Scooters power two-wheeler industry growth in Q1 FY2018

In the first quarter of FY2018, the scooter segment has increased its market share of the two-wheeler industry to 33.65 percent from 30.21 percent in Q1 FY2017, reflecting the spread of scooterisation across India.

Scooters are to the overall two-wheeler market what SUVs are to the passenger vehicle market. The surge in consumer demand for both these vehicle sub-segments is what is driving overall segment numbers.

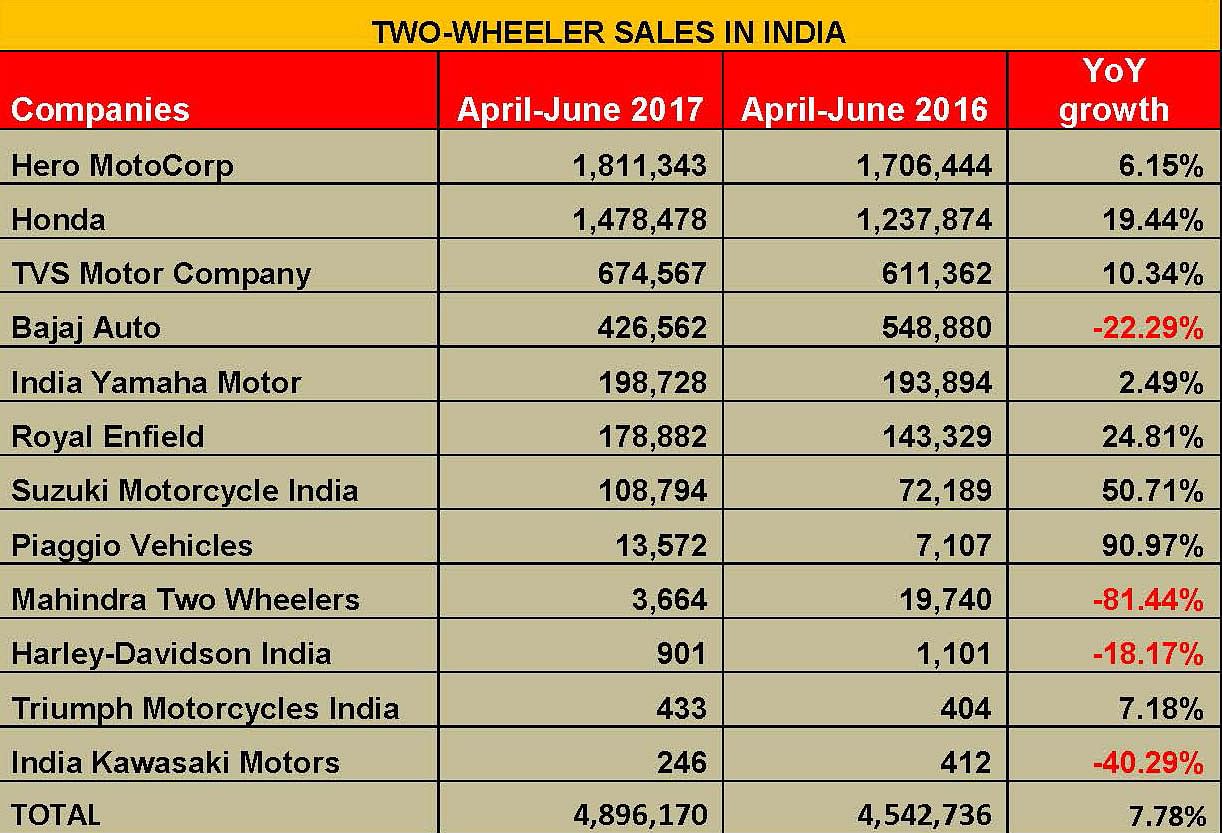

A quick look at the sales numbers of the first quarter (April-June 2017), released by apex industry body SIAM, reveals that total domestic volumes of the two-wheeler industry stood at 48,96,170 units, up 7.78 percent YoY (Q1 FY2017: 45,42,905 units). Interestingly, the data indicates that the growth in the two-wheeler industry has outperformed all the other segments across the automotive industry. While commercial vehicles and three-wheelers have registered a YoY decline, passenger vehicles with YoY growth of 4.38 percent was the sole segment, along with two-wheelers, to record positive numbers for the period.

What’s amply clear is that growth in the two-wheeler industry, which is much bigger in overall numbers than all the other segments, is being driven by scooterisation. The scooter segment has yet again outperformed motorcycle sales in Q1 FY2018.

For Q1 FY2018, the scooter segment commands a share of 33.65 percent as compared to 30.21 percent in Q1 FY2017. This highlights the segment’s rapidly growing share in the two-wheeler industry.

A pointer to the growing strength of the scooter market is that fact that Hero’s 110cc Maestro has become the fourth scooter brand (after the Activa, Dio and Jupiter) to enter the Top 10 Scooters list in June 2017.

India’s two-wheeler industry has three clear leaders in each segment – scooters, motorcycles and mopeds. Honda Motorcycle & Scooter India (HMSI) is a scooter-making and selling machine.

In the April-June 2017 period, the overall scooter market, led by Honda, saw sales of 16,47,690 scooters (+20.06%) as compared to 13,72,388 units in Q1 2016.

Meanwhile, the Hero MotoCorp-driven motorcycle segment has registered total domestic sales of 30,54,987 units during Q1 FY2018 (+3.44%). In compariison, the motorcycle industry sales Q1 FY2017 were 29,53,316 units.

TVS Motor Co is the boss in the moped category, where it has no competition since there is no OEM which makes this type of two-wheeler. This segment has seen a YoY decline of 10.92 percent with sales of 193,493 units in Q1 FY2018 as against sales of 217,201 units during Q1 FY2017.

HOW THE OEMS STACK UP IN Q1 FY2018

Hero MotoCorp, which continues to be the largest two-wheeler player in India, sold 18,11,343 units in the domestic market during Q1 (+6.15%). Rallying aggressively behind the industry leader is HMSI, which has registered the best numbers amongst all OEMs and sold 14,78,478 units (+19.44%).

Hero MotoCorp, which was leading Honda by sales of 468,570 units in Q1 FY2017, is now ahead of the aggressive Japanese counterpart by 332,865 units in Q1 FY2018. It is learnt that Hero has a an aggressive new product launch plan in place for the upcoming quarters to boost its sales and put a check on the reducing sales gap with its arch rival.

Honda, meanwhile, has recently launched India’s most affordable scooter, the 110cc Cliq. Continuing to bank on its strengths, the company has a strategic focus of penetrating into the rural markets with its new products. While the Japanese major plans to deploy its tailor-made regional strategies to draw the rural customer – a Hero MotoCorp stronghold – in a big way, it would be interesting to see how the home-grown Hero manages to safeguard its market share in the coming months.

For Q1 FY2018, Hero MotoCorp’s market share stands at 37 percent, down marginally from the 37.56 percent in Q1 FY2017. Meanwhile, Honda’s market share for Q1 FY2018 stands increased at 30.20 percent as against 27.25 percent in Q1 FY2017.

Growing slow and steady, TVS Motor Co sold 674,567 units in Q1 FY2018, up by 10.34 percent YoY (Q1 FY2017: 611,362 units). Clearly, the decline in the sales of its mopeds restricted the company’s quarterly sales growth, which is propelled by its scooter portfolio. TVS’ market share in the two-wheeler industry has seen a mild growth too. It is now 13.78 percent (Q1 FY2018) as against 13.46 percent in Q1 FY2017.

Bajaj Auto, India’s fourth largest two-wheeler company that continues to remain absent in the aggressively growing scooter segment, has sold 426,562 units in Q1 FY2018 (-22.29%). The company had fared better in Q1 FY2017 with sales of 548,880 units.

Bajaj has recently added a new model – NS 160 – to its top-performing Pulsar brand recently to take on the 155cc-160cc rivals from the stables of Honda, Suzuki and TVS Motor. At the top end, the company is expecting its KTM brand of motorcycles to deliver good growth (above 25-30 percent) in the ongoing fiscal. Due to its declining sales for the last quarter, Bajaj Auto’s market share has fallen sharply from 12.08 percent in Q1 FY2017 to 8.71 percent in Q1 FY2018.

Interestingly the big four – Hero, Honda, TVS and Bajaj – continue to dominate the two-wheeler industry as they jointly command an overwhelming share of 89.68 percent (Q1 FY2018) in the domestic market.

India Yamaha Motor has sold 198,728 units in Q1 FY2018 (+2.49%). The company had sold 193,894 units in Q1 FY2017. The company’s soaring scooter sales (of the Ray ZR and Fascino) from last year have now stabilised to respectable monthly numbers as the two models continue to be among the top 10 bestselling scooters in India. It is understood that the company’s growth potential is visibly limited when compared to the big four in terms of its all-India dealership network.

Besides its potent product strategy, Yamaha is working to penetrate deeper into the regional territories to fuel its growth in the near future. If sources are to be believed, the company has been mulling over entering the 125cc scooter segment, which is expected to see new models from the stables of Hero MotoCorp, TVS Motor Company as well as under Piaggio’s Aprilia brand later this year.

Royal Enfield, a company that once struggled to sell 20,000 units annually, is now nearing quarterly sales volumes of 200,000 units. It sold 178,882 units in Q1 FY2018 (+24.81%), compared to 143,329 units in Q1 FY2017.

Notably, total quarterly sales from the 350cc models stood at 1,69,252 units, which accounts for nearly 95 percent of Royal Enfield’s total sales for this period. This also highlights that the brand continues to acquire bulk of new entry-level customers who aspire to own a midsize motorcycle.

Suzuki Motorcycle India recorded sales of 108,794 units in Q1 FY2018 (+50.71%), the growth mainly coming from its top-selling 125cc scooter model, Access 125. Although the 155cc Gixxer range of premium commuter motorcycles continues to garner sales for the company, it is time Suzuki must bring new products to the market to propel its growth in the coming months.

Piaggio Vehicles has recorded growing numbers, thanks to its stylish Aprilia scooter – the SR150. It sold 13,572 units in Q1 FY2018, up by 90.97 percent YoY. The Italian automaker remains focused on the top end of the scooter market with its Vespa and Aprilia brands. While it is gradually expanding its small all-India network to cover all urban markets, it is also mulling over new product categories and their localisation strategies for India.

WHEN THE BIGGIES COME OUT TO PLAY

On the big bike front, Harley-Davidson continues to be the leader in the domestic market with sales of 901 units in Q1 FY2018. However, its Q1 performance has witnessed a decline of 18.17 percent YoY. In Q1 last fiscal, the company had sold 1,101 units.

Triumph Motorcycles is now the second largest big bike retailer in India. It reported sales of 433 units in Q1 FY2018, up by 7.18 percent YoY. The company has launched two new models recently – the modern classic Bonneville Bobber, which is powered by parallel-twin, 1200cc engine, and naked street performance model Street Triple S, powered by in-line three-cylinder, 765cc engine.

India Kawasaki Motors is now the third largest big bike company in India. According to SIAM data, IKM sold 246 units in Q1 FY2018, down 40.29 percent YoY. Due to the end of its alliance with Bajaj Auto on the front of retail network, the Japanese premium bike maker has suffered a visible setback.

However, the company has now moved its operations into its all-new plant in Chakan, near Pune, and is working with complete autonomy to scale up its operations and dealership network in India. The company aims to not only boost its products and services in the local market, it is aggressively working to scale up its aftersales departments to cater to its expanding customer base.

Kawasaki and Triumph are understood to have the largest portfolios of superbikes on offer in the domestic market.

Although several big bike brands such as Indian Motorcycles, Ducati India, DSK Benelli, MV Agusta and others do not currently report their sales data in public, they all are optimistic about the growth potential in India.

Also read : INDIA SALES: Top 10 Two-Wheelers – June 2017

INDIA SALES: Top 10 Passenger Vehicles – June 2017

INDIA SALES ANALYSIS: GST casts a shadow over sales in June

INDIA SALES: Top 5 Utility Vehicles – June 2017

INDIA SALES: Top 10 Scooters – June 2017

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

18 Jul 2017

18 Jul 2017

26144 Views

26144 Views

Shahkar Abidi

Shahkar Abidi