Reality check for automakers in August, chip crisis set to hit festive September

Passenger vehicle sales impacted by demand-supply mismatch; flagging motorcycle sales remains worrisome for industry.

With pent-up demand from the early part of CY2021 over by end-July or early August, India Auto Inc could be headed for another round of slow sales. Ample proof of that is in the cumulative sales numbers of the passenger vehicle, two-wheeler and three-wheeler segments for the month of August.

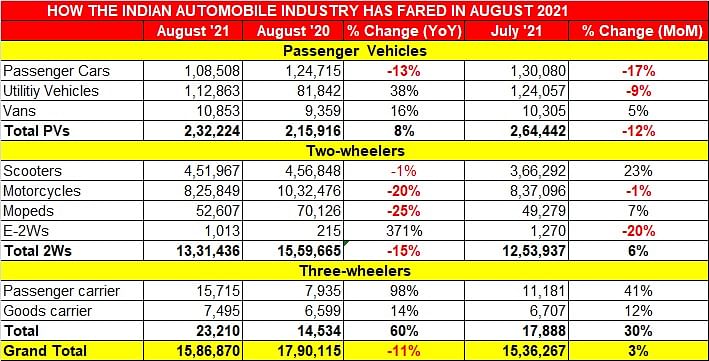

As per the data released by the Society of Indian Automobile Manufacturers (SIAM), at 1,586,870 units, overall vehicle sales are down 11 percent of year-ago sales, which stood at 1,790,115 units in August 2020. While last year itself was a low base,with marginal growth of 3 percent over July 2021 sales of 1,536,267 units, things are not exactly looking bright for OEMs.

Add to that the burgeoning crisis of semiconductor shortage, which has seen many majors announce sizeable production cuts in September. Maruti Suzuki India (by 60%) and Mahindra & Mahindra (by 25%) are two such carmakers; what one gets is a situation not what captains of the industry would have liked just before the advent of the festive season in India.

Passenger vehicles: 232,224 units / +8%

The passenger vehicle segment clocked cumulative volumes of 232,224 units last month (August 2020: 215,916 / +8%) but compared to the July 2021 numbers, which stood at 264,442 units, there is a notable sales decline of 12 percent.

Passenger car sales at 108,508 units reported a 13 percent year-on-year (YoY) decline, which becomes more aggravated on a month-on-month (MoM) comparison basis (July 2021: 130,080 / -17%). While utility vehicles registered a 38 percent YoY growth at 112,863 units, this accelerating segment too showed a MoM drop of up to 9 percent (July 2021: 124,057).

The stark shortage of semiconductor is driving waiting periods up to 8 months and as high as 12-15 months in case of popular models like the Mahindra Thar and Hyundai Creta.

Two-wheelers: 1,331,436 units / -15%

The two-wheeler segment clocked sales of 1,331,436 units, registering a notable 15 percent YoY drop compared to sales of 1,559,665 units in August last year. However, the situation is better on a MoM basis with a 6 percent growth compared to July’s 1,253,937 units.

With the gradual reopening of urban India, scooters remained almost flat at 451,967 units (August 2020: 456,848 / -1%), whereas the motorcycles registered a significant 20 percent YoY de-growth, going home to 825,849 buyers (1,032,476). Industry experts believe that the aftereffects of a good monsoon will only be seen in the rural sales around the festive season.

On the other hand, electric two-wheelers have come a long way during the last year and clocked sales of 1,013 units in August (August 2020: 215 / +371%). But the semiconductor shortage is clearly affecting these electronics-intensive machines as well which have registered a 20 percent MoM decline over 1,270 units sold in July.

Three-wheelers: 1,586,870 units / -11%

The three-wheeler segment registered cumulative sales of 1,586,870 units and a YoY de-growth of 11 percent (August 2020: 1,790,115). Compared to July 2021’s sales of 1,536,267 units, there is an overall 3 percent MoM growth. It is the passenger carrier category of three-wheelers which has almost doubled the sales from last year, when public transportation was at its lowest point due to the peak of the pandemic. Passenger carriers sold 15,715 units last month (August 2020:7,935 / +98%).

Goods carriers, on the other hand, clocked sales of 7,495 units (August 2020: 6,599 / +14%).

SIAM has not revealed the wholesale numbers for commercial vehicles.

Growth outlook

Despite improving consumer sentiments and the onset of the festive season, the prevalent challenges in the automotive industry are posing huge roadblocks for the sector to attaining a seamless growth momentum. The semiconductor crisis is worsening into a nightmare for suppliers and OEMs, which are struggling to sustain uninterrupted production at their assembly lines. The firefighting continues and it is the consumer who is likely to end up waiting more for a new car in the foreseeable future as well.

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

10 Sep 2021

10 Sep 2021

5027 Views

5027 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi