Revealed: India’s top 20 SUVs and MPVs in first-half FY2025

Utility vehicles with 1.34 million units sold and 13% growth in April-September 2024 continue to buffer the passenger vehicle segment. In the highly competitive market, 20 best-selling models accounted for 87% of total UV sales. The Tata Punch is currently in the lead but the Hyundai Creta, Maruti Ertiga and Brezza are hot on its wheels. This, even as seven models’ sales are down on their H1 FY2024 performance.

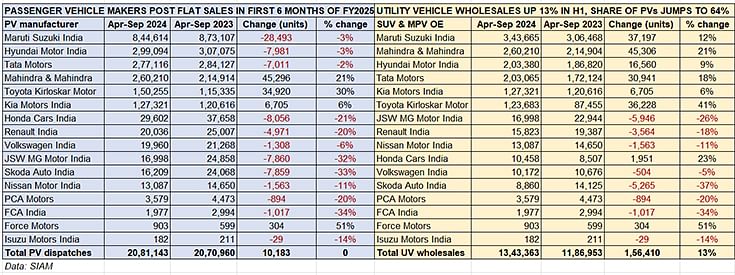

After three straight years of strong growth, India Passenger Vehicle Inc has registered flat sales (up 0.5% YoY) in the April-September 2024 period – the 20,81,143 units are just 10,183 units more than in the year-ago six-month period. Utility vehicles, which comprise SUVs and MPVs, continue to save the blushes for the overall passenger vehicle segment and how.

The H1 FY2025 passenger vehicle wholesales data chart for 16 manufacturers (given below) has plenty of red ink, with 12 OEMs registering a year-on-year sales decline including the top three – Maruti Suzuki (844,614 units, down 3%), Hyundai Motor India (299,094 units, down 3%) and Tata Motors (277,116 units, down 2%).

Halfway into FY2025, PV sales at 20,81,143 units (up 0.5%) are 49% of FY2024’s record 42,18,746 units. In comparison, UVs at 13,43,363 units (up 13.2%) are already 53% of the record 25,20,691 units sold in FY2024.

Halfway into FY2025, PV sales at 20,81,143 units (up 0.5%) are 49% of FY2024’s record 42,18,746 units. In comparison, UVs at 13,43,363 units (up 13.2%) are already 53% of the record 25,20,691 units sold in FY2024.

UV share of PV sales jumps to 64% from 57% in H1 FY2025

Of the three sub-segments, passenger car and sedan dispatches continue to be down – the 660,098 units in H1 FY2025 are down 18.5% YoY while vans, at 77,682 units, were up 5.3% YoY. Utility vehicles remain the bulwark of the overall PV segment and have helped buffer the slowdown in demand for cars and sedans.

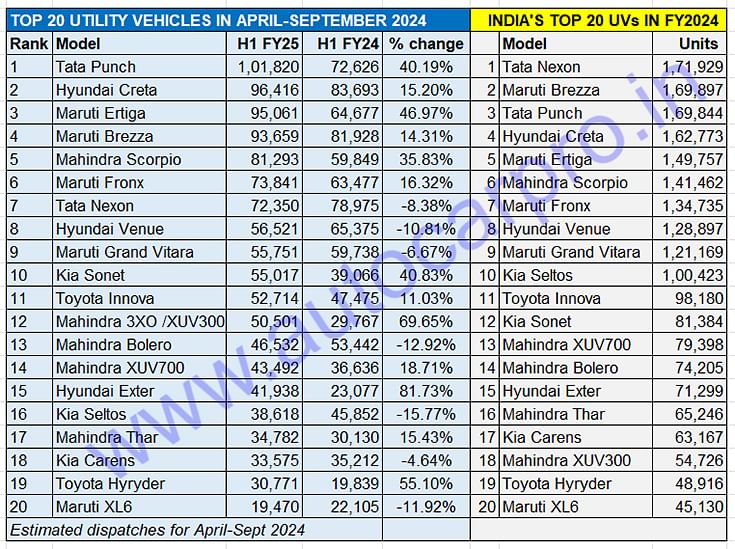

Total UV wholesales at 13,43,363 units were up 12.2% YoY (H1 FY2023: 11,86,953 UVs), which translates into 156,410 additional UVs being dispatched between April and September 2024 over the year-ago period. What’s more, this stellar performance has meant that the UV share of overall PV sales has scaled a new high – 64% vs 57% in H1 FY2024. Of the over 110 UV models and a mind-boggling 800-plus variants sold, the Top 20 best-selling models for H1 FY2025 revealed here clearly make a difference in what is a highly competitive marketplace. Let’s take a close look at the first half of the Top 20 models (entire best-selling UV models list at the bottom).

Tata Punch in the lead but Hyundai Creta, Maruti Ertiga and Brezza closing in

Tata Punch in the lead but Hyundai Creta, Maruti Ertiga and Brezza closing in

Cumulative wholesales of these Top 20 models add up to 11,74,122 units, which constitutes an overwhelming 87% of the total 1.34 million UVs sold between April-September 2024. As per the estimated wholesales data gleaned from SIAM and company releases, the Tata Punch (ranked third in FY2024) is currently in the lead with 101,820 units. The Punch, sold in petrol, diesel, CNG and electric avatars, has recorded strong 40% YoY growth (H1 FY2024: 72,626 units).

Hard on the Punch’s wheels are three other models – the Hyundai Creta (96,416 units), Maruti Ertiga (95,061 units) and Maruti Brezza (93,659 units). The Creta, which is India’s best-selling midsize SUV and ranked as the fourth best-selling UV in FY2024, is now in second position with 96,416 units, up 15% YoY (H1 FY2024: 83,693 units). Credit this performance to the new Creta launched in January 2024. The popular Ertiga MPV (ranked fifth in FY2024) has moved into No. 3 position as a result of its strong performance – up 47% YoY (H1 FY2024: 64,677 units).

The game-changing Maruti Brezza, which kicked off the compact SUV juggernaut all those many years ago, is No. 4 with 93,659 units, up 14% YoY (H1 FY2024: 81,928 units) but down on its No. 2 rank in FY2024. The Mahindra Scorpio has moved up one rank from FY2024 to No. 5 in H1 FY2025 with sales of 81,293 units, up 36% YoY (H1 FY2024: 59,849 units).

Currently ranked No. 6 is the Maruti Fronx with 73,841 units, up 16% YoY (H1 FY2024: 63,477 units). In September this year, the Fronx became the second Nexa SUV to achieve 200,000 sales, after the Grand Vitara. In FY2024, the Fronx was ranked seventh.

UVs No. 7, 8 and 9 are all currently witnessing a YoY sales decline. The Tata Nexon, India’s best-selling SUV for three straight fiscals – FY2024, FY2023 and FY2022 – has dropped all of six ranks to No. 7 position. At an estimated 72,350 units in H1 FY2025, the Nexon is down 8% on year-ago dispatches of 78,975 units. With the recent launch of the Nexon CNG as well as the Nexon ICE model acing the Bharat NCAP crash test with a 5-star rating, it is expected the Nexon should recover market momentum. Sibling Punch has been outselling the Nexon right since January 2024. The Nexon, which turned seven years old in September 2024, has sold over 700,000 units since launch.

The Hyundai Venue, the Korean manufacturer’s first compact SUV, with 56,521 units, is down 11% YoY albeit it retains the same eighth ranking as it did in FY2024.

Demand for the Maruti Grand Vitara seems to have slowed down a tad – the 55,751 units are down 6% YoY. The highest-selling Nexa SUV with over 217,000 units sold since launch, Maruti is currently offering the Grand Vitara hybrid with savings of up to Rs 100,300, along with a 5-year extended warranty. The GV though maintains its No. 9 position of FY2024 in H1 2025.

The Kia Sonet is ranked 10th with 55,017 units, which marks strong growth of 41% YoY (H1 FY2024L 39,066 units). The rollout of a new model has clearly accelerated demand for this compact SUV.

Small can be big: Compact SUVs have 50% share of Top 20 UVs

The compact SUV segment, which accounted for 671,674 units or exactly 50% of the total 13,43,363 UVs sold in the April-September period, also lords over the Top 20 best-selling UVs in H1 FY2025. Starting from the No. 1 model, the Tata Punch, there are all of nine models whose combined wholesales of 592,179 units make up the same ratio – 50% of the total 11,74,122 units these Top 20 models have sold in the first six months of FY2025.

The midsize SUV segment, starting with the Hyundai Creta, has seven models whose combined wholesales of 381,123 units constitute 32% of the cumulative Top 20 number. And there are four MPVs – Maruti Ertiga, Toyota Innova Crysta / Hycross, Kia Carens and Maruti XL6 – whose combined sales of 200,820 units give them a 17% share of the Top 20 models.

In terms of OEM model-wise share in these Top 20 UVs, Maruti Suzuki and Mahindra & Mahindra have five models each while Korean automakers Hyundai and Kia have three each. Tata Motors and Toyota Kirloskar Motor have two models each.

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

17 Oct 2024

17 Oct 2024

15983 Views

15983 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau