October sees CV sales revive but record high diesel prices could spoil rally

At 61,609 units, October sales up 3% YoY but down 10% on September. Continued diesel price rise worrying.

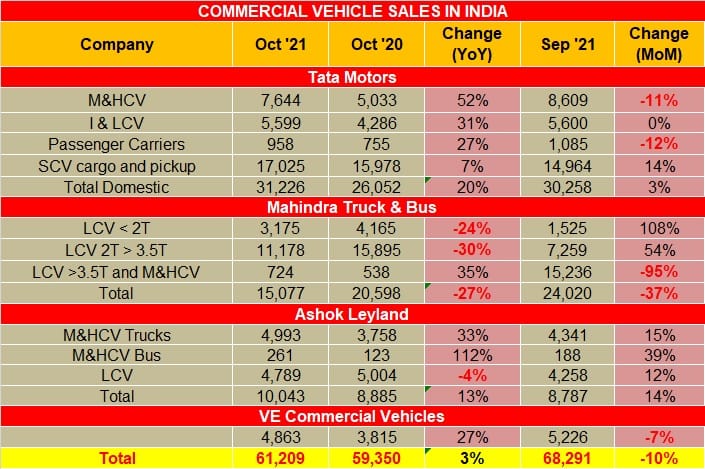

Finally there is light in the tunnel for the burgeoned commercial vehicle sector or is it a temporary spurt? It is a difficult question to answer for most OEMs, but each one is hoping that the sales recovery is part of the sustained recovery in the CV segment. For the month of October, overall wholesales were 61,209 units (October 2020: 59,350 units) which was 3 percent better YoY, but 10 percent lower compared to September 2021.

What’s interesting to note is that while the sales in the M&HCV segment are plodding their way upwards, the small CV segment continues to witness healthy market momentum. In addition to the challenge of semiconductor shortage on the supply side, on the demand side the M&HCV segment is seeing that while big customers are upgrading their fleets, retail customers (with demand for one or two trucks) continue to face challenges in terms of finance availability, which is seen as a cause of concern for OEMs.

In October CV market leader Tata Motors reported YoY growth of 20 percent with sales of 31,226 CVs including 7,664 M&HCVs, 5,599 I&LCVs, 958 passenger carriers and 17,025 cargo SCVs and pickups. The OEM says it is focusing to unlock the supply bottlenecks by working proactively with its vendor partners. The focus for the CV segment remains growing its market share (SCV in particular) and protecting margins amidst an inflationary environment. The company recently launched 21 new CVs, as it expects strong revival in the second half of FY2022.

Girish Wagh, executive director, Tata Motors said: “During the quarter, we accelerated the sales momentum to increase market share in every segment of commercial vehicles. Looking ahead, we expect the demand for commercial to remain strong even as concerns about the supply of semiconductors and high input costs continue. We are taking definitive actions in the near term to mitigate these effects through an agile, multi-pronged approach to address supply bottlenecks and drive our savings program harder. In parallel, we continue to progress our future-fit initiatives of transforming customer experience digitally and strengthening our lead in sustainable mobility.”

Mahindra & Mahindra, which has been one of the most severely impacted because of semiconductor shortage, reported wholesales in the red. The company sold 15,077 CVs (-27% YoY) compared to 20,598 units for the same period last year. In terms of MoM sales was down 37%.

With re-opening of offices, growth in infrastructure projects, Chennai-based Ashok Leyland witnessed a growth of 13% year-on-year. The company sold 10,043 CVs, which includes 4,993 M&HCVs, 261 buses and 4,789 LCVs.

VE Commercial Vehicles, which recently launched new coach and sleeper buses, targeting the mid-premium segment saw a growth of 27% YoY, selling 4,863 CVs. On the other hand, sales was down 7% compared to September 2021, where the company sold 5,226 CVs.

Growth outlook in a time of record high diesel prices

Even as the CV industry is beginning to feel the first wave of return of demand, there is a new demon: high-priced diesel. In the month of October alone, the price of diesel rose sharply by Rs 8.78 a litre or 9% in Mumbai to high a record high of Rs 106.62 on November 1 in Mumbai. Diesel had crossed the Rs 100-a-litre mark on October 9, taking 21 days more to hit the current price.

This unabated price rise in diesel is palying havoc with CV and fleet operators' profitability. The TCO – Total Cost Of Ownership – formula is being hit for a six. Already badly impacted by the 28-month Covid-induced downturn and just when business is beginning to see an uptick, owners of medium and heavy commercial vehicles (M&HCVs) or even small CVs will be compelled to rejig their business models. For instance, a 37-tonner Tata truck like the LPT 3718 has a 400-litre tank. In April 2020, a full tank of diesel would have cost the owner Rs 26,076 in Mumbai. On November 1, 2021, the truck owner has had to pay Rs 42,648 for the same quantity of diesel – Rs 16,572 more – each time the truck is tanked up. Between October 1, 2021 (when diesel cost Rs 97.84 a litre) and November 1 (diesel cost Rs 106.62 a litre), the truck owners has had to pay Rs 3,512 more to travel the same distance.

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

03 Nov 2021

03 Nov 2021

8154 Views

8154 Views

Shahkar Abidi

Shahkar Abidi