – the Creta’s biggest weakness.

Maruti’s Ertiga is a popular fleet and family vehicle in India. This urban MPV, based on the Swift platform, has been a consistent high-seller for the country’s largest carmaker since its launch in 2012. Offered with a host of engine options ranging from petrol, CNG and diesel variants, and more recently an SHVS mild hybrid variant, the Ertiga remains popular with buyers. Mahindra & Mahindra’s warhorse, the Bolero, is another high seller. Toyota Kirloskar Motor’s Innova Crysta completes the Top 5. The Innova has always been a big selling UV and with the new Crysta, Toyota has not only enhanced the Innova's core strengths of space, comfort, practicality and quality but has addressed its key weaknesses too. It's no longer underpowered or under-equipped, and it looks very modern too. For those who want a luxury MPV to carry friends and family around in comfort, there is no better choice – which is why buyers have been flocking to this vehicle.

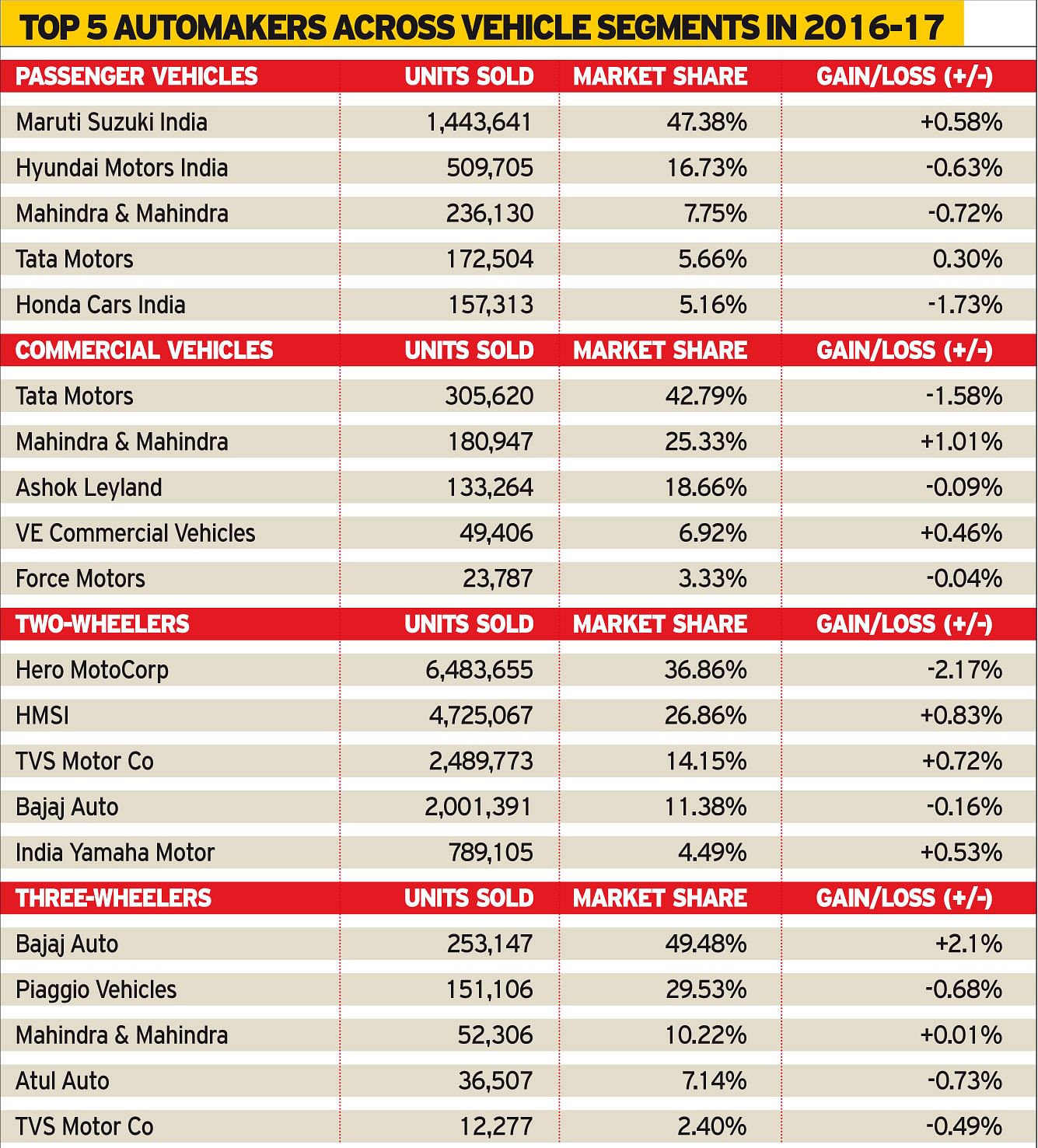

The biggest contributor to PV sales in 2016-17 was, of course, Maruti Suzuki India with 1,443,641 units (+10.59%). Of that number, a good 1,095,891 or 24 percent were utility vehicles. The country’s largest carmaker now has a 47.38 percent market share in PVs and a 52.11 share in passenger cars. No 2 player Hyundai Motor India, which has a 17 percent market share, sold a total of 509,705 (+5.24%). It is followed by Mahindra & Mahindra with a 7.75 percent market share for its 236,130 units (.07%) sold in 2016-17. At No. 4 is Tata Motors with 172,504 units (+15.45%) and a PV market share of 5.66 percent, followed by Honda Cars India with sales of 157,313 units (-18%) for a market share of 5.16 percent.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

By Autocar Professional Bureau

By Autocar Professional Bureau

13 Apr 2017

13 Apr 2017

22362 Views

22362 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal