SALES ANALYSIS: September 2017 | India Auto Inc in festive mood as all segments drive onto growth road

With passenger vehicle sales notching a record high in September, commercial vehicles steering into sustained growth and two-wheeler numbers picking up pace, the Indian automobile industry is headed for good times, some hiccups like the GST cess and fuel prices notwithstanding.

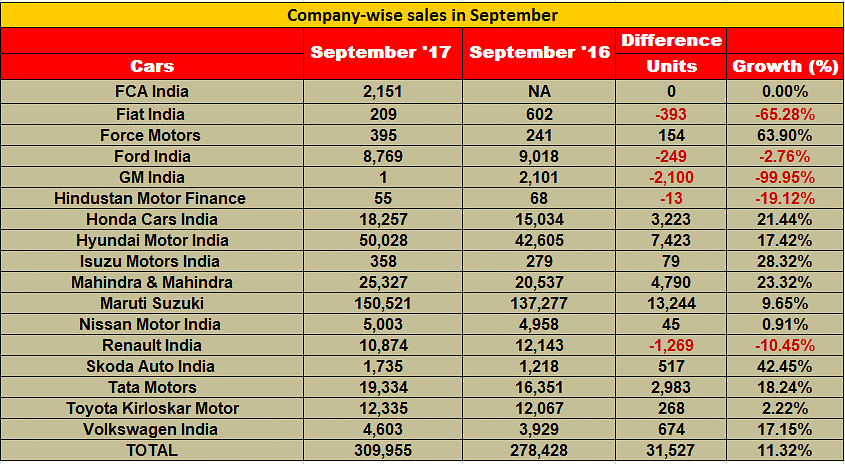

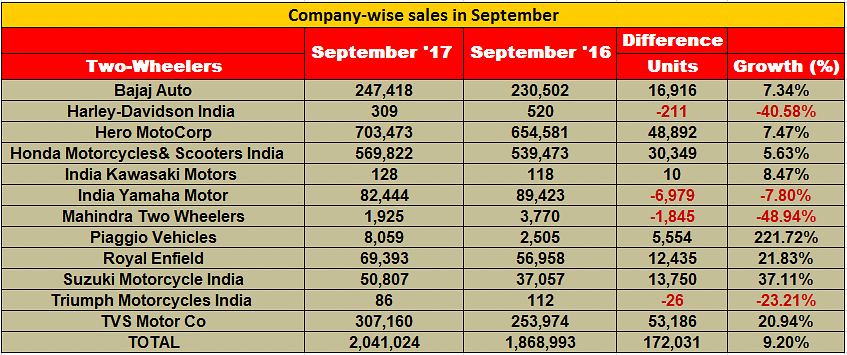

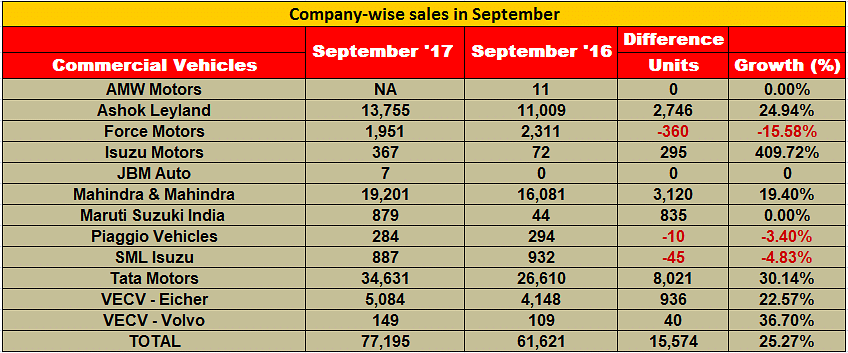

Diwali has come early for the Indian automobile industry as overall numbers point to 10 percent year-on-year growth. Official industry sales data for September 2017, revealed by apex body SIAM, shows all vehicle segments put together have closed in on the 2.5 million mark. In fact, at 2,490,034 units sold, it is barely 9,966 units short of the landmark. Importantly, all segments – passenger vehicles (309,955 / +11.32%), commercial vehicles (77,195 / +25.27%), three-wheelers (61,860 / +19.08%) and two-wheelers (2,041,024 / +9.05%) – have posted robust growth.

What the September 2017 sales numbers indicate is that demand has bounced back, particularly from rural India. A combination of new vehicle launches, a bountiful monsoon in most parts of the country translating into demand for PVs, small CVs and two-wheelers, as well as a boost in consumer demand from the nine-day Navratri festival and Dussehra, which is seen as an auspicious day to buy vehicles, have helped automakers post robust numbers.

Cumulative numbers for the half-year or April-September 2017 period also point to industry being firmly in positive territory. At 12,751,143 units, industry sales across the four vehicle segments in H1 FY2018 are a smart 9.40 percent YoY growth. Leading the charge are the PV (1,630,945 /+9.16%) and two-wheeler (10,507,308 / +10.14%) segments and followed by CVs (353,342 / +5.96%). The three-wheeler industry is the sole one still with negative growth – 259,548 / -9.89% – but as September 2017 numbers show, this segment is already seeing the green shoots of recovery.

The sub-segments showing the smartest year-on-year growth are, not surprisingly, utility vehicles (440,010 / +17.81%) and scooters (3,577,421 / +17.26%), as also LCV goods carriers (201,031 / +19.70%). The blistering growth in the UV and scooter segments has helped boost overall numbers in the PV and two-wheeler segments even as demand for last-mile transportation and e-retail goods has given a fillip to LCV goods carriers.

Let’s take a closer look at how the various vehicle segments fared in September 2017.

PV INDUSTRY HEADED FOR RECORD SALES IN FY2018

The spurt in PV numbers is thanks to a stronger than ever before performance from market leader Maruti Suzuki India which looks well set to notch its best-ever sales for a fiscal year. In H1 FY2018, the country’s largest carmaker has sold a total of 886,689 units (+15.6%), comprising 825,832 domestic sales (+17.1%) and 60,857 export (-1.1%). In FY2017, it had sold a total of 1,568,603 units. Given the current pace of its sales in the domestic market, Maruti should easily surpass this number. As is known, the company is gunning for 2 million sales annually by the year 2020. And it has 2.5 million sales in its crosshairs by FY2023.

Compared to July 2017 (153,298 units / +21.9%) and August 2017 (151,270 units / +26.2%), September 2017 PV sales of 150,521 units (+9.6%) are muted by the carmaker’s high standards but there’s no denying the fact that the company’s stranglehold on the market remains firm.

Other than for the entry-level hatchback duo of the Alto and Wagon R, which sold 38,479 units, down -13.3% (September 2016: 44,395) and the premium Ciaz sedan at 5,603 units (-14,4% / September 2016: 6,544), sales for other segments are all up. The Ciaz had clocked its best-ever monthly sales in April 2017 (7,024).

Demand for the five compact cars (Swift, Celerio, Ignis, Baleno and Dzire) rose smartly by 44.7% year on year to 72,804 units (September 2016: 50,324), reflective of the surging demand for the premium Baleno hatchback and the new Dzire sedan.

While the Baleno, the largest of the company’s hatchbacks which comes with ABS and dual airbags as standard across the 11-variant range, continues to draw buyers, the big surprise has been the spurt in demand for the Dzire which had notched its best-ever monthly sales – 26,140 units (comprising 14,083 diesel and 12,057 petrol)) in August 2017. The Dzire, for long, has played second fiddle to the Maruti Alto, the longstanding No. 1 machine, and sometimes to the Swift. Expect the Dzire to have done well in September too and contributed a large share to overall numbers.

Total sales of Maruti passenger cars in September were 116,886 (+11.1%) over the 105,236 units sold a year ago.

Sales of Maruti Suzuki’s utility vehicles – Gypsy, Ertiga, Vitara Brezza and S-Cross – surprisingly have slowed down: at 19,900 units (+8.0% / September 2016: 18,423). Expect the Maruti Vitara Brezza, which notched its best-ever monthly sales of 15,243 units in July 2017 and 14,396 units in August 2017, to have contributed the bulk of the UV numbers. However, going forward, the Brezza will have to contend with the Nexon, Tata Motors’ first-ever compact SUV and possibly its first strong challenger. The compact SUV battle for the consumer just turned a lot more exciting.

Bringing up the rear are the two vans, the Omni and the Eeco which together sold 13,735 units, making for flat sales of 0.9% (September 2016: 13,618).

Hyundai Motor India, the No. 2 PV player, sold 50,028 units in September 2017, a growth of 17.42 percent (September 2016: 42,605). Helping drive the sales momentum is the recently launched new Verna sedan, which went home to over 6,000 owners even as the Creta SUV, Elite i20 and Grand i10 hatchbacks continue to see popular demand.

Mahindra & Mahindra registered sales of 25,327 units in September, up 23 percent (September 2016: 20,537). While UVs, including the Scorpio, Bolero, XUV500, TUV300 and KUV100 accounted for the chunk of the volumes selling 24,109 units (September 2016: 19,206), cars and vans sold 1,218 units (September 2016: 1,331). Commenting on the sales resurgence, Rajan Wadhera, president, Automotive Sector, M&M, said: “Industry has witnessed a buoyant demand in September leading up to the festive season both in urban and rural markets. We are particularly happy with the performance of our Scorpio brand, which has had its highest monthly sales in September since inception.”

Honda Cars India posted strong growth of 18,257 vehicles, up 21 percent, (September 2016: 15,034), led by the company’s high-selling sedan City (6,010), along with stable sales from the WR-V (4,834); they together accounted for more than 50 percent of Honda’s domestic sales. The other contributors were the Brio (504), Jazz (3,001), Amaze (2,561), BR-V (1,298), CR-V (31), and Accord Hybrid (18). Commenting on the numbers, Yoichiro Ueno, president and CEO, Honda Cars India, said, “Honda Cars India is witnessing one of its fastest growth years in sales, backed by strong performance of our latest models, the City and WR-V. We have had a good start to the festive season. With the festive purchase on full swing, our sales outlook for the season is very promising."

As per SIAM data, Tata Motors sold 19,334 PVs, a YoY growth of 18.24 percent (September 2016: 16,351) and mainly driven by demand for the Tiago, Tigor and Hexa. The recently launched Nexon compact SUV has also received a strong market response. Tata Motors says its cumulative PV sales for the April-September 2017 period are 81,417 units, a growth of 12 percent compared to 72,665 units, in the same period last fiscal.

Meanwhile, Toyota Kirloskar Motor sold 12,335 units in September 2017, 2.22 percent up year on year (September 2016: 12,067). The company has recently launched limited editions in the form of the Etios Cross X-Edition and Fortuner TRD Sportivo to make the most of the festive season. It has also introduced festive offers across its dealerships on the Etios series and Corolla Altis.

Commenting on the monthly sales, N Raja, director and senior vice-president, Sales & Marketing, TKM, said, “We revised the price of our products on September 12, 2017 in line with the cess hike which nearly reflects the prices in the pre-GST scenario. We are happy that our customer demand had minimum impact of the cess hike and the festive season has ushered in a positive growth in the domestic sales. With demand on the rise, the current waiting period for the Innova Crysta has gone up to around 6-8 weeks and Fortuner to 10-12 weeks respectively.”

Ford India’s sales declined 2.76 percent in September 2017 at 8,769 units, as opposed to 9,018 units a year ago. Anurag Mehrotra, president and managing director, Ford India, said, “New model launch planning along

with ongoing constraints

in the supply chain continued to impact our wholesale in September. We believe these should be addressed by the fourth quarter, helping us move back into the growth trajectory.”

HERO AND HONDA SALES ON FIRE, BUT OVERALL NUMBERS BELOW ESTIMATES

Like the PV sector, the biggies in the two-wheeler industry are firing on all cylinders on the sales front. September 2017 sales for the top two players – Hero MotoCorp and Honda Motorcycle & Scooter India (HMSI) – have gone through the roof but despite their turbocharged numbers, overall two-wheeler industry sales could be below estimates.

Although Hero MotoCorp, India’s largest two-wheeler manufacturer, has reported its best-ever sales for any single month in September 2017, it has recorded YoY growth of only 6.78 percent, albeit on a large base (September 2016: 674,961), with despatches of 720,739 units. According to the company, surpassing domestic sales of 700,000 units in any month is a global benchmark in the two-wheeler industry.

The record sales have come on the back of festive season as well as building dealer inventory across its expansive countrywide network, preparing for the incoming demand during Dhanteras and Diwali in October. Meanwhile, Hero claims to have sold more than a million units during this year’s festive season thus far.

Commenting on the company’s performance, Ashok Bhasin, Head of Sales, Marketing and Customer Care, Hero MotoCorp, said, “With close to three weeks still remaining in the festival season, we have set an all-time record by selling over a million motorcycles and scooters in domestic retail sales in the festive period so far, further consolidating our market leadership.”

Notably, prior to September, Hero MotoCorp had clocked its highest-ever monthly sales in August 2017 (678,797 units including exports of 17,307 units). The company has been reporting sales of over 600,000 units every month since May 2017, thus making September the fifth record month in a row.

Growth for Hero MotoCorp is primarily driven by demand for its popular Splendor, HF Deluxe and Passion brand of commuter motorcycles. While the demand for Passion has remained flat so far during this fiscal, the Splendor and HF Deluxe continue to outpace their YoY monthly sales. The Splendor has already sold more than a million units between April-August and its sales tally is estimated to be fast riding towards the 1.5 million-unit sales mark. Autocar Professional estimates that India’s most popular motorcycle brand will cross the 1.5 million-unit mark in October 2017.

The HF Deluxe too is nearing the million-unit mark and is likely to achieve that in October 2017. It is estimated that the HF Deluxe has already sold more than 900,000 units during the April-September period this fiscal.

On the cumulative front, Hero MotoCorp claims to have sold more than 75 million two-wheelers since its inception.

Although Honda recorded sales of 569,888 units last month, it managed additional volumes of only 30,484 units over its September 2016 sales (539,404 units). The company’s YoY growth stands at 5.65 percent, the lowest among all the OEMs in September 2017. Nevertheless, considering the total monthly sales of 601,998 units (including exports), September has now become the second month in a row when HMSI has reportedly breached the 600,000-unit mark.

Honda claims to have recorded a good Navratri with more than 52,000 units sold on Day 1 (September 21). Further, it claims to have retailed more than 100,000 units on Dussehra (September 30). Yadvinder Singh Guleria, senior VP (Sales & Marketing), said, “As a trend, we are seeing huge spike in our customer walk-ins and overall retails in every festival, be it Ganesh Chaturthi, Onam or the most recent 50 percent jump in Navratri. On Dussehra alone, Honda’s retails crossed the 100,000 mark for the first time ever. We are confident that the stage is set for a bumper festival ahead.” The company is currently operating at its peak production capacity.

TVS Motor Company, India’s third largest two-wheeler manufacturer, reported sales of 307,160 units in September, up 20.94 percent YoY (September 2016: 253,974). As a result of surging demand for its Jupiter scooter, TVS’ total scooter sales at 121,601 units were up by 43 percent. Its motorcycle sales grew 17 percent YoY to 143,923 units (September 2016: 122,813).

Festive demand has also helped Bajaj Auto record a YoY growth in September for the first time in CY2017. The company’s monthly domestic sales have been in the red right since demonetisation in November last year. The Pune-based motorcycle manufacturer sold 247,418 units last month, a YoY growth of 7.34 percent (September 2016: 230,502).

Meanwhile, Royal Enfield’s monthly sales are now inching closer to the 70,000-unit mark. It sold 69,393 units in September, up 21.83 percent YoY (September 2016: 56,958). The iconic midsize motorcycle brand is seeing a sharp spike in demand since the past year and has recently expanded manufacturing capacity.

Suzuki Motorcycle India sold 50,785 units, a YoY growth of 37 percent (September 2016: 37,057).

Although September 2017 marks the second month in a row when Suzuki has sold more than 50,000 units, it had sold more than August (56,745 units). The company, which has targeted domestic sales of 500,000 units this year, is fast expanding its dealer network, now standing at 467 dealerships across India.

Commenting on Suzuki’s sales, Sajeev Rajasekharan, EVP, Sales and Marketing, said, “We are thrilled at the flying start we have made to the festive-season. Our performance in September is just an extension of the excellent run we have been enjoying in 2017-18.”

With Diwali coming up and a flurry of new models set to roll out till the end of the year and beyond, it expect consumers to spend more and the industry to record improved numbers in H2, FY2018.

COMMERCIAL VEHICLE SALES DRIVE INTO BETTER TIMES

AFTER A DIFFICULT Q1 FY2018, when the commercial vehicle industry was down 8.4 percent YoY — M&HCV trucks (-32%), M&HCV buses (-27.1%) and LCV buses (-14%) — OEMs are now resolutely heading towards happy times.

Sales numbers for September 2017, revealed by top CV OEMs, indicate that growth is here to stay, after month-on-month growth in July and August. While there are growing whispers in some corridors that the economy is slowing down, the uptick seen in the critical medium and heavy commercial vehicle (M&HCV) segment indicates otherwise, as demand for these vehicles is directly related to the overall economic activity in the country.

Higher freight load due to the ongoing festive season and greater infrastructure spend have ensured superior sales of haulage trucks and tippers, the two key product categories in the M&HCV segments. LCV sales also continue to grow as improved demand for last-mile connectivity in rural India and big cities are giving a fillip to sales of small CVs and pickups.

All CV manufacturers have registered strong sales across categories in September. The top two players Tata Motors and Ashok Leyland have recorded 29 and 28 percent growth respectively in overall CV sales.

For Tata Motors, which has recently embarked on an aggressive turnaround strategy to post smart growth and regain market share, its CV sales of 36,679 units will be a shot in its arm — up 29.33 percent year-on-year growth (September 2016: 28,360).

Tata Motors says it sold 12,259 M&HCV trucks (+25%) in September 2017. This pivotal segment witnessed strong growth in demand on the back of continuously increasing acceptance of Tata Motors’ SCR technology, infrastructure development led by government funding and restrictions on overloading, creating

greater demand for new high-tonnage vehicles, especially for new launches of 37-tonne multi-axle trucks and 49-tonne tractor-trailers. The I&LCV (Intermediate & light commercial vehicle)

segment has done well too with sales of 4,449 units (34%).

The pickup segment, which sold 5,569 units in September 2017, saw strong growth of 50 percent with the newly launched Tata Xenon Yodha gaining acceptance and demand across markets. The SCV cargo segment with sales

at 10,040 units posted

40 percent growth,

following good demand for the XL range. However, sales of passenger carriers (including buses) at 4,362 units, were flat.

Ashok Leyland registered a strong growth in its overall sales, growing 28 percent with 15,370 units (September 2016: 12,052). M&HCV sales rose a strong 32 percent to 11,804 units (September 2016: 8,958) while LCVs posted 15 percent YoY growth at 3,566 units sold (September 2016: 3,094).

Mahindra & Mahindra continues with double-digit growth with overall CVs up 19 percent to 19,201 units (September 2016: 16,081). Its M&HCV sales shot up a massive 143 percent to 884 units albeit on a low year-ago base (September 2016: 364). The below-3.5T GVW segment grew 16 percent YoY, selling 17,803 units (September 2016: 15,282), while those in the above-3.5T GVW segment turned positive by 18 percent with sales of 514 units (September 2016: 435).

VE Commercial Vehicles’ domestic sales were up by 22.6 percent at 5,084 units (September 2016: 4, 148 units). The company will be looking to drive numbers with growing demand for its recently launched Pro 5000 Series of trucks.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

12 Oct 2017

12 Oct 2017

20507 Views

20507 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau