Passenger vehicle exports scale a new high in FY2017, sustain drive for Ford, Nissan, VW and GM

While Hyundai, Maruti Suzuki and Nissan saw marginal growth, Ford, Volkswagen and GM saw growing demand for their made-in-India vehicles. Ford has, in fact, sailed past Maruti Suzuki India to take the No. 2 export player slot.

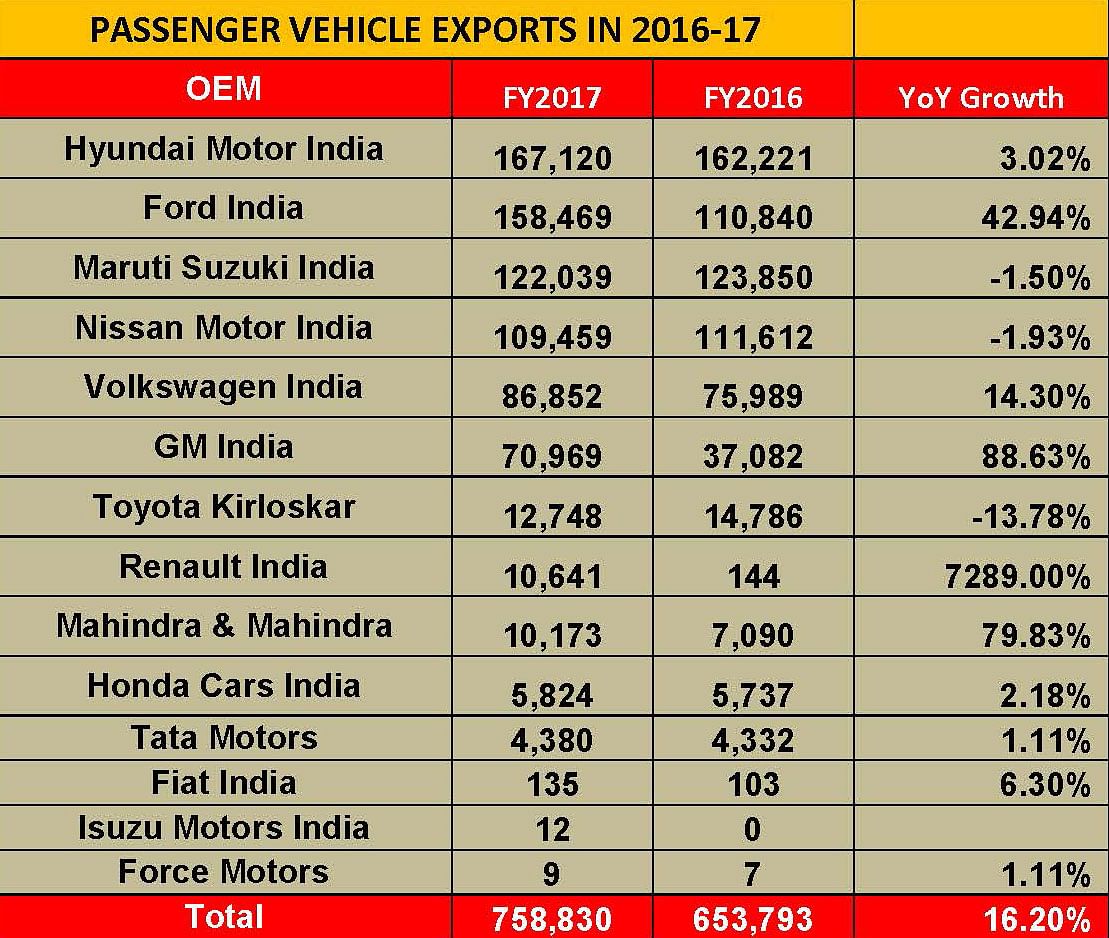

Even as sales of passenger vehicles in the domestic market for the just-ended FY2016-17 have crossed the 3-million mark for the first time – 3,046,727 units (+9.23%) – passenger vehicle exports too have notched their best-ever numbers. At 758,830 units shipped out of India, the PV industry has recorded 16.20 percent year-on-year export growth, the only vehicle segment to have registered double-digit growth in the last fiscal.

While India is fast developing as a hub for small car manufacturing, it is also evolving into a major export hub for small cars wherein Hyundai leads as the largest car exporter from India. Contributory factors to the fast-growing small car exports is an abundance of skilled labour force, low cost of manufacturing compared to global markets and upskilling of the supply chain that can now meet international quality standards. Also, as India enters into more Free Trade Agreements with global powers, additional new markets are set to be opened up that will offer a vista of new opportunities for the passenger vehicle industry.

Exported vehicle data, released by apex industry body SIAM, facilitates analysis of all the automakers who ship their products overseas. While there are a couple of upsets in the top 5 positions, the numbers also reveal how some newly launched models have frimly entrenched themsleves on the export firmament and also acted helped reduce the impact of slowing demand for some existing models.

TOP 5 PASSENGER VEHICLE EXPORTERS IN 2016-17

A close look at the FY2017 export numbers (depicted above) reveals that while Hyundai Motor India remains the county’s largest PV exporter at 167,120 units, Ford India has jumped two spots from fourth position in FY2016 to No. 2 position in FY2017 with 158,469 units, unseating Maruti Suzuki India to third place.

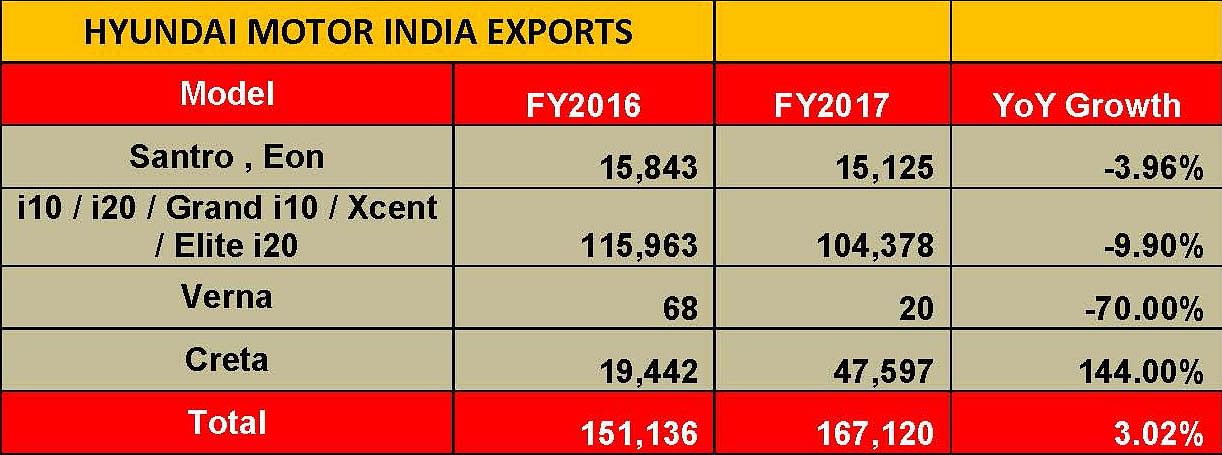

Hyundai Motor India currently exports its vehicles to 87 countries worldwide The models being exported are the Eon, Grand i10, Xcent, Elite i20, i20 Active hatchbacks and the Creta SUV. The key global markets for the company are:

Latin America: Mexico, Chile , Peru, Panama

Africa & Middle East: South Africa, Algeria, Tunisia

Asia Pacific: Philippines, Nepal

According to a company spokesperson, “All cars that are exported from our plant are customised as per market requirement in the destination country on the basis of safety features, design, government regulations and customer demand.”

As regards the company’s export outlook for FY2017-18, the spokesperson said: “We have retained our exports lead for the last 13 years and made our brand synonymous with global customers’ aspirations. Our made-in-India products meet the quality standards conforming to the global benchmarks. Among the new models, the new Grand i10, Creta and Xcent are high in demand and have garnered positive reviews across the world markets. HMI is currently exporting to bigger markets like Africa, Middle East, Latin America and Asia. We will continue to search newer global markets for our products in future.”

A glance at the Korean carmaker's exports in FY2016-17 reveals that surging exports of the Creta have helped overall numbers. Thanks to the 144 percent growth to 47,597 units, the Creta has helped buffer the reduced offtake in the other export models.

The surge in Ford India’s export numbers has come about thanks to the growing demand from overseas markets for the made-in-Chennai new Figo, which is sold as the Ka+ in the UK and Europe. The new Figo gave a fillip to Ford’s exports in end-July when it started shipments to European countries.

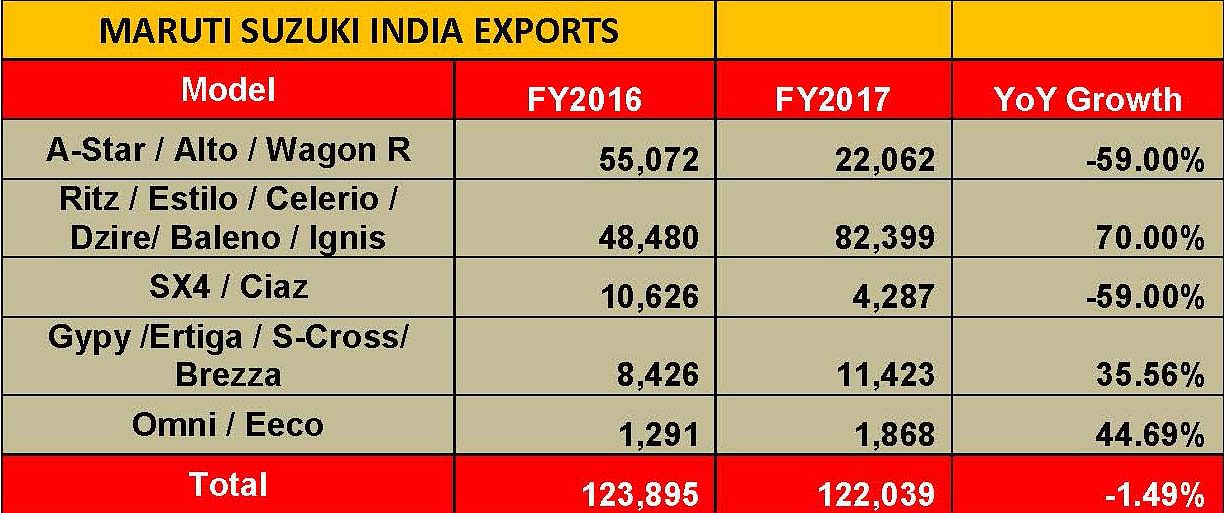

If Maruti Suzuki India has dropped one slot to No. 3, that’s because of capacity constraints and having to meet huge demand in the domestic market, particularly for the Baleno hatchback and the Vitara Brezza compact SUV.

The country's largest carmaker exported a total of 122,039 units, down 1.50 percent (FY2016: 123,850). The Baleno and the Vitara Brezza, like they have in the domestic market, have helped drive export volumes for the carmaker. The Baleno, which became the first made-in-India Maruti car to be exported to Japan, also saw export demand in Europe where it went on sale last year.

Nissan Motor India, which has dropped from No. 3 position in FY2016 to No. 4 in FY2017, has had to contend with slowing exports what with the Japanese carmaker’s new Micra to be made for European markets at its UK operation. Volkswagen India retains its No. 5 position from FY2017.

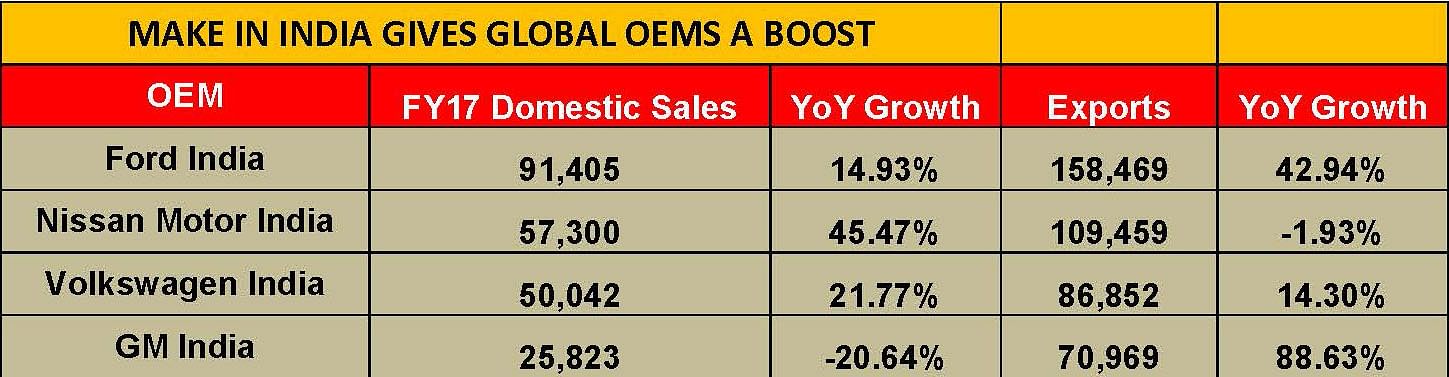

MAKE IN INDIA HELPS SUSTAIN DRIVE FOR FORD, NISSAN, VOLKSWAGEN AND GM

What is giving global carmakers like Ford, Nissan, Volkswagen and GM an impetus in their India operations is their rising exports, helping them utilise their sizeable manufacturing capacity. Each of these four OEMs have shipped more vehicles abroad than they have sold in the domestic market, which is indicative of the strong role exports are playing for them (see detailed table above). Cumulatively, they exported a total of 425,749 units in FY2017, which is a good 56 percent of the overall PV exports of 758,830 units.

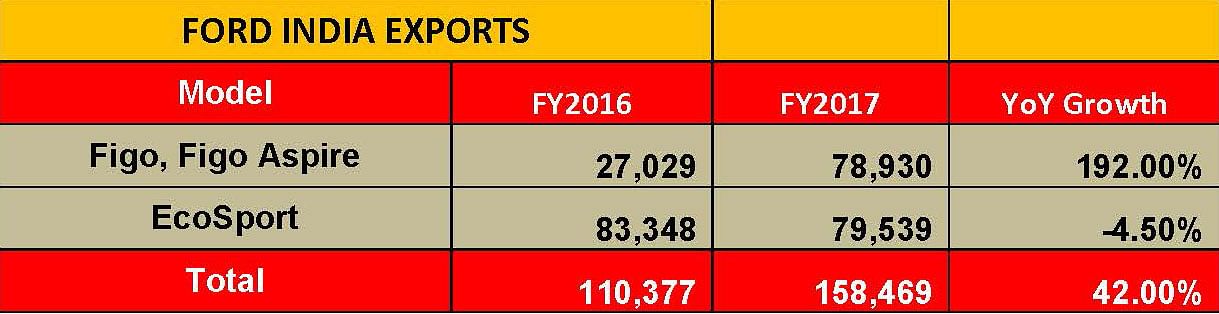

Ford India’s rise in the export rankings comes about mainly due to the handsome demand for the new Figo in Europe where the hatchback is exported and went on sale last year as the Ka+. Export numbers of the made-in-Chennai hatchback rose from 27,029 units FY2016 to 78,930 units in FY2017, up 192 percent YoY. They also helped buffer slowing sales of the Ecosport SUV which saw despatches of 79,539 units in FY2017, down 4.5 percent YoY (FY2016: 83,348).

For Nissan Motor India, which in March this year, notched a milestone of having exported 700,000 cars since it began export operations seven years ago, sales dipped 1.92 percent YoY to 109,459 units (FY2016: 111,612). Slowing sales of the Micra have impacted numbers. In the hatchback segment (Nissan Micra, Datsun Go and Redigo), it exported a total of 76,435 units, down 4.9 percent YoY (FY2016: 80,433). Export growth of the Sunny sedan was marginal – 1.28 percent at 31,425 units (FY2016: 31,027). What helped Nissan was demand for the Go+ MPV which, together with the Evalia MPV and Terrano SUV), sold 1,599 units, up 951 percent YoY albeit on a low base of 152 units in FY2016.

Volkswagen India has, for long, been benefiting from its make in India growth strategy. The German major exports cars from its Pune plant to over 35 countries across the four continents of Asia, Africa, North America and South America. Mexico continues to be its biggest export market, contributing over 80 percent of its overseas volumes. The range of cars being exported includes left-hand drive as well as right-hand drive Polo and Vento cars. In FY2017, the company shipped a total of 86,852 units from India, registering 14.30 percent YoY growth.

While demand for the Polo hatchback grew 19.33 percent to 15,313 units, a total of 71,539 sedans, comprising the Vento and Ameo, were exported.

For GM India, which is all set to shut down its Halol, Gujarat plant from April 28, exports have helped keep its Talegaon plant running.After failing to ignite much interest for its cars in the domestic market, the American carmaker had some time ago shifted its focus on exports to better utilise the manufacturing capacity investments made in the country. The strategy has reaped benefits as the Chevrolet Beat, which is sold as the Spark in many countries globally, has become one of the most exported cars from the country in 2016-17.

GM India, which produces the left-hand-drive Chevrolet Beat at its Talegaon, Pune plant, exports the car to many markets including Mexico, Chile, Peru, Central American and Caribbean countries, Uruguay and Argentina. In FY2017, the company exported 70,969 units, an 88 percent YoY growth.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Autocar Professional Bureau

By Autocar Professional Bureau

17 Apr 2017

17 Apr 2017

12626 Views

12626 Views

Ajit Dalvi

Ajit Dalvi