Surging demand for SUVs powers robust market share gains for Kia, Hyundai, Renault and MG in April-Dec 2019

New models ride wave of demand for SUVs, eat into established OEMs' share and lead the charge for these global players in the Indian market.

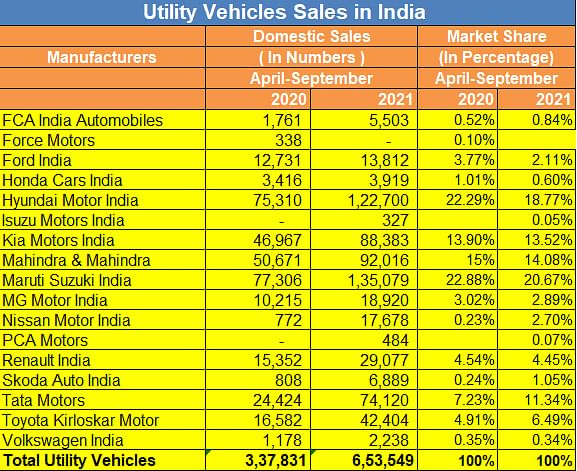

The SUV market in India is firing on all cylinders and how. Yesterday, apex industry body SIAM released industry sales data for CY2019, December 2019, and April to December 2019 and the sole sub-segment in positive territory is that of utility vehicles. In fact, it is thriving despite the hugely dampened market conditions, as seen below:

UV SALES

CY2019: 984,801 (4.78%)

Apr-Dec '19: 725,563 (6.35%)

Dec '19: 85,252 (30.02%)

If it weren't for the sizeable 34.25% contribution from the UV segment to the overall passenger vehicle (PV) market, the PV segment which is down 16.40% (2,117,837) in April-December 2019 would have been floundering even more.

India Auto sales crash 14% in CY2019, industry awaits GST cut to revive growth

SUVs clearly are good news for the beleaguered Indian automobile industry, which has seen over a year of overall sales decline, a trend which looks to continue till the fiscal year-end and beyond. What's driving this growth are a clutch of recently launched SUVs, from Kia Motors India (Seltos), Hyundai Motor India (Venue), MG Motor India (Hector) and Renault India (Triber). Not surprisingly, their robust sales have helped these OEMs increase their UV market share and also eat into established UV OEMs' share. This at a time when the chips are down for the rest of the industry.

Meanwhile, key models from established manufacturers like Mahindra & Mahindra (XUV300), Maruti Suzuki India (Vitara Brezza) and Tata Motors (Nexon) are also playing a key role in the resurgence of demand for this vehicle type.

Take a close look at the detailed market share statistics table below and it's not surprising to find that of the 17 OEMs in the UV market, only 4 (Hyundai, Kia, MG and Renault) have increased their market share.

Hyundai: 19.18% UV share, compact Venue delivers big gains

Leading the SUV charge for the Chennai-based Hyundai Motor India, is its first-ever compact model, the Venue. Launched on May 21 the Venue, and the well-established Creta, have sold a total of 138,211 units, accounting for 99.31% of total UV sales of 139,165 units.

The Venue, which comes with three engine options – a 90hp, 1.4-litre diesel, an 83hp, 1.2-litre naturally aspirated petrol unit, and a 120hp, 1.0-litre turbocharged unit – is the volume driver and in the eight months since launch has been a regular in the Top 5 UVs chart.

Hyundai's SUV sales account for 37% of the company's total PV sales (376,997) in April-December 2019, up from 22.73% (93,562 UVs/411,980 PVs) a year ago. No surprise then that Hyundai has seen its UV market share grow to 19.18% from 13.71% a year ago.

Kia: 6.23% UV share, Seltos shines and how

Kia Motors, Hyundai's sister company, is having a super run in India. In a scant five months since launch on August 22, the Seltos has grabbed a 6.25% UV market share with total sales of 45,226 units. This constitutes a monthly average of 9,045 units, absolutely splendid going for a brand-new brand in the Indian market. Reason enough to give it a UV market share of 6.23%, just behind Tata Motors (6.51%), Toyota Kirloskar Motor (7.18%) and ahead of Ford India (4.61%) and Renault India (4.39%). Kia is currently sixth in the total UV market share rankings in India.

In November, the Seltos notched its best monthly sales yet – 14,005 units – and has been India's No. 1 UV for two straight months in October and November, losing out in December, most likely to the Maruti Vitara Brezza.

Kia Motors India says it has received over 80,000 bookings for the Seltos till now and, to ensure timely deliveries, has started the second shift to ramp up production at its manufacturing facility in Anantapur. The company says it will not close bookings as the plant is fully capable of meeting the surging demand for the Seltos.

On January 1, Kia has hiked prices by up to Rs 35,000, with the Seltos, available in 18 variants, now priced between Rs 9.89-17.34 lakh. With this, the petrol version carries an asking rate of Rs 989,000-14.09 lakh and sees a bump of Rs 20,000 for the base HTE variant and Rs 30,000 for the trims above. Positioned at Rs 13.79-17.29 lakh, the more powerful turbo-petrol version sees the prices go up by Rs 30,000. The diesel Seltos receives the highest mark-up of Rs 35,000 and now bears a sticker price of Rs 10.34-17.34 lakh.

Renault: 4.39% UV share, tracks true with Triber

Renault India looks to be making a comeback in the UV market, thanks to the recently launched Triber which, along with the Duster, Captur and Lodgy makes up its UV range. For the April-December 2019 period, the company has 31,853 UV units to its name, which marks handsome 185% YoY growth, albeit on a low year-ago base.

What's making a difference, and speedily at that, is the sub-4-metre, 7-seater Triber. Launched on August 28 at an aggressive Rs 495,000, through to Rs 649,000 for the top-end variant, the Triber's compact size, spacious interiors and flexible seating configurations, coupled with the price, seems to be drawing buyers. The seven-seat model is available in four variants and comes with one engine and one gearbox. The Triber is one of two compact (under 4m) seven-seater offerings in the Indian market; the other being the Datsun Go+.

The Triber is turning out to be quite a game-changer. In December 2019, the Triber sold a total of 5,631 units, taking its five-month total of 24,142 units or a monthly average of 4,828 units. This means it accounts for 75.79% of the company's total UV sales in April-December 2019, helping Renault grow its UV market share to 4.39% from 1.64% a year ago. We have ramped up the production and are taking concerted efforts to further accelerate production to enable faster deliveries and best-in-class quality. Together with the metro cities, the Triber has seen wide acceptance in the rural markets as well, and we have a robust strategy to build our presence across these markets, which offers significant growth potential,” said Venkatram Mamillapalle, Country CEO and managing director, Renault India Operations.

MG: 2.20% UV share, Hector shows its heft

MG Motor India, the other new car brand that entered India, is seeing increased sales traction for its Hector SUV. The Hector, which comes in four diesel variants, two petrol-manual variants, two petrol-automatics and three petrol-hybrids, has sold a total of 15,930 units, which gives it a UV market share of 2.20%, a strong performance for a new brand in India.

MG Motor India has close to 40,000 bookings in hand, making the midsize SUV sold out till February 2020. It now aims to clear the entire backlog till February with the second-shift at its plant in Halol, Gujarat having begun this month. On October 22, four months after it launched the SUV in India, the company achieved the milestone of rolling out the 10,000th Hector.

Established UV players see market declines

New competition always brings challenges and the clutch of new models from Hyundai, Kia, MG and Renault have impacted the established UV players. Club the Korean family of Hyundai and Kia and what you get is a combined market share of 25.41% or one-fourth of India's UV market. While Maruti and Mahindra control two-fourths (45.55%), 13 other players fight for bits and pieces of the last portion.

Market leader Maruti Suzuki India, which sold 184,330 UVs in April-December2019, down 5.16% (April-December 2018: 194,370) has seen its UV market share go down to 25.41% from 28.49% a year ago but the rate of decline is slowing down. Likewise, the strong No. 2, Mahindra & Mahindra has seen its share reduce to 20.14% from 23.88% a year ago. With sales of 146,164 units in April-December 2019, M&M sees its UV numbers drop 10.30% (April-December 2018: 162,949) but again like Maruti, its sales are picking up. All the other UV players, which have single-digit UV market share, have seen their sales and share decline in the period under review.

Three months left in this fiscal and about 75 days for the BS VI mandate to kick in. Before that there is the Auto Expo 2020, which will see a lot of SUV new product action. This is one vehicle segment, which will continue firing on all cylinders in 2020.

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

11 Jan 2020

11 Jan 2020

24927 Views

24927 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi