Maruti Suzuki set to be No. 1 car and SUV exporter for fourth fiscal in a row

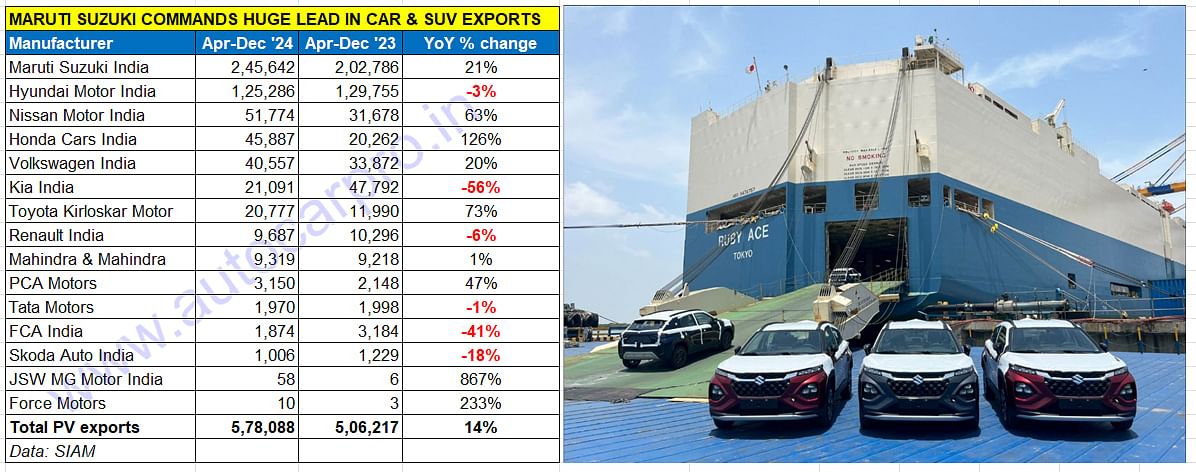

With overseas shipments of 245,642 vehicles, a 140% increase in demand for its UVs and a 43% export market share in April-December 2024, Maruti Suzuki India is 120,356 units ahead of Hyundai and well set to retain the passenger vehicle exporter crown in FY2025, having already done so for the past three fiscals.

Nine months into the current fiscal year, the India automobile export growth story is in good nick. As per the latest SIAM industry export data, India Auto Inc has shipped a total of 39,30,793 vehicles overseas, which makes for a strong increase of 18% YoY (April-December 2023: 33,32,477 units).

Of this, the passenger vehicle industry accounts for a 14.70% share – the 578,088 PVs exported are up 14% YoY (April-December 2023: 506,217 units). This total is already 86% of FY2024’s total exports of 672,105 units. The PV exports in April-December 2024 comprise 312,850 hatchbacks and sedans (down 5.3%), 258,867 UVs (up 52%) and 6,371 vans (up 8.5%).

If the PV industry maintains the same growth trajectory in January-March 2025, exports could scale a new high in FY2025 to go ahead of the 758,830 units in FY2017.

If the PV industry maintains the same growth trajectory in January-March 2025, exports could scale a new high in FY2025 to go ahead of the 758,830 units in FY2017.

Leading the Made-in-India export vehicle charge is the PV market leader Maruti Suzuki India. Between April and December 2024, the company has shipped 245,642 vehicles, up 21% YoY (April-December 2023: 202,786). This is already 87.50% of its record export sales of 280,712 units in FY2024 and ensures that the car, SUV and MPV manufacturer is well set to retain the title of ‘India’s top PV exporter’ for the fourth fiscal year in a row. If it maintains the same growth rate, Maruti Suzuki, which currently has a 43% PV export market share, could end FY2025 with best-ever exports in the region of 325,000 units.

Maruti Suzuki’s exports comprise 1,21,286 cars (down 18% YoY), 118,264 UVs (up 140% YoY) and 6,092 vans (up 9% YoY).

Maruti Suzuki exported 118,264 UVs (up 140%) which account for 48% of the 245,642 PVs in April-December 2024. While the Grand Vitara (above left) is seeing good demand, Fronx exports to Japan have given new charge.

Maruti Suzuki exported 118,264 UVs (up 140%) which account for 48% of the 245,642 PVs in April-December 2024. While the Grand Vitara (above left) is seeing good demand, Fronx exports to Japan have given new charge.

The company, which exports to nearly 100 countries and sees Africa, Latin America, Asia and the Middle East are its key markets, currently exports 18 models with the Fronx being the latest to join the export portfolio. clearly establishing their similar importance both in the domestic and export markets for the company. Maruti Suzuki exported 118,264 UVs (up 140%) which account for 48% of the 245,642 PVs in April-December 2024.

What has added tailwinds to SUV exports is the kicking off of overseas shipments of the Grand Vitara and, from August 2024, of the Fronx compact SUV which has gone on sale in in Japan. The made-in-India Suzuki Fronx has received a strong market response in Japan and currently has bookings of 15,000 units and a three-month waiting period.

Other Maruti models with high export demand include the Brezza SUV, Dzire sedan, and the Swift, S-Presso and Baleno hatchbacks.

Hyundai Motor India, with exports of 125,286 units, sees a YoY decline of 3% (April-December 2023: 129,755). The company, which lost the top exporter title to Maruti Suzuki in FY2022, has been stretched for manufacturing capacity and has focused on catering to demand in the domestic market. In FY2024, the company’s manufacturing plants in Chennai operated at 97.10% of its total capacity. With additional capacity coming its way with the acquisition of GM India’s Talegaon plant, which is expected to commence commercial operations partly in the second half of FY2026, Hyundai will be better placed to cater to exports in the coming years.

Hyundai’s top PV exports included i10 and i20 hatchbacks and Aura sedan (63,102 units, down 3%), the new sixth-generation Verna sedan (39,787 units, down 5%), Venue and Exter SUVs (12,758 units, up 20%), flagship Alcazar SUV (6,763 units, down 22%) and the Creta SUV (2,876 units, down 12%).

Nissan Motor India, which was ranked No. 4 in H1 FY2025, has moved up one rank with exports of 51,774 units, up 63% YoY. The Sunny sedan continues to be its top export model with 41,544 units, (up 61%), followed by the Magnite SUV (10,230 units, up 75% YoY). Nissan’s export performance is better than in the domestic market where it has sold 20,665 units in April-December 2024.

With export of 33,506 WR-Vs (the made-in-India Elevate), Honda is the second-highest UV exporter after Maruti Suzuki in the first nine months of FY2025.

With export of 33,506 WR-Vs (the made-in-India Elevate), Honda is the second-highest UV exporter after Maruti Suzuki in the first nine months of FY2025.

Honda Cars India, the No. 5 in H1 FY2024, is now No. 4 with exports of 45,887 units, up 126%. These comprise 841 units of the Amaze, 11,540 City sedans (down 39%) and 33,506 Elevate SUVs. The Japanese carmaker, which is back in the SUV game with the Elevate, has received a huge boost with exports of the made-in-India WR-V (the rebadged Elevate SUV). With export of 33,506 WR-Vs (the made-in-India Elevate), Honda is the second-highest UV exporter after Maruti Suzuki in the first nine months of FY2025. Nine months into FY2025, the Elevate accounts for 73% of Honda’s exports.

Volkswagen India, which witnessed strong export demand in FY2024 (44,180 units), and was ranked No. 3 in H1 FY2025, has dropped three ranks to be the current No. 6. The company has shipped 40,557 cars and SUVs in April-December 2024, up 20% and is only 3,623 units shy of its FY2024 exports. Leading the charge for the German carmaker is the made-in-India Virtus global sedan with 28,460 units, up 15%, and the Taigun midsize SUV with 12,097 units, up 32%. Both the models are built on VW’s MQB-AO-IN platform (as are Skoda Auto India’s Slavia sedan and Kushaq SUV).

Kia India, which was the No. 3 PV exporter in FY2024 (52,105 units, down 39%), is now down to No. 6 position in April-December 2024. The 21,091 units constitute a sharp 56% YoY decline (April-December 2023: 47,792units). Numbers have been dragged down because of the YoY decline in its top two export models – the Sonet (10,467 units, down 65%) and Seltos (4,201 units, down 63%). The Carens MPV, however, has bucked the trend with shipments of 6,423 units, up 3% YoY.

Toyota Kirloskar Motor, which has increased production capacity at its plants in Bidadi, Karnataka, retains its seventh ranking (as of FY2024) in the first nine months of FY2025 with 20,777 units, up 73% YoY (April-December 2023: 8,264). The export model driving the charge is the Urban Cruiser Hyryder midsize SUV.

WILL CAR AND SUV EXPORTS IN FY2025 SCALE A NEW HIGH?

Given that FY2024 exports at 672,105 units were up just 1.4% YoY, India Passenger Vehicle Inc’s total overseas shipments of 578,088 units in the first nine months of FY2025 are already 88% of that total and 94,017 units away from surpassing that number.

India PV Inc's best-ever export year was FY2017 when a total of 758,830 units were shipped overseas (with Hyundai Motor India, Maruti Suzuki and Nissan Motor India leading the charge). PV exports had slid to their lowest level – 404,400 units – in the past 10 years in FY2021.

If the top car and SUV exporters led by Maruti Suzuki maintain the same growth trajectory they have registered in the past nine months in the January-March 2025 period, the industry just might see PV exports drive near the record FY2017 export total or maybe even surpass it.

ALSO READ: India to be export hub for EVs for Suzuki: SMC President Toshihiro Suzuki

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

17 Jan 2025

17 Jan 2025

11988 Views

11988 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau