Maruti Suzuki achieves highest ever domestic and export sales in FY2024

The bellwether of the Indian passenger vehicle industry registers best-ever domestic market sales of 1.75 million units and overseas shipments of 283,067 units. Utility vehicle share in PV sales jumps from 23% in FY2023 to 36% in FY2024, helps buffer slowdown in demand for passenger cars.

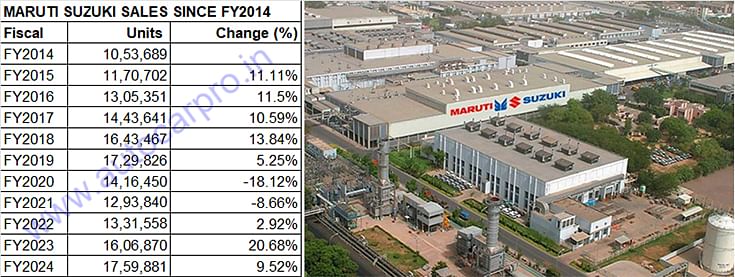

FY2024 is slated to be the best-ever year for the Indian passenger vehicle industry with total wholesales of around 4.25 million units, recording 9% year-on-year growth. Fittingly enough, Maruti Suzuki India, the bellwether of the industry, has reported its best-ever fiscal year dispatches of 1,759,881 or 1.75 million units, up 10% on the 1.60 million units it sold in the domestic market in FY2023.

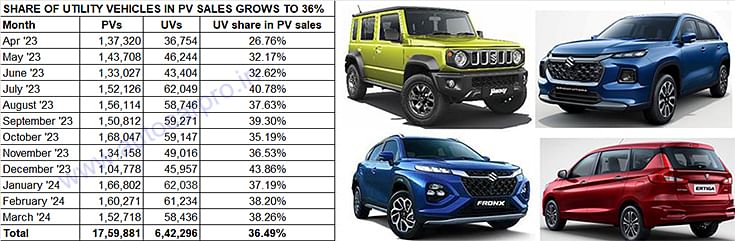

Maruti Suzuki sold 642,296 UVs in FY2024, registering handsome 75% growth and also buffering the decline in sales in hatchbacks and sole sedan.

Maruti Suzuki sold 642,296 UVs in FY2024, registering handsome 75% growth and also buffering the decline in sales in hatchbacks and sole sedan.

Providing the sales charge, as it has been for the entire fiscal, has been the company’s SUV and MPV range. The eight-model utility vehicle (UV) portfolio, comprising the Brezza, Grand Vitara, Fronx, Jimny, S-Cross, XL6, Ertiga and the new Invicto, has helped buffer the decline in overall sales of hatchbacks and sedans.

For the past year or so, utility vehicles – SUVs and MPVs – have transformed into the firm growth driver for Maruti Suzuki, offsetting the sharp 39% sales decline in Alto-S-Presso sales as well as the 4% YoY decline in demand for the seven-car group of the Baleno, Wagon R, Swift, Dzire, Tour S and Ignis. The company’s total UV sales of 642,296 units in FY2024 are a handsome 75% increase – an additional 276,167 units YoY – over FY2023’s UV sales of 366,129 units.

To place the data into perspective, Maruti Suzuki’s UV sales in FY2024 alone are more than the FY2024 sales of some of the major car and SUV OEMs in India – Hyundai Motor India (614,721 units), Tata Motors (570,955 units), Mahindra & Mahindra (459,877 units) and Toyota Kirloskar Motor (244,940 units).

From the 23% share of PV sales in FY2023 (366,129 UVs in 1.60 million PVs), the UV penetration in PV sales has jumped to 36.49% in FY2024.

UV share of PV sales grows from 23% in FY2023 to 36% in FY2024

The increasing weightage of UVs in Maruti Suzuki’s overall passenger vehicle sales is clearly seen in the numbers. Between FY2023 to FY2024, there is a 13-percentage basis point increase in UV penetration level – from the 23% in FY2023 (366,129 UVs in 1.60 million PVs), the UV share of PV sales has jumped to 36.49% in FY2024 (642,296 UVs in 1.75 million PVs).

With UVs estimated to account for over 55% total PV market in FY2024, MSIL's total UV market share would have increased from 11% in FY2023 to 22% in FY2024. “This is a healthy sign for us, and a resultant of the company's growing market share, which was pegged at nearly 42% by end-FY2024,” said Shashank Srivastava, Executive Committee Member, MSIL, at a press briefing in New Delhi today.

However, the company missed its 25% FY2024 SUV market share target by a slight margin. According to Srivastava, “SUV share is critical for us to achieve our overall objective of reaching 50% overall market share. At 22% in FY2024, our SUV market share is lower, and it is one area where we need to push up our game,” he added, while mentioning that some of the company’s latest introductions such as the Fronx and Grand Vitara have been well received by the market.

Maruti Suzuki's sales in rural India rose by 11% in FY2024 to 787,000, better than the 7% sales recorded in urban India.

Maruti Suzuki's sales in rural India rose by 11% in FY2024 to 787,000, better than the 7% sales recorded in urban India.

Meanwhile, MSIL’s rural India volumes in FY2024 were pegged at 787,000 units, registering 11% YoY growth compared to 7% growth for the urban market. “Government investments in infrastructure for rural areas, as well as rising income levels, along with the positive sentiments owing to a normal monsoon have been the key factors driving rural growth in FY24,” Srivastava explained.“Considering the industry’s overall volume growth was pegged at 8.5 percent in FY24, the urban growth at 7 percent is quite good,” he pointed out.

Nexa sells over half-a-million units, record 52% growth

MSIL’s premium retail channel – Nexa – breached the 500,000-unit mark for the first time in FY24, and registered a 52% YoY growth last year. The company also revealed that of top 10 models retailed in FY2024, six models are from Maruti Suzuki, and out of the top 15 models, the Top 10 belonged to MSIL, with an average of around 100,000 units in FY2024.

The company revealed that its current order book stands at 198,000 units, with the Ertiga MPV commanding the highest waiting period of up to 4.5 months, and an order backlog of around 70,000 units.

Exports scale new high, Maruti Suzuki leads for third consecutive year

Maruti Suzuki India remains the PV export market leader for the third year in a row. In FY2024, the company shipped a total of 283,067 units, which is an 11% increase over FY2023’s 255,439 units. FY2022 exports were 235,670 units.

RELATED ARTICLES

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

01 Apr 2024

01 Apr 2024

15854 Views

15854 Views

Ajit Dalvi

Ajit Dalvi