Infra projects, e-commerce drive December CV sales December

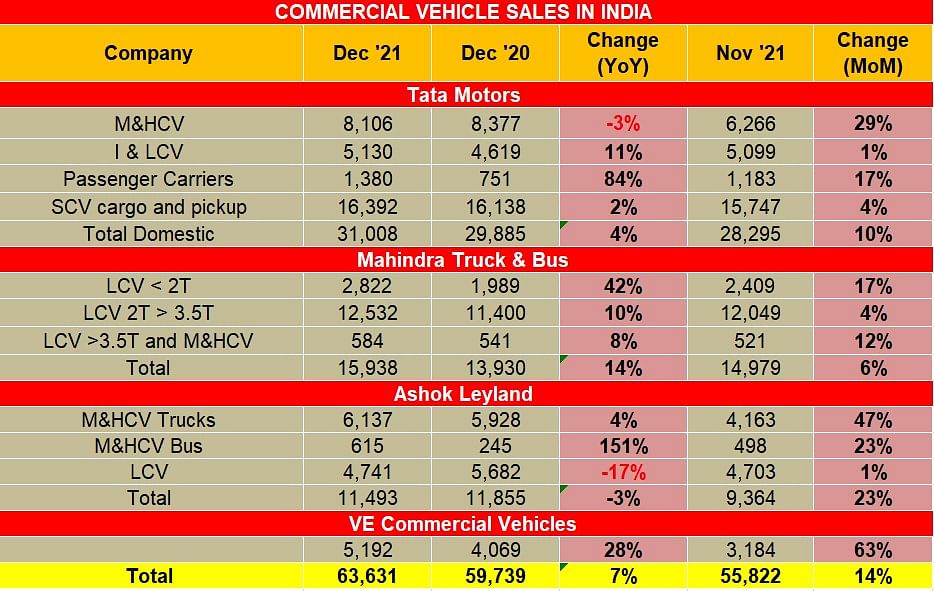

Though Covid-led challenges and semi-conductor crunch continues, the CV segment clocked 7 percent higher sales YoY at 63,631 units.

The December sales numbers indicate slight improvement in the demand for commercial vehicles in the country. Though Covid-led challenges and semi-conductor crunch continues, the CV segment clocked 7 percent higher sales YoY at 63,631 units. Even on a month-on-month comparison, the December sales are 14 percent higher compared to November, 2021.

Tata Motors’ reported wholesale of 31,008 units in December, compared to 29,885 units for the same period last year. On a quarterly basis, Tata Motors’ commercial vehicle domestic sale in Q3 FY2022 at 90,529 units was around 15% higher than the previous quarter (Q2 FY22) and 10% higher than the same quarter last year (Q3 FY2021).

Girish Wagh, executive director, Tata Motors pointed out that the “retail sales were ahead of wholesale by almost 15 percent in December, which enabled inventory alignment. The SCV and ILCV segments continued to benefit from the growth in e-commerce and the increasing need for last-mile delivery. Construction and infrastructure spending by central and state governments along with rising activity in sectors such as mining, petroleum-oil-lubricants and allied industries facilitated the demand for M&HCVs.”

Tata Motors’ international business too continued its recovery momentum and grew by around 10 percent over the previous quarter (Q2 FY2022) and 33% over the same quarter last year (Q3 FY2021). “Going forward, we expect the situation to remain fluid as the semiconductor shortage continues, instances of Covid begin to rise and underlying demand continues to remain under pressure. We are keeping a close watch on the evolving situation and sharpening our agile, multi-pronged approach to fulfil customer orders,” added Wagh.

Mahindra & Mahindra reported an uptick of 14 percent YoY, selling 15,938 units in December. The sales were primarily driven by the ILCV segment or the 2-tonne to 3.5-tonne segment. Veejay Nakra, CEO – Automotive Division, Mahindra & Mahindra said, “We have seen growth in business segments including Passenger Vehicles, Commercial Vehicles and International Operations, owing to continued strong demand across the product portfolio. The issues around semi-conductor related parts continue to be a challenge for the industry and remains a major focus area for us.”

Ashok Leyland reported sales of 11,493 units in down 3 percent YoY but 23 percent higher compared to the previous month.

VE Commercial Vehicles (VECV) registered a growth of 7 percent YoY, with sales of 5,192 units, compared to 4,069 units for the same period last year.

Overall the CV companies showcased strong demand across the product portfolio but the semi-conductor crunch could impact retail sales and continues to be a major overhang for the auto industry.

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

03 Jan 2022

03 Jan 2022

8835 Views

8835 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi