July wholesales up 11% as OEMs gear up for festive season

PV OEMs’ dealer supplies driven by surging demand for UVs; 3-wheeler market gets EV boost; 2-wheeler makers banking on return of demand for scooters and entry-level bikes.

The July 2022 wholesales numbers for three vehicle segments – passenger vehicles, three- and two-wheelers – were released by SIAM today. The apex industry body did not reveal the data for commercial vehicles though.

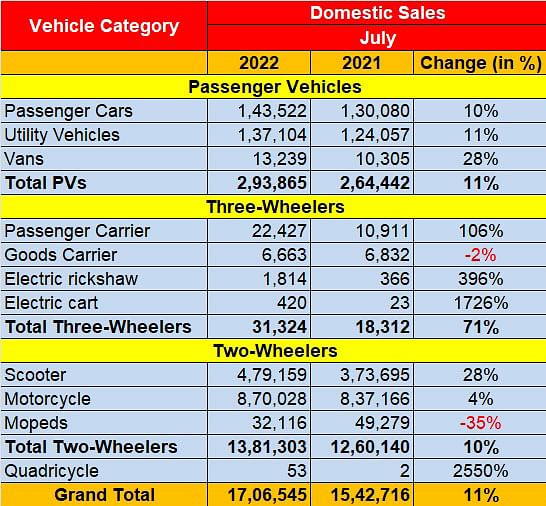

Total wholesales of 17,06,545 units translate into a 10.61% year-on-year increase (July 2021: 15,42,716). While this augurs well for the industry per se and also reflects strong PV and two-wheeler demand for new models, July numbers also indicate OEM readiness for the festive season ahead when new vehicle purchases are the order of the day.

July, which is typically being a lean month for new buys, can be seen to be a month when vehicle manufacturers ramp up deliveries to their showrooms and dealers across the country, to ensure speedy model availability to customers.

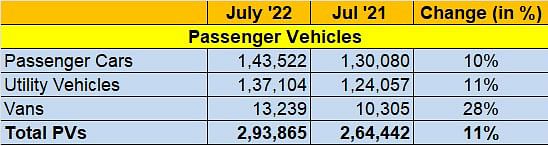

Passenger Vehicles: 293,865 units, up 11%

The PV segment, which is seeing leading players like Maruti Suzuki and Mahindra having sizeable waiting periods for their popular models, saw total despatches of 293,865 units, up 11% (July 2021: 264,442). The 16-OEM total would have easily crossed the 300,000-unit mark albeit Tata Motors does not provide its monthly wholesale numbers to SIAM.

Of total wholesales, cars comprised 143,522 units or 49% while SUVs with 137,104 units had a 46% share, and vans with 13,239 units took 4.50% of the share. Clearly, the supply-demand mismatch in SUVs is evident in the segment’s reduced share, considering for the past year, every second PV sold in India is an SUV. Nonetheless, all three sub-segments – cars (10%), UVs (11%) and vans (28%) – saw YoY growth.

Market leader Maruti Suzuki despatched 142,850 units, accounting for 48.61% of total PV wholesales. While the seven-car lot of the Baleno, Celerio, Dzire, Ignis, Swift, Tour S, Wagon R accounted for 84,818 units (up 20.70%), the entry level duo of the Alto and S-Presso had 20,333 units to their credit (up 3%). Maruti’s overall tally could have been better if not for its inability to put out more supplies of its UVs – the quartet of the Brezza, Ertiga, S-Cross and XL6 added 23,272 units but this is 28% down on year-ago 32,272 units.

Hyundai Motor India sent out 50,500 units last month, up 5%, Three SUVs – the Creta, Venue and Alcazar – accounted for 27,513 units, up 13.75% (July 2021: 24,186). While the Venue was the best-seller with 12,000 units (46%), the Creta’s despatches at 12,625 units were 2.88% down on July 2021’s 13,000. The premium Alcazar with 2,888 units was down 3.7% on the year-ago numbers. It looks like Hyundai too is feeling the heat of slowed supplies of semiconductor chips.

Hyundai’s hatchbacks in the form of the Aura, Elite i20,Grand i10 and i20 contributed 20,894 units to the July 2022 total, down 4.5% (July 2021: 21,880 units)

Mahindra & Mahindra pushed out 28,053 units to its dealers last month, up 33%, indicating that the company is ramping up production and supplies to reduce the sizeable backlog of orders, noqw estimated at over 273,000 with the recent opening of bookings for the Scorpio N. M&M’s despatches included 17,470 units of the Bolero, Thar and XUV300 (up 11%) and 10,293 units between the Scorpio, XUV500, XUV700 and the Marazzo (up 105%)

Kia India has 22,022 units to its credit, up 46% YoY. The Korean carmaker has, in July, increased despatches of all but two of its four products. The Seltos with 8,541 units is up 22%, while the recently launched Carens MPV added 5,978 units. The Sonet with 7,215 units was down 6% on year-ago’s 7,675 units and the Carnival MPV with 288 units is also down 19% YoY.

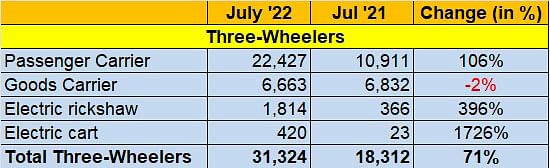

Three-wheelers: 31,324 units, up 71%

With the country and the economy back on the move, offices and schools having re-opened and the e-commerce boom necessitating speedy last-mile deliveries, as a result of low total cost of ownership for fleet operators across city, town and country, the three-wheeler industry is making sizeable gains.

This upward movement can be gleaned from the 31,324 units despatched by OEMs in July 2022, which is a 71% YoY increase over the Covid-pandemic-impacted July 2021’s 18,312 units.

Of the seven manufacturers in this segment, Bajaj Auto with 18,519 units (up 00%, July 2021: 11,039) accounts for 68% of total despatches. This total is split between 15,928 Maxima RE passenger carriers and 2,591 Maxima goods carriers.

At No. 2 position is Piaggio Vehicles with 5,540 units, up 84% (July 2021: 3,009) comprising 3,313 units of the Ape City and Ape Auto passenger rickshaws, and 2,227 units of the Ape Xtra goods carrier (July 2021: 2,214).

Mahindra & Mahindra is in third place with 4,351 units, up 102% on July 2021’s 2,148 units. M&M’s total despatches include 1,493 Alfa Treo passenger carriers, 1,550 units of the e-Alfa Mini and Treo Yaari electric rickshaws, up 406% (July 2021: 306). In the goods carrier segment, there were 1,067 units of the Alfa and Treo and 241 units of the e-Alfa Cargo.

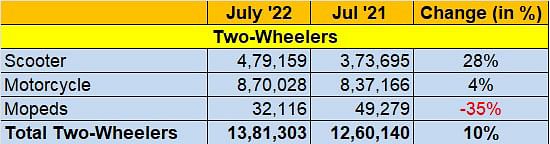

Two-Wheelers: 13,81,303 units / up 10%

The two-wheeler industry is banking on the upcoming festive season to re-start the good times but before that it is looking to amply stock all dealerships. At the end of July 2022, as per dealer body FADA, the inventory for two-wheeler ranges dealers ranged from 20-23 days. In its note FADA had said, “The two-wheeler retail run witnessed poor demand as rural India continues to underperform. This coupled with high inflation, erratic monsoon and high cost of ownership continues to keep bottom-of-the-pyramid customers at bay.”

With the bountiful monsoon across the country, OEMs will be hoping fervently that demand for entry level commuter bikes returns. The cautious optimism is reflective of market leader Hero MotoCorp’s despatches of 430,684 units last month, just 0.34% up on July 2021’s 429,208 units.

No. 2 player, Honda Motorcycle & Scooter India though is banking on the return of demand for scooters and this is seen in its 402,718 units, up 18% (July 2021: 340,420).

TVS Motor Co, in third position, is similarly buoyant with 201,942 units despatched to its dealers across India, up 15% (July 2021: 175,169).

Bajaj Auto, the only other player with six-figure despatches, has 164,384 units in its July 2022 tally, up 5% on the year-ago 156,232 units.

Growth outlook

Commenting on the July 2022 wholesales numbers, Rajesh Menon, Director General, SIAM said “The market for entry level passenger cars, two-wheelers and three-wheelers is yet to recover. Sales of two-wheelers in July 2022 are still below July 2016 numbers and sales of three-wheelers are still below July 2006 numbers. Third hike in a repo-rates in a row, to rein in high inflation, will make auto loans costlier, making it more difficult for entry level vehicles to recover.”

Clearly, India Auto Inc will have a speedier run if demand in the entry level, or affordable, vehicle category returns. But OEMs, which are seeing strong demand in the executive segment and upwards would be looking to ensure they can bag every sale, even as the chip crisis eases.

As per dealer body FADA, at the end of July 2022, average passenger vehicle inventory ranges from 20-25 days while that for two-wheelers ranges from 20-23 days. While the scenario is good for the PV sector, which is having a dream run thanks to the continued and ever-surging wave of demand for SUVs and new models, it remains fingers-crossed when it comes to two-wheelers.

Scooter OEMs though are banking on demand returning from urban India as a result of the economy opening up. A worry remains for the entry-level motorcycle market, which is seeing a prolonged drought of demand, something which a revival of sales from rural India can sort out. The run up to the festive season could see two-wheeler manufacturers offering good discounts, particularly on the entry-level, mass-market models.

Meanwhile, the three-wheeler market is benefiting in a large manner from the fast-growing demand for electric models as also the return of demand for passenger-ferrying rickshaws. In July, electric rickshaws and karts comprised 7.1% of overall 3-wheeler numbers, which is indicative of their growing market share.

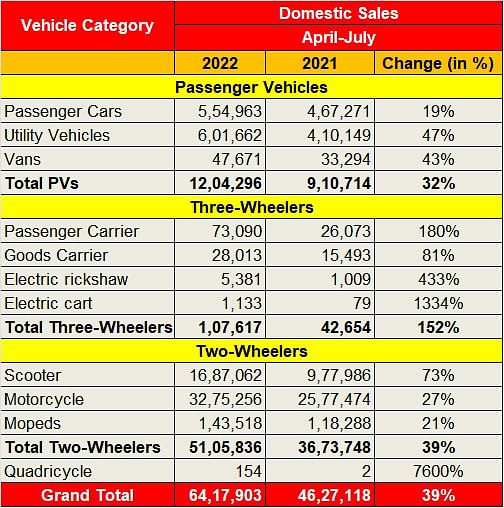

The cumulative April-July 2022 numbers indicate 39% YoY growth to 64,17,903 units (April-July 2021: 46,27,118). PV demand continues to be SUV-driven and one out of two cars sold in India is an SUV (50% of 12,04,296 PVs). The last-mile delivery dynamic is enabling new growth for three-wheelers and e-three-wheelers have taken 6% of market. On the two-wheeler front too, things are looking up. So, if the momentum is sustained through the coming eight months of FY2023, OEMs could be looking at a strong, high-on-numbers fiscal.

RELATED ARTICLES

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

TVS And Bajaj Auto Spar for E-2W Leadership, Ampere Outsells Ola

Powered by demand from the new and aggressively pricedChetak 2501 which takes on the popular TVS iQube2.2 kWh variant, B...

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

12 Aug 2022

12 Aug 2022

5641 Views

5641 Views

Ajit Dalvi

Ajit Dalvi

Shahkar Abidi

Shahkar Abidi