Kia, Hyundai and Tata grab UV market share, Maruti and Mahindra feel the heat in FY2021

Surging demand for the Seltos, Creta and Nexon helps OEMs increase market share; Kia takes No. 3 position from M&M in a year fraught with many challenges.

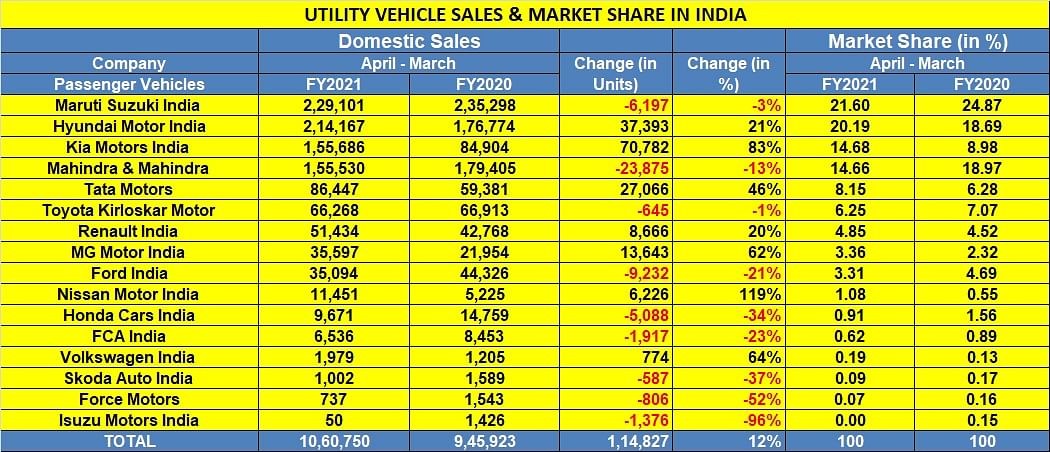

In the competitive marketplace that India is and especially in the booming utility vehicle space, they say it is the SUV-ival of the fittest. So, even as the UV vehicle market with 10,60,750 units (12.13%) was the star performer among all vehicle segments – driving past the million-sales landmark for the first time ever – and the sole one to enter positive sales territory, there is an intense battle underway among OEMs to grow market share. Some number-crunching reveals interesting insights.

Maruti Suzuki and M&M see their UV share decline

While Maruti Suzuki India remained the UV market leader in FY2021 with 229,101 units, its UV market share has dropped from 24.87% in FY2020 to 21.60% in FY2021. These sales came from the Vitara Brezza, Urban Cruiser and Gypsy (97,414), Ertiga and S-Cross (105,855) and the XL6 (25,832).

Nonetheless, it is a very creditable performance from the company, considering that it moved out of the diesel market in April 2020 and has since focussed on selling only petrol- and CNG-powered vehicles.

Hyundai Motor India, the No. 2 with 214,167 UVs sold in FY2021 increased its market share to 20.10% from 18.69% in FY2020. The new Creta, with 120,035 units or 56% of total Hyundai UV sales, is the biggest contributor, followed by the Venue with 92,972 units or 43%. The Kona EV and Tucson make up the rest with 1,160 units.

Kia Motors India, which has been on a roll in the market, sold a total of 155,686 units in FY2021, notching handsome 83% YoY growth and substantially increasing its UV market share to 14.68% from 8.98% a year ago. The Seltos, Kia’s vehicle of entry into India, remains its best-seller with 89,173 units, followed by the Sonet with 63,717 units and the Carnival MPV with 2,796 units. Kia’s strong performance means it has unseated Mahindra & Mahindra from the No. 3 position, breasting ahead by a mere 156 units.

Mahindra & Mahindra, now at No. 4 position, sold a total of 155,530 units, down 13% (FY2020: 179,405). This meant that the SUV maker’s market share has fallen from nearly 19% in FY2020 to 14.66% in FY2021. At 4.31 percentage points, this is the biggest drop followed by Maruti Suzuki with 3.27 percentage points. But the recently launched new Thar is giving M&M a new charge in the market and FY2022 should be different story what with the company planning new product rollouts.

A resurgent Tata Motors, which clocked 60% YoY growth in its PV business, sold a total of 86,447 units in FY2021, up 46% (FY2020: 59,381), enough to see its UV market share increase to 8.15% from 6.28% in FY2020. The popular Nexon compact SUV was the best-seller with 63,756 units or 74% of total sales, followed by the combine of the Harrier, Safari and Sumo with 22,691 units.

Toyota Kirloskar Motor, which had a decent outing with 66,268 units, saw its UV market share grow to 7.07% from 6.25% a year ago. The Innova Crysta MPV, with 37,934 units, was its best-seller followed by the Urban Cruiser with 16,316 units. The remaining 12,018 units were contributed by the Fortuner,Land Cruiser,Prado and Vellfire.

Meanwhile, Renault India, MG Motor India and Nissan Motor India are benefiting from their new products. Renault India, which sold 51,434 UVs, recorded 20% YoY growth in FY2021. Its growth has been powered by the Triber and more recently the Kiger compact SUV. MG Motor India, with 35,597 units, clocked 62% YoY growth (FY2020: 21,954). Leading the charge for MG Motor India is the Hector with 31,585 units, followed by the recently launched Gloster (2,513) and ZS EV (1,499). For Nissan, the recently launched Magnite is helping revive fortunes. The Japanese carmaker sold a total of 11,451 UVs in FY2021, improving its year-ago performance by 119% albeit on a low base.

Growth outlook

Expect FY2022 to be a year when there will be a glut of SUVs rolling into the market. Having an SUV or two in your PV arsenal is a must if an OEM has to succeed in India and that’s just what is happening. Demand for sub-four-metre compact SUVs seems insatiable and OEMs are going all out to introduce new products. The coming months will see a number of new models getting introduced including the likes of Mahindra’s new XUV700, Skoda’s Kushaq, Volkswagen’s Taigun and Hyundai's Alcazar.

Tata Motors is aggressively driving its growth plan and Korean carmakers Hyundai and Kia, who between them have 34.87% of the UV market, will be looking to further up the SUV ante. Any which way you see it, it’s an exciting time for the segment. Stay tuned.

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

14 Apr 2021

14 Apr 2021

23592 Views

23592 Views

Ajit Dalvi

Ajit Dalvi