Passenger vehicle sales in India hit 55-month high in October

Riding on festive demand and other market moving parameters, 280,677 PVs went home to new owners last month, scaling a new high since March 2012.

The festive season brought about plenty of reasons to cheer for the Indian automotive industry with the passenger vehicle industry clocking its highest monthly sales since March 2012 (292,118 units).

Lifting of the diesel ban in Delhi-NCR, festive season demand and the better-than-expected monsoon across the country gave a fillip to overall numbers. The stronger festive demand has come on the back of the payouts of the Seventh Pay Commission, a marked improvement in consumer buying trends from rural India, following a good monsoon season, new models and a high level of discounting on older models.

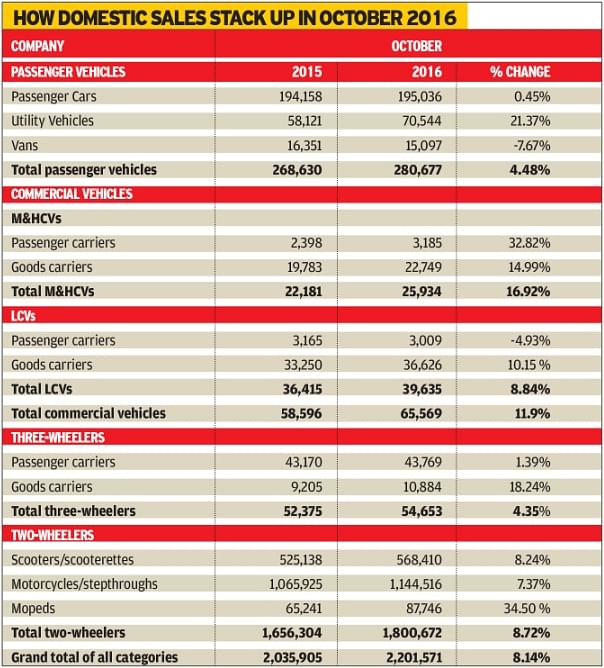

According to data released by the Society of Indian Automobile Manufacturers (SIAM) today, domestic PV sales last month stood at 280,677 units (up 4.4 percent) as against 268,630 units in October 2015. Even as sales growth was muted when compared YoY, the industry has expanded significantly as PV sales had seen a bumper month in October 2015 as well. So far in 2016, the previous best sales performance was reported in August when the segment clocked sales of 258,722 units.

Yet again powering PV sales during the month was the UV segment which grew by 21.4 percent to 70,544 units. The strong UV sales helped offset the muted performance by vans (15,097 units), which fell 7.7 percent and passenger cars (195,036 units), which remained flat.

CV sales in growth mode after 3-month decline

October also saw a strong recovery in CVs, which had declined for three consecutive months earlier. CV sales rose nearly 12 percent to 65,569 units, thanks to a resurgent demand in the M&HCV segment, complemented by a double-digit growth in LCVs during the month.

M&HCV sales had contracted over the last three months as fleet owners had delayed purchasing decisions. Demand for M&HCVs last month saw an improvement across various sectors including construction, auto logistics, cement, petroleum products and FMCG / consumer durables segments. Lead players Tata Motors and Ashok Leyland have both witnessed strong growth in their M&HCV numbers. After recording consistent growth for almost two years, both OEMs has seen M&HCVs sales dip in July, August and September as a result of slackening replacement demand and hampered movement due to monsoon in parts of the country.

Sales surge in two-wheelers

Strong momentum was also seen in the two-wheeler segment with scooters and motorcycles growing by 8 percent and 7.5 percent respectively. Like the passenger vehicle industry, the two-wheeler industry too also saw a sales surge following a good monsoon, return of demand from the rural markets, and release of funds from the Seventh Pay Commission. Overall sales in the two-wheeler segment stood at 1,800,672 units up 8.7 percent.

The overall industry sales expanded by over 8 percent to 2,201,571 units in the month, with all sub-segments including three-wheelers reporting positive growth during the month.

How April-October 2016 domestic sales stack up

If the sales in the domestic market for the first seven months of FY2016-17 are anything to go by, then the automobile industry seems to be in good nick, albeit the recent demoniterisation of Rs 500 and Rs 1,000 notes could see an impact on two wheeler and small CV sales in rural India.

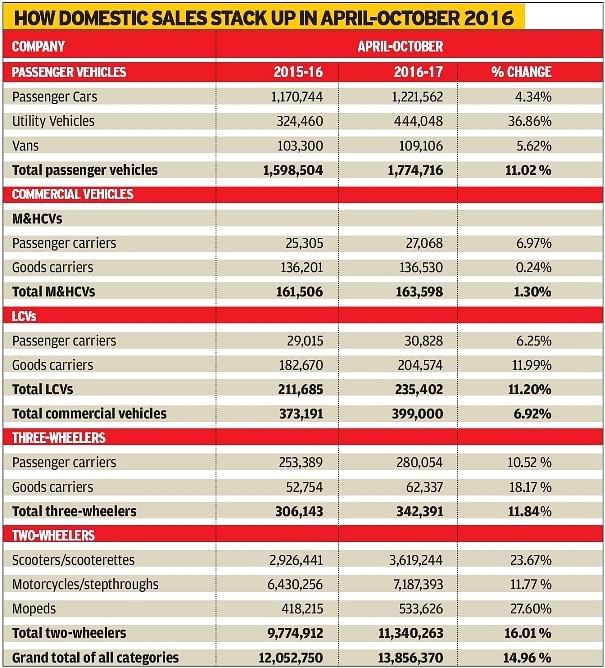

PV sales grew by 11.02 percent in April-October 2016 to 1,221,562 units. Within the PV segment, passenger cars, UVs and vans grew by 4.34 percent, 36.86 percent and 5.62 percent respectively during April-October 2016 over the same period last year.

The overall CV segment registered growth of 6.92 percent in April-October 2016, thanks to growth returning to Medium & Heavy Commercial Vehicles (M&HCVs) after three months of declining sales. While M&HCV sales rose by 1.30 percent to 163,598 units, sales of Light Commercial Vehicles grew by 11.20 percent during April-October 2016 to 235,402 units.

Three-wheeler sales grew by 11.84 percent in April-October 2016 to 342,391 units. Passenger and goods carrier sales grew by 10.52 percent and 18.17 percent respectively in April-October 2016 over April-October 2015.

Two-wheeler sales continued to see momentum and registered growth of 16.01 percent during April-October 2016. Scooter, motorcycle and moped sales grew by 23.67 percent, 11.77 percent and 27.60 percent respectively in April-October 2016 over April-October 2015.

Exports down by 9.27 percent

If there is a concern, then it is to down with overseas shipments of vehicles from India. Overall automobile exports declined by (-) 9.27 percent. While PVs and CVs exports registered a growth of 15.16 percent and 12.31 percent, exports of three-wheelers and two-wheelers fell sharply by (-) 36.24 percent and (-) 11.28 percent respectively in April-October 2016 over April-October 2015.

Recommended:

- India Sales Outlook: PVs to clock double-digit growth in FY2017

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

By Shourya Harwani

By Shourya Harwani

10 Nov 2016

10 Nov 2016

8620 Views

8620 Views

Ajit Dalvi

Ajit Dalvi